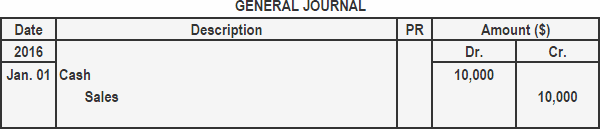

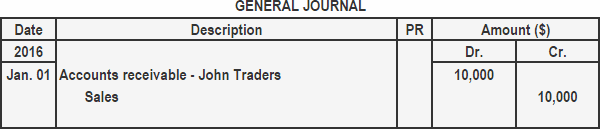

Businesses sell merchandise for cash as well as on account. The journal entries for both types of transactions are discussed below. When merchandise are sold for cash, the accounts involved in the transaction are the cash account and sales account. The cash account is debited and the sales account is credited. See the following example: Example On 1 January 2016, Sam & Co. sells merchandise for $10,000 cash to John Traders. Sam & Co. would record this cash sale in its general journal by making the following entry: When merchandise are sold on account, the two accounts involved in the transaction are the accounts receivable account and sales account. The accounts receivable account is debited and the sales account is credited. See the following example: Example On 1 January 2016, Sam & Co. sells merchandise for $10,000 on account to John Traders. Sam & Co. would record this credit sale in its general journal by making the following entry:When Merchandise Are Sold for Cash

When Merchandise Are Sold on Account

Journal Entry for Sale of Merchandise FAQs

Cash sales are sales made on credit and where the payment of money is received in advance.

When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. Also, there is no increase or decrease in sales revenue. The only transaction that affects the income statement is cash sale less any cash discounts allowed to customers.

When merchandise are sold for cash, an increase or decrease in cash is recorded on the cash account. Also, there is no increase or decrease in Accounts Receivable. The only transaction that affects the balance sheet is cash sale less any discounts allowed to customers.

When merchandise are sold for credit (account), an increase or decrease in Accounts Receivable is recorded. Also, there is an increase in sales revenue and no change in cash (except for any cash discounts allowed). The only transaction that affects the income statement is credit sale less any cash discounts allowed to customers.

When merchandise are sold for credit (account), an increase or decrease in Accounts Receivable is recorded. Also, there is an increase in cash and no change in sales revenue. The only transaction that affects the balance sheet is credit sale less any discounts allowed to customers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.