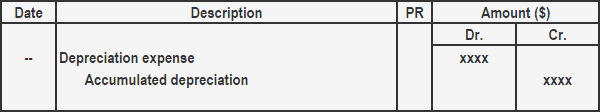

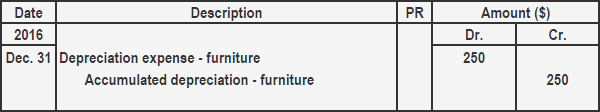

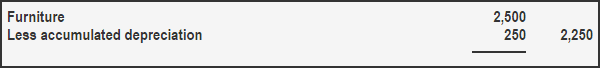

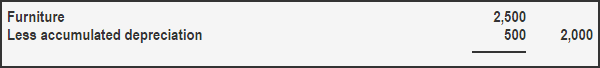

When fixed assets are acquired for use in a business, they are usually useful only for a limited period. The cost of these assets is allocated as an expense over the years they are used. This gradual conversion of an asset into an expense is known as depreciation. In other words, depreciation is the allocation of the cost of a fixed asset to the period over which the benefit is obtained from the use of the asset. Depreciation is calculated on the original cost. Importantly, depreciation should not be confused with an asset's market value. Any decrease in the market value of an asset cannot be regarded as depreciation. To clarify the concept of depreciation, let's consider an example. A lorry costs $4,000 and will have a scrap value of $500 after continuous use of 10 years. This means that the cost of $3,500 ($4,000 - $500) is to be allocated as an expense over 10 years. If the fixed installment method of depreciation is used, a cost of $350 is to be allocated as an expense at the end of each year. This is achieved through an adjusting entry. If this allocation is not made, the income statement will reflect a higher income or lower loss. In other words, the decline in the value of the asset by way of depreciation results directly from its use in the process of generating revenue. In view of this, such loss should be charged against revenue. The amount of depreciation charged on various assets is considered a business expense. At the same time, it is a reduction in the value of the particular asset upon which depreciation has been charged. Therefore, depreciation has the following two effects on final accounts: The adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. This is shown below. The depreciation expense appears on the income statement like any other expense. The accumulated depreciation is a contra asset account; it is shown as a deduction from the cost of the related asset in the balance sheet. Both of these presentations are illustrated in the following example. K & Co. purchased furniture costing $2,500 on 1 January 2016. The furniture's salvage value is zero, and it is decided to provide depreciation @ 10% p.a. on the original cost. Required: Make an adjusting entry for depreciation expense on 31 December 2016. Also, how will the purchase be shown as a fixed asset on the balance sheet on 31 December 2016 and 31 December 2017? Adjusting entry for depreciation on 31 December 2016: The above adjusting entry will also be made at the end of the next 9 years. After that period, the furniture will be fully depreciated ($250 × 10 years = $2,500). Partial balance sheet as of 31 December 2016: Partial balance sheet as of 31 December 2017: Balance in accumulated depreciation account at December 31, 2017: $250 + $250 = $500.Example: Depreciation

Accounting Treatment of Depreciation

Adjusting Entry

Example: Adjusting Entry

Solution

Adjusting Entry for Depreciation Expense FAQs

An adjusting entry for depreciation expense is a journal entry made at the end of a period to reflect the expense in the income statement and the decrease in value of the fixed asset on the balance sheet. The entry generally involves debiting depreciation expense and crediting accumulated depreciation.

The depreciation expense is calculated by multiplying the original cost of the fixed asset by the percentage of depreciation. For instance, if a company uses the straight-line method of depreciation, it will allocate an equal amount of the cost of the fixed asset to each year of its useful life.

Depreciation expense has two main effects on an organization's financial statements. First, it is treated as an expense in the income statement, which reduces taxable income. Second, it is a reduction in the value of an asset on the balance sheet. This decrease in value is matched with an increase in accumulated depreciation, which provides a more accurate valuation of assets on the balance sheet.

Depreciation expense reduces taxable income, as it is an expense that is deducted from revenue. In other words, it reduces the amount of income that a company has to pay taxes on. This lowers the company's tax bill and increases its net income.

Depreciation expense does not have a direct impact on cash flow. However, it can indirectly impact cash flow by reducing taxable income and, as a result, lowering the amount of taxes that a company has to pay. This frees up cash that can be used for other purposes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.