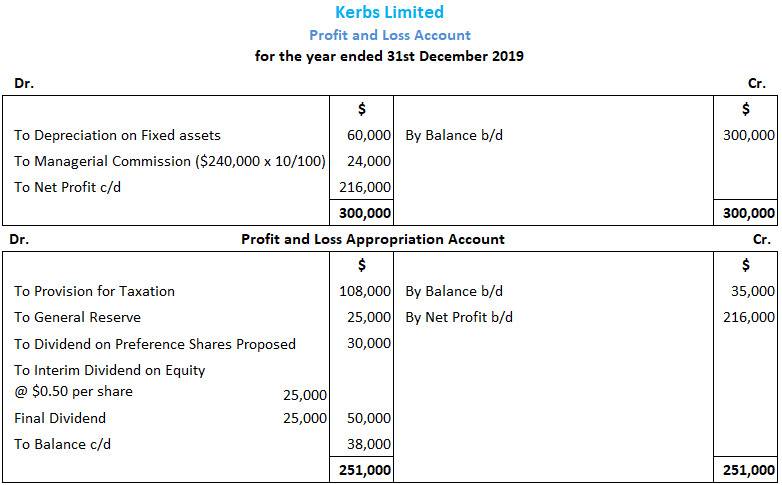

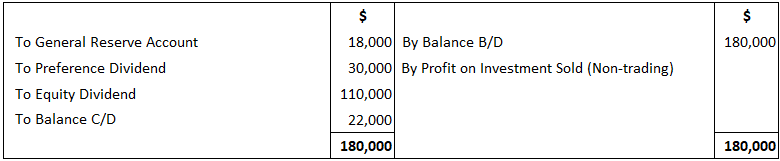

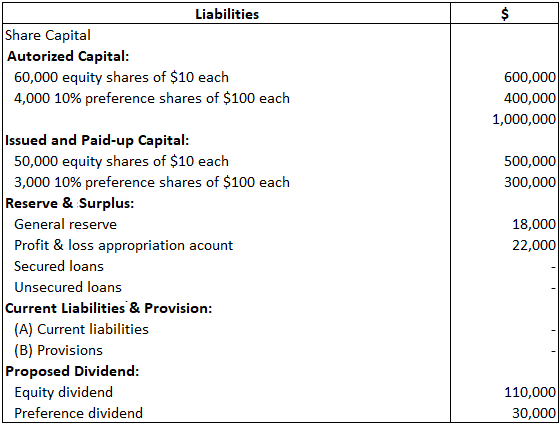

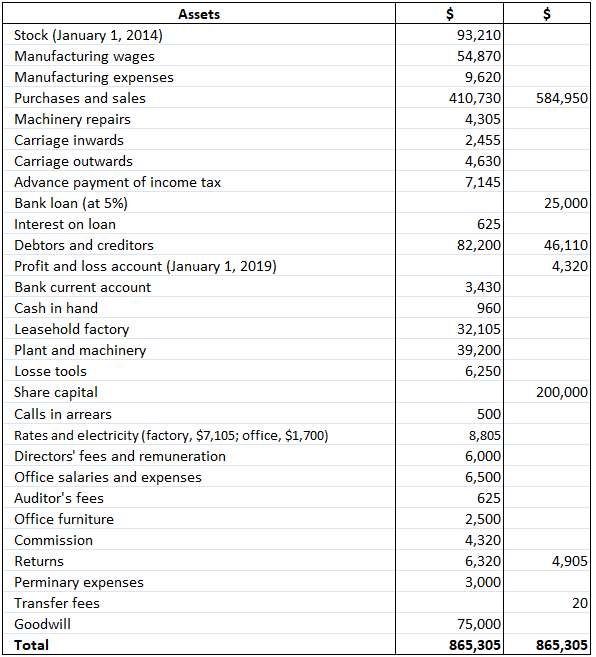

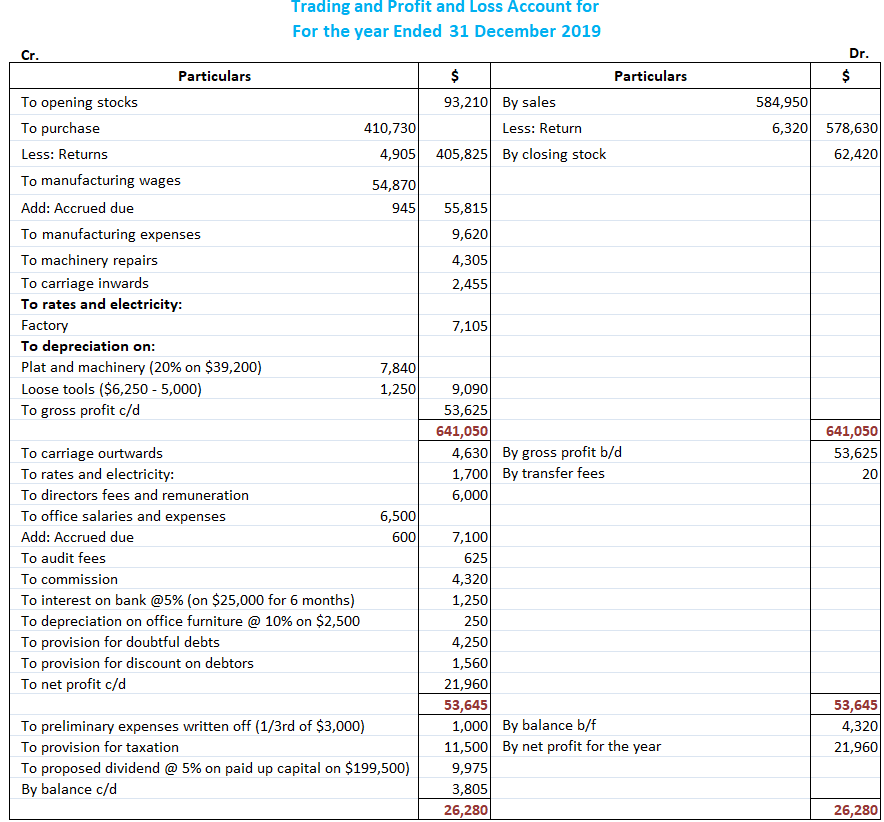

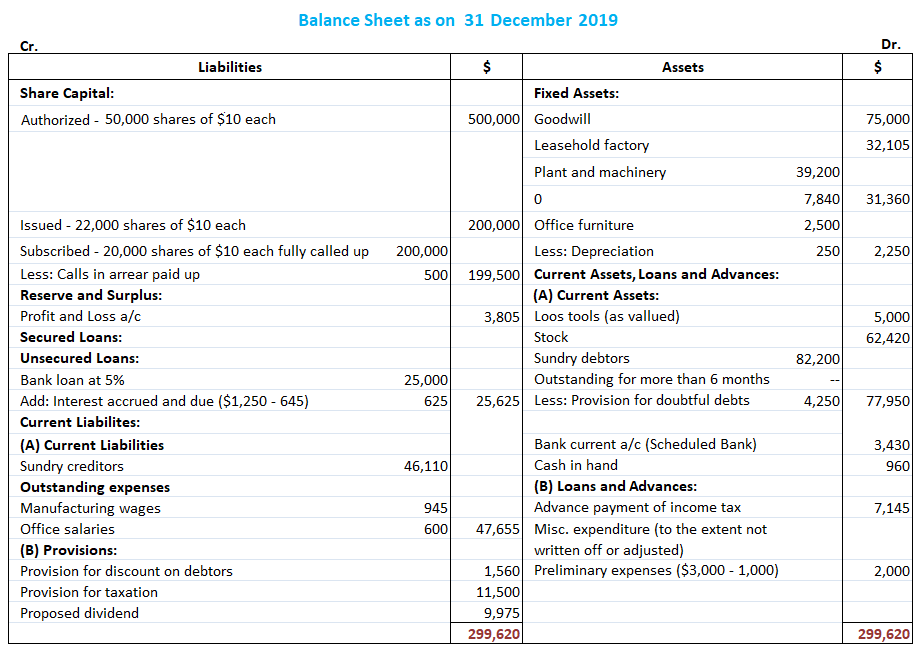

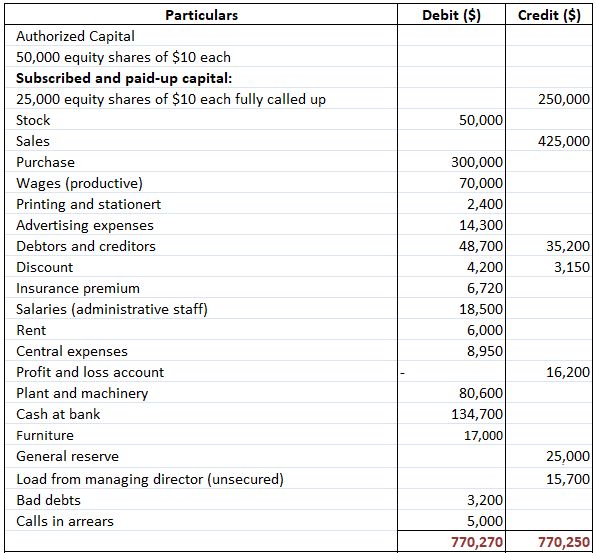

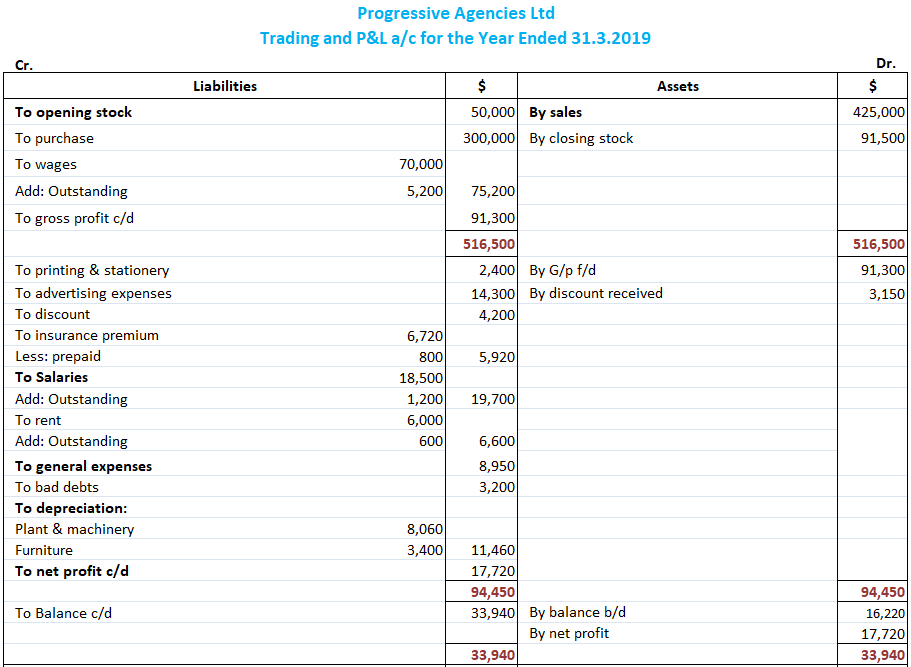

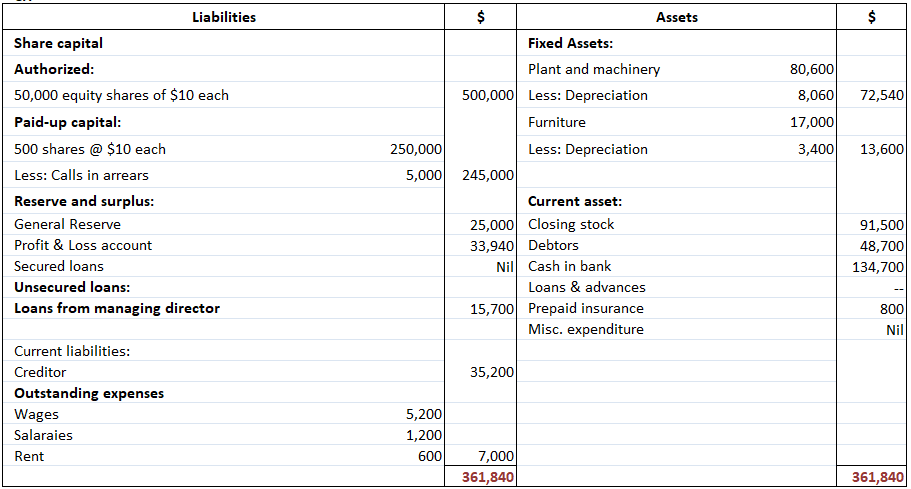

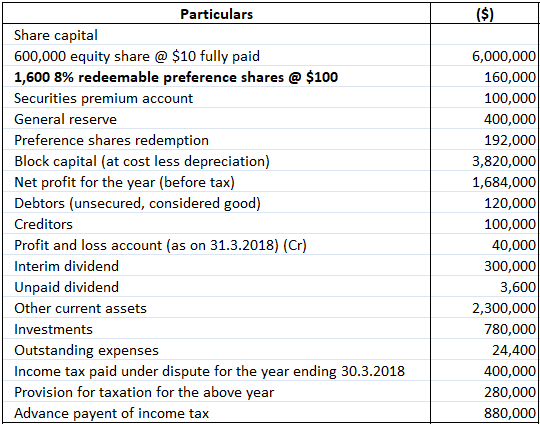

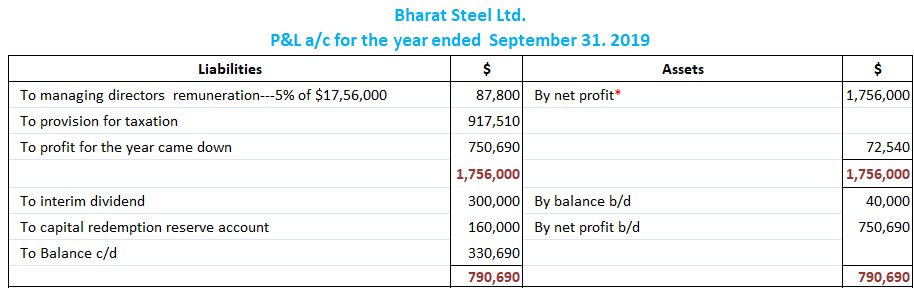

This set of problems and solutions on Company Final Accounts is intended to help students understand concepts relating to Final Accounts in greater depth. For the year ended 31 December 2019, the profit of Kerbs Ltd. before changing depreciation on fixed assets and managerial commission amounted to $300,000. Depreciation for the year amounted to $60,000 and a commission of 10% of the profits (before charging such commission) was payable to the manager. The paid-up capital of the company consisted of $1,000,000 divided into 5,000 6% preference shares of $100 each, along with 50,000 equity shares of $10 each. Interim dividend @ $0.50 per share was paid during the year. Brought from the previous year, the credit balance in the profit and loss account was $35,000. Also, the following appropriations were proposed by the board of directors and subsequently passed at the company's annual general meeting: Required: Show the profit and loss appropriation account. The profit and loss account of X Ltd. is shown for the year ended 31 December 2019 before providing for the following: Note: Depreciation allowance for income tax purposes amounts to $25,000. Required: Redraft the profit and loss account after providing for the amount of managerial commission on net profit due in accordance with the provisions of the Companies Act, and show the calculation for the amount of commission. A limited company has an authorized capital of $1,000,000 divided into 60,000 equity shares of $10 each and 4,000 10% preference shares of $100 each. Out of this, 50,000 equity shares and 3,000 preference shares were issued and fully paid up. The profit for 2019, the first year of operation, amounted to $180,000 after income tax. The directors decided to declare a dividend of 22% on the equity share capital after: Required: Prepare profit and loss appropriation account and show the liabilities side of the balance sheet, Profit and Loss Appropriation Account for the Year Ended 31 December 2019 Since the dividend to be declared is greater than 20% of the paid-up capital, 10% of the net profit is to be transferred to the reserve. Balance Sheet as on 31 December 2019 A company was registered with a nominal capital of $500,000, divided into shares of $10 each, of which 20,000 shares had been issued and fully paid. The following is the trial balance extracted on 31 December 2019. Required: Prepare a trading and profit and loss account for the year ended 31 December 2019. Also prepare a balance sheet for the same date, taking into consideration the following adjustments: The trial balance of Progressive Agencies Ltd. is shown below for 31 March 2019. Required: Prepare a trading and profit and loss account, as well as a profit and loss appropriation account, for the year ended on 31 March 2019. In addition, prepare a balance sheet for the same date. More information is given below. The value of stock on 31 March 2019 was $91,500. Depreciation is to be provided at 100% per annum on plant and machinery, as well as at 20% per annum on furniture. Outstanding liabilities are: The insurance premium includes a sum of $800, being the charge for the quarter ended on 30 June 2019, No dividend payment is proposed and provisions for taxation are not considered necessary. Balance Sheet as on 31 December 2019 The following balances were extracted from the books of Bharat Steel Ltd. Required: Prepare company final accounts (i.e., in the statutory form) and a profit and loss account for the year ended 31 March 2019. In addition, prepare a balance sheet for the same date. Further information for this problem is given below. Also, for Bharat Steel Ltd., profit was calculated after charging $72,000 paid to the managing director as minimum remuneration. The director is to be given a remuneration @ 5% of the net profit before tax, subject to the above minimum. Preference shares were redeemed on 1 October 2018 at a premium of 20% but no entries were recorded in the books for this, except for the payment standing to the debit for preference share redemption account. Income tax demanded for the year ended 30 September 2018, amounting to $400,000, has not been provided in full because an appeal is pending. In addition, the market value of the investments is $710,000. Finally, income tax for the year is to be provided @ 55% on the year's book profits. Note: The net profit shown in the problem is $1,684,000. To this, $72,000 paid as remuneration to the managing director has been added. Do you want to further test your knowledge about final accounts? We have prepared more quizzes for you.Problem 1

Solution

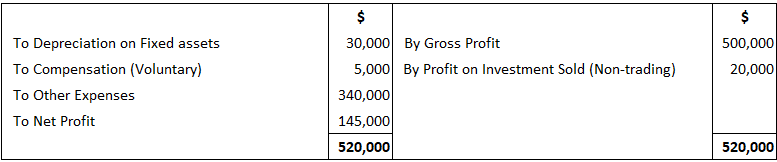

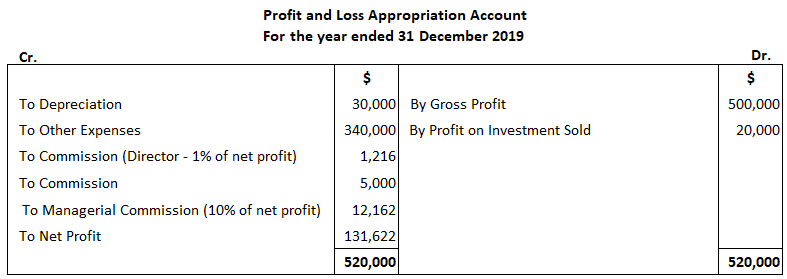

Problem 2

Solution

Problem 3

Solution

Problem 4

Solution

Problem 5

Solution

Problem 6

Solution

Company Final Accounts: Practical Problems and Solutions FAQs

Company final accounts are a set of documents that contain the financial details of a company.

A company's final accounts are very important because it shows the financial situation of a business. It tells how much money is coming in and going out of a business, which lets us know if they are making more or fewer profits each year.

Trading accounts and company accounts

To make a company's final accounts, we must first create a trial balance. This shows all the entries which have been made into the books of accounts. After that, we would subtract total debits from total credits to arrive at net profit or loss. Following that, we would show any share capital. After that, we must add depreciation and then arrive at net profit or loss to get the final account.

There are many limitations of the final accounts. The main limitation is that we can only show specific transactions and we cannot show any future transactions in the final accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.