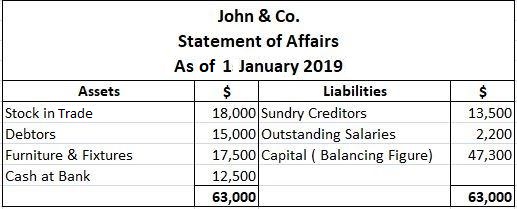

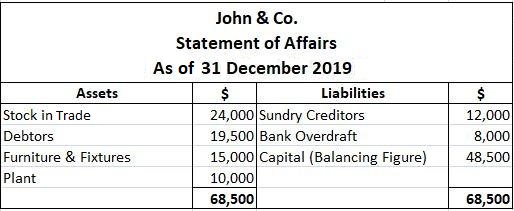

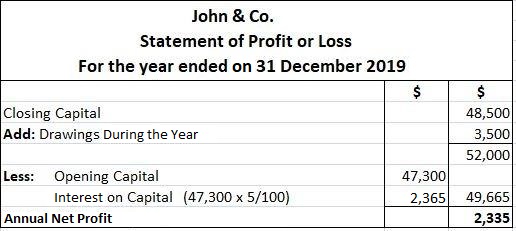

Similar to a balance sheet, a statement of affairs is a statement of assets and liabilities that is prepared to find out capital under the single entry system. When calculating profit or loss using this method, it is worth considering both fresh capital (or additional capital) and drawings. If fresh or additional capital is introduced during the period, it will make the closing capital incorrect. To calculate the true amount of profit or loss, deduct the fresh capital from the closing capital. If an owner withdraws an amount for personal use during the period, the drawing will reduce the amount of closing capital. Therefore, it is necessary to add the amount drawn to the closing capital to reflect the true profit, as shown here: Net Profit = Closing Capital + Drawings - Opening Capital - Fresh Capital John & Co. keeps their books using the single-entry system. The position of the firm on 1 January 2019 was as follows: The position of the firm on 31 December 2019 was as follows: During the year, one of the owners withdrew $3,500 for personal expenses. In this case, charge interest on capital @ 5% p.a. Required: Prepare Statement showing the company's profit or loss for the year ended 31 December 2019.Statement of Affairs: Definition

Fresh Capital or Additional Capital

Drawings

Differences Between Statement of Affairs and Balance Sheet

Statement of Affairs

Balance Sheet

Prepared under the single-entry system

Prepared under the double-entry system

Prepared from various sources (e.g., information from other sources, money, etc.)

Prepared only from books of accounts

Accuracy is unreliable due to preparation from incomplete records

Accuracy is reliable and can be verified because it is prepared from a set of books maintained under the double-entry system.

Example

Solution

Statement of Affairs FAQs

The statement of affairs is a financial statement that summarizes a company's assets, liabilities and owner's equity under the single entry system.

A statement of affairs is prepared under the single entry system, while a balance sheet is prepared under the double entry system.

A statement of affairs summarizes its assets, liabilities and owner's equity by making use of only one account.

Fresh capital refers to additional capital that is introduced during the period.

A statement of affairs is used to find out the capital under the single entry system. It's similar to a balance sheet and helps us determine profit or loss for a period of time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.