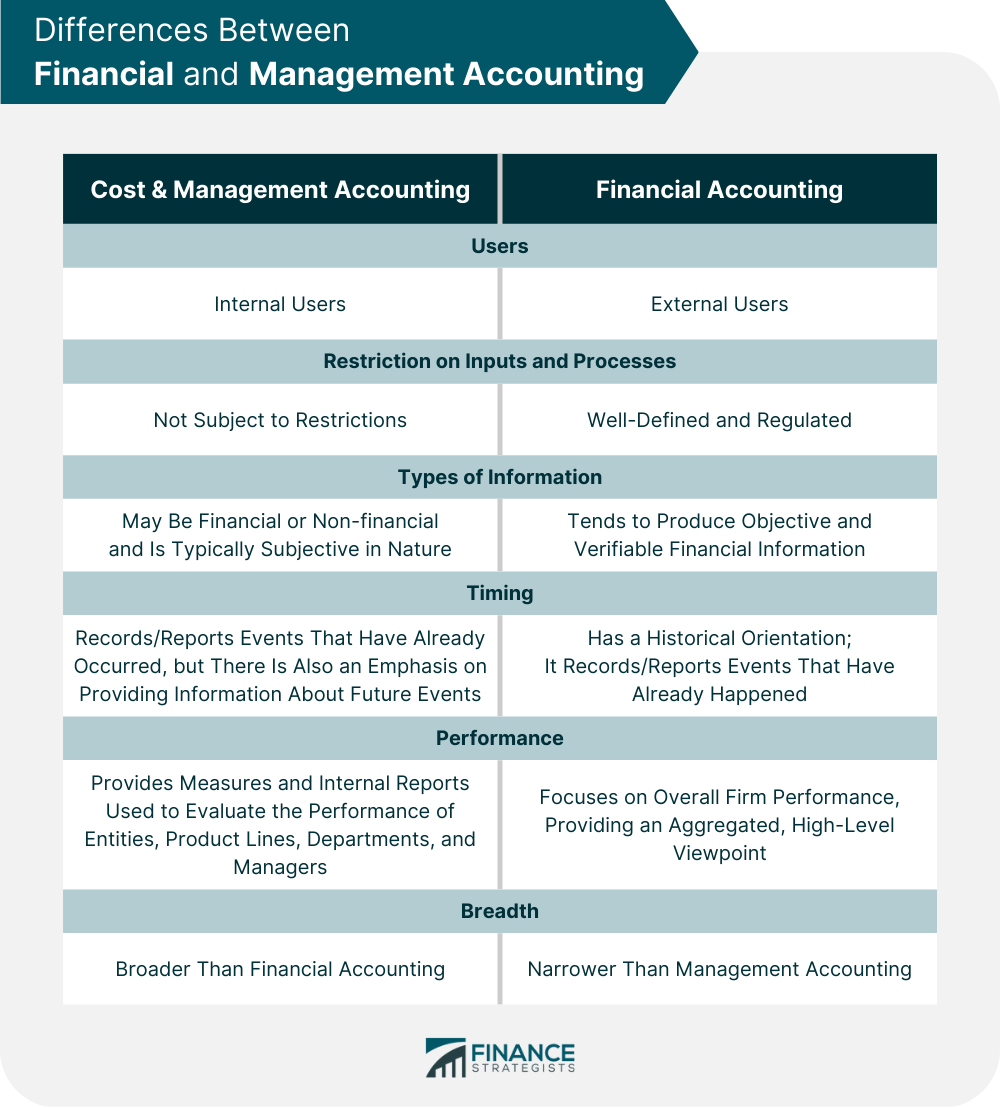

Accounting is often divided into two categories: financial accounting and management accounting. Financial accounting information is designed primarily for use by persons outside the firm, including creditors, stockholders, owners, governmental agencies, and the general public. Most companies publish financial accounting data through a set of general-purpose statements known as the company's annual reports. These statements provide most of the information needed by external users. The specialized needs of specific users are satisfied through supplementary reports, which are published at various intervals (e.g., annually or quarterly). Financial accounting provides information that covers relatively long periods of time. In addition, financial accounting information is historical in nature, where financial accounting reports concentrate principally on the results of past decisions. Financial accounting is governed by generally accepted accounting principles (GAAP). These principles are subject to ever-changing rules and regulations, as well as disputed interpretations. Financial accounting reports are developed from the basic accounting system, which is designed to highlight data about completed transactions. Management accounting is primarily concerned with the managers of a company and the provision of useful information intended for internal use. Managers gather management accounting data and analyze, process, interpret, and communicate the results so that the information can be used to promote sound internal decision-making. The types of decision-making that management accounting is used to inform include financial decisions, marketing decisions, production decisions, resource allocation decisions, and so on. Management accounting helps different departments in an organization to work in a coordinated manner. This is because it acts as a communication link between the departments. Managerial accounting reports are usually designed for a specific decision and provide information for relatively short periods of time. They are not governed by any set of principles and are not required by law. Since management accounting is not required by law, the reports prepared by management accountants are subject to cost-benefit analysis (i.e., the perceived benefits of the report should exceed the costs). Also, since no external standards are imposed on information provided to internal users, management accounting reports run the risk of being subjective. Both management and financial accounting deal with economic events. Furthermore, both are concerned with revenue, expenses, assets, liabilities, and flows of cash. Also, both require quantifying the results of the organization's economic activity. In actual practice, it is difficult to classify information as being either exclusively financial or managerial. The two accounting systems are part of the total business system and, for this reason, they normally overlap. For example, much of the future planning data associated with managerial accounting is based on the historical information that is retained for financial accounting purposes. The basic differences between management accounting and financial accounting are summarized below.Financial Accounting

Management Accounting

Comparison of Financial and Management Accounting

Differences Between Financial and Management Accounting

Difference Between Financial and Management Accounting FAQs

No. Financial and Management Accounting deal with different aspects of the business operations and so both systems are distinct from each other. The purpose of financial accounting is to provide information about past events, while that of managerial accounting is to help decision-makers within their organizations plan better for the future.

Financial accounting reports are prepared for external communications and dissemination, while Management Accounting reports are generally developed with one part of the organization in mind.

The primary objectives of both management and financial accountings include recording business transactions, recording revenues and expenses as they occur, as well as preparing Financial Statements. However, the primary objective of financial accounting is to provide information for use by external users while Management Accounting focuses on providing information for making better business decisions within the organization.

As a part of a client’s or company’s larger accounting system, managerial accounting performs the function of planning and decisions-making. It provides information about future events and can be used to help determine budgets, profit margins, sell prices, etc.

Both are concerned with providing relevant information for decision-making within an enterprise. Managerial accounting’s primary focus is on providing usable information for management and internal users while financial reporting focuses on providing relevant, verifiable information about the organization to outside users.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.