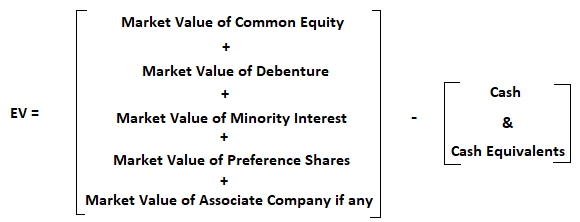

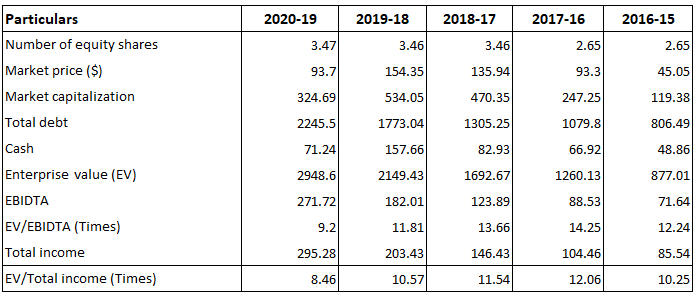

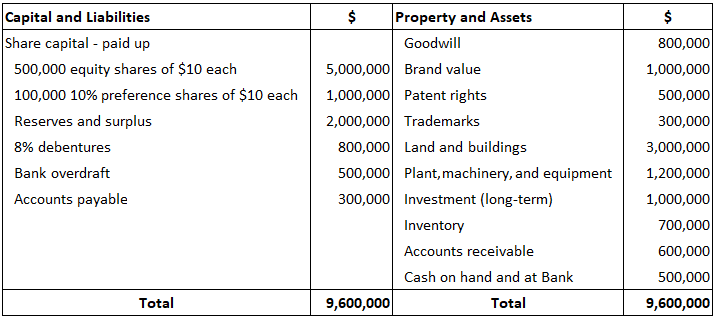

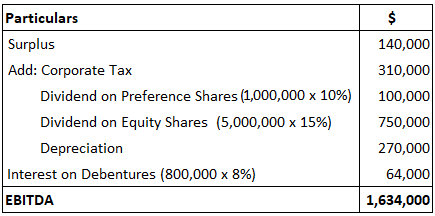

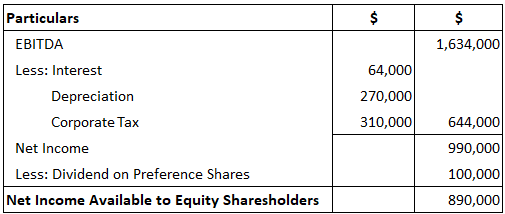

Enterprise value (EV) is an economic measure reflecting the market value of the whole business. It is also called entity value or firm value. EV is the sum of claims of all the security holders (i.e., debt holders, preference shareholders, minority shareholders, common equity shareholders, and others). EV is a fundamental metric in business valuation, financial modeling, accounting, portfolio analysis, and other important tasks. EV is more comprehensive than market capitalization (market cap), which includes only equity. The formula below is used to calculate EV: EV = Market capitalization + Total debt - Cash In this formula, market capitalization is equal to the market value of equity shares (otherwise called the common equity). The expanded version of this formula is: All the components in this formula are taken at market value (not book values), reflecting the opportunistic nature of the EV matrix. Some proponents argue that debt should be accounted for based on carrying value or book value. This argument holds good in times of bankruptcy where all claims that should be settled before the claims of equity shareholders should be based on book value or par value. EV for purposes other than bankruptcy should be based on the market value and not the book value. This ensures the maximum advantage or market price. Furthermore, debt is less liquid compared to equity. Therefore, the market price may be significantly different from the price at which an entire debt issue could be purchased in the market. The other key components in the EV formula above are mentioned as follows: Noteworthily, EV may be negative in certain cases. For example, when there is more cash in the enterprise than the value of the other components of EV, the value will be negative. Another way to conceptualize EV is as follows: EV = Net purchase value (NPV) of the enterprise As shown so far in this explanation, EV measures the value of a company on a particular date. It is calculated by making adjustments to the market capitalization of a company. Using EV as a measure, companies can be compared easily irrespective of their capital structure. Moreover, EV is used to calculate the ratio of EV to EBIDTA multiple. EBIDTA stands for earnings before interest, depreciation, tax, and other appropriations. Hence, EBIDTA can be calculated by adding the figures of interest, depreciation, and other appropriations to the amount of Profit before Tax (PBT). It indicates that the value of the enterprise is equal to a multiple of the company's earnings. As the figures of interest, depreciation, and tax are added back, it makes the comparison between two enterprises easier by eliminating accounting and tax differences. The above measure for GRUH for a period of five years is shown in the table below. The benefits of enterprise value (EV) are as follows: The main disadvantage of EV is that it is more complex to calculate than market capitalization. Market capitalization is a simple multiplication of the number of shares by the share's unit value. By contrast, EV takes other less tangible factors into account, making the calculation more elusive. Enterprise value to EBITDA or EV/EBITDA is a measure of the cost of a stock. It is used more frequently than the price to earnings ratio (P/E) for comparisons across enterprises. EV/EBITDA measures how expensive a stock is. It measures the price (in the form of EV) an investor pays for the benefit of the enterprise's cash flow (in the form of EBITDA). This ratio may vary due to differences in the way depreciation and amortization are calculated (e.g., at different rates over time). Unlike P/E ratios, EV/EBITDA can be used to compare a wide variety of companies. EV/EBITDA is also a better measure of an enterprise's take-over value as it can indicate how attractive the enterprise would be as a leveraged buyout candidate. There are two ways to calculate EV: the market capitalization method (or simple method) and the complex method. The more complex method of the two has greater reliability because it is more rigorous. In the following example, let's consider how to apply both methods. Zenith Ltd has 200,000 equity shares valued at $10 each. The market value of the shares is $25 per share. The company also has long-term debt amounting to $1,000,000 and 50,000 preference shares at $10 each. The company's cash and cash equivalents amount to $300,000. Now, let's calculate EV using the simple method and the complex method. 1. Simple method (or market capitalization method) EV = Number of equity shares x current market price per share = 200,000 x $25 = $5,000,000 EV 2. Complex method EV = Market capitalization + Long-term debt + Preference shares value - Cash and cash equivalents. EV = $5,000,000 + $1,000,000 + $500,000 - 300,000 = 6,500,000 - 300,000 = $6,200,000 EV Note: There is a significant difference between these two valuations. The more complex calculation indicates that the company is worth more than its market capitalization. The following information was extracted from the books of Fair Look Limited for the year ending 13 March 2019. You are required to calculate: Balance Sheet as on 31 March 2020 The book value of the company's assets is calculated as follows: Book value of assets = Total assets - Total liabilities = $9,600,000 - $1,600,000 = $8,000,000. Total liabilities = Debentures $800,000 + Bank o/d $500,000 + A/cs payable $300,000 (b) Tangible book value of assets = Total tangible assets - Total liabilities = $7,000,000 - $1,600,000 = $5,400,000 (Intangible assets = G.W $800,000 + B.V $1,000,000 + PR $500,000 + TM $300,000) Tangible assets = Total assets $9,600,000 - $2,600,000 Intangible assets = $7,000,000) 1. Market capitalization method EV = Number of equity shares x Current market price per share = 500,000 share x $40 per share = $20,000,000. EV = $20,000,000 (Market capitalization). 2. Compex method (or account method) EV = Market capitalization + Long-term debt + Preference share value - Cash and Cash equivalents EV = $20,000,000 + $800,000 + $1,300,000 - ($600,000 + $500,000) EV = $22,100,000 - $1,100,000 = $21,000,000 Therefore, EV = $21,000,000. Note: There is a noticeable difference between the two valuations. This means that the company is worth more than its market capitalization value. This would act as a negotiating price for the intending buyer. EBITDA Total Income EV = 21,000,000 EBITDA = 1,634,000 EV ÷ EBITDA = 12.85 times Net Income = 890,000 EV ÷ Net Income = 29.60 timesWhat Is Enterprise Value (EV)?

Formula For Enterprise Value (EV)

Explanation: EV Formula

Example

Benefits of Enterprise Value (EV)

Disadvantages of EV

Points of Caution

Benefits of Enterprise Value (EV) to EBITDA Ratio

Key Points

Ways to Calculate Enterprise Value (EV)

Example

Solution

Book Value

Enterprise Value

Enterprise Value Formula & Calculation FAQs

No, it does not. Cash and cash equivalents are generally added back to market capitalization when the calculation is being made from simple method. However, under accurate method, they would be considered as a part of total liabilities line item.

In this case, they are usually added back to the simple capitalization value of the company. If there is no liquid assets or cash and cash equivalents, then the difference would be referred to as book value difference which will be added to/subtracted from market capitalization.

In this case, the long-term debt is added to the total liabilities line item in both calculation. However, under accurate method, it would be deducted from the valuation as per current market value of the company.

The Depreciation is added back to the valuation in the method of calculation. On an average, this would be around 5-6% of total assets which can be added back to the valuation under simple way. However, over a period of time, the Depreciation of more than 6% may decrease the book value significantly.

No, preference share capitalization is added to market capitalization of Equity Shares in both simple and accurate ways of calculation. If there are no preference shares, then it will be considered as 0 (zero).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.