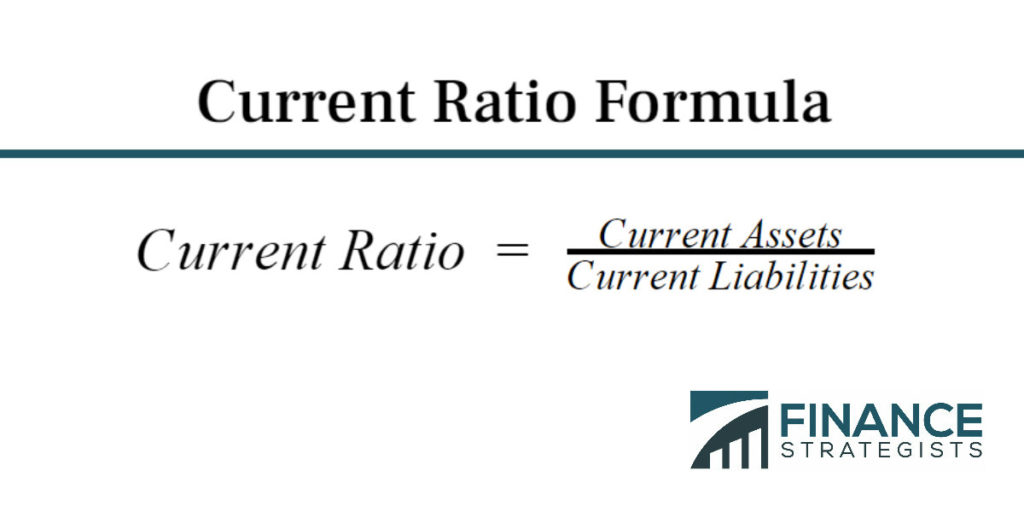

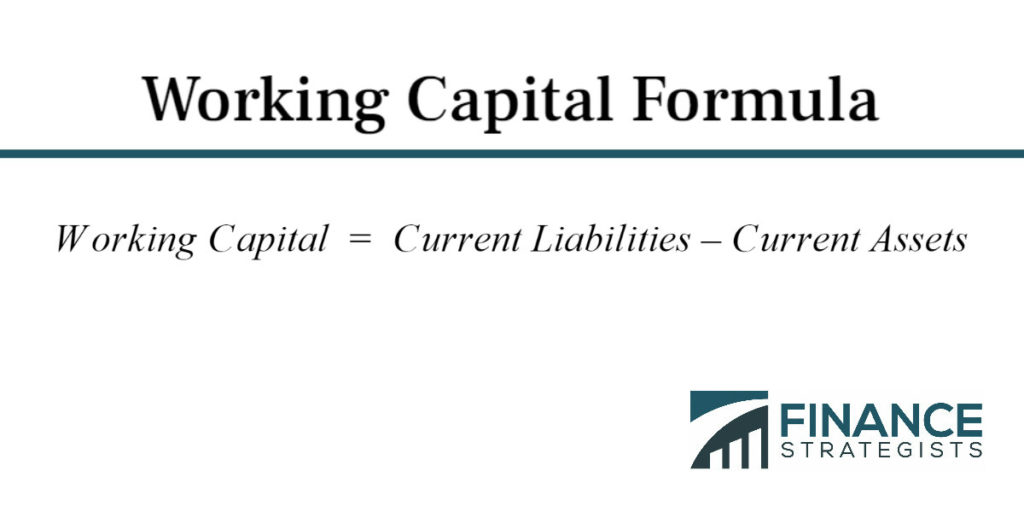

Current liabilities are short-term financial obligations that are due either in one year or within the company’s operating cycle. Current liabilities are different from long-term liabilities, which refer to debts or obligations that are due in more than a year. Current liabilities are generally a result of operating expenses rather than longer-term investments and are typically paid for by a company’s current assets. Having an optimal amount of current assets on hand to cover current liabilities is essential to having a healthy cash flow. Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. Examples of typical items reported as current liabilities on a company’s balance sheet are: Current liabilities are used to calculate financial ratios which analyze a company’s ability to meet its short-term financial obligations. The Current Ratio is calculated by dividing current assets by current liabilities and displays the short-term liquidity available to a company to meet debt obligations. Working Capital is calculated by subtracting current liabilities from the total current assets available. If current assets exceed current liabilities, then the company has enough current assets to pay off its current liabilities. However, if a company has too much-working capital, some assets are unnecessarily being kept as working capital and are not being invested well to grow the company long term.Current Liabilities Defined

Current Liabilities Put Simple

Current Liabilities on the Balance Sheet

Current Liabilities Importance

Current Ratio Formula

Working Capital Formula

Current Liabilities From a Company Perspective

Current Liabilities on the Balance Sheet FAQs

Current liabilities are short-term financial obligations that are due either in one year or within the company’s operating cycle.

An example of a current liability is accounts payable, or the amount owed to vendors and suppliers based on their invoices.

Current liabilities are used to calculate financial ratios which analyze a company’s ability to meet its short-term financial obligations.

Long-term liabilities are going to be around on a company's balance sheet for over a year. Current liabilities will be paid off within a single year.

Not necessarily. If a company has too much-working capital, some assets are unnecessarily being kept as working capital and are not being invested well to grow the company long-term.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.