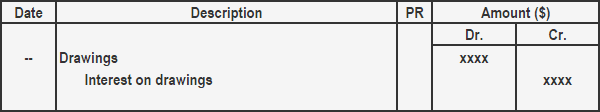

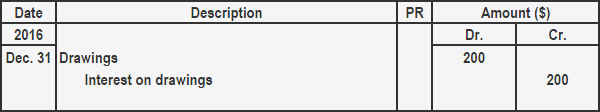

In accounting, drawings are withdrawals of cash, merchandise, or other items from the business by the owner for their personal use. In certain cases, drawings are treated as loans to the owner, with interest charged at the normal rate. The amount of interest charged on drawings is an indirect income of the business. On the other hand, it is a personal expense of the owner. Interest in drawings has the following two effects on final accounts: Interest on drawings is a form of business income. Therefore, it is credited in the books of the business. The proper journal entry to record interest on drawings is given below: On 1 January 2016, Mr. Black withdrew $2,000 in cash from his business for his personal use. The amount was not returned to the business until the end of the accounting period on 31 December 2016. The interest on drawings is to be charged @ 10% p.a. Required: What adjusting entry should be made to record the interest on drawings at the end of the accounting period? Interest on drawings = 2,000 × 0.1 = 200 In the example above, we calculated interest on drawings for the full year because the money was drawn for a full year. If the withdrawal date was not given in the question, the interest on drawings would be calculated based on the whole amount for six months, assuming that the money is drawn throughout the year.Accounting Treatment

Adjusting Entry

Example

Solution

Note for Students

Adjusting Entries for Interest on Drawings FAQs

As a business expense. Hence, it will be reduced from the drawing account. It's an expense for the owner as he withdraws cash from his business to meet personal expenses.

Interest on drawings increases the common stock equity. It's an income to the business, recorded on its books (profit and loss account), but is also a personal expense for the owner which he will pay out of his capital investment.

Interest on drawings increases total assets as it's an income recorded on books (profit and loss account).

Interest on drawings increases total liabilities as it's an expense which will be paid by the company. It also increases common stock equity because the owner has to pay this out of his investment capital.

Interest on drawings decreases gross profit. It increases expenses recorded on books (profit and loss account) which reduces net income/or or bottom line/profit before tax. This, in turn, reduces gross profit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.