Accounts Payable Ledger: Definition

The accounts payable ledger is a subsidiary ledger that lists the individual accounts of creditors. It is also referred to as the creditors' ledger.

A subsidiary ledger is a ledger that contains only one type of account, such as the accounts payable ledger.

Accounts Payable Ledger: Explanation

When a business has only a few creditors, it is possible to maintain a separate Accounts Payable account for each creditor.

If a business has many creditors, which is often the case, having an individual ledger account for each creditor could result in a very large and unwieldy ledger.

Imagine, for example, a business that makes credit purchases from 200 different creditors. Then, envision the size of its ledger if, in addition to all other accounts, a separate account is maintained for each creditor.

A single ledger would be too large to handle efficiently. This would make it difficult to prepare a trial balance or financial statements.

To overcome these problems, accounts for creditors are often set up in a separate ledger. A separate ledger containing only one type of account is called a subsidiary ledger.

A subsidiary ledger containing only creditors' accounts is called an accounts payable ledger or a creditors' ledger.

When subsidiary ledgers are used, the main ledger, which contains the accounts needed to prepare financial statements, is called the general ledger.

Format of Accounts Payable Ledger

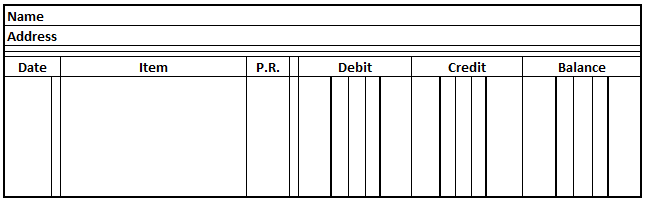

Accounts in the accounts payable ledger are designed to show the balance owed to each creditor. The three-column account form, as shown below, is usually used.

Accounts Payable Ledger

Liability accounts normally have credit balances. Therefore, with rare exceptions, creditors' accounts will have credit balances.

Thus, the three-column account form is more suited for creditors' accounts than the four-column account form commonly used in the general ledger.

Accounts in the accounts payable ledger are usually not assigned numbers. Instead, they are arranged in alphabetical order to make it easy to add new accounts and remove inactive accounts.

The balances of creditors' accounts in the accounts payable ledger are summarized by the Accounts Payable account in the general ledger.

That is to say, when all posting is complete, the balance of the Accounts Payable account will equal the sum of the balances of the creditors' accounts. Thus, the Accounts Payable account is said to control the accounts payable ledger.

A controlling account is an account in the general ledger that summarizes accounts in a related subsidiary ledger.

Example

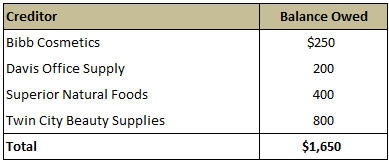

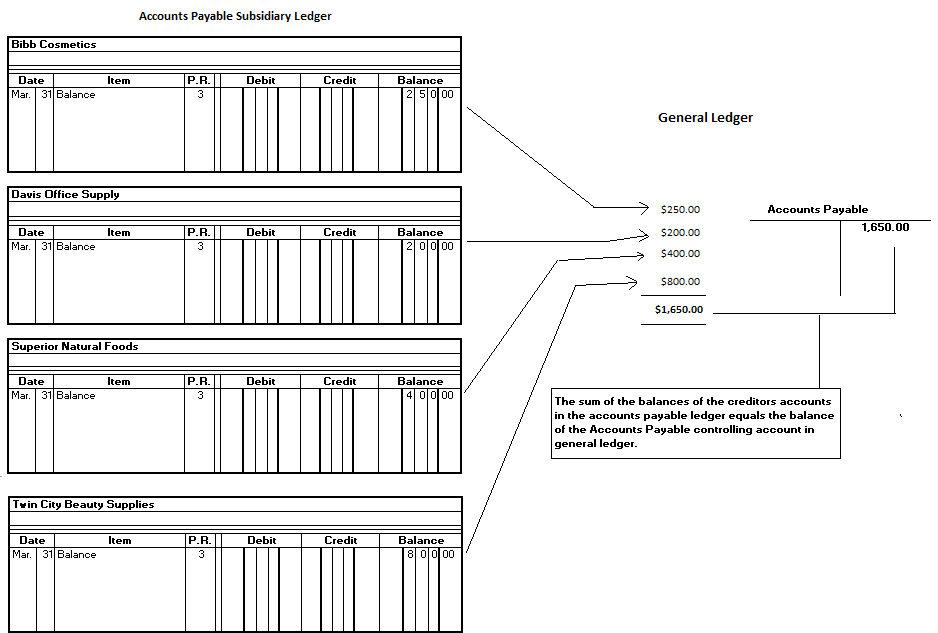

To illustrate the controlling account/subsidiary ledger relationship, let's examine the amounts owed by Judy Bowman, a health and beauty supplies distributor. The following balances were for 31 March 2019:

Judy maintains an accounts payable subsidiary ledger, which is summarized by an Accounts Payable controlling account in her general ledger. The figure below shows the relationship between the two.

Posting to the Accounts Payable Ledger

Each entry in the purchases journal represents a purchase on account and requires an individual posting to the subsidiary ledger account of the creditor from whom the purchase was made.

Posting to creditors' accounts is a five-step process. To illustrate, the below figure shows how Lakeside's 2 November journal entry recording a purchase from Key Suppliers is posted to the accounts payable ledger.

The entry is posted using the following steps:

Step 1: Enter the date of the journal entry in the Date column of Key Suppliers' account.

Step 2: Enter the amount of the journal entry, $575, in the Credit column of Key Suppliers' account.

Step 3: Calculate the balance of Key Suppliers' account and enter it in the Balance column of the account.

Since there was no previous balance, the balance of Key Suppliers' account is $575. Had there been a previous balance, the current posting of $575 would have been added to that balance to obtain a new balance.

Step 4: Enter P1 (purchases journal, page 1) in the PR column of Key Suppliers' account.

Step 5: Enter a checkmark in the PR column of the purchases journal.

The checkmark indicates that an individual posting has been made to the accounts payable ledger. A checkmark is used because accounts in the subsidiary ledger are not assigned numbers.

Accounts Payable Ledger FAQs

No. The accounts payable ledger is not a separate set of books from those used for general accounting purposes. Rather, it is simply a convenient way to group all creditors’ accounts together in one place.

The accounts payable account is also called the sundry creditors’ ledger, purchases on account ledger, and creditors’ ledger.

No. For example, if a purchase of equipment on account were not paid for by the end of the fiscal year, the balance of the equipment account would be a debit in the accounts payable ledger. This would mean that the creditor who supplied the equipment would have a negative balance in the accounts payable ledger.

Yes. An inactive account can be removed from the accounts payable ledger by entering a closing transaction to close out the account. A balance sheet for the subsidiary ledger would then be reported in the General Ledger without showing an amount in this closed out account.

Yes. The accounts payable account is usually the only controlling account in most companies. However, some companies may find it convenient to utilize more than one controlling account in cases where the company has several accounts payable creditors that are similar (e.G., Suppliers of certain types of equipment or supplies).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.