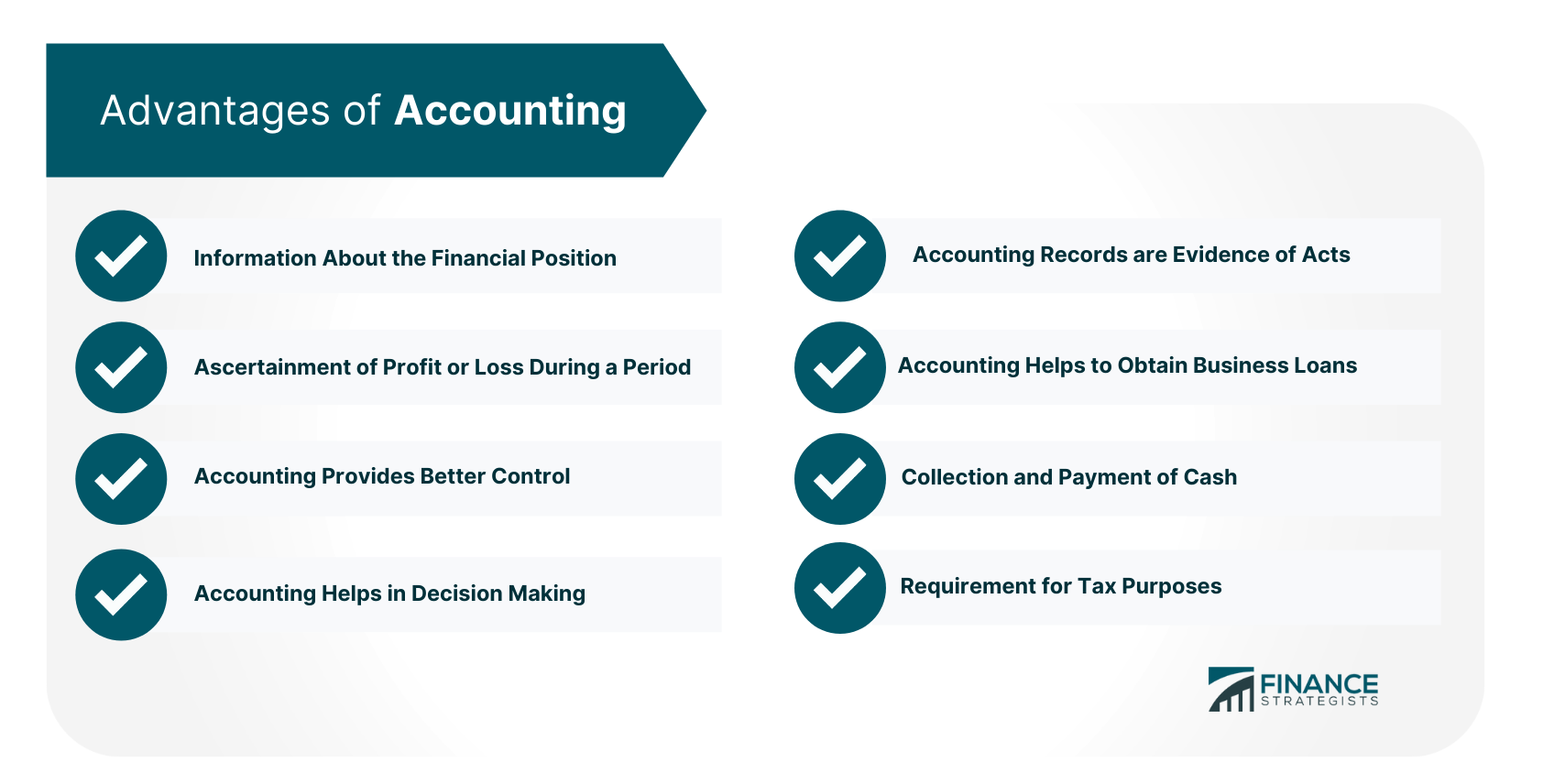

The main objective of maintaining a set of accounting books is to enable the business owner to receive information about the financial position and conduct of their business as and when they need it. Every business person makes financial transactions in the course of running their business. It is virtually impossible for them to remember each and every detail of all these transactions. Yet each of them affects the business in some way or another. Accounting provides the business owner with information that can enable them to see the individual effect of each transaction, as well as the collective effect of all the transactions, made in a particular period. Some common advantages of accounting are discussed below: Perhaps the most obvious advantage of accounting is the fact that it ensures business people are informed about the financial position of their businesses. Business owners can learn almost every detail about their company's financial affairs simply by checking the accounting records. Accounting records help business people to accurately calculate profit or loss over a particular period. For a person who depends on their business for a living, it is essential to know the exact amount of profit each month. This will ensure that the owner's drawings from the business in a given month do not exceed the profit. Profit is the sole motive of most business people, and it is imperative that they should be well informed about how they are progressing toward this objective. By making available information concerning the movement of a company's assets, accounting helps business people to exercise effective control over both assets and employees. Without accounting records, it would be extremely difficult (if not impossible) to notice theft or misappropriation of cash, stock, and other assets. Accounting records and statements allow business people to make decisions (e.g., regarding expansion, opening up a new branch, or closing down loss-making departments). They also help business people to draw up future plans. Accounting records typically provide evidence of a transaction. In certain cases, a business person may be asked to prove that they performed a particular act (e.g., paying for goods). If they can produce accounting records showing that they did perform that act, they may be spared from the obligation of performing it again. Also, in the event of a dispute over any aspect of a transaction entered into by a business person, accounting records prove useful in sorting out matters. Accounting provides information about the financial position and worth of a business. This fact alone is critical for a number of reasons. For example, no business person can reasonably expect to be granted a loan or overdraft without producing evidence (in the form of accounting statements) of their financial health. Similarly, should a business person decide to sell their business, accounting records will play an essential role in helping to determine the company's worth. Accounts are of particular importance for traders who buy or sell goods on credit. Traders depend on well-kept and detailed accounts for the prompt recovery of debts from customers, as well as for settling their obligations to suppliers. Accounts are necessary for income and other tax purposes. In the absence of proper accounting records, it is extremely difficult to prove to the tax authorities the correct income on which the tax should be levied. Similarly, taxes such as sales tax and excise duty are collected based on a company's turnover. For this reason, records and proof of sales revenue are essential.Objectives of Accounting

Advantages of Accounting

Information About the Financial Position

Ascertainment of Profit or Loss During a Period

Accounting Provides Better Control

Accounting Helps in Decision Making

Accounting Records are Evidence of Acts

Accounting Helps to Obtain Business Loans

Collection and Payment of Cash

Requirement for Tax Purposes

Objectives and Advantages of Accounting FAQs

There are several benefits of doing business including consumers, investors, employees and more. The benefits of accounting for consumer companies include knowing what products are most popular among customers to better meet their needs. Tracking the cost of goods sold assists in determining if a product is profitable or costs too much to make which can be reduced in the future. Accounting also assists in keeping track of expenses and how they can be reduced to keep costs down.

Accounting provides corporations with useful information about their operations, including sales revenues and expenses. This information can help companies evaluate where they stand in terms of profit and loss, which allows them to make informed decisions about how they proceed in business. Additionally, accounting records are legally required in some transactions. For example, when a business is sold, accounting records are required to prove the value of the company.

Accounting provides organizations with information about their financial condition and performance. It can be used for both internal and external purposes, helping improve decision-making regarding operations, planning for future activities and reporting on past activities. Accounting records are also legally required in certain transactions, such as when a business is sold.

Accounting records typically provide evidence of a transaction. In certain cases, a business person may be asked to prove that they performed a particular act (e.G., Paying for goods). If they can produce accounting records showing that they did perform that act, they may be spared from the obligation of performing it once more.

Providing a formal record of financial transactions and events taking place in a business, as well as evidence that certain acts have been performed (e.G., Paying for goods).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.