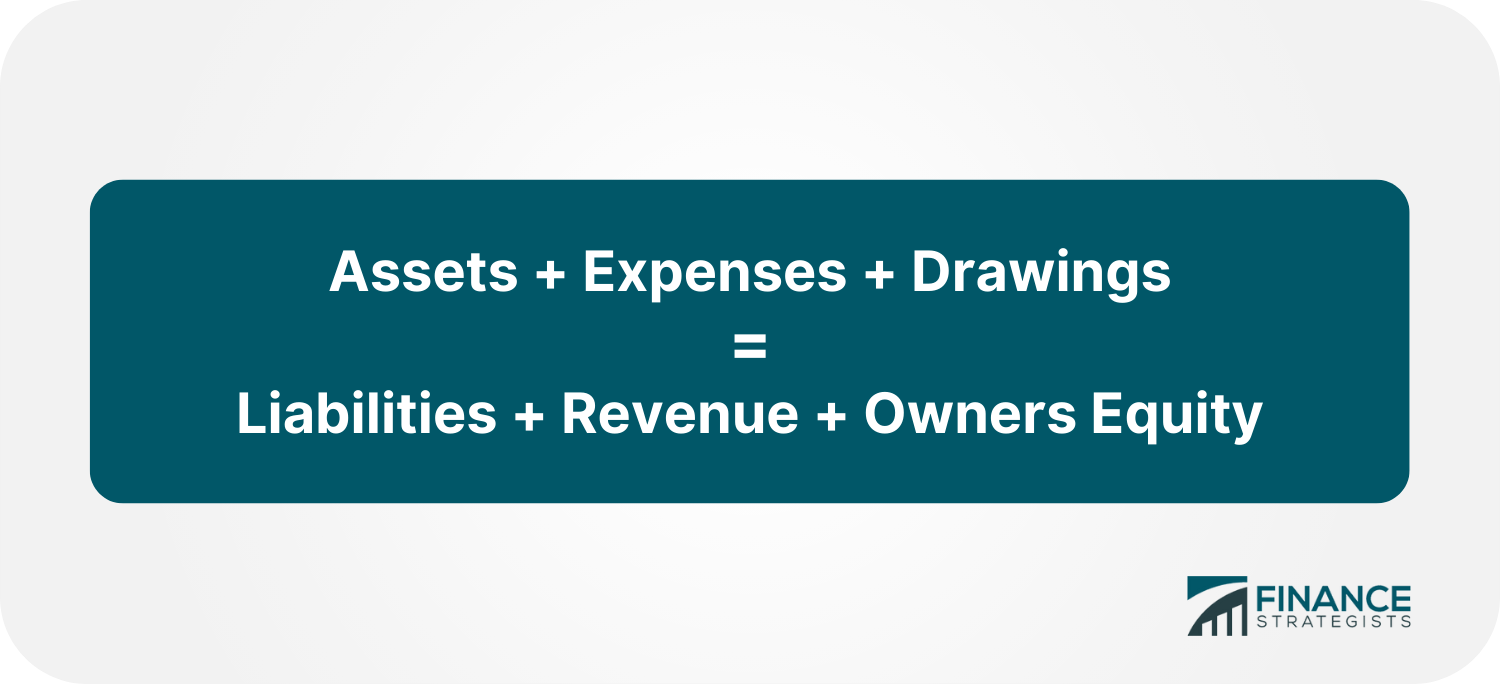

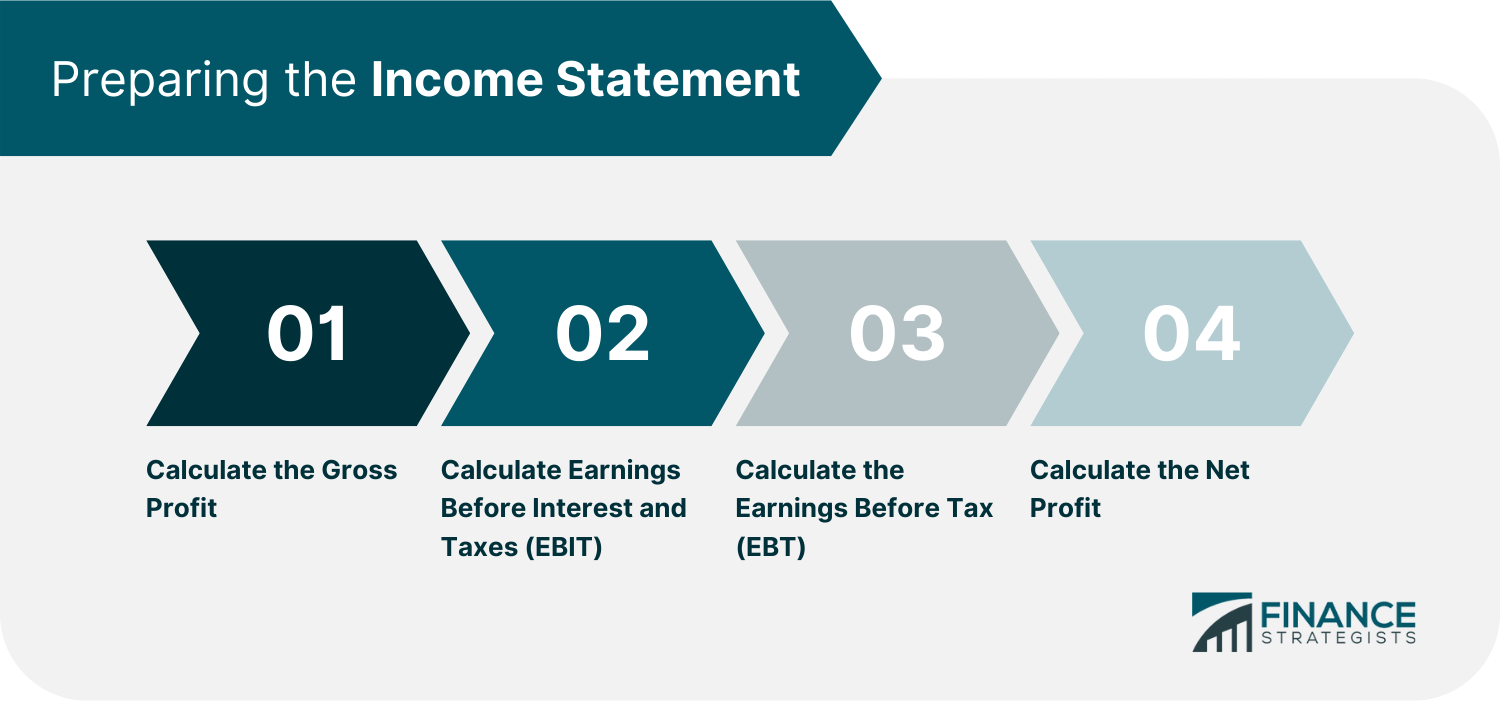

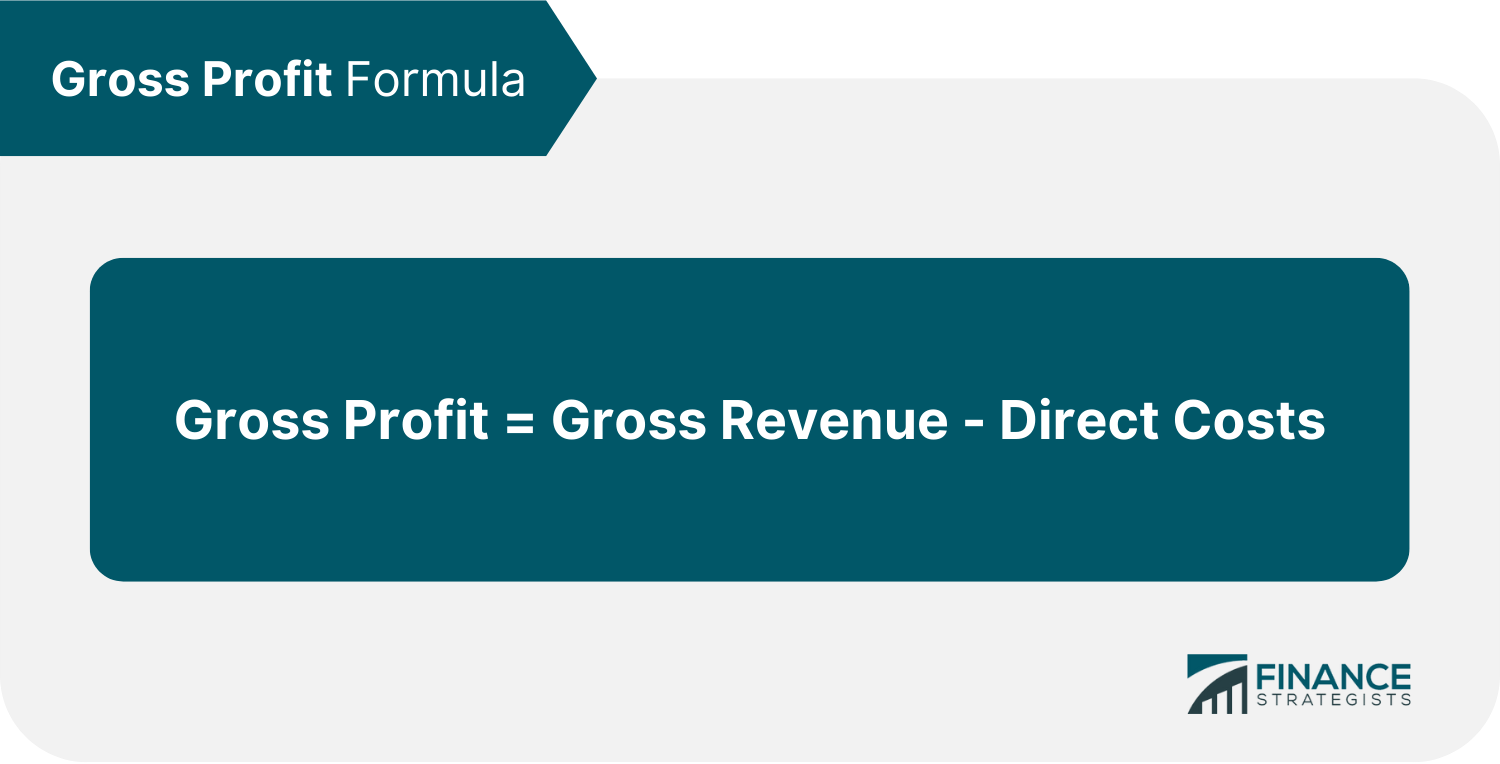

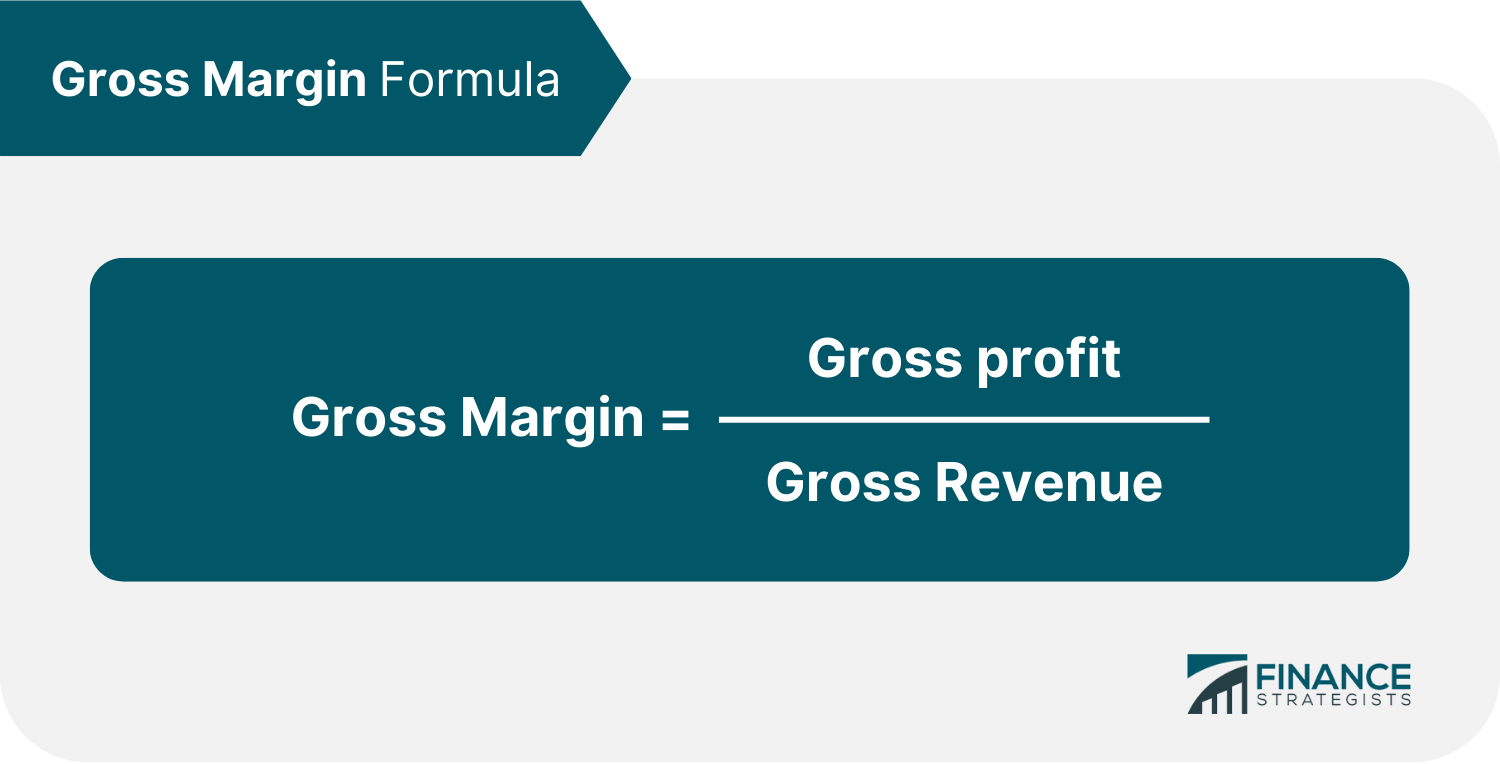

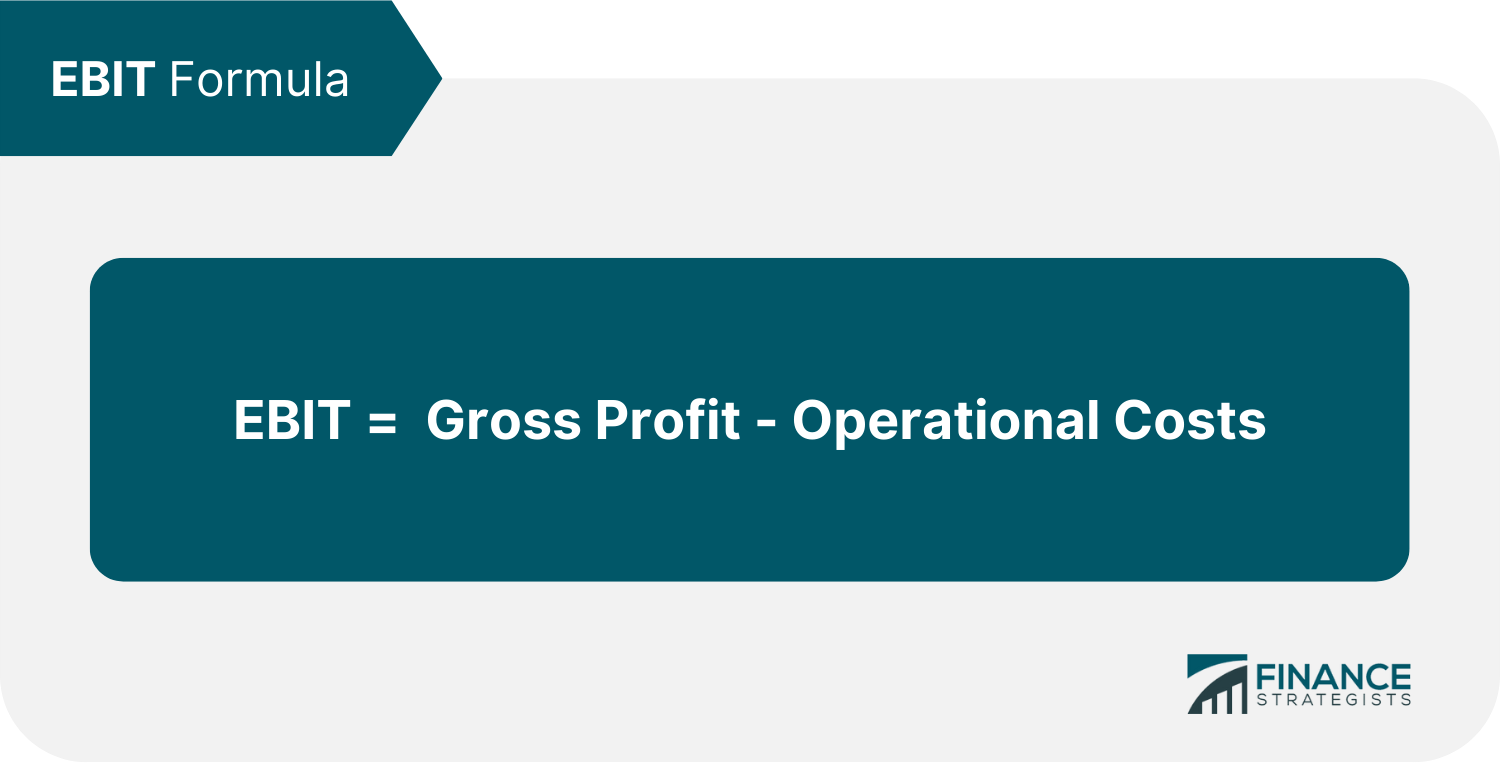

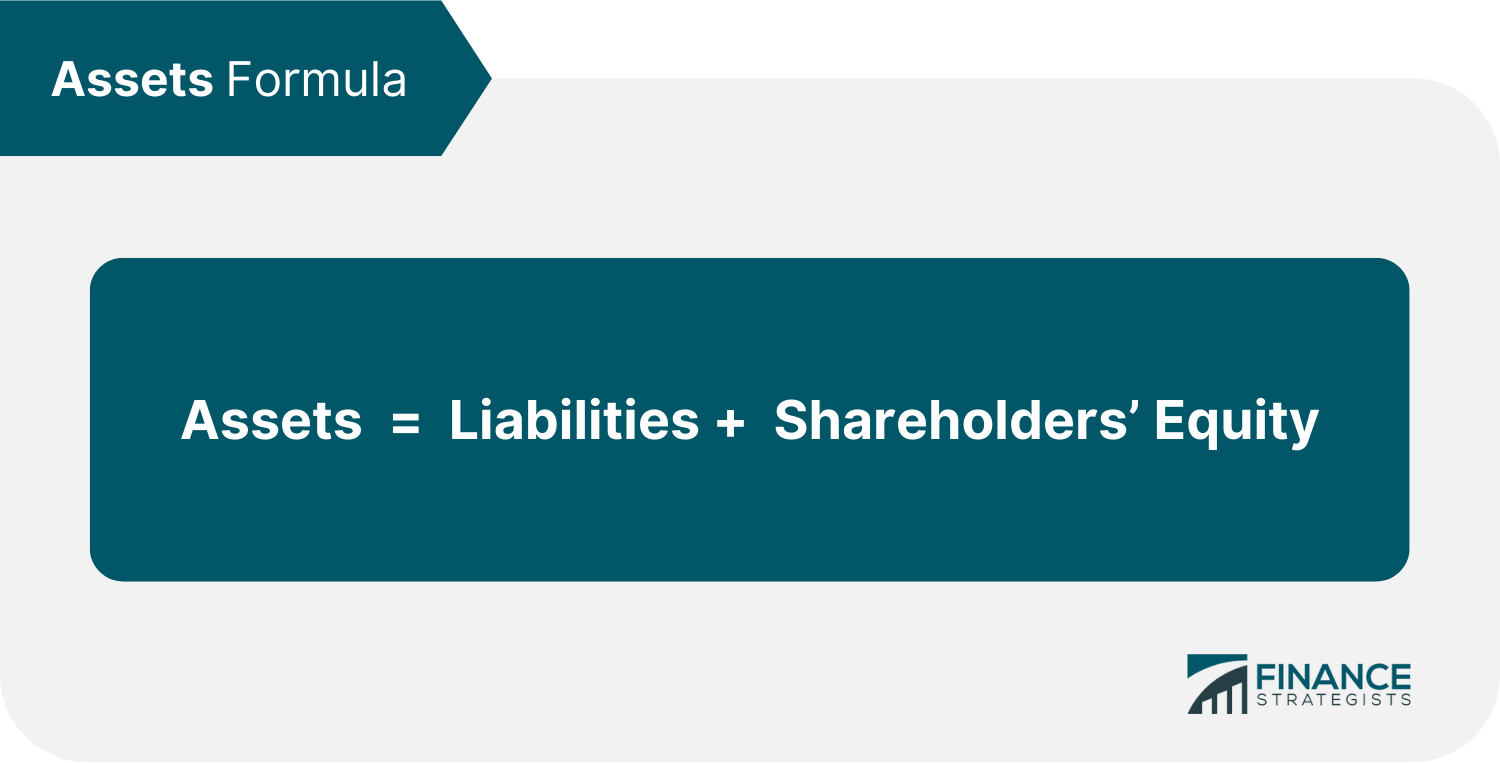

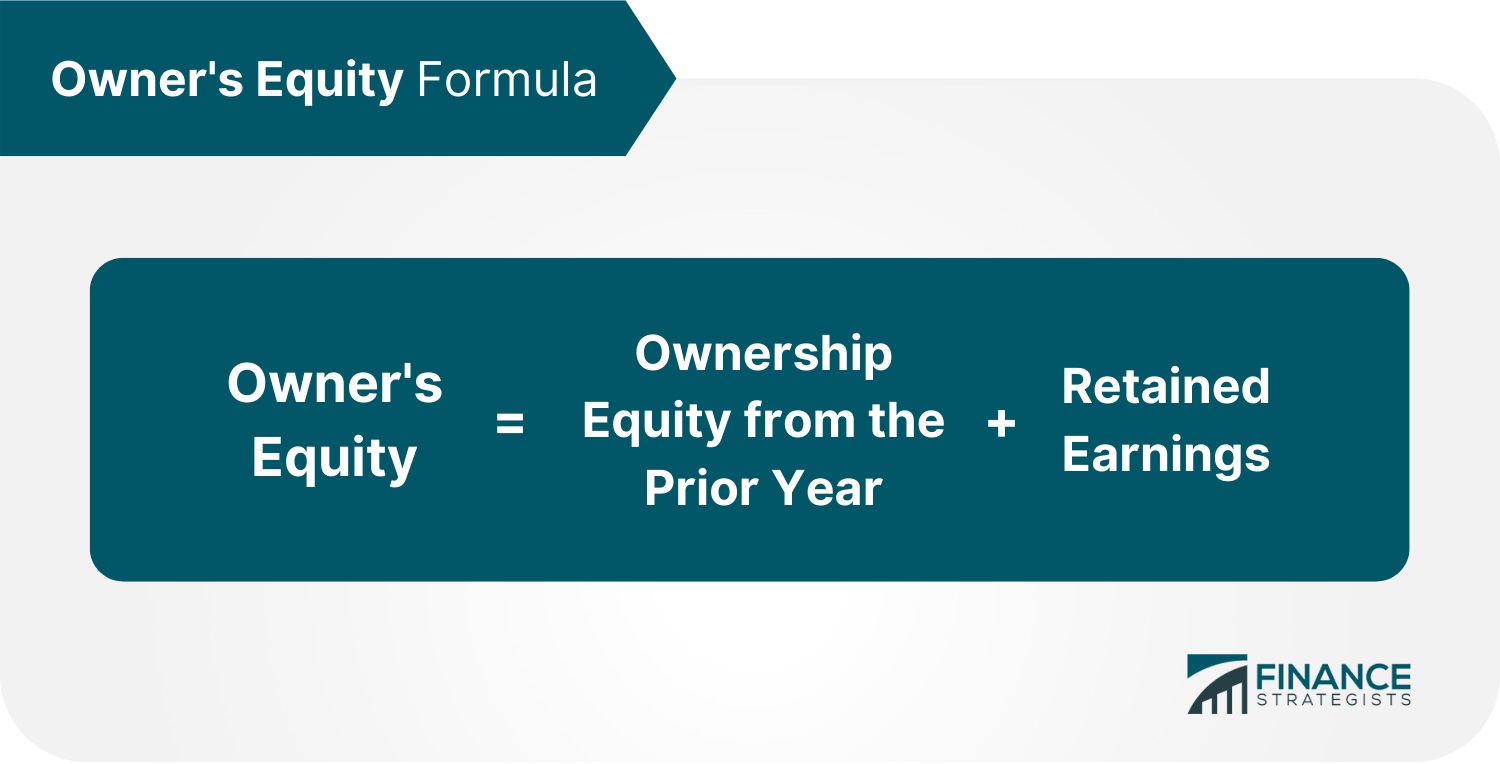

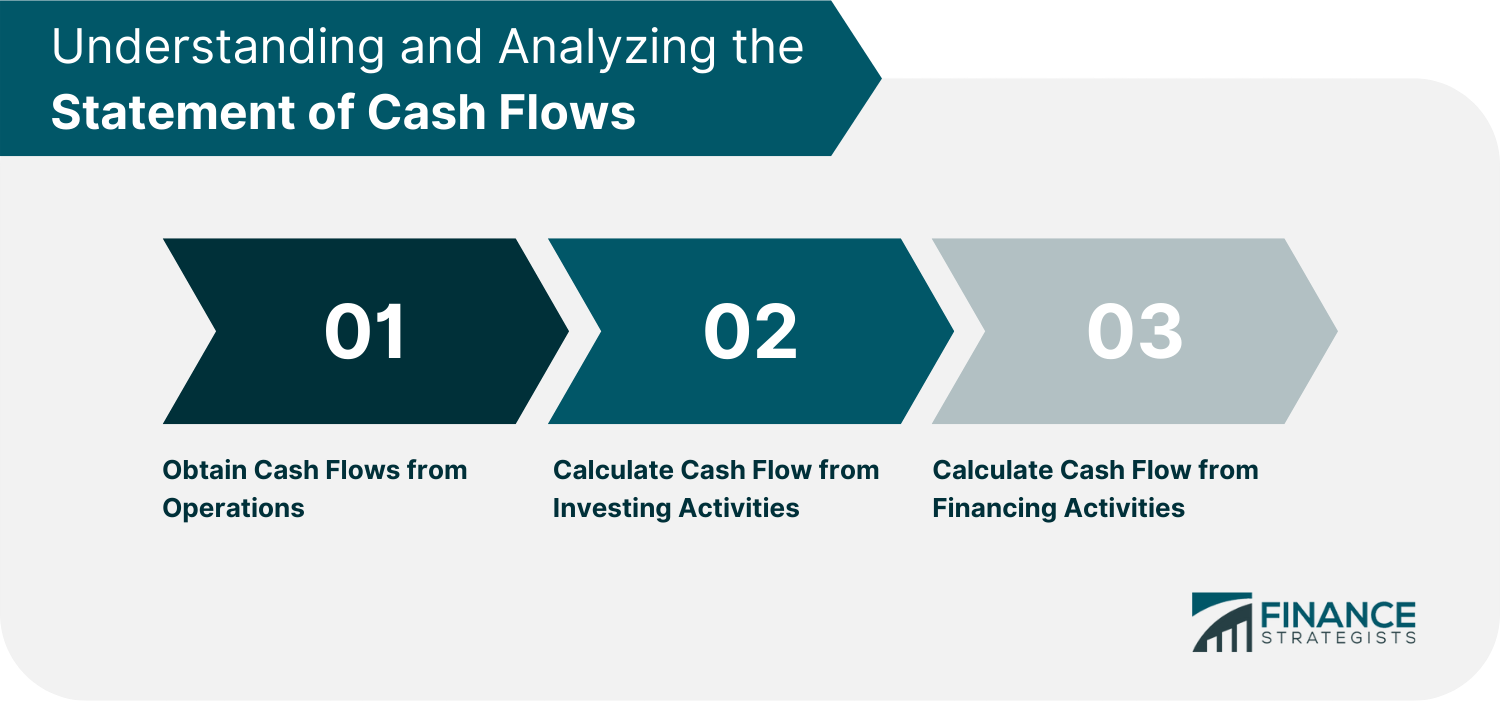

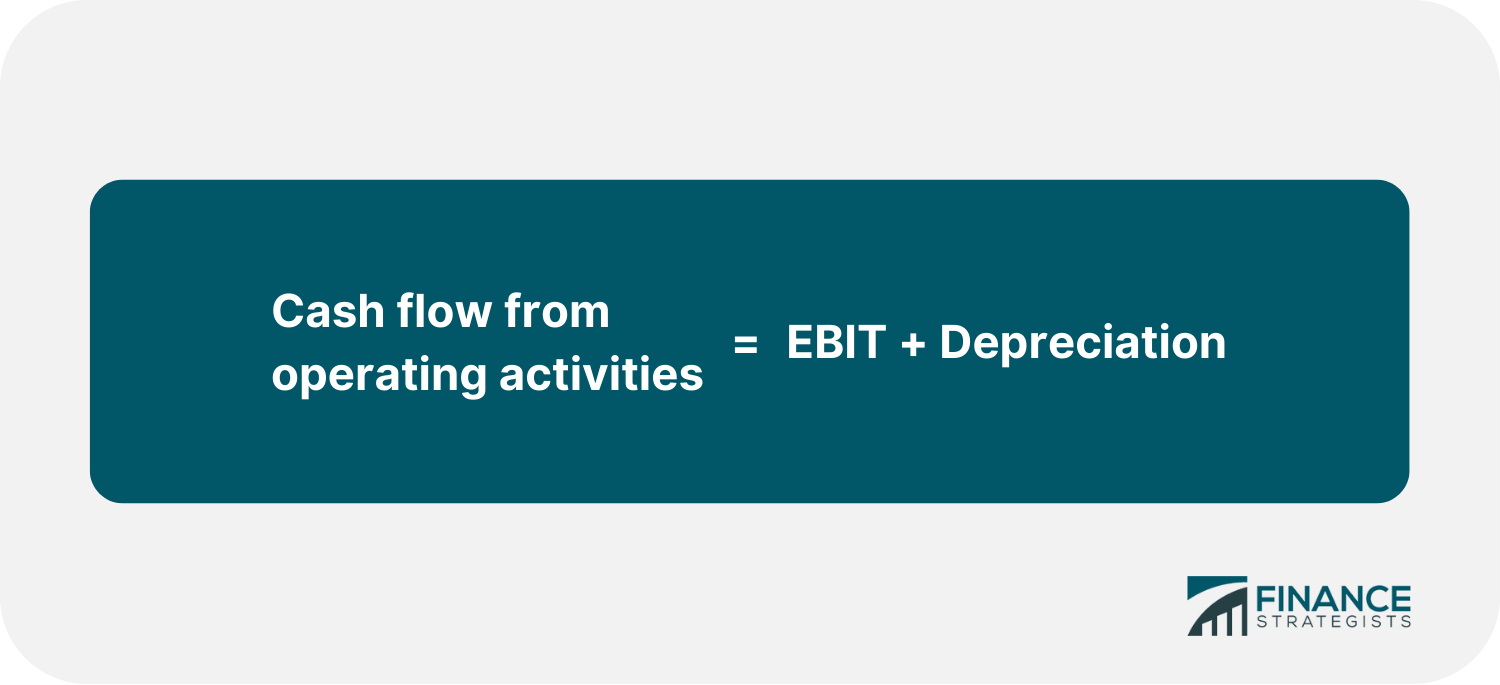

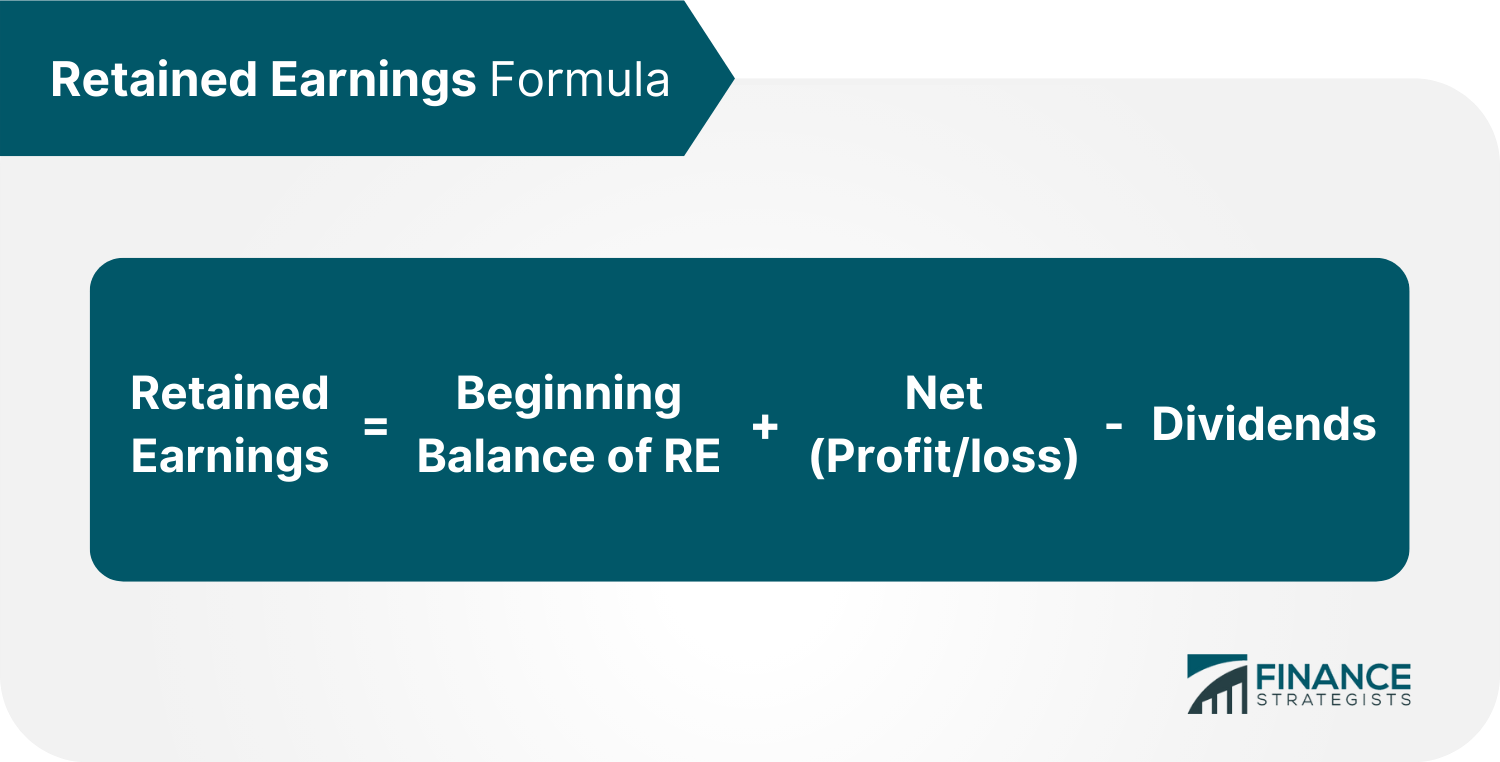

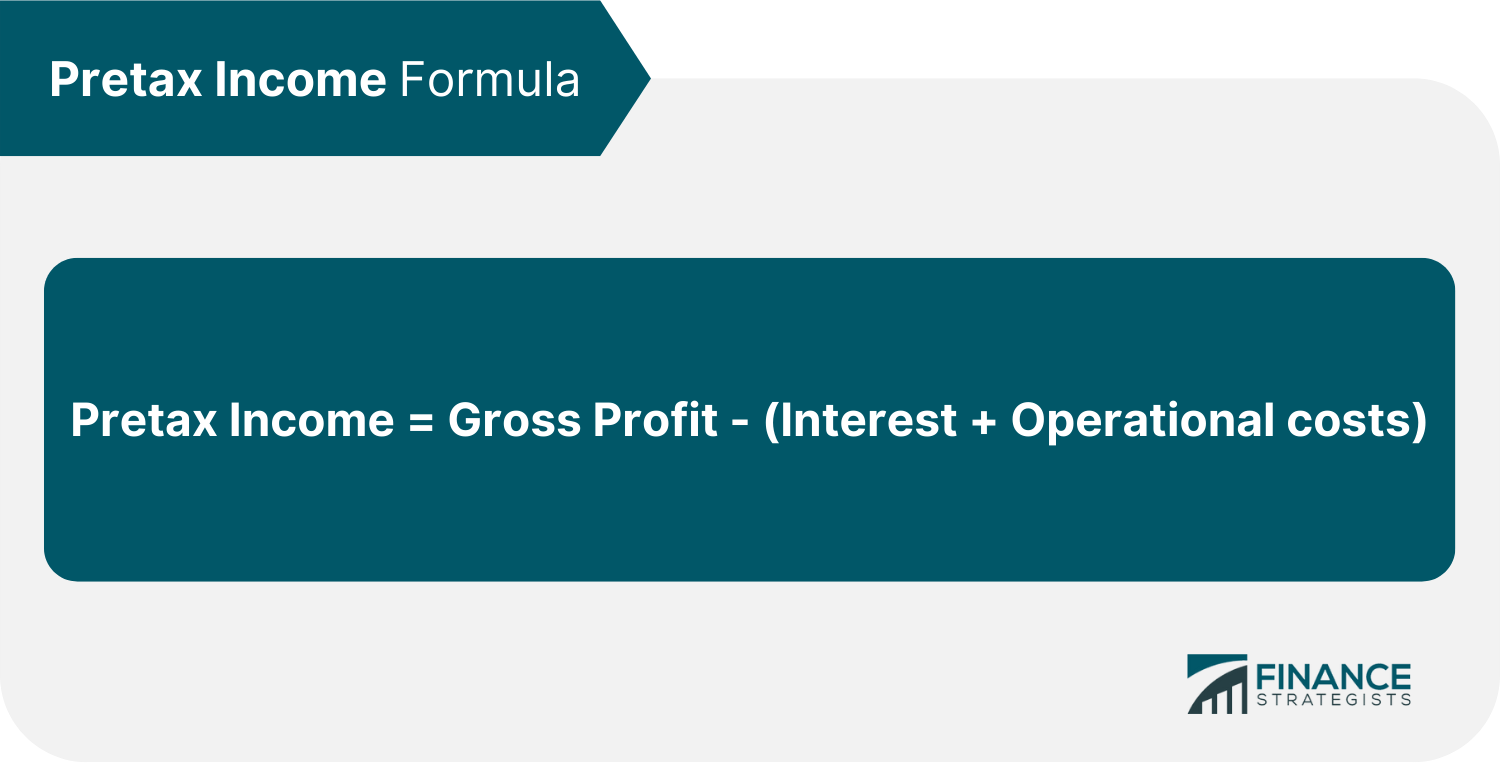

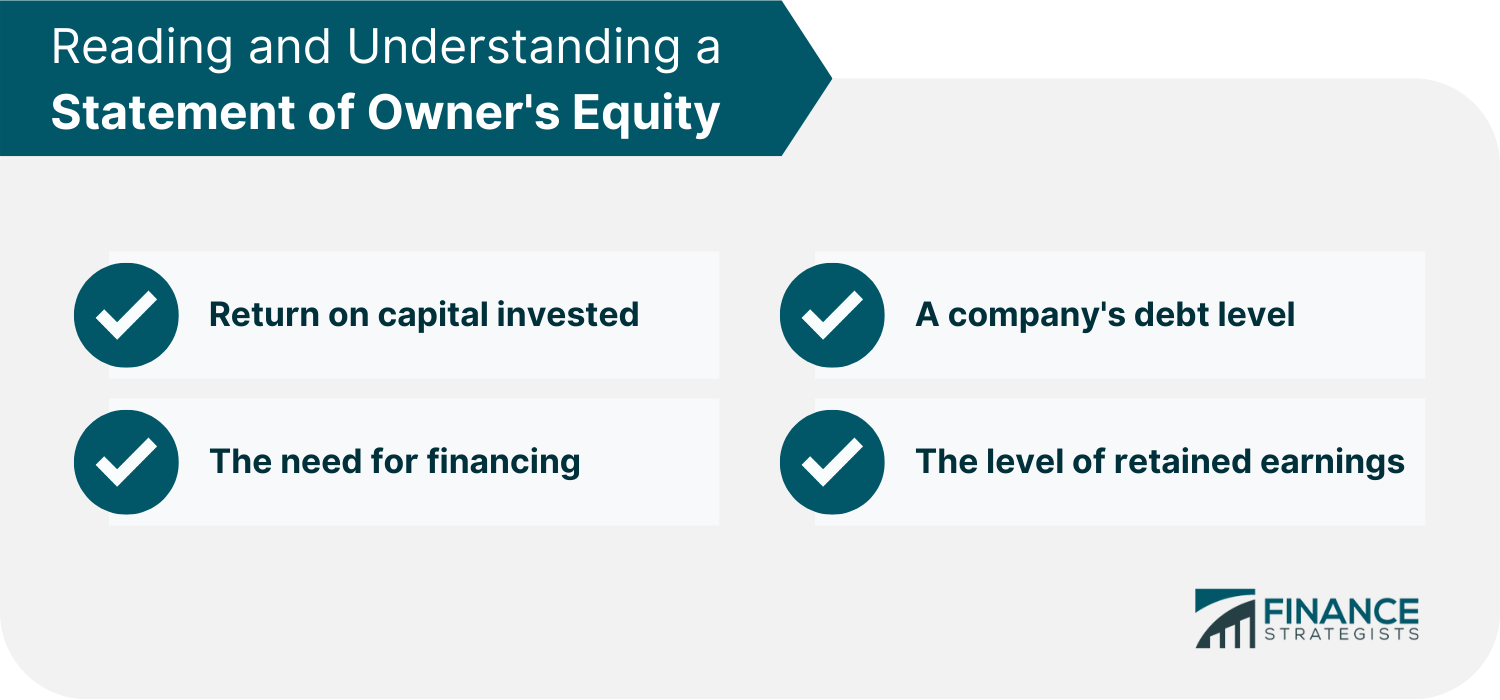

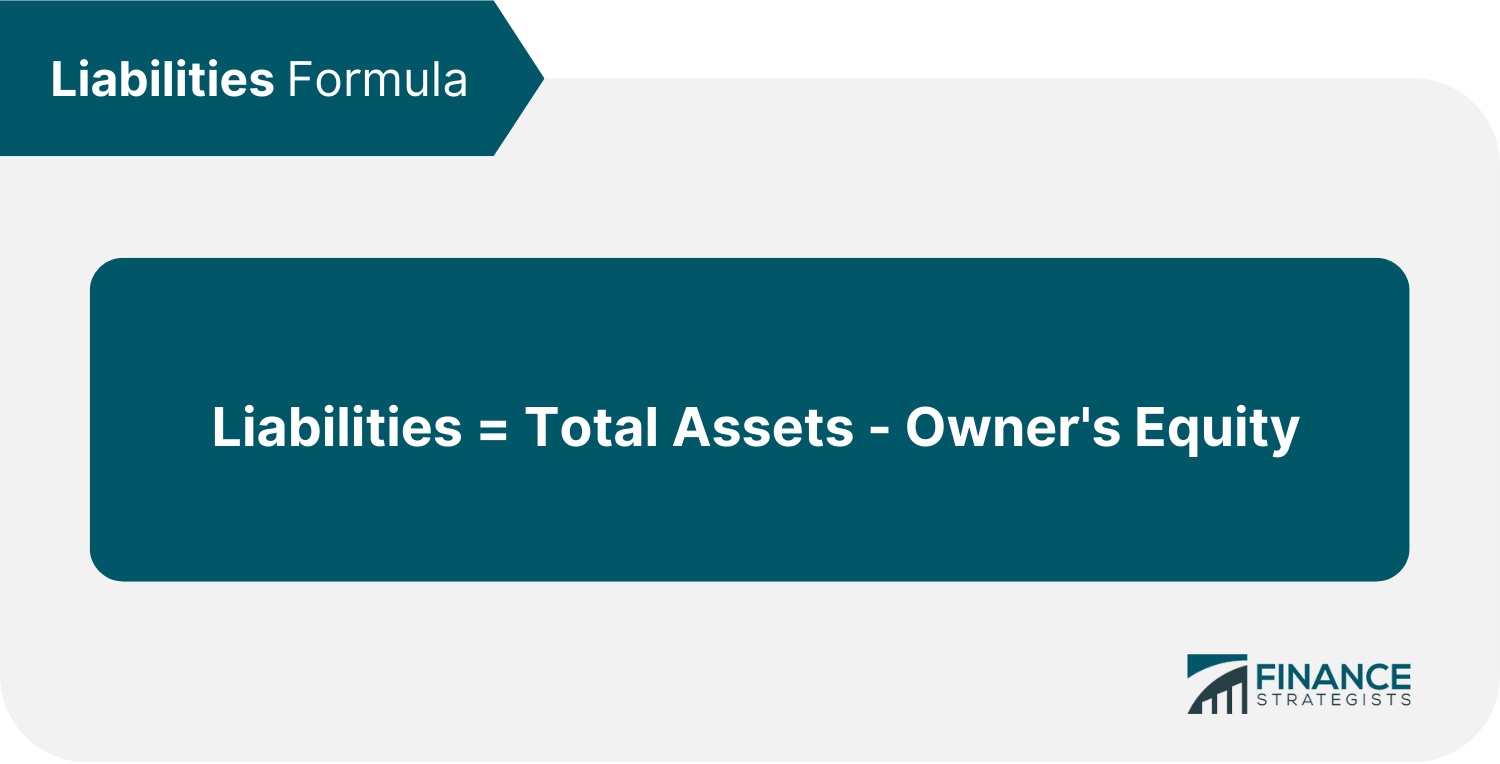

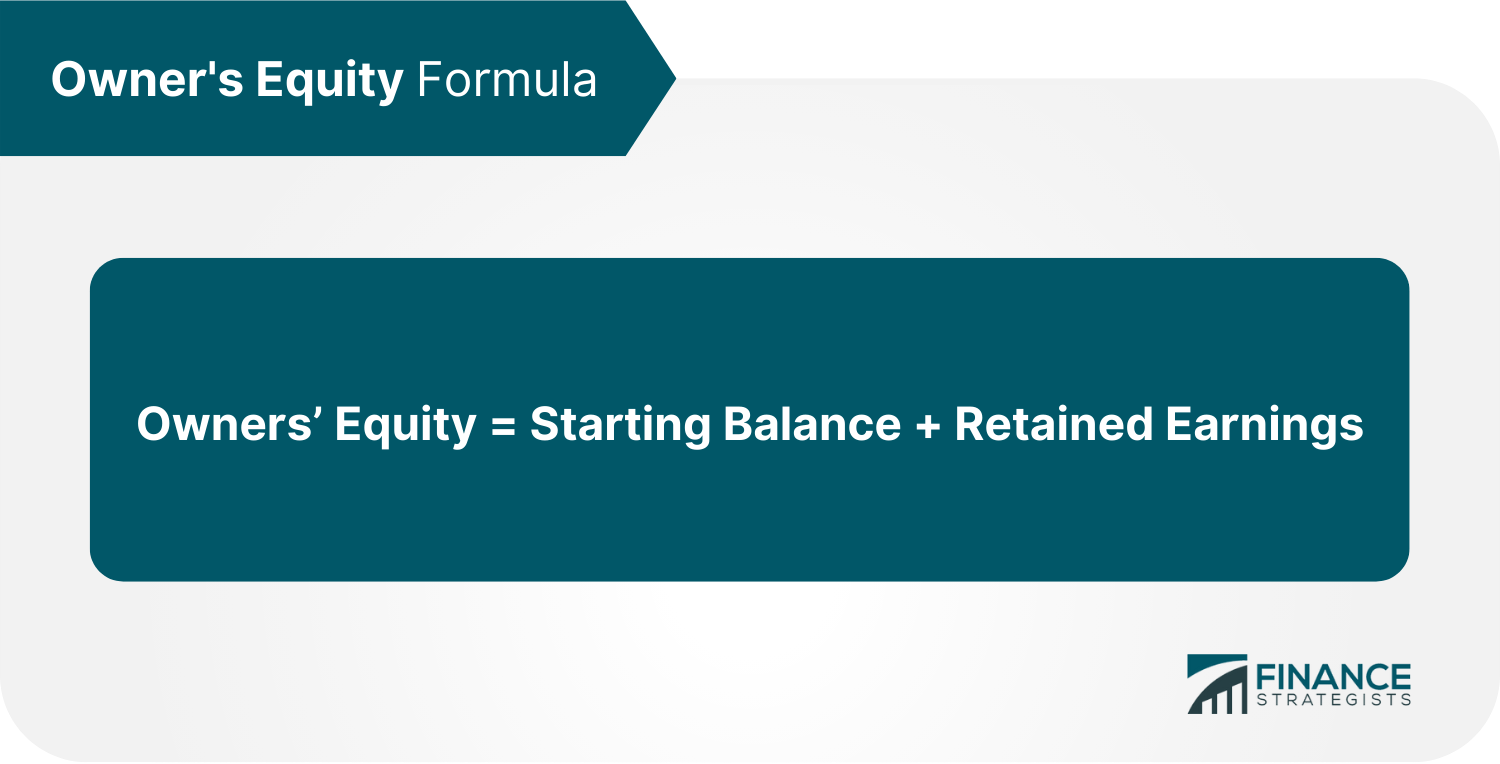

Learning about financial statements can be overwhelming for the average person. Financial statements are a series of reports that measure a company’s financial performance and health over a specific period of time. However, with a basic understanding of what the different parts of a financial statement represent, you will be able to better understand how your investments are performing and whether or not a company is in good financial shape. Analysts and investors use financial statements to calculate financial ratios that can be used to compare companies across different industries. On the other hand, business owners can use financial statements to make informed decisions about where to allocate their resources. In this article, we will break down each part of the three most common types of financial statements – the balance sheet, income statement, and cash flow statement – so that you can confidently navigate your way through them. Accounting is a complex field that takes years to master. However, you can learn the basics of accounting in just one week and be able to manage your business accounts on your own. This article will not make you into a professional accountant, but it will help you manage your accounts without relying on anyone else. To be able to become an accountant in such a short time, you must focus on the fundamental concepts of the discipline. This chapter will show you the essential principles of accounting and bookkeeping. It will answer questions like “What is accounting?” and “How different is it from bookkeeping?” as well as “How do you keep track of your finances?” Before we define accounting, let us clear up some common terms used by accountants that you will come across while reading this article. By keeping these terms in the back of your mind, it will be easier to understand the concepts presented here. Accounts Receivable (AR): An account receivable is a bookkeeping entry that represents money or assets owned by customers or clients. Think of accounts receivable as money that belongs to the company but is currently in the possession of another party. Accounting (ACCG): The term accounting refers to the system that businesses use to track and report their financial transactions. This only applies to established businesses, as they are generally the only ones who can enter into legal agreements. Accounts Payable (AP): Accounts payable is the term for money that your business owes to creditors. This can include suppliers whom you have purchased goods or services from on credit. Accounts payable should be recorded in the books of accounts as soon as possible after the purchase has been made. Assets (fixed and current) (FA, CA): The term assets can be used to refer to any item of value that a company owns. If you are running a business, anything that adds value to your business can be referred to as an asset. These assets are then divided into two categories: Current Assets (CA) and Fixed Assets (FA). Current assets are items of value that can be turned into cash within one year. This could include cash, inventory, accounts receivable, etc. On the other hand, fixed assets are those which cannot be converted to cash within twelve months and may include machinery, real estate or land. Asset Classes: A group of securities that tend to behave in a similar way in the marketplace is called an asset class. The three main asset classes are equities, fixed income bonds, and cash equivalents. Balance Sheet (BS): Accountants are required by law to provide a balance sheet as part of their duties. It is a document that summarizes the company’s assets, liabilities, and owner’s equity over a specific period of time. The growth of your business may be estimated via the balance sheet over time. Capital (CAP): The term “capital” refers to the company’s money or assets that can be put into use. “Working capital” specifically describes the money currently available for business operations and is calculated by subtracting current liabilities from current assets. Cash Flow (CF): The term cash flow refers to the revenue or expenses your business generates from activities like manufacturing, sales, and procurement. You prepare cash flow statements based on a specific time frame. Certified Public Accountant (CPA): The phrase certified public accountant refers to someone who has passed the standardized CPA examination and obtained the necessary job experience. In other words, to be a CPA, you must fulfill certain criteria such as passing the exam and having work experience. The good news is that in order to work as an accountant at your company, you do not need to meet any of the criteria. Cost of Goods Sold (COGS): The cost of goods sold (COGS) refers to the direct expenses related to the goods a business sells. Different businesses will have different ways of calculating their COGS, depending on their model. For example, in retail, it might simply be the cost of purchasing the goods from a supplier. But in manufacturing, other factors could be included – like raw materials, labor and power costs. Credit (CR): In accounting, the term credit refers to an entry in the books of accounts that signifies a decrease in assets or an increase in liabilities and equity on a balance sheet. By using a double-entry method of bookkeeping, we can see that every transaction must have two entries (A debit and credit entry). Debit (DR): The term debit is the opposite of credit. A debit indicates either an increase in assets or a decrease in liabilities on the balance sheet. Diversification: The process of spreading money across various assets is known as diversification. Companies often do this to reduce risk by investing in areas outside their normal operations. Enrolled Agent (EA): An enrolled agent is a tax professional who helps clients interact with the Internal Revenue Service. You may employ an enrolled agent to process your taxes, or you may decide to do it yourself. Expenses: There are many different types of expenses that businesses have to account for, such as fixed costs, variable costs, and accrued expenses. All of these refer to the money that is spent on a day-to-day basis to keep the business running. There are four major types of expenses. Fixed expenses (FE) are payments such as rent that will recur whether or not the business is operational. Variable expenses (VE) represent expenditures like labor that can vary over time. Accrued expenses (AE), in contrast, represent future costs that have not been paid yet. Finally, we have operational expenses, which are non-production related and include things like taxes, insurance, and so on. Equity and Owner’s Equity (OE): Equity refers to a company’s assets minus its liabilities. In other words, equity is the portion of the company owned by shareholders. Owners’ equity specifically refers to the percentage of stock an individual has ownership of in a company. Insolvency: A firm can be declared insolvent if it is unable to pay its debts. This happens when the assets of the company are much less than its liabilities. Generally Accepted Accounting Principles (GAAP): The GAAPs are a set of rules that govern accountants and businesses. These rules are in place to ensure that financial reports from different businesses are consistent with each other. All businesses must follow the GAAPs, but they are especially important for publicly traded companies. General Ledger (GL): The general ledger is a crucial book of accounting that includes all financial transactions undertaken by a business. When these transactions are recorded properly in specialized ledgers, they are then summarized in the general ledger. To manage finances successfully, it is essential to maintain an accurate general ledger. Trial Balance: A trial balance is a financial statement that accounting professionals use to check the accuracy of their record-keeping. This document contains all debits and credits from a company’s ledger in order to test whether or not the system is working properly. Normally, businesses should have an equal number of credit and debit transactions; if this is not the case, it is likely that there are missing or inaccurately entered items somewhere. Liabilities (current and long-term): The term liability is used to signify all of a company’s debts throughout its business operations. Liabilities are classified as current and long term. Current liabilities (CL) are debts owed by a firm within one year, such as payments to suppliers. Long-term liabilities (LTL) are debts that can be paid over a longer period than one year. A mortgage loan with terms greater than one year is an example of a long-term liability. Limited Liability Company (LLC): LLCs protect the owners of the company from being held liable for the company’s debts and liabilities. This type of business shields the owners from losing personal assets if the business becomes insolvent. Net Income: The net income is the total earnings of a company over a given trading period. This is calculated by subtracting expenses from total revenue. Present Value (PV): The term present value refers to the amount a future sum of money is worth now. For example, if I tell you that I will give you $100 next year or that I am giving you $100 right now, you will see that the money is more valuable today than it will be a year from today. If this money is owed to you and has the capacity to be invested and expanded, its current value must grow over time in order for it to equal one year later. Because cash may be invested and multiplied, the present value aids us in determining the worth of cash in the future. Profit and Loss Statement (P&L): The Profit and Loss Statement is one of the most crucial financial documents. This document is utilized to evaluate a firm’s performance by examining sales, costs, and expenses over a particular trading period. Return on Investment (ROI): ROI refers to the amount of money that is earned as a result of investing in a business. For example, if you were to invest $1000 today in a business that generates $2000 in 1 year, your return on investment would be $1000. The purpose of calculating ROI is to determine whether or not an investment is likely to generate profit. To find the ROI, divide net profit by the cost of investment. Individual Retirement Account (IRA, Roth IRA): An Individual Retirement Account is a retirement savings plan. A traditional IRA allows workers to contribute taxable funds to an investment that accumulates in value with deferred taxes. The tax obligation is simply postponed but not neglected in IRAs. Roth Is a type of retirement investment vehicle where the taxpayer does not defer taxes on earnings. In other words, the disbursements are tax-free for individuals who qualify. The 401(k) and Roth 401(k): A 401(k) is a sort of retirement savings vehicle that allows you to invest a portion of your income into an investment-based retirement account. The money will not be taxed until it is withdrawn. After taxes, any member of the Roth 401K can still contribute, eliminating the need for taxation at withdrawal time. Subchapter S Corporation (S-CORP): S-Corp is a type of business that satisfies IRS criteria. Rather than being taxed as a corporation, these firms are taxed as partnerships. Dividends paid by publicly traded businesses are subject to double taxation, which is not the case for S-Corps. Bonds and Coupons (B&C): A bond is a type of debt investment referred to as fixed security. An investor loans money to another entity with the promise of receiving the money back with interest. For all bonds, there is an annual interest that is paid. The annual interest paid on top of the bond is what we refer to as a coupon. Retained Earnings (RE): The profits a business gains after dividends and taxes are paid that go back into the company instead of being distributed to shareholders or used to pay off liabilities. Accounting is the process of consolidating, summarizing, analyzing, and reporting financial records. An accountant is responsible for ensuring that all financial reports are prepared and analyzed correctly. They are also consulted in regards to interpreting and explaining accounting records. On the other hand, bookkeeping simply refers to the practice of recording all accounting data. A bookkeeper is an individual who meticulously records a company’s transactions and keeps the data organized. Transactions are recorded for future reference and proper accounting. In simpler terms, both bookkeeping and accounting can be done by an accountant. The bookkeeper’s primary role is to streamline the accounting process for the accountant. In essence, all of a bookkeeper’s responsibilities may be handled by an accountant effectively. Because most firms have so many transactions, they delegate recording activities to bookkeepers and give the task of assessing a company’s financial performance to the accountant in order. Although their roles are quite different, accountants and bookkeepers need each other to be successful. A bookkeeper’s work is fruitless unless an accountant consolidates and analyzes it. Likewise, an accountant cannot do any task without clear records from the bookkeeper. That being said, an accountant has a more extensive skill set and performs tasks that are generally more complex than those of a bookkeeper. To qualify as an accountant, one must acquire a degree or CPA certification. Because the bookkeeper provides the foundation documents, he or she must also be familiar with the fundamentals of accounting. Although it is not necessary for a bookkeeper to have formal training, they must provide information that is useful to the accountant. The responsibilities of a bookkeeper vary based on the business. Some employers want their bookkeepers to handle broad financial management, such as recording and organizing financial records, as well as providing accounting services. Sometimes, a bookkeeper’s only job is to document financial transactions and send them to the accountant. If you are starting your own business, you might be able to handle the books yourself instead of hiring someone. Most businesses when they first start out don’t hire bookkeepers or permanent accountants. As long as you can keep up with all the transactions by yourself, stick with simple bookkeeping until you absolutely need to bring in an accountant for things like processing payroll and taxes or professional advice. Some of the duties bookkeepers are responsible for include: 1. Because bookkeepers are in charge of recording, organizing, and managing data, they can recommend the best software for a company’s needs, manage it effectively, and implement it to ensure that it offers value. 2. Recommend, implement, and monitor bookkeeping policies: Another key responsibility of bookkeepers is to suggest strategies that will make the bookkeeping process run more smoothly. 3. Develop credit and debit accounts: A bookkeeper’s primary responsibilities stretch to maintaining different subsidiary books of accounts along with the general ledger. To be able carry out this role, the bookkeeper must develop credit and debit accountings while also assigning expense types. 4. Everything required to conduct business, such as expenses and income, should be entered into the software: It is the responsibility of the bookkeeper to ensure that all transactions are recorded. Modern bookkeepers will be expected to digitally document all documents, including cheques and receipts, due to the improved data quality. 5. The bookkeeper is responsible for activities such as handling all banking, which creates accountability and transparency of cash flow. All money coming in and out of the company must go through the bookkeeper. 6. The bookkeeper must train all staff members on how to use any relevant bookkeeping software that the company uses. 7. A bookkeeper’s responsibility is to confirm accuracy of all recorded transactions by matching documentation such as receipts and checks. If any discrepancies are found, the bookkeeper must make corrections. 8. Check that the data is accurate and that the accounts are in balance. 9. Maintain records, backup and archive as needed. 10. Assist the accountant in preparing financial statements: The bookkeeper may be required to assist the accountant with the preparation of financial statements. In some organizations, it is the bookkeeper who produces financial reports. The trial balance, which is always prepared by the bookkeeper, is the first financial statement to be corrected. 11. Ensure that bookkeeping procedures and government rules are followed. The duties of a bookkeeper are not as intricate as those of an accountant. Some responsibilities undertaken by accountants include: 1. Data Management: The accountant is responsible for ensuring that all financial data is recorded accurately and stored securely. If the bookkeeper makes any mistakes in recording or storing transactions, it falls on the accountant to correct these errors when preparing financial statements. To prevent such problems from occurring in the future, an accountant must double-check that all data being recorded by the bookkeeper is credible and formatted correctly. 2. Financial Analysis and Consultation: The accountant’s second responsibility is to provide analysis and consultation on financial decisions. The accountant is better positioned to interpret the financial statements after they are published, providing advice on the best course of action for the firm. 3. Financial Reports: The accountant is in charge of generating the various IRS and other bodies required financial documents. The balance sheet, income statement, etc. must be accurate and provide an accurate picture of the company’s performance. The accountant must make certain that any discrepancies are addressed as they arise and that the reports present real figures for the firm’s net worth and earnings. 4. Regulatory Compliance: Finally, the accountant is responsible for ensuring that the organization is in compliance with laws and regulations. Accountants will be required to submit taxes for employers and the firm, process payroll, educate the board and staff about best financial practices, and ensure that the company adheres to all relevant laws and regulations. Any person practicing accounting follows specific rules to ensure transparency and accuracy in financial statements. If you are new to accounting, there are several rules, known as the Generally Accepted Accounting Principles (GAAP), which must be followed in order to ensure transparency and correlation between financial statements. In fact, understanding these principles will make learning accounting much easier overall. GAAPs are regulations that guide bookkeeping and accounting practices across the U.S. and other parts of the world; some of these principles include. The first rule in accounting is to assume that all businesses are economic entities with the goal of making a profit and gaining value. This premise is necessary when preparing financial statements. If we do not assume that an establishment wants to make money, then there is no need for creating records such as the profit and loss statement. The rule of accounting that all transactions must be under one currency still stands. This principle does not state which currency to use, but it does insist that every transaction is done with the same one. You can not suddenly start recording numbers in USD if you were using British pounds earlier on. Even if a company has expansive international reach, they are required by this rule to funnel everything into one wallet for neatness’ sake. In addition, all accounting financial reports need to demonstrate outcomes from a particular time frame. Such reports cannot be created out of thin air–every single one must illustrate the period it covers. For example, some are completed monthly while others may only be done quarterly, semi-annually, or annually. The timeframe is chosen by the business so that its milestones and progress can be monitored appropriately. The cost principle is one of the two principles that govern accounting. It states that the cost of an item in financial reporting should not fluctuate over time. In other words, if a thing is bought today for $100, it should be recorded at $100 in the financial report even if four months later the same thing costs twice as much. Every transaction is preserved as it occurs during the first operation and should not alter regardless of whether the price of an item changes. The first caveat is that all information relevant to a company’s financial statements’ primary purpose must be disclosed in notes accompanying the statements. In other words, do not just give out financial statements without also providing explanatory notes for pieces or numbers that may confuse some people. Using the going concern principle in accounting requires that businesses manage their finances as if the company will remain operational indefinitely into the future. In other words, all businesses are assumed to have an infinite life span and must be treated accordingly in financial reporting. Every period should allow for transactions to take place in subsequent periods. When it comes to accounting, this rule states that all businesses should use the accrual method and provide financial information in this way. There are two types of bookkeeping: the accrual and the cash system. In the cash approach, deals are recorded as soon as money changes hands, but in the accrual method, deals may be recorded before money changes hands. Under the accrual method, for example, you can record a purchase on credit as a whole transaction. However, under the cash system, only after you have paid for the item will this technique be recognized. Another tenet of accounting is that money should be recorded when it is acquired and not when it is received. This principle builds on the accrual basis of bookkeeping. All transactions are deemed completed once they occur, regardless of whether money has been received or not, in this method. This principle is mostly applied to small firms and corporations. Smaller enterprises such as sole proprietorships and partnerships might be excused from some of the principles. A firm with revenue less than $1 million will not be affected by most of these rules. The principle of materiality dictates that accountants use their best judgment to determine the course of action in case of an error. This principle recognizes that business transaction records may have errors, and if said errors are not significant, then it is the accountant’s responsibility to rectify the situation using their best discretion. In most cases, this means siding with the company they represent. However, any errors with long-reaching effects cannot be so easily fixed and more substantial actions must be taken to correct them accordingly. The recording principle stipulates that if there is more than one way to document a transaction, businesses should first record liabilities and expenses, and then gains and revenue. This guideline protects companies from being overcharged in taxes because of inadequate record-keeping. Every time money and gains are recorded, the firm’s tax burden increases. Liabilities and expenditures, on the other hand, decrease the taxes that will be paid. This idea ensures that businesses do not have to pay taxes when their records are delayed. If profits are recorded first, it is possible that costs may be forgotten, resulting in a company paying too much in taxes. Understanding these accounting concepts will make your job much easier and help you grasp accounting a lot faster. Before we go on to the next chapter, spend some time reviewing them to ensure that you understand them thoroughly. Let us now take a look at financial statements, now that you know what accounting is and the fundamental concepts utilized in it. The entire article is about generating and interpreting financial statements. In this chapter, I will explain financial statements, their usage, and the significance of them in your company. Financial statements are records that show a company’s activity and performance. They use easy-to-understand language so that anyone can interpret them. The summary is made from data stored by bookkeepers. When a business operates, the bookkeeper records all of the transactions every day to build up a store of information. This must be summarized over time to provide a clear view of performance and identify any areas that need improvement according to key documents and accounting principles. Financial statements are legally binding documents, so they must adhere to accounting best practices. If the statements do not follow the set accounting principles, they may not be admissible in court if there is a legal dispute. Financial statements are usually audited by responsible government agencies, accountants, and other companies. To put it another way, these summarized papers are crucial to a lot of stakeholders. If you operate a company, your financial records will influence how much tax you pay, the type of business partners you attract, and your creditworthiness. As a result, every firm must keep accurate accounting in order to complete these tasks. Proper bookkeeping is also essential in this step. The balance sheet, income statement, and cash flow statement are the three main financial statements. The focus should be on interpreting these core financial statements for anybody new to the realm of accounting. Other auxiliary financial statements may be useful in preparing and analyzing. The statement of owner’s equity, as well as the statement of retained earnings, might be of interest to you. In this article, we will focus on balance sheet preparation and interpretation, revenue statement evaluation and interpretation, cash flow statements analysis and comprehension, and statement of proprietorship equity. These are the main financial statements that reveal a company’s future prospects. However, we will look at the rest of the financial documents and tools as we go so you can have a thorough grasp on your records The reason for selecting the four main financial records is that they can tell you everything you need to know about your business. The balance sheet provides an overview of the company’s assets and liabilities, from which we can determine the company’s position in terms of financial stability. The income statement focuses on a company’s revenue and expenses, while the balance sheet helps you understand the net worth of your business by assessing its assets and liabilities. Understanding both statements is key to getting a full grasp of how well your business is doing currently and what its long-term prospects may be. The cash flow statement allows us to identify how the company pays its debts through operational costs and expenses. This statement is important in assessing the financial position of the company and whether or not it can continue operating smoothly in the near future. Many people rely on the information provided in financial statements when making decisions. This includes investors, financial analysts, tax authorities, and shareholders. For publicly traded businesses, financial statements are especially important in providing guidance about the company’s performance in the stock exchange market. As you can see, there are different types of financial statements. Each statement has its own purpose and benefits. The balance sheet is an overview of a company’s assets, liabilities, and owner’s equity. This type of financial statement is important because it takes into account the entirety of what a business possesses (assets) as well as what it owes other entities (liabilities) and provides perspective on growth or decline. The balance sheet is created from the fundamental equation: The purpose of preparing a balance sheet is to record the growth of the business and calculate its net worth. This is done by categorizing assets on one side, and liabilities and owner’s equity on the other. The balance sheet is a financial statement that may be prepared even before your company begins operating. Prepare your first balance sheet as soon as you’re ready to get started so that it may help you assess the firm’s net worth in the future. A company’s value is represented by its assets, as seen in the equation. The cash invested by the owner at the beginning of the business becomes the owner’s equity, while cash borrowed to get started represents liabilities. This is how a balance sheet appears in its simplest form when a business first starts. However, as profits or losses are earned, liabilities and assets will change – sometimes growing larger and sometimes shrinking. The balance sheet includes assets such as cash accounts, accounts receivable, and inventory. The liabilities include debts- both short term and long term, accounts payable, and dividends payable. Owner’s equity is calculated separately after the income statement has been prepared. The balance sheet is a snapshot of the company’s value at a specific date and time, while the income statement shows figures from a certain period of time. The period over which you will be trading may range from one month to several months or a year. The majority of organizations produce their financial statements once a quarter, semi-annually, or annually. If you are operating a small firm, I propose that you maintain track of your financial position by preparing quarterly and semi-annual reports. Simply maintaining track of the company’s performance might be sufficient. The formula for the income statement is as follows: Net Income = (Revenue – Expenses). The income statement’s primary goal is to determine the company’s overall revenue, expenditures, and net profit. If you calculate your income statement after three months, it will show you how much money was spent, generated, and profit made during that time. The general ledger is where you will find the information you will need to prepare an income statement. It is the general ledger that keeps track of all your activities (Expenses and revenue), which are essential for calculating net profit. However, to properly prepare an income statement, you must ensure that the data in the general ledger is correct. A trial balance is made to test the accuracy of the general ledger. To prepare an income statement, you must first categorize your revenue and expenses. Because many firms only have one source of income, the entire procedure is straightforward. If you are a car dealer without any additional sources of income, preparing your earnings statement should be simple. The main source of a company’s revenue is operating revenue (OR). This means the income that comes from the business’ primary activity, such as selling cars. In addition to this type of revenue, businesses can also gain money from interest earned on cash in the bank or rental income on property. Finally, companies may bring in extra money by selling long-term assets like land or vehicles. All forms of revenue are accounted for and tracked in the income statement. Expenses can additionally be split into primary and secondary expenses. The former sort of expense directly results in revenue, for instance the cost of goods sold and operational costs. On the other hand, general administrative expenses, research and development costs, among others are classified as secondary expenses. The third vital income statement is the cash flow statement. This displays a summary of the money that comes in and out of the company. The debt, expenses, revenue, and fund investments are all included in this document so it can be used to help supplement the income statement and the balance sheet. The cash flow statement mainly provides information to investors, particularly potential partners, on the business’ ability to pay its debts and continue operating. There is no set formula for the cash flow statement, but it can be divided into three sections: operating activities, financing activities, and investing activities. The cash flow statement’s operating activities include sources and uses of cash that result from the business’ day-to-day operations, such as selling goods or services. The operating CFS may reflect changes in accounts receivable and payable, depreciation, inventory levels, wages paid to employees, taxes owed to governments, and rent expenses. Any uses and gains of cash from long-term investments are included under investing activities. For example, if a business loans money to another company and interest is paid on that loan, the cash will be recorded as part of investment activities. Simultaneously, if you have to pay interest on prior borrowing, the amount will be classified as investing activity. The financing activities section includes sources of cash from investors, such as other companies or banks. This part of the report mainly focuses on cash coming into the business from outside sources rather than what the business already has or money paid to shareholders. You may also include items such as stock purchases, equity issuance repayment debt, and others in this section. The statement of owner’s equity is the last financial statement we will discuss. It shows how much of the company belongs to its owners. We have already seen that the amount invested by the business’ founder(s) on starting day makes up their initial stake in the company (capital). However, as time goes on, if the business turns a profit and keeps some of that money within itself instead of distributing it (retained earnings), then this expands the founders’ ownership percentage (owners’ equity). Therefore, you calculate owners’ equity by taking retained earnings and adding them to previous total owner’s equity. The statement of owner’s equity mainly shows the increase or decrease in the owner’s capital at the start of the trading period. This means that the capital plus retained earnings at the end of the period is what we call the owner’s equity. When preparing a statement of owner’s equity, you will want to include a heading with: The name of your company, the title of the report, and finally, the list of the period covered. The title of your report will read “The statement of owner’s equity” if you are a sole proprietor. If you have partners, the title should be changed to “The statement of Partner’s Equity.” And finally, for corporations and public limited companies, we use the term “The statement of Stockholders’ Equity.” The owner’s equity is calculated at the end of a specified trading period, just like the income statement. After completing your income statement and obtaining your net revenue, you may proceed to allocate the money as needed. Once all of the revenue has been paid out and a portion is kept back to be reinvested in the company, add it to the previous period’s owner’s equity. The statement of owner’s equity is mostly determined by what occurs in the income statement. Given that we have established that the owner’s equity equals the capital invested by owners of the firm at inception, expenses will reduce the capital. Simultaneously, revenues will increase. Because the income statement seeks to produce a net profit figure, you can see that if expenses exceed revenue, the income is likely to be negative. As a result, capital will decrease, resulting in a reduction in owner’s equity. The financial statements are extremely important to businesses. Although each of the financial reports has its own uses, let us consider the benefits of preparing company financial statements as a whole. 1. Track Financial position of the company: The balance sheet is an important document that shows the financial position of the company. The balance sheet includes information on the company’s assets, liabilities, and net worth. This information is essential for planning the future of the business. 2. Examine the financial performance of a firm: Income statements are also important in evaluating the previous success of a business. The revenue and expense data from an income statement is critical for understanding a company’s performance. Any interested party may calculate the company’s earnings and longevity using this material. Investors, lenders, and government authorities all rely on such data. Even if you apply for financial assistance, even if you do not have trustworthy financial statements to demonstrate the success of your firm, you may not be able to obtain it. 3. Display the company’s current financial condition: The statement of cash flow is especially significant in showing the present status of the firm. Suppliers, for example, may want to work with your firm if they are confident that it will be able to pay its obligations. The statement of cash flow is a key indicator of a business’s financial health and its ability to repay debts. This is important for business owners who wish to secure trading partners, as lenders will be more likely to work with businesses that are transparent about their finances. 4. Show the net worth of your company. By examining the balance sheet, we can assess the assets, liabilities, and owner’s equity. The company’s value will only increase if the business is profitable and retains those profits–all factors that can be determined by looking at various financial statements like the balance sheet or statement of owner’s equity. 5. Planning for the future: The financial statements’ secondary purpose is to provide information that will help the management plan for the future. You should consider future investments and make educated judgments to aid the company’s development while being a business owner or manager. You can not make vital decisions without having a thorough knowledge of your firm’s current financial position. The income statement aids decision making by providing data that makes decision-making simpler. 6. Use the income statement to guide your shareholders’ investments: Shareholders invest in businesses that are profitable and have growth potential. The only way to access this information is through financial statements. Knowing whether a company is on an upward or downward growth trend can be discerned by examining their income statement and balance sheet. This information is essential for current and future investors alike; even individuals without shares in the company can benefit from this data when making investment decisions. 7. Guide for creditors and lenders: Lenders and creditors must also consider the company’s financial statements. Lenders and creditors need to review financial reports as well. The income statement and statement of cash flow are critical for lenders and debtors because they reveal a company’s financial liquidity, debt ratio, profitability, and return on investment. These indicators will have an impact on how the firm operates in the future. It indicates a company has insufficient operating capital if it has more past debts than current assets. In other words, it may not be able to settle its immediate liabilities. Creditors and lenders might refuse to participate in a deal with such a firm. 8. Employees compensation: The income statements also show how much employees are paid. We can see that a company is profitable or in the red on its financial statements. Employees utilize such data to analyze their salaries and prospects for a raise. If you work for a firm that continues to make losses year after year, it’s likely you should look for new employment opportunities. This information provided by businesses allows employees to plan ahead for their future with the current employer. 9. Calculating taxes to be paid: It is impossible to calculate taxes owed without financial statements. As a result, all businesses must keep financial records. The tax authorities use the submitted financial records to determine how much tax a firm will pay. If you don’t give correct accounting data, you may be undertaxed as an organization. It’s important to create the most accurate corporate financial documents possible. 10. Debt management: The data included in financial statements is also crucial to the company’s management. If you’re in charge, you will want to know how much debt the firm has, its liquidity, cash flow, and other factors. Financial statement information will assist you in managing your debts properly, regulating borrowing and lending. 11. Trend Analysis: It is always important for businesses to invest based on trends and performance. To do this, you need to analyze financial reports in order to get an understanding of where the company stands. The profit and loss statement, for example, provides data about sales and spending. With this information, you can pinpoint which areas are draining funds and identify what products are selling well. This allows you to make strategic decisions concerning marketing and production that will help your business grow. 12. Tracking: Thanks to our financial tracking, the management team always has a good idea of what is to come. This allows us to avoid any potential disasters before they have a chance to happen. By analyzing our cash flow reports, we can often tell when there might be issues with our supply chain and make decisions accordingly that will help keep things running smoothly in the future. 13. Compliance: In addition to the other benefits of financial statements, they also help companies comply with government regulations. This is especially true when it comes to taxes and employee wages. Without financial statements, it would be nearly impossible to determine how much tax a company owes. Because of this, it is a legal obligation for all organizations to maintain accurate financial records and make them public. Every firm must audit its books, verify the data, and make it available for government review. This promotes transparency by ensuring that everyone can see what’s going on. We have already discussed some of the people who might be interested in your financial records. The list of potential customers, though, is longer than you may imagine. Some of the parties interested in obtaining your financial data may have malicious intentions, but you are required to release it freely. The following parties will require the financial papers: 1. The company’s management team is the primary audience for financial statements. They need information to assess a firm’s liquidity, profitability, and cash flows. This data is critical for keeping the company running on a daily basis. 2. Rivals or people who do the same type of business as you will want to know your financial information. For example, if they can tell from your financial reports that you’re making a lot of money from selling a certain product, they might start selling that product too so that they can try to steal some of your customers. 3. Customers are one of the many groups who utilize financial statements; in fact, most customers will not award a tender to a supplier without first reviewing their financial statement. By looking at a company’s financials, potential customers can discern whether that company will be able to provide the necessary goods and services. 4. As we have seen, employees also need to be aware of a company’s financial position. If it looks like the company is going to make losses, an employee may choose to leave before they lose their job. Reviewing the financial reports can also give employees ammunition to negotiate for better terms. 5. The government needs to view financial reports for the purpose of taxation. Any business that generates profits is required by law to pay taxes to governments in the areas where it resides. As a result, governments will have to examine your company’s financial records. 6. Investment analysts can only do their job properly if you give them the right data. The information they need to make key investment decisions is found in financial statements, so you must make sure your business has accurate financial statements. 7. Financial statements are required by investors who wish to work with your company or provide money. You won’t be able to get a loan for your firm unless you have suitable financial statements, as stated previously. Whether it’s banks, individuals, or other credit providers, the financial statements are the most important thing to look at when investing in a firm. 8. All businesses, no matter how big or small, are evaluated at some point. The credit worthiness of a firm is determined by its ratings. If your company’s credit score is too low for it to qualify for credit, you will not be in business for long. These agencies rely on financial data supplied by you to calculate your credit rating. They establish your credit rating on the amount of assets available, as well as profit and owner’s equity. 9. The other group of people who will benefit from your financial statements are suppliers. Suppliers primarily use financial statements to assess whether a potential customer is suitable for a business corporation. 10. Lastly, unions use the information provided in financial statements to ensure that companies can pay union fees and retain membership. Employee unions also look at accompanying books when lobbying for employee rights, such as demanding a pay raise. They must be able to show that a company is making enough money before any rights are granted. In the next section, we will go over how to prepare and analyze all of the financial statements mentioned earlier. I promised to make this as easy as possible, so we’ll be using shortcuts and simple examples that everyone can understand. As established before, the three main financial statements are the balance sheet, income statement, and cash flow statement. However, in order to make accounting simpler, we will include additional documents such as the trial balance and the statement of owner’s equity in this section. Although the trial balance is not considered a major financial statement, it serves as the foundation for preparing all of the financial statements. The general ledger is at the core of preparing all other financial reports in essence. A general ledger may, however, contain mistakes. Preparing the trial balance will assist us in addressing any errors that may have occurred in the general ledger. The trial balance is one of the most crucial financial statements because it shows how financial data is transformed from one item to another. I expect that you already have a bookkeeper and a well-organized ledger notebook. Accounting begins with a bookkeeper entering all transactions in specialized accounts. The accumulation of transactions is summarized and recorded in the general ledger once they accumulate. At the end of the trading day, general ledger transactions are summarized under separate accounts. This is when we need to make a trial balance to ensure that the data in the general ledger is correct. If the information is incorrect, we will never be able to prepare an accurate income statement, resulting in an incorrect balance sheet. The closing balances of credit and debit transactions during a specified period are shown in a trial balance. If your firm has been functioning since January through December, the trial balance tries to compare the transactions over this time period to ensure that they balance one another. The following equation is used in the formation of the trial balance: This equation proves that the total assets of a company when added with the expenses and money taken out from the business must equal to the liabilities, revenue, and owner’s equity. In simpler terms, all of the assets and expenses for the company can only be funded by either borrowed money (liability), earned funds (revenue), or invested finances (owners’ equity/ capital). The equation works as you can see from the sample trial balance shown above. All of the credit entries sum to all of the debit entries, therefore the equation is satisfied. To prepare a trial balance, you first need to consolidate all the balances in your ledger accounts and cash book. To organize your finances, create a three-column worksheet. The first column is for the account name, the second column is for debit balances, and the third column is for credit balances. Fill in the account name and corresponding balances in the appropriate debit or credit column. Lastly, add up all the credit balances and debit balances. They should completely be equal. Please arrange the following accounts’ balances on the debit side of your trial balance for simplicity: For the credit side of the trial balance, arrange the following accounts balances: If the trial balance does not balance, it is probable that there are mistakes in your data. The following are some of the errors that might cause the trial balance to fail to balance: The trial balance has many advantages for business owners, most of which are internal. This document is occasionally required by people outside of the company, but it offers these benefits: 1. To confirm that debits equal credits: If debits and credits are unequal, it is likely that errors exist in the accounting or bookkeeping process. It is the responsibility of the accountant and bookkeeper to identify such errors and correct them. 2. To find journalizing errors: This document will help you locate any mistakes made in the subsidiary books of entry. Any time accounts cannot be balanced, an error must be located and corrected at its source. 3. To discover the existing problems with posting: The trial balance aids accountants in detecting mistakes caused by incorrect entries or postings. 4. To make financial statements: The trial balance is not an actual financial statement, though it is essential to have one in order to prepare the other financial statements. 5. To list the accounts at a single place: The trial balance allows you to confirm that all of your accounts are in one place. Oftentimes, businesses will record their accounts in different books, which can be difficult to organize and keep track of. With all the benefits offered by the trial balance, the statement also has a lot of shortcomings. This document is vital for the internal correction of errors, but it may not be helpful in some instances because of the following shortcomings. 1. The trial balance does not confirm that all transactions have been recorded. Even though a critical transaction is missing, the trial balance will still balance if you omit a transaction on both credit and debit sides. 2. It does not confirm whether the ledger entries are accurate or incorrect. For example, if you make a mistake such as writing $4000 instead of $400 on one side of the balance, the trial balance will remain balanced as long as both sides have the correct figure. 3. It is unable to discover any missing entries from the journal. The income statement, also called the profit and loss statement, summarizes a business’s income and expenses over a specific period of time. This information comes from the general ledger, which keeps track of all transactions. To prepare an income statement, all you need to do is determine your revenues and expenses from recorded transactions, then compile them in a table format to see net incomes. Here is step-by-step guide on how to create an accurate income statements: The gross profit is the first step in preparing an income statement. The items on the income statement are organized according to a template. The total revenue is the first item on your list. We’ve already seen how to calculate the entire revenue by adding sales from goods and services with other sources such as interests or asset sales. To determine the gross profit, subtract direct costs from the total revenue. The gross profit is the income produced by a firm before deductions for expenses such as operational costs, taxes, and more. The gross margin may be expressed as a percentage of revenue. If you sell t-shirts in a downtown shop and pay $10 each for 10 t-shirts, your direct expenses would be $100. If you sold all of the t-shirts for $12 each, your total income would be $120. The gross profit in this example is $120 -$100 = 20, with a gross margin of 16.6 percent ($20/$120) x 100). The gross margin is a good indicator of how well your business is doing financially. A high gross margin means that your business is stable and likely to stay afloat for a longer period of time. However, if you have a low gross margin, it might mean that you need to change some aspects of your operations in order to reduce expenses or increase revenue. On your income sheet template, you will calculate the pre-interest and taxes earnings. This figure stands for the money a firm would have made if it did not have to pay tax or interest on loans. The cost of goods and operational costs are subtracted from gross sales to arrive at this value. The most effortless way to find EBIT is by subtracting operational expenses from your gross profit. Operational costs are a business’s normal day-to-day expenditures, for example rent and utilities. After you find your company’s EBIT value, calculate the earnings before tax. Many small business owners make the mistake of assuming that the EBIT is their pre-tax income, but it must also account for depreciation– which takes into consideration how much value from assets a business loses over time through normal wear and tear. To calculate this, determine the value of depreciation and subtract it from the EBIT value. What remains is your company’s true earning before tax. Finally, determine the business’s net income to see whether it made a profit or loss during the specified trading period. The EBT value listed above does not represent your firm’s actual earnings. You must first deduct indirect expenditures from GAAP earnings before taxes to get the net income. Indirect expenses include tax and insurance fees. The main goal of producing an income statement is to establish whether the firm is generating profits or losses. The formula above provides a final value for your income, which will be your net gain or loss. It’s worth noting that the amount you get will be determined by your accuracy. If you leave out any expenses or revenue amounts in your income statement, you’ll likely receive a phony result. There are a variety of methods for running a business. To put it another way, you must attempt to comprehend your company’s model and use your best judgment to ensure that all possible sources of income and expenditures are included in the income statement. If you are unfamiliar with accounting, using accounting software can be daunting. For those who do not know how to use complex tools, Excel is a good place to start. Microsoft’s excel provides easy-to-use income sheet templates that can help you prepare your income sheet. The balance sheet is a document that shows the book value of a company. You can create a balance sheet on the first day of your business, as we said before. However, the value of your firm changes daily because of profit and losses generated from normal operations. As a result, you must first generate an income statement before considering preparing a balance sheet. The balance sheet is made up of 3 key items; the assets, liabilities, and owners’ equity. The reason why I recommend preparing the income sheet before preparing the balance sheet is that you must first calculate your owner’s equity in order to have a balanced balance sheet. The balance sheet is critical to both the company’s owners and external investors. It is through analyzing the firm’s assets that the proprietors may plan for the future. The balance sheet also provides a clear image of the company’s liabilities and overall value. As we know, according to the accounting equation. The first thing you need to do when preparing a balance sheet is decide on the reporting date. A balance sheet, as we’ve talked about, is a photo of sorts that captures the value of a company at one moment in time. So it’s important to account for all assets, liabilities, and owner’s equity on the day you’re running your calculations. This date is typically called the reporting date. A balance sheet can be prepared as frequently as quarterly, semi-annually, or annually for most businesses. For example, those who opt for preparing quarterly would have to do so 4 times in a year. This provides the best coverage for reviewing said business’s growth. The quarterly approach is used more often than not to review the growth of smaller businesses closely. The annual approach for reviewing a company’s books usually occurs on December 31st, although you may select any date that better suits your business. On the chosen date, bring together your business’ assets, liabilities and owner’s equity to ascertain its value. After you have chosen your reporting date, start by looking at all of your assets on the date of balance sheet preparation. We usually listed each asset in its column before summing up the assets on the balance sheet, as seen here. Cash, stock, accounts receivable, and so on have been entered in this section. Each of these components is a resource and must be recorded separately. The value of most assets may be determined from your ledger book. At the beginning of each new trading period, all outstanding balances from the previous one are carried over into the new ledger book. In other words, your general ledger should have all the information you need to prepare your balance sheet. When preparing the balance sheet, make use of current assets and long-term assets as a way to simplify your job. Cash and cash equivalents, accounts receivable, marketable securities, inventory, and other current assets are examples of items that should be included in the current assets section. You can list things like company property under the long-term assets component. When we make a balance sheet, we utilize a template that is divided into two main parts. The first will total the assets, and the second will total the liabilities and owner’s equity. After you have completed identifying and cataloging your assets, it is time to identify and list all of your liabilities. You should list your liabilities as current and long term, much like with assets. Accrued expenses, accounts payable, deferred revenue, the present value of long-term loans, and so on should all be included in the current liabilities category. Long-term obligations, such as deferred revenue and long-term lease obligations, are included in the long-term liabilities section. In addition, include the subtotal for current liabilities and long term debts, followed by the final figure on total liabilities. After you have completed listing and calculating the value of current and long-term assets and liabilities, you will need to compute the owner’s equity. Calculating a sole proprietorship’s owner’s equity is simple and straightforward. However, for a publicly traded firm, several elements must be taken into account when computing owner’s equity. Common stock, preferred stock, treasury stock, and retained earnings are just a few of the things that should go into your shareholder’s equity section. You may quickly compute owner’s equity using the previous reporting date balance sheet if you have it ready. In a sole proprietorship, the owner’s equity can be readily calculated by adding retained earnings to the prior owner’s equity. Before you compute your balance sheet, you must first determine the value of retained earnings. Once you have determined the owner’s equity value, compare the values of assets to liabilities and owner’s equity. If the two do not match up, there may be errors in your calculations. You could have used incorrect figures, or you might have imported incorrect data from the general ledger. You can observe from the balance sheet that assets are totaled differently than liabilities and owner’s equity. The sum of all assets equals the combined total of both liabilities and owner’s equity The next most important financial statement is the statement of cash flows. The statement of cash flows helps us determine the ability of a business to continue running its day to day operations. When preparing the statement of cash flows, we divide it into three sections: cash flow from investing activities, financing activities, and operation activities. 1. Cash flow from operations: This is the cash that a firm spends on day-to-day operations. The money earned from the sale of goods and services, as well as money spent on paying rent, are included under operating cash flows. When preparing the statement of cash flows, negative cash flows are subtracted from the positive ones. For example, because the money used to pay staff has to be deducted from income generated by sales transactions, we must subtract it here. 2. Investing activities cash flow: The investing activities cash flow statement shows the money earned or spent from investments like market securities or long-term assets. For example, earnings and losses from selling fixed assets and trading stocks are included. In simpler terms, this is the money coming in or going out from investment opportunities outside of your usual business ventures. 3. Financing activities cash flow: Another component of the cash flow statement will include money made or spent on financing activities. This incorporates money received or spent as a result of business-related cash or cash-related transactions between the firm and its owners, investors, or lenders Owners who receive dividends from the company would be included in this category. At the same time, firms that borrow money from lenders are considered to be investing activities. To begin, you must collect and list all the cash flows from operations. These are easy to find because they are already in your profit and loss statement. If there is any information missing from your profit and loss document, it will be in your ledger books. The earnings before interest and taxes EBIT is the first figure to appear in your cash flow statement. You will also need to work out the value for depreciation and include it in your cash flow statement. To obtain a clear picture of your financial operations, you must calculate the value for depreciation so that you do not overestimate your company’s financial ability. Once you have calculated the depreciation value, use this equation to compute the operating cash flows from activities. In the majority of cases, cash flow amounts can either be positive or negative. Values that are positive signify cash flow activities that generate income for the business. Negative cash flows, on the other hand, represent activities that use money from the company. In most cases, we utilize a negative sign rather than putting the values in brackets. When listing items using the formula above, for example, if your EBIT value is $4000 and the depreciation value is $500, we will still use the equation but will subtract depreciation from EBIT. This is how we’ll account for them on our statement of cash flows. EBIT $4000 Depreciation ($500) Operating cash flows ($3500) This implies that while we incorporate depreciation to EBIT value, we are required to subtract because depreciation consumes money from the company. Follow the same procedure to calculate cash flows from investing activities after you have completed calculating cash flows from operating activities. As we know, investing activities are those that add money to the company through purchases or withdrawals. Under-investing activities, among others, include asset sales, settlement receipt, lending money out, and collecting loans. We tend to classify giving out loans and collecting loaned money as investing activities. However, if your business borrows money from lenders, that becomes a financing activity. Similarly, using money to pay off loans is also a financing activity. Simply list the items in this section as we did with the operating activities above, and subtract the negative cash flows from the positive cash flows to calculate your investment activities cash flows. Finally, calculate the cash flows from financing activities. In this section, only list the positive financing activities and omit the negative ones. As we have seen, financing activities are those that inject money into the business or withdraw money from the business to its owners, creditors, or investors. A financing activity, for example, is the purchase of company stock to assist in its operation. If an investor invests funds into a firm to help it operate, that action is considered a financing activity. Long-term loans and payments on such loans are included in the cash flows of financing activities. Other items to include in your finance activity cash flows include owners’ capital injections, as well as the collection of dividends. In order to create your final summary document, you will have to compile the cash flows from all three categories: operating activities, investing activities, and financing activities. If any of the cash flows are negative numbers, be sure to deduct them instead of adding them. For example, if your investing activities section shows more money going out than coming in, your cash flows from investing activities are likely to be negative. If the final value of these cash flows is negative, you will need to deduct it from the sum of the other two sections to get the final value. And if all three types of investing activities generate negative cash flow, you will need to add them together and include the final figure in brackets next to “Investing Activities” to show that it is negative. Finally, we must prepare and evaluate the owner’s equity statement. The statement of owner’s equity is a crucial document that aids in the valuation of a company owned by company owners. However, before we compute the owner’s equity, we must first account for retained earnings. Take a look at our balance sheet from earlier; you’ll notice how it works. Retained earnings are a company’s profits that are not distributed to shareholders. It can be used to finance the business growth or pay down debts, among other things. The value of retained earnings goes up when the business makes a profit and decreases when the business experiences a loss. Since stakeholder’s equity is such an important part of the balance sheet, retained income must be included as part of it. The statement of retained earnings is utilized to determine the proportion of a firm’s profits that are kept in the company after production. The retained earnings of a business are derived by adding the current year’s retained earnings to the previous year’s retained earnings. Retained earnings, in other words, accumulate over time. If the firm retained 30% of its revenue in year one and has to retain 30% of its income throughout the second year, the retained earnings for the third year will be equal to what has to be kept from profits during that year plus what was held in the first. This implies that if a company generates profits, its retained earnings value rises; if it loses money, their value falls. The formula for finding out retained earnings at the conclusion of a trading period is as follows. The formula shows that to arrive at the current retained earnings, you must use the amount of retained earnings brought forward from last year. To calculate the owner’s equity, you will need to use the value for retained earnings. The owner’s equity is the portion of the company that can be claimed by its owners. Like retained earnings, owner’s equity is compounded. You will be able to determine the owner’s equity by finding the beginning balance of the owner’s equity and adding investments made by the owners as well as retained earnings. Owners’ Equity = Beginning Balance + Investments by Owners ± Retained earnings When you are done preparing financial statements, you should be able to understand them and interpret what they represent. Even if you are not the company’s manager or owner, you may simply want to understand its financial statements. In this section, we will look at how to read financial statements. We must figure out what each statement means, what the figures represent, and how you may utilize the information in your day-to-day business activities. At the end of the day, all of the data displayed in financial statements should add value to your company. If you can not understand various financial statements, you will have a hard time making crucial business decisions and even fail to meet your company’s growth goals. You can discover the following by learning to read and interpret your company’s financial records: 1. The amount of debt the firm has compared to the available equity. This data may be found on your balance sheet, and it can assist you in making future borrowings and debt repayment decisions. 2. The speed at which customers pay their bills after receiving goods; this data can be found on your income sheet and will aid in managing your cash flow. 3. Is there a drop or an increase in short-term cash? This data may be found on the cash flow statement, which is important for a business to keep operational management going. 4. The number of assets that are tangible and have the potential to generate income over a long period of time. This information can be accessed through the balance sheet and will help you plan your investments for the future. 5. To see if customers are returning or purchasing products at rates higher than usual, which can be gleaned from the income statement in order to manage product production and marketing more efficiently. 6. The length of time it takes for your company’s inventory to sell. This data may be found on the income statement and used to plan future marketing and production efforts. 7. You can use your cash flow and owner’s equity statements to determine whether the money you invested in infrastructure and development is giving any results, and if those results are viable for the future. Doing this will help you plan your future investments. 8. The interest coverage ratio on bonds indicates whether there has been a decline in interest. This data can be retrieved from the balance sheet and owners’ equity statements and applied to future investment planning. 9. The company’s debt interest rates. This can be found on the cash flow statement and is key to deciding future financing activities. If the company spends too much money on loan repayment because of high interest rates, you could restructure the plan to lighten the load on the company. 10. The company’s long-term earnings are allocated to various projects or areas. The cash flow statement shows where the profits were invested and spent over the course of a year. This information may be found in your cash flow statements and can assist you in planning for future investing decisions. You must use the information in these key documents to manage your business on a day-to-day basis. Most people who run businesses should be able to understand and use financial statements. Even though accountants are supposed to explain all of the information in the books, they might still lie about some things to mislead your decision making. That is why it is important to invest in tools that will help you make informed decisions. The balance sheet is an essential tool that can provide business owners with much-needed insights. This was evident from the balance sheet equation we looked at earlier. You may access information such as your assets, liabilities, and owner’s equity with a single click. You can tell whether your company’s assets are increasing or decreasing just by comparing two balance sheets prepared in successive periods. Liabilities and owner’s equity can also be plotted over time to reveal their growth and decline. The financial health of a firm is determined by the value of its assets and owner’s equity. If your firm has more debts than assets and owner’s equity, it suggests that it is financially fragile. Looking at the balance sheet may provide a glimpse of where your business is going, but it does not give you much information. For all financial statements, we use financial ratios to analyze the information provided and determine the meaning of the information. For instance, you may realize that your company has more liabilities than assets and start thinking that it is headed downhill. In reality, some business models can support high debts as long as they remain operational. For this reason, we use analysis tools known as financial ratios to analyze the financial statements. The debt to equity ratio and the working capital ratio are two of the most important ratios used when analyzing a company’s balance sheet. 1. The Debt to Equity Ratio: The debt to equity ratio is determined by dividing the total liabilities of a firm by the total shareholder’s equity. In other words, this method can help you figure out how much debt compares to equity. It becomes a high-risk investment if your stake in the company is less than your obligations, since even if the business shuts down at any time, it may not be able to pay its debts accordingly. The debt to equity ratio, which gauges a company’s debts in comparison to the owner’s equity, is helpful in measuring the value of net assets. In other words, the company’s net assets equal total assets minus all long-term liabilities. A high debt to equity ratio indicates that the company relies heavily on borrowed money to finance its operations and purchase its assets. A lower debt to Equity Ratio suggests less reliance on debt financing . The debt to equity ratio varies depending on the company’s business model. In some sectors, a high debt to equity ratio is acceptable. You don’t have to worry if the large debt to equity ratio is allowing the firm to develop and expand its operations in a healthy way. If the corporation’s debts continue growing despite an ongoing lack of growth in operations, it will likely collapse. Ultimately, if you are borrowing in order to increase operations, generate more money, and extend the business, you are on the correct path. A high debt to equity ratio is commonly considered high risk. However, since the debt to equity ratio offers opportunities for business growth, most people compare the owner’s equity to long term debts to get a better understanding of the company’s operations. For example, if your business relies on supplies that provide goods on credit, you may end up having a high debt to equity ratio that does not pose any danger to your business. On the other hand, if the debt to equity rate is already high and you have even more 2. Working Capital: The working capital ratio is a measure of a company’s short-term financial health. It tells you whether the company has enough resources to meet its current obligations. The working capital ratio is calculated by subtracting current liabilities from current assets. Working capital is a measure of a company’s financial flexibility. The working capital ratio indicates how well a firm can run its current operations without the need for external financing. If your company’s working capital ratio is high, it implies that it may operate effectively in the short term. To run your day-to-day activities, you don’t have to borrow excessively. A firm, on the other hand, that relies on borrowed funds to keep the operation going may be at risk of falling at any time. 3. Net Working Capital: This is another ratio that might assist you in analyzing the balance sheet. This measure of liquidity concerns a firm’s cash flow. It refers to the disparities between current operating assets and current operating liabilities. These data may be found on a company’s payable plus inventories. A company’s operating capital is a good sign that it has the potential to develop. You may use the funds available to increase your manufacturing and aim for a greater market share. Determine how much cash you have at your disposal and whether it is enough to keep your business running from your balance sheet. If the firm has more liabilities than assets, you can add more money to boost its operational capital. Having more liabilities does not necessarily imply that your organization is spending all of its earnings paying off debt; it just means it has fewer assets. These financial strength ratios give you an idea of the company’s financial health. They may assist you in determining how a business finances its operations and the company’s financial stability. These measures reveal a firm’s strength and ability to finance its cycle. You can get a lot of information about the balance sheet by examining these ratios. The balance sheet may also be used to track the growth of a firm over an extended period of time. You may calculate how quickly your company is growing if you compare its assets and liabilities to their start date. The balance sheet is not the only thing you need to be able to interpret and use correctly–you also have to understand your income statement. However, this can be much simpler than it initially appears, especially if your accountant breaks the information down into small sections. The use of exponential notation in accounting can be complicated to understand. For example, if the accountant combines a lot of numbers together, it becomes difficult to comprehend your financial statements. We split the income statement into four sections in our approach to producing the income statement. The gross profit is first discovered, followed by the gross margin calculation. We continue by determining earnings before interest and tax, as well as earnings before tax. Finally, we find net income (earnings after taxes minus other expenses). In certain cases, a balance sheet might be summarized in such a manner that you only see the total revenue minus the total costs. You may not be able to figure out what the numbers on your income statement imply in this situation. If you can comprehend your income statement, you will reap plenty of rewards from it. Some benefits that business owners and board members gain from an income statement are: 1. Determines Net Sales (sales or revenue): The first significant aspect we can calculate from the income statement is net sales. The net sales of a firm may provide us with a lot of information about the company. Most investors and other interested parties will not associate with any organization that does not make sales, so the first thing we want to look at is how they have been generating them. The net sales of a firm may be used to assess its potential for profit generation. The company’s ultimate earnings will be determined by the net sales value. Even if the profit margin on items sold is tiny, extra purchases might result in greater long-term profits. As a result, it is critical to ensure that the net sales value in all of your income statements grows, decreases, or remains constant. 2. Cost of goods sold (COGS): Another critical element we may extract from the income statement is the COGS. Unfortunately, determining the precise COGS before generating the income statement can be difficult at times. A business that does not account for the cost of its goods sold is bound to make losses eventually. It is crucial for all businesses, therefore, to determine the value of their goods and use that knowledge to plan their operation costs accordingly on a day-to-day basis. A reliable accountant will take into consideration many different aspects when determining the total cost of production, such as raw materials price, labor availability and manufacturing processes quantity/quality. 3. Gross Profit: The gross profit and gross margin are two additional pieces of information that you can extract from the income statement. These two factors play a significant role in determining your business’s profitability over all. A firm may have a small net profit but a large gross profit. It is only through the income statement that you can distinguish between net profit and gross profit. Such distinctions may assist you in making adjustments to cut operational expenses while also increasing company profits after tax (net). To calculate the gross profit, we subtract the cost of goods sold from the gross revenue. 4. General and Administrative Expenses: Despite the fact that operational expenditures are seldom considered, they are crucial in determining a company’s net profit. Some operational expenses might cause the cost of production to become prohibitively expensive, making it impossible for businesses to generate profits. Managers have a lot of control over these costs, according to financial analysts. To put it another way, managers may raise or decrease operating costs depending on their policies. It is the responsibility of managers to cut expenses when the company is struggling to make money. If the company is profitable, that income can be used to improve working conditions and increase productivity. Therefore, it’s crucial for business owners and managers to review the income sheet and use it to make informed decisions. 5. Operating Income: The other factor you can determine from your income statement is the operating income, or the money a business earns before interest and taxes. This figure helps show how much profit a company makes and if it is doing well. For example, if there is enough operating income to cover all operations and costs of goods sold, then the business probably is not struggling. However, if there is not enough operating income, it might not be able to sustain itself for very long. The operating income is defined as the profit of a company before operational expenses such as interest, insurance, and taxes are considered. This figure provides an accurate representation of the business’s financial status. The operating income is evaluated and measured in terms of profitability. 6. Interest Expense: The state of your firm’s borrowing may be learned from your income statement. Some businesses pay excessive interest on borrowed money, and as a result, they have no profits. You can figure out how much to repay on borrowed funds based on the income sheet and see whether the interest being paid is sustainable. 7. Pretax Income: The earnings before tax are another crucial element to consider when looking at your income statement. The earnings before taxes assist in determining the amount of taxes to be paid. They also show how solid the business is and whether it has the ability to continue operating. The difference between gross profit and interest, as well as operational costs, is used to calculate earnings before taxes. If you find that a company’s profit is being strained by interest and operational costs, you have the chance to adjust operation costs to help cover up the interest and increase the company’s net profits. 8. Income Taxes: When you’re finished trading, the income statement will show you how much tax you’ll have to pay. There is a percentage of your revenue that must be paid to the government as taxes, depending on the size of your company. Small companies are required to send approximately 30% of their pretax earnings to the authorities. The income statement provides the information needed to calculate the income tax payable for a given period, which can then be submitted to the relevant government authorities. Without an income statement, it would be difficult or impossible to determine how much tax is owed. In addition, government agencies charged with collecting taxes may require proof of payment in the form of an accurate and up-to-date income statement. In many cases, auditors from the IRS will review your books and validate the information contained within your income statements. 9. Extraordinary Expenses or Special Items: The second significant element to consider on your income statement is the extraordinary expenses. Some expenditures that are not typical in a business calendar might occur at the end of the trading period. For example, if you have to write off some of the company’s assets, there will be a loss of company assets without necessarily selling it. When preparing the income statement, such expenditures must be factored in. As a result, managers and owners can use the income statement to see whether any expenses are incurred outside the scope of normal business activities. 10. Net Income: The income statement’s primary purpose is to help you calculate the company’s net income. Net income indicates a company’s profitability after deducting all expenses, including taxes. If total expenses exceed revenue, there will be a net loss instead of profit. Once you know the business’ net profit, you can then reinvest or pay out dividends accordingly–usually to preferred shareholders first. Any leftover funds are kept within the business as retained earnings. Without a profit and loss statement, you as the company’s owner are unable to know your individual earnings, the amounts of dividends to be paid to preferred shareholders, or how much money should be retained in the firm. To figure out how the business’s profits are being utilized, you must look at your net income as well as other elements of your income statement. 11. Comprehensive Income: Lastly, you can use your income statement to determine the comprehensive income of the business. However, the term comprehensive income is only used by big businesses that operate across borders. Some companies offer both their net income and comprehensive income figure on their income statements, but most only report net income. Net income is the value that best represents a company’s earnings within the given period, factoring in foreign currency exchange rates and minimum pension liability adjustments, among other elements. The income sheet, which is often called the profit and loss statement, is an extremely important financial document that may assist any company’s owner in making crucial judgments. In most situations, the business owner and manager must consult with accountants to obtain a clear picture of everything shown on the income statement. If your accountant gives you a summarized income report, ask for a comprehensive income statement that accounts for all of the factors we’ve discussed above. The statement of owner’s equity is an important document that can offer value to any business. This statement is often used by the owners of the business and interested investors in order to make more informed decisions. An investor interested in purchasing stock from a company will want to know about the portion of assets that come from loans. A lower debt to equity ratio means the business borrows less, effectively showing it doesn’t need to depend on loans to finance its assets. You may evaluate and comprehend the statement of owner’s equity by applying the ratios utilized to examine the balance sheet. The equity to debt ratio, for example, determines how much of a company’s capital is owned by its owners versus liabilities. At the same time, the statement of owner’s equity can be used to see whether a firm is expanding or declining. The portion of the owner’s equity in a company that is on an upswing should be further expanded. However, if its owner’s equity value starts to drop, there’s a good chance it will have more overdue payments than it can satisfy and collapse as a result. The statement of owner’s equity contains several things to consider. Some of the most crucial information you may discover from this document are: 1. Return on capital invested: The first and most vital lesson you may take away from your statement of retained earnings is the return earned on capital. For most entrepreneurs, the goal is to make money and invest it into the company until it becomes large enough. If you have been reinvesting profit back into the firm, there’s a chance that your owners’ equity will appreciate, which can be beneficial over time. We have already said that the owner’s capital is the portion of the firm that you, as the owner, control. It represents the percentage of a business that is owned by two people after they start it as a partnership. After several years of operation, you should be able to see that the money put into it has generated some profits. If your company is not bringing in money, there’s a good chance it will fail to meet its goals. 2. The need for financing: The necessity for finance is another crucial aspect to consider. The owner’s equity versus a company’s liabilities can tell you whether you need to put money into the business or borrow more. If a firm has more debts than owner’s equity, it suggests that investing in the company as the owner is preferable to borrowing. If a company’s owner’s equity value is greater than its liabilities, it implies that it may borrow money from other lenders to help advance its growth. It is critical to make sure your equity-to-debt ratio does not exceed 40%. The equity-to-debt ratio of a stable business should be approximately equal. If your firm can operate successfully without borrowing, keep running it until you need to borrow external sources of income. 3. A company’s debt level: You can also find a company’s debts by looking at the balance sheet, which lists the value of everything the owner(s) equity. However, if you do not have access to this document, but do have an income sheet, you could potentially evaluate their liabilities from that instead. You may compute the company’s debt using this formula and compare it to owners’ equity in a matter of minutes. We have already established that you should never borrow more than the company can handle. 4. The level of retained earnings: The statement of owner’s equity shows us how much money the company has kept over time. The most crucial thing about a statement of owner’s equity is that it allows us to determine the amount of retained earnings. Every year, businesses should retain some profits. If your firm is earning money but is not retaining any, it implies that your business will not expand in the future. In fact, a company with no retained earnings will have an increasing owner’s equity in the near future, which might put it out of business anytime soon. As stated in the first part of the article, owner’s equity is the invested capital of business owners from the start. For example, let us pretend you want to begin a company with $10,000. After researching your market and being ready to start, you realize that buying the required tools and making your desired profit margin operational will take $14,000 instead of the $10,000 available. To finance what you need for this venture, you borrow $4000 from a bank under the business’ name. When starting out, this net worth will be $14 000 . If you use all of the money available to you to buy company assets- including inventory and cash on hand – your total assets will amount to $14,000. This information comes from our balance sheet equation which states that: As you can see from the figures above, the proprietor’s portion of the entire business is what we call owners’ equity. The assets total $14,000 and liabilities total $4,000; thus, owner’s equity equals $10,000. Always keep in mind that the owner’s equity can go up or down. There are two methods of growing the owner’s equity: either by investing more cash into the business, or through borrowing less money from the bank. For example, if you chose to invest an additional $2000 into the business while only borrowing $2000 from the bank, your owner’s equity would then rise from $10000 to around $12000. Another way to increase the owner’s equity is by retaining part of the profits earned. Now, in our example above, you started the business at $14000 and it operated for one year before making a net profit of $3000. From that amount, you chose to spend $2000 and reinvested $1000 back into the business. Your owner’s equity will have increased by At the start of next trading year, your owner’s equity will be $11000.” While the owner’s equity of a firm may rise or fall as a consequence of regular business activities, it can also decline. Business failures and depreciation are the primary causes of drops in owner’s equity. If you start a company that loses $1,000 each year after you have been in operation, this amount will be subtracted from your equity. In other words, the value of your equity would drop from $10,000 to around $9,000. In addition, if your business is only making profit and not retaining any of the amounts earned, it will likely start to depreciate. Assets lose value as time progresses; for example, an asset worth $5,000 at the beginning of a business might be down to $3,000 after five years of use. Without retained earnings there would be no cash to reinvest in new assets meaning eventually the company could not continue running. Last but not least, the statement of cash flow holds a lot of valuable information. Though similar to the income statement, it differs in that it displays where revenue is coming from and how a business’s money is being invested. As we have seen, cash flow activities are categorized into operating, investing, and financing cash flows. From studying the statement of cash flows, you can discover:” 1. Calculate your net income: The first and most essential thing you can take away from your cash flow statement is the company’s total revenue and its sources of income. Although you can determine the overall revenue of a firm from its income statement, the figures given by the cash flow statement are far more detailed. The income statement only shows revenue generated from operational activities, as well as a few investing transactions. The cash flow statement, on the other hand, provides a comprehensive analysis of all sources of income, including investments and financing transactions. While the income statement may provide a thorough rundown of company expenditures, it does not reveal the influence of certain operations on your net profit. The cash flow statement can help you understand the impact of certain activities on your business by revealing how they affect your revenue. You will be able to see how much the payment of loans and interest on loans affects your net income. A look at the cash flow statement gives you a comprehensive picture of your earnings as well as potential sources of income for the firm in general. 2. Convert your income from operating activities to cash (flows): The cash flow statement not only tells you whether a business is making or losing money, but also helps convert the earnings from operating activities into physical cash that can be used by the company. Most businesses use accrual accounting, meaning that we prepare our income statements before receipts are received. Under the accrual method of accounting, transactions are considered final as soon as they occur, rather than when payment is received. For example, once you provide goods to a client, the transaction will be recorded even if you have not been paid for those goods yet. In order to maintain a steady cash flow for business operations, it is crucial to find a balance between the money already in hand and the money that will be coming in. The statement of cash flow provides vital information for making decisions to ensure a continuous supply of cash. 3. The cash flow statement is used by business managers to help with day-to-day operations because it depicts a more accurate state of present cash affairs. You can control the rate at which you disburse money to suppliers based on the information in this statement. For example, if you supplied goods worth $5,000 to a customer but your supplier only provided raw materials worth $3,000, be cautious when distributing payments. Do not pay your supplier before customers have paid for their goods. The cash flow statement illustrates the money going in and out of your business in real time. To put it another way, you may use the value of all revenue earned and the value of all expenditures made to figure out how much cash you will require to keep your company operational for a given length of time. You might not have any cash left to continue operating your business if you do not manage your income and expenses carefully. 4. Calculate the net cash generated by investing and financing activities: The cash flow statement may also be used to calculate the net cash generated by investing and financing activities. We’ve seen that long-term assets may be bought or sold in order to generate income. You can only get the net cash generated from all investing and financing activities by analyzing the statement of cash flows. As we previously discussed, the income statement just considers cash from operating activities. In other words, the income statement will provide you with the net cash produced through operating activities (net profit). While the net income is an essential part of a company’s financial health, there are numerous other sources of money and costs to consider when running it. If you do not keep any earnings in your firm, the owner’s equity value will continue to depreciate. To put it another way, unless you choose to invest the profits in the business, this portion of the business cannot be overlooked. The income statement does not include the following two components of a firm: financing and investment operations. To obtain the net investing activities, you must subtract the negative investing operations from the positive investing operations. In other words, if you buy a new company van for $4000 and sell an old firm vehicle for $1000 in the same trading session, you must record the purchase as a negative investing activity. In simpler terms, it is a financial transaction that takes money out of the company. A sale of a used van is also recorded as a positive investing activity; in other words, it adds to the coffers. To evaluate net investing activities, subtract the cost of purchasing the van from the money received from the sale of the van. In our example, we will have a negative $3000 as a result of this subtraction. This implies that during this trading period, the firm has invested $3000. You must locate the source of this money in any other cash flow activity. Unless you can determine where the company got its funds for investments, it may not be viable in the long term. Avoiding mistakes in your financial statements is crucial to keeping your business afloat. In this chapter, we will focus on some of the most costly accounting errors you can make. We have already seen how even small errors can lead to big problems down the road. So try to avoid them at all costs. After seeing how they failed, we will close our book with a look at the fundamental principles you should remember, as well as commonly asked questions from accountants. If you are just getting started with bookkeeping, be careful not to make any mistakes. Even if you are the owner of a company, it is critical to track all of the transactions and eliminate stupid errors that might be costly in the end. The following are some of the most expensive accounting blunders that most people make: 1. The most common oversight made by people is failing to prepare the accounts receivable when using the cash method of bookkeeping. Although you will be using the cash method, it is still crucial to keep up with the accounts receivable. Though small businesses may use the cash method of bookkeeping, this doesn’t mean they do not need to manage accounts receivable. In other words, every business will have customers who purchase items on credit. If you are not careful in monitoring your accounts receivable, then it is likely that you will lose a lot of money from uncollected payments. 2. The second blunder is usually a failure to track cash transactions for those who employ the accrual approach of accounting. The accrual method of accounting necessitates that all actions be recorded as soon as they occur. In basic terms, money does not have to travel from one person to another before a transaction is considered final. The disadvantage of this technique of accountancy is that most financial experts concentrate on significant essential deals such as raw materials purchases, etc. If you neglect to keep track of the smaller purchases that occur along the way, you may end up losing money through accumulating transactions over time. As a result, all organizations should maintain a petty cash book that addresses seller transactions. These activities generally include operational expenses that might build up over time if precautions are not taken. 3. A lack of communication is the most common issue between an accountant and bookkeeper. As stated before, their duties rely on each other. An accountant cannot do their job correctly if they don’t receive accurate information from the bookkeeper. A bookkeeper may not bring any worth to the table if the data is not used by an accountant. As a result, it is critical for communication between the two individuals to be constant. The accountant must oversee the work done by the bookkeeper and offer suggestions. If you choose to do your own bookkeeping, ensure that you hire an accountant from time to time to guarantee that your records are up-to-date with accounting norms. 4. Using incorrect or out-of-date bookkeeping software: The most typical accounting blunder made by most accountants is using faulty accounting software. The type of accounting software employed will have an impact on the quality of records kept. Most firms now use automated accounting systems that are programmed to record transactions in real time in order to minimize the risks of fraud. However, it is essential that you understand how a new software works before implementing it in your company. If you want to use different accounting software, hire an experienced accountant who can teach the other staff members how to use it properly. This will ensure accuracy and precision in all work completed. 5. Failure to maintain records from proving transactions: Government agencies and internal auditors are the most common audit subjects. The job of auditing is to assess whether the bookkeeping and accounting procedures are simple. People may employ fraudulent accounting methods in order to guarantee that the books balance, in some cases. The only method to authenticate all events is to keep copies of all documents. There are several papers that can be used to corroborate a transaction’s existence. For example, you will need a bank deposit slip to show that cash was deposited or withdrawn in person. You may need a copy of the check to confirm that payment has been made. Or, you might require a receipt to verify that an item was purchased. Therefore, it is crucial to file and digitalize any document which proves transactions occurred. If you digitize such papers, you can save them in a variety of forms and quickly retrieve them if necessary. Such documents are essential for detecting and correcting errors because the subsidiary records of entry are the source documents. 6. Inconsistent bookkeeping: One of the most common mistakes novice accountants make is failing to properly keep track of their entries in both the subsidiary books and the general ledger. If you take too long to summarize the subsidiary book entries, they might grow chaotic and time-consuming to combine. You should total up all of the summaries and move them to the general ledger after recording important events in the subsidiary books. Make careful while transferring so that you do not inadvertently transfer mistakes between books. 7. Failure to prepare the trial balance: Finally, most individuals who are new to accounting may submit financial statements without preparing the trial balance. Although the trial balance is not one of the financial reports, it is considered one of the most important tools for evaluating a business’s financial position. The trial balance allows us to confirm the accuracy of general ledger entries. Cross-checking these entries is vital to guarantee that the final reports provided through the financial statements show the true status of a company. If you compile financial statements with multiple mistakes, you might end up paying additional taxes. You should never forget the following accounting basics, as they play a role in an accountant’s ability to generate accurate financial statements. As someone who owns or manages a business, you ought to keep these principles at the forefront of your mind to assist with sound decision-making. A few examples of such accounting basics include: 1. Accounting software is as vital as the accountant: having the appropriate software is the most crucial aspect of bookkeeping and accounting. Even if you have the greatest bookkeeper or accountant in the world, they may not be able to help you unless you give them adequate software. When it comes to bookkeeping, accounting programs are especially significant. Many businesses employ automated transaction recording software to keep track of all transactions that take place inside the establishment. When you invest in bookkeeping and accounting software, look for one that is appropriate for use by all staff while also providing the greatest security to financial management teams. 2. Tracking your business’ cash flow is crucial: as soon as you start operating, set up a dedicated business bank account. Many people make the mistake of using one account for both personal and business finances when first getting into business. By keeping a close eye on your business’s cash flow–that is, the timing of money coming in and going out–you can better manage your future investments, day-to-day operations, and overall profits. 3. Keep track of inventory: The most difficult problem that most people confront is obtaining an accurate inventory count. When it comes to accounting for inventory, bear in mind both direct and indirect expenses. Account for the expenditure of all materials, as well as any packaging costs, before making a decision regarding the quantity of goods on hand. 4. Understand cost of goods sold: Another key consideration when it comes to accounting is the cost of goods sold. If you do not know what your actual cost of goods sold is, you will almost certainly lose money. The cost of goods sold (COGS) affects the price of your products and, as a result, your profits. You can calculate your COGS based on the business model you are using. If yours is a production-based model, include in your calculation the cost of raw materials, labor, power, and other elements used in manufacture. 5. Get your expenses right: To accurately calculate your business expenses, you must include more than the cost of goods sold. There are other operating costs that businesses have to factor in as well. Although they may be less than the cost of goods sold, there are some circumstances where fixed expenses can match up exactly. Start by determining these indirect yet constant expenses incurred whether or not your business is operational. They play a large role in overall profitability. 6. Determine your break-even sales requirement: Another important consideration is the break-even sales requirements. It is your responsibility to select the best pricing and required sales volumes to cover all of your expenses after calculating the cost of goods sold and any other expenses. If you do not meet your break-even sales volume, your business will result in losses. In all businesses, there is a certain level of manufacturing and selling that leads to profitability. In the long run, you must target past profits when making sales decisions. 7. Track your sales and profits pre-tax: The other essential accounting principle for managers is tracking revenue and profits. If you can ascertain your income and expenses, you should be able to track your profits. By monitoring your costs and revenue, you can determine the likelihood of your business making a profit or loss even before the end of the trading period. 8. Establish the correct tax rates for clients: As a business owner, you should implement managerial policies that allow the company to develop. You must utilize accounting data when determining pricing and taxes for goods and services. At the end of the day, financial statements should not only assist you in making informed decisions but also help you establish the best prices for customers. If your firm is already losing money, examining manufacturing costs, sales, and other expenses may be useful in determining how to sell your products in order to generate profits. 9. Plan ahead for your tax payments: Financial statements are intended to assist you in making the appropriate tax payment choices at the proper moment. Understanding your income and expenditures should help you make wise tax payments decisions. The taxes paid by a business are determined by the profits made and the physical location of the firm. Different governments have varying tax rules that must be satisfied in order to keep your company operating. One of accounting’s most fundamental responsibilities is to calculate profits and, as a result, taxable income during a particular trading period. 10. Know your balance sheet: It is critical for any business owner or manager to understand the balance sheet. The balance sheet is the financial statement that shows the net worth of a business. Just by looking at the balance sheet, you can tell how much assets the business owns, what level of debt it has, and what value of equity the owners have. If you want to set your business up for future success, learn to interpret your balance sheets and use them wisely. You, as the business owner or manager, need to vet the financial statements for accuracy. This includes being able to tell if information provided is valid. If you can not review them properly, you could make decisions that cost the company money – even when it’s actually doing well otherwise. To catch discrepancies in financial records, look out for these things: 1. Exclusion of financial operations: A sensible business manager will not only look at the company’s financial statements, but will also examine the ledger book and other records of entry. In fact, all financial reports may be manipulated to give a false impression of a company’s activities. For example, an accountant might decide to eliminate specific transactions from the record. The firm could end up making losses without either the owner or the manager realizing that it was doing so. You should take a day or two to go through the other financial records in order to track any mistakes. Examine the general ledger and subsidiary books of entry for any errors. Look at the source documents to see whether there are any omissions, comparing the transactions to those recorded in the general ledger. 2. Lack of connection to prior financial statements: If the financial statements produced in consecutive accounting periods are totally disconnected, you should begin asking questions. For example, if the financial records for the trading period ending December 31st, 2019 differ significantly from those prepared in June 2019, it’s probable that they’re being cooked. If the company is manipulating its figures, the accountants may not be careful enough to keep everything consistent. You can examine financial statements and compare them with older ones to check for any discrepancies. With some statements, like the income statement, it is normal to see big changes from month-to-month or year-to-year. But after six months there shouldn’t be drastic differences on the balance sheet or in owner’s equity. 3. The lack of source documents to back up transactions: Examining source materials is one approach to identify possible errors in your financial statement. The cash and bank accounts are one of the most reliable indicators of the accuracy of your records. The cash account will allow you to track all transactions that have taken place throughout the trading period. You should be able to produce all supporting papers for monetary account transactions. Simultaneously, the bank account may assist you in assessing the validity of transactions. Source documents such as bank slips and cheques are essential in demonstrating that particular transactions took place during the trading period. Simply choose one account and request for source documents regarding activities in that account whenever you receive financial statements from your accountant. You may, for example, ask for all cash transactions entered and exited the bank. You will determine whether the figures on your income statement or balance sheet are accurate based on these events. 4. Statements are not a true reflection of reality: You should also utilize your best judgment in determining the truthfulness of the statements. I mean using your judgment to be able to determine the typical revenue of a business based on day-to-day operations. If, for example, you have an operation that spends a lot of money on production and makes a lot of sales, you may predict that it generates a healthy amount of income. However, if you find that the sales value or accounts receivables are significantly higher than revenue, you must delve into the reasons behind these disparities. When you don’t perform a thorough examination of your financial statements, accountants may alter the real figures in your accounts and steal money from your company. 5. Analyze financial ratios: Another approach to detecting accounting mistakes is to examine financial ratios. For example, we’ve seen that the debt-to-equity ratio may be used to assess a company’s stability. It will be simple for you to identify errors in your financial statements if you produce these measures at the end of each trading session. If the metrics from prior periods differ dramatically, it is likely that your accountants are employing unethical tactics to steal money from the company. For example, if you notice that your debt-to-equity ratio has increased but you have not borrowed any more money, then it’s likely that the accountants are stealing from the business. They do this by manipulating the owner’s equity or the value of liabilities. Even though other figures on financial statements can vary greatly from one accounting period to another, financial ratios don’t change much. 6. Hiring an Internal Auditor: Last but not least, when the financial statements are ready, you must be prepared to hire an internal auditor to examine them. Certified public accountants (CPA) specialize in auditing financial records and are better equipped to identify and correct errors made by other accountants. In accounting, whether due to carelessness or negligence, mistakes can happen at any time. Unfortunately, regardless of whether they are intentional or unintentional, omissions will cause the trial balance and balance sheet to remain balanced. Though using documents like the trial balance or balance sheet to check your financial records’ accuracy might seem like a good idea, it’s not the best approach. This is because these documents can only help prove a few facts, and serious errors could be missed. To avoid this, you should find a way to review all subsidiary entries. Have an auditor go through all books of original entries and confirm each entry with its corresponding source document. Hiring an accountant to audit your accounts might be the ideal solution for those who don’t have accounting expertise. You should select someone carefully. Some auditors may collaborate with accountants to defraud the business. To ensure that you receive the best findings from your audits, you must make sure that all significant source documents are accessible. At this point, we have covered everything you need to know about financial statements. You should be able to prepare and evaluate financial statements without difficulty. At the same time, you should be able to spot any mistakes in the financial statements. There are five major components in every financial statement. These include: 1. Assets: These are items of value that the company owns, such as cash, equipment and real estate. 2. Liabilities: In other words, liabilities are what the company owes to others including accounts payable and loans. 3. Equities: These are cash or cash equivalents that show the ownership of the company. The term equity in accounting terms is what determines the value of both the company and its ownership stake. 4. Revenues: One financial statement element, revenue mainly appears on the income and cash flow statements. Revenue encompasses all money earned by a company during a set trading period. A business’s revenue can differ from one accounting term to the next and determine that enterprise’s net income after expenses have been deducted. 5. Expenses: The expenses of a business are generally used to help construct the income sheet and cash flow statement. Outlays depict how a company uses its money. Different types of expenditure include direct expenses like the cost of inventory sold, and indirect costs such as rent or taxes. Financial statements are primarily intended for the owners and managers of a firm. Although most individuals believe financial statements are made for external investors and tax authorities, in fact, company executives and proprietors need the documents the most. Financial statements help managers understand the cost of production and reduce expenses. This information helps them budget better and make more informed decisions about where to cut costs. The board of directors also rely on financial statements to determine the net worth, debt level, and assets of the company. From the balance sheet, they can see if the company is in a good position to take out loans or not. The accounting office is responsible for preparing financial statements. This requires the work of both accountants and bookkeepers who record transactions and prepare auxiliary statements such as the trial balance. While an accountant’s main duty is to prepare financial statements, they also interpret these findings. There are some companies that only hire one accountant instead of both positions; in this case, the single individual would be responsible for performing the duties of a bookkeeper as well. The balance sheet, income statement, and cash flow statement are the three primary financial statements. 1. Balance Sheet: This is the financial statement that depicts a company’s net worth at a particular time. The balance sheet primarily tracks assets, liabilities, and owner’s equity. You may calculate the firm’s net worth and debts from the balance sheet. 2. Income Statement: The income statement is another vital financial document that showcases a company’s revenue and expenses. This information allows you to see where the Money is coming from as well as going. You can also find out if the business made a profit or loss during this period by looking at the bottom line of the income statement. 3. Cash Flow Statement: The cash flow statement is the third most important financial statement for businesses. It shows how money comes into the business and how it is spent. The cash flow statement is used to determine a company’s liquidity and whether or not the business can sustain its operations. The three financial statements listed above are critical to management. However, if I were a business manager, I would choose the income statement. The balance sheet and the cash flow statements are vital, but they can not compare to the value of the income statement. The income statement is more valuable than the balance sheet or cash flow statements because it gives an accurate reflection of a company’s current operations. You may figure out where to invest and how to improve revenue by looking at the income statement. You may also discover strategies for lowering spending in order to make your firm more profitable. Financial statements are also essential to the company’s owners, who may interpret them in a variety of ways. External investors can assess whether a firm is suitable as an investment partner based on its financial statements. For example, reviewing a company’s statement of cash flows can help suppliers decide if they should supply goods to the business. If there is enough money circulating within the company, this gives investors confidence that it will be able to pay its debts. Similarly, looking at the balance sheet allows investors to discern whether or not the company has potential for growth. A financially stable business will likely have more assets than debts.” As mentioned before, accounting is mostly done by bookkeepers and accountants. However, a bookkeeper cannot take on the responsibilities of an accountant. One important duty of an accountant is to make financial statements. Bookkeepers can’t prepare financial statements since they are not certified, but accountants are certified. Therefore, an accountant can do everything a bookkeeper does – like recording transactions.Accounting for Financial Statements Overview