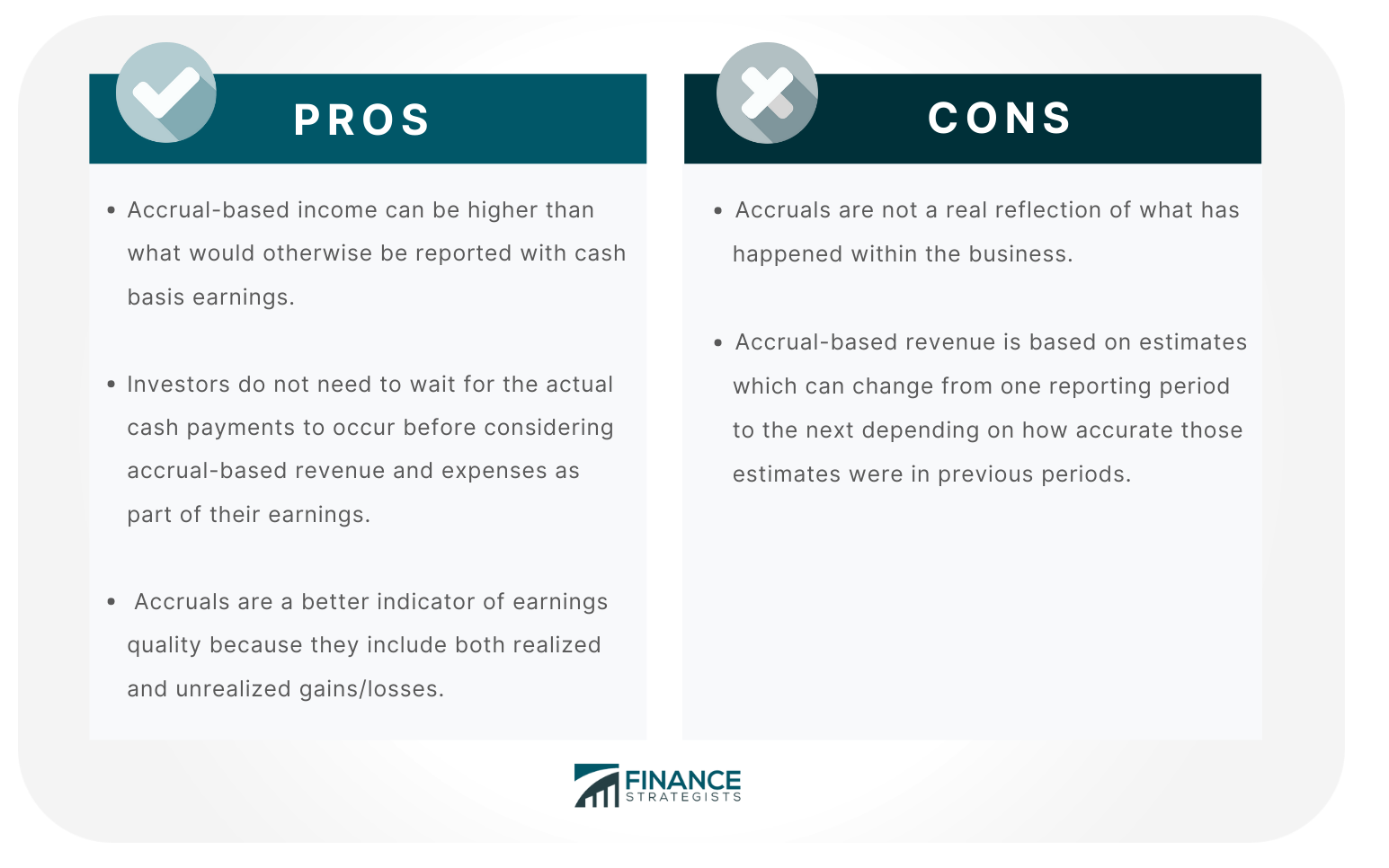

Accruals are incurred expenses and the revenues that are earned over time but which are recorded periodically only. Accrual accounting differs from cash accounting because it includes revenue that has yet to be collected (accounts receivable) and expenses that have yet to be paid out (accounts payable). Accruals are created when revenue is earned, or expenses are incurred, but the corresponding cash has not been received or paid yet. For example, a business may have billed their customers $100 on January 15th for services provided in December of last year (accrued revenue). They owe $50 to an employee who worked through the month of December (accrued expense). The company would record these balances as “accounts receivable” and “accounts payable.” At the end of February, it will make another journal entry that records receiving payment from its customer for service performed in January ($100) along with paying out money owed to this same person after their work was complete ($50). While there is no actual movement of cash in this scenario, the business has accrued $150 worth of revenue and expenses. These are the reasons why accruals are important to investors: The more accrual expenses, the less profitable the business will be. Conversely, revenue that has yet to be collected (accounts receivable) or expenses that have yet to be paid out (accrued expense) must still exist somewhere in the financial statements. Investors can view these as real assets and liabilities instead of unrealized gains their balance sheet. Since accrued expenses and revenue must be accounted for before the actual cash transaction occurs, they affect net income. This can also work to a company’s advantage too. If they have an accrual asset (such as accounts receivable), it means there is more likely to be cash waiting on their balance sheet than what actually exists internally. Since accrual expenses and revenues exist, investors can easily determine how quickly a company pays off its liabilities or collects on its receivables. If these balances continue to grow over time, it may signal that the business has trouble meeting its obligations when they come due. On the other hand, if accounts payable and accrued expense fall relative to sales over longer periods of time (quarter-to-quarter), this would indicate that the company can meet its payment terms with suppliers and keep up with its demands for cash from creditors too. Businesses could also be using “off-balance-sheet financing” techniques which means not including certain operating leases as part of current assets/liabilities. Under cash accounting, the business only records transactions when an actual movement of cash occurs. This means that a company may have accrued expenses and revenue but not recorded them yet in their financial statements if they expect to receive payment or make payments at some point in the future. This will result in overstating assets (because more has been earned) and understating liabilities/stockholders’ equity (since less is owed). The pros of accruals include: On the other hand, cons are: As mentioned, net income can be higher or lower than it otherwise would have been if only cash transactions were accounted for instead. This makes tracking performance more difficult since investors must simultaneously look at both types of financial statements to get an accurate picture of how profitable the business is over time (i.e., using GAAP versus non-GAAP measures). For example, let’s say that Company A has accrued revenue and expenses on their books. Company A receives payment in cash before recording it as “revenue” while simultaneously paying out money owed to an employee who worked during this time period before recording these transactions as “expenses.” This would mean that net income does not accurately represent what the business earned because expenditures have been moved around instead of recorded where they actually occurred. This makes comparisons between current and past performance metrics more difficult since investors may not be able to rely solely on accruals for their analysis purposes. Despite its shortcomings, accruals remain a valuable and essential tool for investors, especially when used alongside other performance metrics. Accrual accounting remains an integral part of financial accounting today because it allows businesses to account for all transactions that have yet to take place concerning revenues and expenses alike. Investors can use this information to make more informed decisions about a company’s current and future health.Accrual Accounting Definition

How Does It Work?

Importance To Investors

Accruals are an indicator of how profitable a company is.

Accrual expenses have a direct impact on net income.

Accruals are an indicator of liquidity.

How Does It Differ From Cash Accounting?

Pros & Cons of Accruals

The Bottom Line

Accruals FAQs

Accruals are entries used to record an amount of revenue and expenses when they have yet to take place.

Accruals are used to record an increase/decrease in assets or liabilities when the transaction has yet to occur. The company will then go on to record these transactions for real once it does happen, at which time it should also record any associated costs that the business has incurred during this same period.

Accruals provide information that will allow investors to track performance more accurately than they would otherwise be able. Accrued expenses and revenues both indicate a future transaction taking place at some point in the future, which means that net income may be higher or lower before it eventually becomes realized as cash flow once those transactions happen.

Cash accounting only tracks the transactions that have actually taken place by recording revenue and expenses as they are paid out or received. On the other hand, accruals will record both realized gains/losses and unrealized gains/losses associated with future transactions until those occur to provide more information that investors can use to make better decisions.

Accruals do come with several pros and cons, but the main issue is the degree of accuracy involved. This information should always be used alongside other performance metrics to provide an accurate picture for investors. Accrued revenue and expenses can be manipulated, which means that net income may not always accurately represent how profitable a business is. Accruals also make it more difficult to track both current and past performance metrics because investors will have to rely on estimates until these transactions actually occur for real.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.