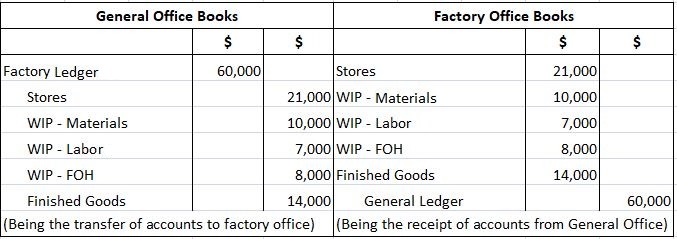

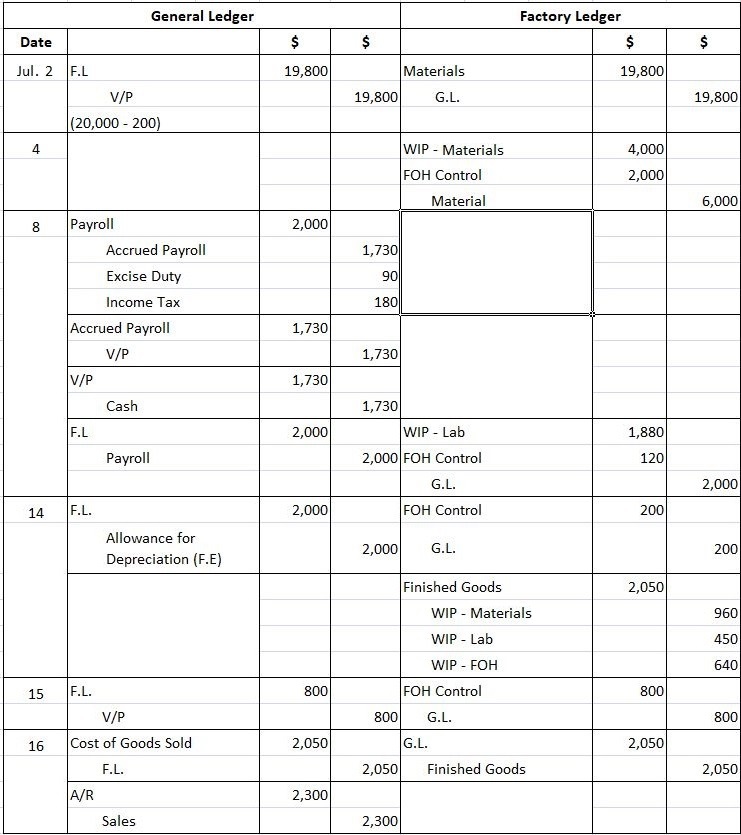

The first problem in this set of three focuses on opening a factory ledger. The following balance appeared in the books of Marry & Company on 31 December 2018. Due to difficulties and other problems experienced by the accountant in the previous year, the company's management wants to create a factory ledger at the start of the year (i.e., immediately after the books have been closed for the preceding year). Required: Pass the necessary journal entries, both in the general ledger and factory ledger. The AMH Corporation uses a general ledger and factory ledger. The following transactions took place in July: July 2: Purchased raw materials for the factory for $20,000. Terms 1/10, n/30. July 4: Requisitions of $4,000 of direct materials and $2,000 of indirect materials were filled from the stockroom. July 8: Factory payroll of $2,000 for the week was made up at the home office, with $1,730 in cash sent to the factory. Excise duty was $90 and income taxes were $180 ($1,880 direct labor and $120 factory repairs).

July 14: Depreciation of $200 for factory equipment was recorded (asset accounts are kept on the general office books).

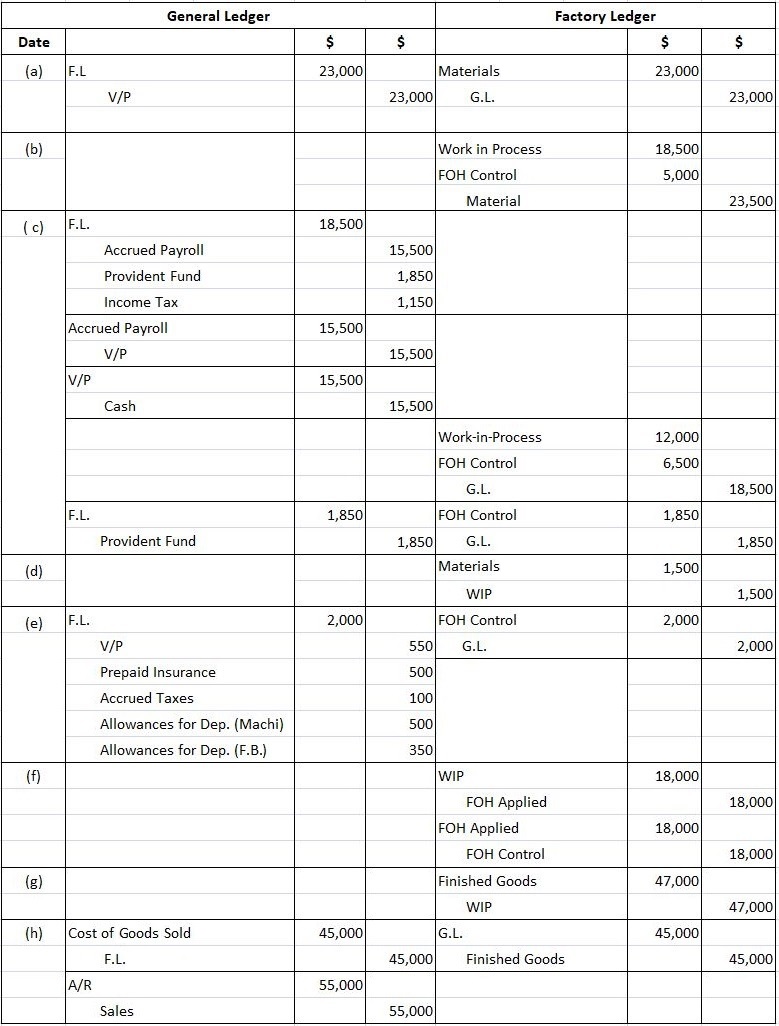

July 14: A job was completed in the factory with $960 direct labor and $450 of materials previously charged to the job. FOH is to be applied at 66% of direct labor. July 15: Miscellaneous factory overhead amounting to $800 was vouched and paid by the home office. July 16: The completed job was shipped to the ABC Company on instructions from the home office. The customer was billed for $2,300. Required: Pass general entries in the factory books and the general office books. The following transactions were recorded by Nissan Corporation, which maintains both a factory ledger and a general ledger. (a) Stores purchased and received at the factory $23,000. (b) Requisitions received and materials/supplies issued as follows: the factory $23,000. (c) Paid the factory payroll for the week as follows: Note: Deduct 10% from the payroll for provident fund and $1,150 for income tax. A factory payroll book is maintained at the factory. At the end of each week, the factory payroll is reported to and paid by the general office. The only payroll entry on the factory books is one distributing the payroll to the appropriate accounts. The company also contributes 10% of the payroll from its side for the provident fund. (d) Direct materials returned to the storeroom. (e) A transfer voucher from the general office showing the following expenses to be recorded. (f) Manufacturing overhead is applied to production at a rate of 150% of direct labor cost. (g) Work completed during the week: $47,000 (h) Goods costing $45,000 were sold for $55,000 Required: Prepare journal entries to record the above transactions in the general office books and factory books. Use only one work in process.Problem 1

Cash

$39,000

Accounts Receivable

15,000

Stores

21,000

Work-in-process Materials

10,000

Work-in-process Labor

7,000

Work-in-process Factory Overhead

8,000

Finished Goods

14,000

Machinery & Equipment

1,36,000

Land & Building

240,000

Capital Stock

$250,000

Retained Earnings

40,000

Mortgage

200,000

$490,000

$490,000

Solution

Problem 2

Solution

Problem 3

Solution

General Ledger Practical Problems and Solutions FAQs

The factory ledger is used to record transactions relating to goods that have been manufactured or altered, or services that have been provided. This includes recording the purchase of raw materials, the manufacture of the finished products, and excise duty on manufactured products.

A General Ledger is used to record all financial activities within an organization. The General Ledger accounts can be subdivided into many sub-headings, the most notable of which are cash, Accounts Receivables, and payable.

The asset account for the purchase of raw material should be debited when it is purchased.

The asset account for the finished goods should be credited when it is sold.

A transfer voucher is a document that is used to track expenditures from one ledger to another. This type of voucher can also be known as a "journal voucher" because it acts as a journal entry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.