Funds From Operations (FFO): Definition

Funds from operations can be defined as the difference between the inflow of funds in the form of expenses.

Funds from operations are the largest source of funds used for the repayment of loans, purchase of assets, and the payment of dividends, taxes, and others.

FFO: Explanation

A controversial point is that an enterprise making a substantial profit may not have adequate funds at the end of the year/period.

Also, enterprises may have enough funds at their disposal, but they might still have incurred a substantial loss at the end of the year/period.

The reason for this paradox is that the profit and loss account records all expenses paid and outstanding, as well as all income (received and accrued).

Furthermore, charging of depreciation and amortization of intangible and fictitious assets does not require the use of funds in the current period. Rather, they simply reflect the apportionment of past expenses.

This means that the profit and loss account does not distinguish between fund flow and non-fund flow items when calculating the net profit.

Note: Non-fund flow items include depreciation, goodwill written off, amortization of intangible assets such as patents, writing off of discount on shares and/or debentures, and writing off of preliminary expenses.

Calculation of FFO

To calculate funds from operations, you can use any one of the formats shown below:

- Profit and loss adjustment account (T format)

- Statement form

There is no prescribed format; the choice of a particular format is only a matter of convenience.

Profit and Loss Adjustment Account

Funds from operations can be calculated either in the account format or statement format. If it is presented in the form of an account, an adjusted profit and loss account is prepared.

The account starts with the opening balance of profit on the credit side and ends with the closing balance of profit on the debit side.

If there is a loss, the opening balance appears on the debit side and the closing balance of loss appears on the credit side.

All non-operating expenses are shown on the debit side and all non-operating incomes are shown on the credit side. If the debit side is more than the credit side, the difference is referred to as funds from operation.

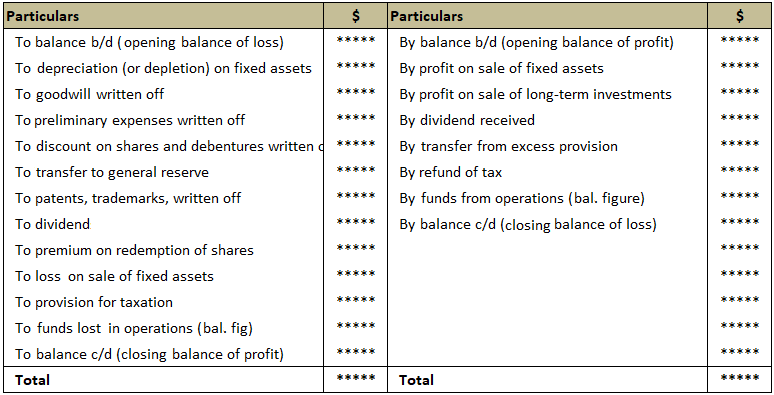

On the contrary, if the credit side is greater than the debit side, the difference is called funds lost in operation. The format of the adjusted profit and loss account is shown as follows:

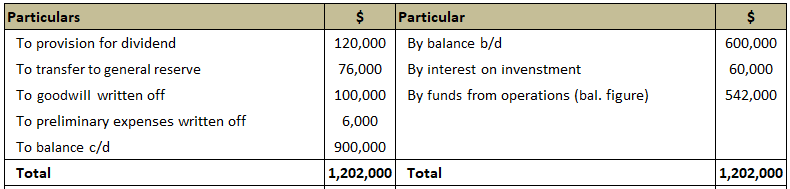

Profit and Loss (P/L) Adjustment Account

Note: Either the funds from operations or the funds lost in operations will appear in the statement. This is also the case for opening and closing balances of the profit and loss account (profit or loss).

Statement Form

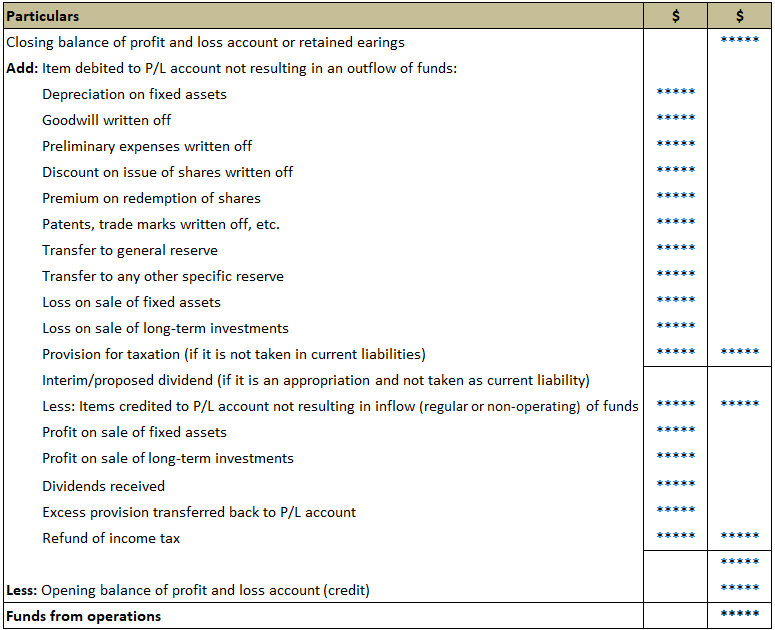

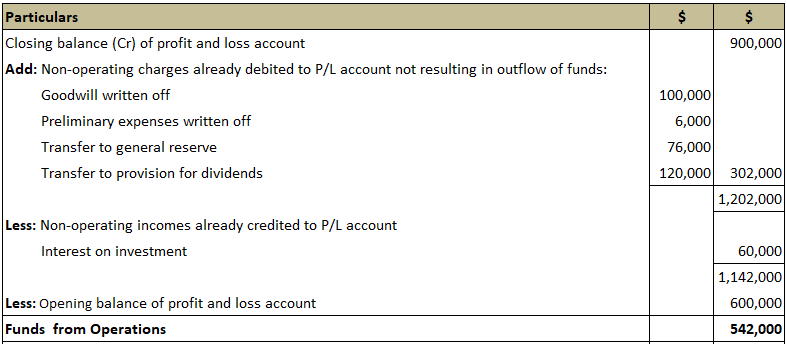

If the profit and loss adjustment account is prepared in statement form, the statement will start with the closing balance of the profit and loss account.

All such expenses that do not result in an outflow of funds are added to the profit, and all such incomes that do not result in an inflow of funds are deducted.

If the profit stated in the profit and loss account is, after making all appropriations, then the balance in the profit and loss account at the beginning of the year must also be deducted to arrive at funds from operation.

A pro forma is shown below that is useful for calculating funds from operations in statement form.

Statement Showing Funds from Operations

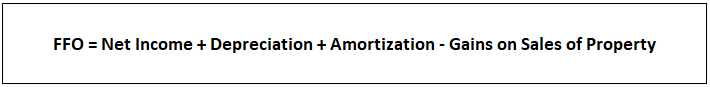

The formula used to calculate funds from operations (FFO) is shown below:

Example

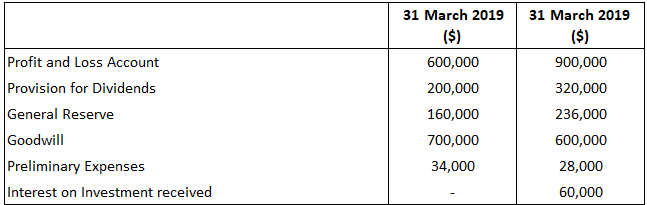

From the following balances extracted from the books of Goods Going Ltd., calculate funds from operations for 2020 using both account format and statement format.

Solution

Calculation of Funds From Operations

1. Account Format

Adjusted Profit and Loss Account

2. Statement Format

Statement Showing FFO

Funds From Operations (FFO) FAQs

Funds from operations can be defined as the difference between the inflow of funds in the form of expenses. Funds from operations are the largest source of funds used for the repayment of loans, purchase of assets, and the payment of dividends, taxes, and others.

Funds from operations can be calculated by adjusting the profit and loss account for non-fund flow items. The adjusted profit and loss will show income from operating activities before deducting funds used in day-to-day business. In other words, it represents cash inflow only from the company's movements in inventories, trade receivables, and other assets used in normal operations.

The main purpose of funds from operations is to assess the cash returns of a business or company. It is therefore used as an indicator of financial health for an organization.

The limitations of funds from operations are as follows: a. It does not include non-cash items such as Depreciation, depletion of assets, or amortization. B. Funds from operations will be calculated incorrectly if the business operates on credit due to goods sold receipts credit method used by many businesses. The other possible reason for incorrect calculation is that recessions might result in credit sales of the firm. C. Liquidity ratios are also more useful than funds from operations because they measure the ability of companies to generate enough cash for debt repayment during both good and bad times. D. Funds from operations do not include Capital Expenditures, which is an important item required for business growth.

The use of adjusted earnings in eps ensures that they are comparable to funds from operations. Therefore, both terms are similar in nature since it is important to know an organization's ability to generate cash.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.