The income statement describes the income achieved by the reporting entity during a specific accounting period. Experience has shown that not all users and preparers accept the complex rules for measuring the amount of income. Using economic theory to define income can demonstrate this complexity. The widely acknowledged capital maintenance theory defines income in terms of wealth. It starts from the premise that a certain amount of wealth at the beginning of the period can increase and decrease during the year. Income represents the amount of consumable wealth during the period such that the wealth at the end will equal the wealth at the beginning. While this concept may help identify relevant measures of income, it fails to provide a model for accountants to apply to generate useful information. This concept has two significant problems. These weaknesses prompted the development of a more practical accounting model. Firstly, instead of focusing on changes in wealth, accounting income represents changes in owners' equity (except for contributions from and distributions to owners). Income tends to be measured in terms of historical cost due to the relative unreliability of other approaches. In response to the second weakness, accountants gather and report information about the effects of the various types of changes in owners' equity throughout the year. This approach provides details about the causes of changes and their separate impacts in an income statement rather than merely reporting the net change. The following data comes from ABC Industries limited for the month ending 31 October 2018. Note: Income tax is 40% on net profit (before tax). In response to users' needs for detailed information, income statements disclose a variety of items. The two primary elements of the income statement are operating and non-operating income, as illustrated in this formula: Operating and non-operating income involve numerous sub-elements, such that the restated formula shows: To help readers evaluate the likelihood and amounts of future cash flows from the firm, accountants frequently identify and segregate the effects of the ongoing efforts exerted to produce income from the effects of other events. In carrying out this refining process, one approach distinguishes operating events as those related to providing goods and services to customers. Current practice has modified this meaning slightly to include only those operating events occurring in the current year. This modification excludes corrections of errors made in measuring the operating events of previous years. The two sub-elements within the operating category are revenues and expenses. Accountants focus on two separate processes: revenue recognition and matching. Revenue recognition determines the period in which revenues should be reported, and matching represents the process of associating expenses with the revenues that they produce. Revenues constitute the gross increases in owners' equity caused by operating events. The events either yield assets or reduce liabilities. In a qualitative sense, revenue can represent a reward obtained by providing goods or services to customers. Accountants have developed several approaches for recognizing revenues. Relating these approaches to the legal concept of the contract helps understand them. When a contract exists between two parties, each agrees to some specified performance. The seller agrees to provide goods or services, and the buyer agrees to make payment. Distinguish the four basic revenue recognition models 1. Accrual Accounting requires that a contract exists and that the selling entity performs its part before revenue can be recorded. For example, a service performed for a buyer, even if cash is not received at once, represents a recognizable service. On the other hand, there is no recognition of revenue if, despite the customer paying, no service is forthcoming. This situation creates a liability that requires satisfaction either by service or a refund. In cases where the seller's performance extends beyond the end of the present period, the percentage of completion approach recognizes revenue in proportion to the amount of effort exerted by the seller. Accrual accounting dominates current practice; organizations should use it when there exists no viable evidence to justify the use of a different method. 2. Cash Accounting requires that a contract exists and that the buyer performs its part of the contract before revenue is recognized. For example, a service provider records revenue upon receiving cash from the customer, irrespective of the service's delivery. This approach avoids the uncertainty associated with recording revenue before cash is received but misrepresents the liability that arises from a prepayment. Cash accounting, as a primary system, is rarely accepted for financial reporting. Two variations of cash accounting occur where the buyer's performance encompasses a series of payments that extend beyond the end of the present period, and high uncertainty surrounds that performance. The installment method allows the recognition of revenue as a part of each payment, and the cost recovery approach allows the recognition of revenue only after the sum of the cash received equals the seller's costs. For example, suppose an asset with a cost of $90,000 is sold in exchange for a promise to pay $120,000 in the form of 12 $10,000 payments. The installment method would recognize 25% ($30,000 ÷ $120,000) of each payment, or $2,500, as gross margin, such that $30,000 would be recorded upon receipt of all 12. The cost recovery method would not record revenue until after receiving the first nine payments ($90,000) and then treat each of the last three payments as revenue. Under Accounting Principles Board Opinion (APBO) 10, the installment method is acceptable only "when the collection of the sale price is not reasonably assured.” The cost recovery approach is allowed under similar circumstances with a low probability of collection. Income tax returns accept several variations of cash accounting (including the installment method), meaning smaller firms frequently use them for reporting to their owners and creditors. These reports, while common, do not comply with GAAP. 3. The Production Approach does not require the existence of a contract or performance by either party. It holds that the mere production of goods recognizes revenue, presumably because there is no doubt that the item can be sold. Under this approach, for example, a manufacturer would record revenue upon the completion of each product, despite no buyers offering to acquire it. The approach lacks the reliability demanded elsewhere in accounting, and its use is limited. ARB 43 allows it in industries that produce interchangeable products for a well-organized market, such as refined rare metals (e.g., gold and silver) and agricultural products. In these situations, difficulties surround the measurement of revenue when market prices are not stable. 4. The Capability Approach holds that revenue can be recognized whenever the seller can earn revenue. Using this approach, a building owner could record rental revenue upon completion of construction, irrespective of occupancy. Similarly, a manufacturer could record revenue as soon as materials and a workforce are available. The extreme uncertainty of this approach has made it unacceptable for practice. Nonetheless, in 1978, the SEC required supplemental disclosures based on a variation of it for the oil and gas industry. According to this method, known as reserve recognition, an accounting company would recognize revenue upon discovering an oil or gas field (that is, a reserve), even if the firm cannot immediately produce from it. Revenue would not be recognized upon the product's extraction from the well, in much the same way that the collection of a receivable is not considered revenue under accrual accounting. The SEC subsequently rescinded this requirement in February 1981. Financial accounting uses a variation of the capability approach the current value method is applied. Expenses represent the gross decreases in owners' equity caused by operating events. The events either reduce assets or create liabilities. In a qualitative sense, expenses indicate the effort expended when providing goods and services to customers. The matching concept requires an offsetting of these efforts (expenses) against the rewards (revenues). Consequently, accountants attempt to discover if revenue and expenses share a connection. Determining causality when reporting the expenses in the period allows the recognition of revenue. This approach adds production costs to the inventory and deducts them as expenses (cost of goods sold) only when the product is sold. If a causal relationship is likely but cannot be reliably determined, the expense is reported in the year when it is incurred. For example, expenses incurred for research and development, advertising, and training represent attempts to increase revenue. However, the lack of a reliable way to associate the expenses directly with the revenue prompts the expenditure's deduction from revenue in the year of its production. An expense may occur in a single period or over several periods. Recognition in the second case may involve allocation among the periods either based on observed revenue generation or on a predetermined time-oriented basis. Examples of these expenses include amortization and depreciation. All events not classifiable as operating are deemed non-operating. The two sub-elements, gains and losses, represent the net increases and decreases in owners' equity resulting from non-operating events, including sales of non-inventory assets, casualty losses, and other events. The gains and losses are recorded as the net change rather than the gross increase and decrease in owners' equity. For example, assume that a company sells an asset with a book value of $800 and receives $1,000. It is common to report only the gain of $200 rather than separately disclosing the selling price and the book value. While an agreement exists on when to report gains and losses and the amount to report, two opposing positions offer the best method of presenting them to statement readers. The current operating concept holds that understanding and using the income statement is more likely if it features only the results of operating events. On the other hand, the all-inclusive concept holds that using and comprehending the income statement is more likely if it is the only place where the period's operating and non-operating events are disclosed. This approach would preclude the use of judgments about the classification of an event as operating or non-operating to distort the reported results. Thus, a firm could not delete the effect of a non-operating event from the income statement to present a better picture. The above conflict produced unsettled and conflicting accounting practices concerning non-operating items. The Accounting Principles Board (APB) dealt with the situation by issuing opinions 9 and 30 that specified the disclosure locations of particular events. While these pronouncements did not resolve the theoretical question, they brought more uniformity to practice. The fundamental approach used in the pronouncements sees all gains and losses appear on the income statement. However, the APB required the reporting of non-operating items as either ordinary or extraordinary. APBO 30 was issued to provide a more precise definition of "extraordinary": The key point to recognize is that the event itself is neither ordinary nor extraordinary. Instead, its context determines whether it is one or the other. The authors interpret this opinion to indicate that the accountant must consider the external and internal environments of the firm. The firm's external environment comprises its economic and physical surroundings and determines whether the event is usual or unusual. The APB said in Opinion 30: On the other hand, a firm's history and management policies affect its environment. The likelihood of a recurring gain or loss from a particular type of event depends on the plans and decisions made by management. The company has agreed to settle all class-action antitrust suits in connection with alleged price-fixing relating to folding cartons, milk cartons, and corrugated containers. The company's long-established policies requiring strict compliance with all laws in the conduct of its business apply to all segments of the company's operations, including the Hoerner Waldorf paper-packaging business acquired in 2017. The company has for many years emphasized these policies and will continue to take all actions it deems necessary to ensure rigid compliance at all levels. Therefore, it considers significant antitrust litigation settlements unusual, nonrecurring, and extraordinary. In some instances, a company's management may initiate new policies to prevent the recurrence of actions that led to losses through litigation. Similarly, a decision to replace an earthquake-damaged building with one designed to withstand another earthquake would reduce the likelihood of a recurring loss. The above example summarizes this interpretation of APBO 30. An event must be considered both unusual for the external environment and nonrecurring in the firm's internal environment to be deemed extraordinary. Under this definition, such uncontrollable events as natural calamities or other accidents are classified as ordinary if they occur naturally in the environment. On the other hand, an event that the management can control, such as selling an unusual investment, can be deemed extraordinary. Overriding considerations mean both the APB and the FASB require that certain items be reported as extraordinary even though they do not fall within the criteria of APBO 30. With this background, we can now turn to a more detailed description of the structure of the income statement. When preparing the income statement, several items require consideration: heading, revenues and expenses, other ordinary items, discontinued operations, income taxes, extraordinary items, and earnings per share. The heading of the income statement identifies the entity, presents the title of the income statement, and shows the period covered by the report. Presentation of the revenues and expenses reflects the preference of the issuer. The single-step format lists all the revenues and ordinary gains and then deducts all the expenses and ordinary losses involved in calculating ordinary incomes. The multiple-step format contains several subgroups of revenues, expenses, and a separate section for ordinary gains and losses. Variations of these general forms occur in practice. For example, many companies report income tax expenses as a separate item after ordinary income. In the below example, the format selected by McDonald's Corporation illustrates a single-step income statement with separately reported income taxes. The firm presenting the statements chooses the format, which it should continue to use from year to year to ease comparisons. Other ordinary items include the results of events or situations that cannot be classified as operating or extraordinary. Whether each item is reported separately generally depends upon its materiality. APBO 30 requires separate disclosure of material events that are either unusual or nonrecurring, but not both. The following example illustrates the reporting of an unusual gain expected to recur. Note: The company sold at a net gain of $6,730,000 ($0.65 per share), a 20% interest in Canadian coal properties for $3,000,000 in cash, and long-term notes having the then-current value of $8,259,000. The company anticipates selling its remaining 16.75% interest for approximately $10,400,000 in interest-bearing notes. In recognition of the usefulness of income statement information for assessing earning power, the APB called for the segregation on the statement of two income items related to the discontinuation of a particular line of activity. With this segregation, users can identify the income from continuing operations and thus make a more informed estimate of their future cash flows. Implementing this separation requires determining that a significant segment of the business has indeed been discontinued. APBO 30 provides this definition: This definition is broad and subject to judgment. In a subsequent interpretation, the AICPA provided a series of examples of situations to be included or excluded as discontinuances. The thrust of the opinion and the interpretation is that the discontinued segment must have carried on a major set of separable activities or served such a set of customers who will no longer be served after the discontinuance. For example, the disclosure requirements of the opinion would apply if a conglomerate disposes of a glass manufacturing division when it has no other division engaged in that activity. Similarly, if an electronics manufacturer decided to terminate its attempt to establish a chain of retail stores in shopping centers, the decision would result in discontinued operations because a major class of customers would no longer receive direct service. On the other hand, if an automobile manufacturer decided to stop producing four-wheel-drive vehicles, the decision would not be considered discontinuation as it only terminated a product line. Similarly, an airline's decision to stop serving three cities would stand because the same general group of customers would still receive service. In these two cases, the affected productive assets (that is, the machinery to produce vehicles and the aircraft) would not be separable but would remain available for other purposes. In addition to knowing whether discontinuation has taken place, the accountant also needs to know the effective date of the discontinuation to report its effects in the appropriate period. The APB selected the date on which it commits itself to a formal plan to dispose of a segment of the business. The period labeled in the following example as "phaseout" begins with the date of the decision and extends until the completion of the process. The opinion requires that three items require disclosure in the income statement. Any other required information must go in the footnotes. The three items are: The first item reclassifies amounts reported in earlier income statements if those figures are in a comparative form with the current year's figures. The second item involves determining the income or loss earned through operating the discontinued segment from the beginning of the fiscal year up to the date that the decision to discontinue is finalized. The third item comprises two components: If phaseout is completed in the same year as the decision date, the discontinuation gain/loss is the sum of the two components. If it is not completed, the rules become more complex, as described in the below example. Operating losses expected to occur during phaseout are added to the net disposal gain/loss. Expected operating profits are not added to net disposal gains, but are offset against net disposal losses to the extent of those losses. The remainder is recognized as it is earned. For example, consider these four cases: Another item in the computation of ordinary income that receives special treatment is the amount of income taxes. The total amount in a year is allocated among and paired with the major income categories that appear on the statement, such as extraordinary items and gains and losses from discontinued operations. The rationale behind this treatment is the same as the one used to support the disclosure of the components themselves; that is, predictions and evaluations are more likely to be helpful following the identification of the primary causes of income. The reasoning behind the use of the extraordinary category is explained earlier in this chapter. A survey reported that only 53 out of 600 of the surveyed companies disclosed this type of item. The fact that the survey showed 204 disclosures of extraordinary items in 2018 illustrates the restrictive impact of APBO 30 on practice. Where appropriate, the firm should provide a footnote to explain the nature of the gain or loss. In response to an increase in the use of the earnings per share figure and to a large variety of definitions, computations, and disclosure formats, the APB issued Opinion 15. This pronouncement sought to bring uniformity to the computations and presentations of earnings per share. APBO 15 has five major requirements:Income Statement: Definition

Objectives

Income Statement Format

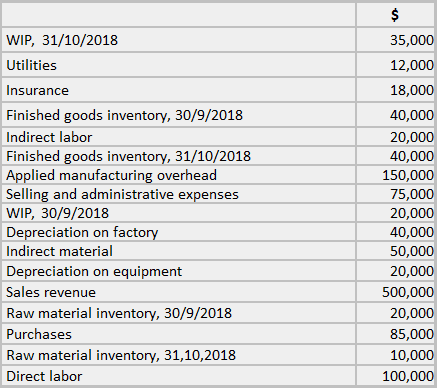

Example

Required

Solution

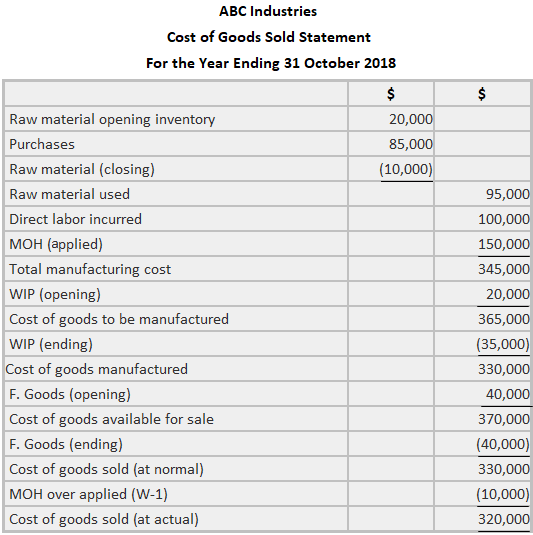

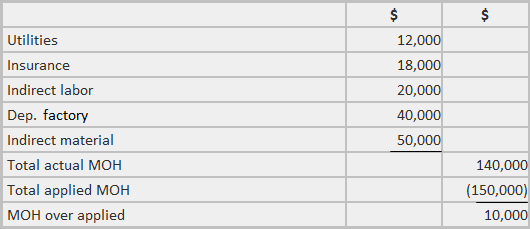

Preparing the Cost of Goods Sold Statement

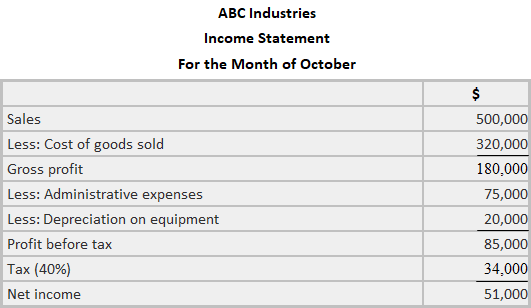

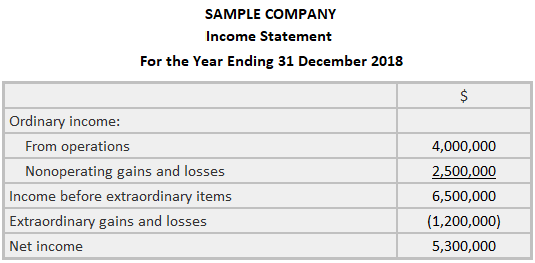

Preparing the Income Statement

Working

Elements

Operating Events

Revenues

Expenses

Non-operating Events

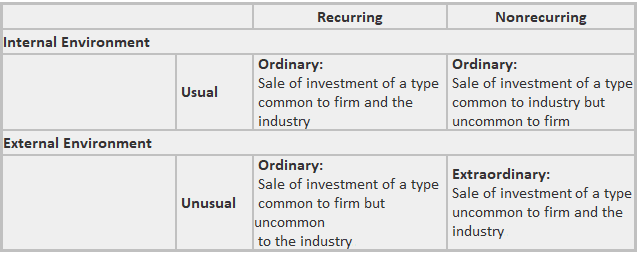

Ordinary and Extraordinary Items

Example

Extraordinary items are events and transactions that are distinguished by their unusual nature and by the infrequency of their recurrence taking into account the environment in which the entity operates.

The environment of an entity includes such factors as the characteristics of the industry or industries in which it operates, the geographical location of its operations, and the nature and extent of governmental regulation.

Example

Structure of the Income Statement

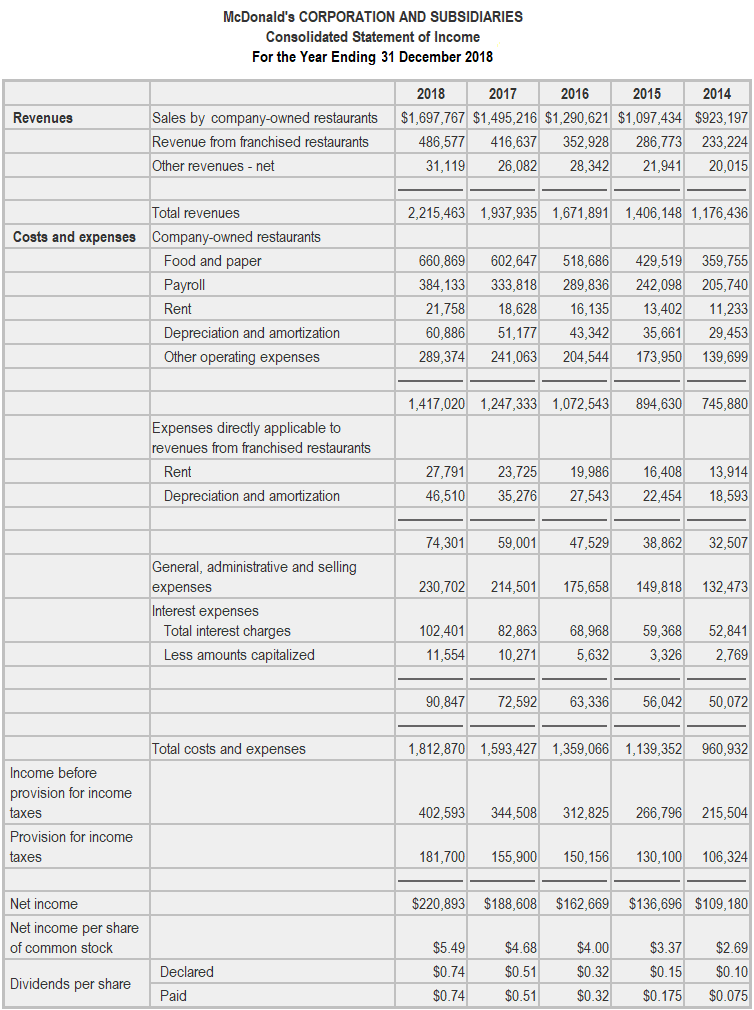

Revenues and Expenses

Example

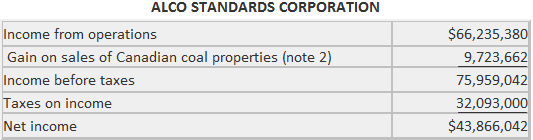

Other Ordinary Items

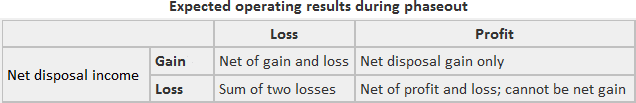

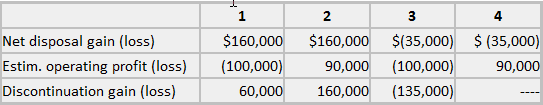

Discontinued Operations

For purposes of this opinion, the term segment of a business refers to a component of an entity whose activities represent a separate major line of business or class of customer.

A segment may be [any organizational unit whose] ... assets, results of operations, and activities can be clearly distinguished physically and operationally, and for financial reporting purposes from the other assets, results of operations, and activities of the entity.

Income Taxes

Extraordinary Items

Earnings per Share

Income Statement Analysis FAQs

Cash inflows are recorded on an accounting basis following the receipt of cash. This may cause some people to think that they are inefficient, since money has been sitting around for days or months before being recorded. On the other hand, income statements do not illustrate this; they usually show income before taxes. Thus, the Cash Flow statement is particularly useful in determining taxable income.

You may spot certain trends that are related to financial difficulty. For example, most companies try to keep their Accounts Receivable balance low because it represents future cash, but an increase in this account may be the result of weaker sales.

Companies usually issue these documents because they are required to by law or stockholders. If a company is publically traded, its income statement must conform to gaap standards. Even private businesses provide them for the sake of their stockholders, creditors, and other interested parties.

The income statement/income tax return, balance sheet, and Cash Flow statements are usually used for different purposes. These reports are also known as Financial Statements.

Gaap stands for generally accepted Accounting Principles.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.