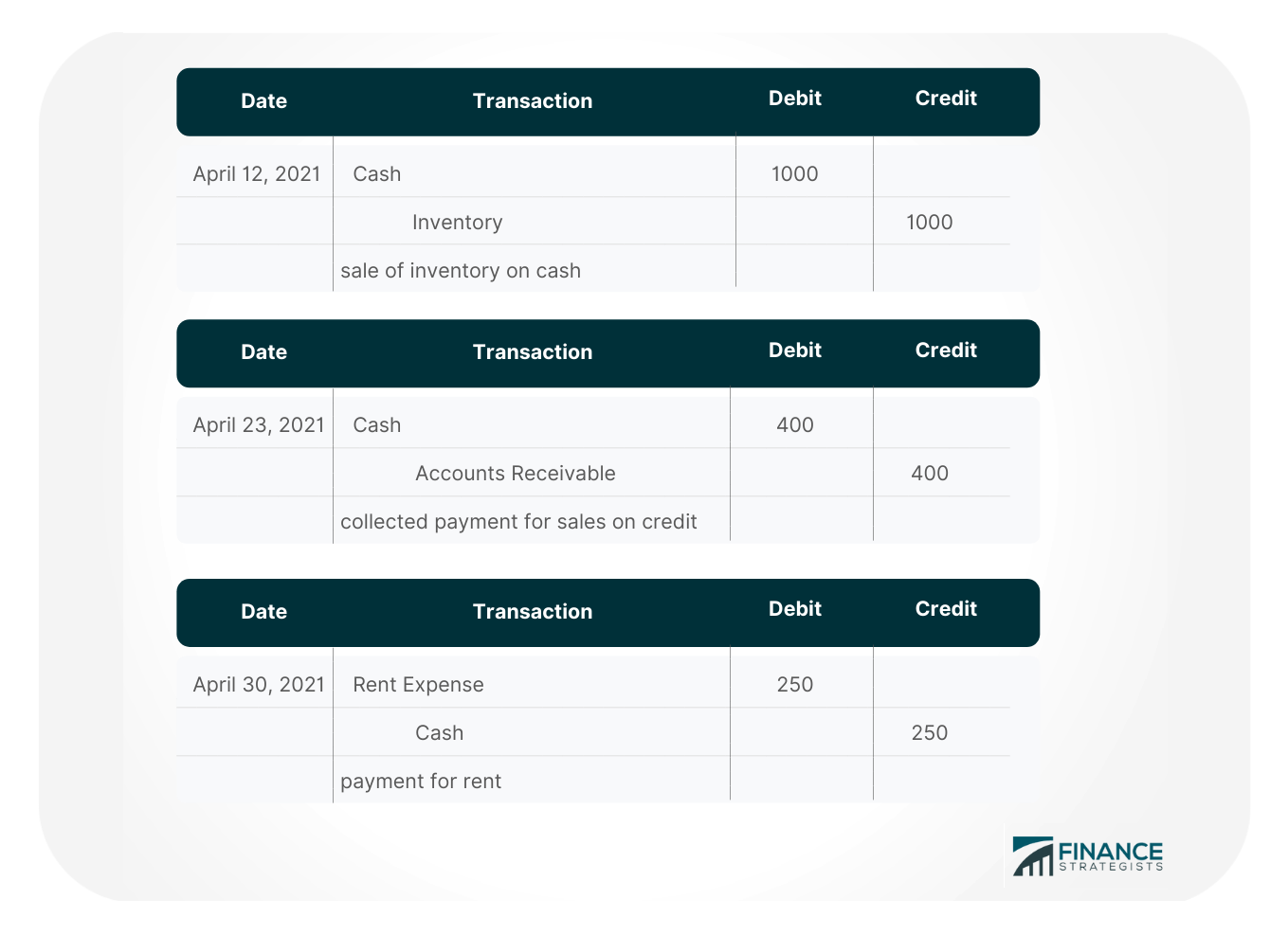

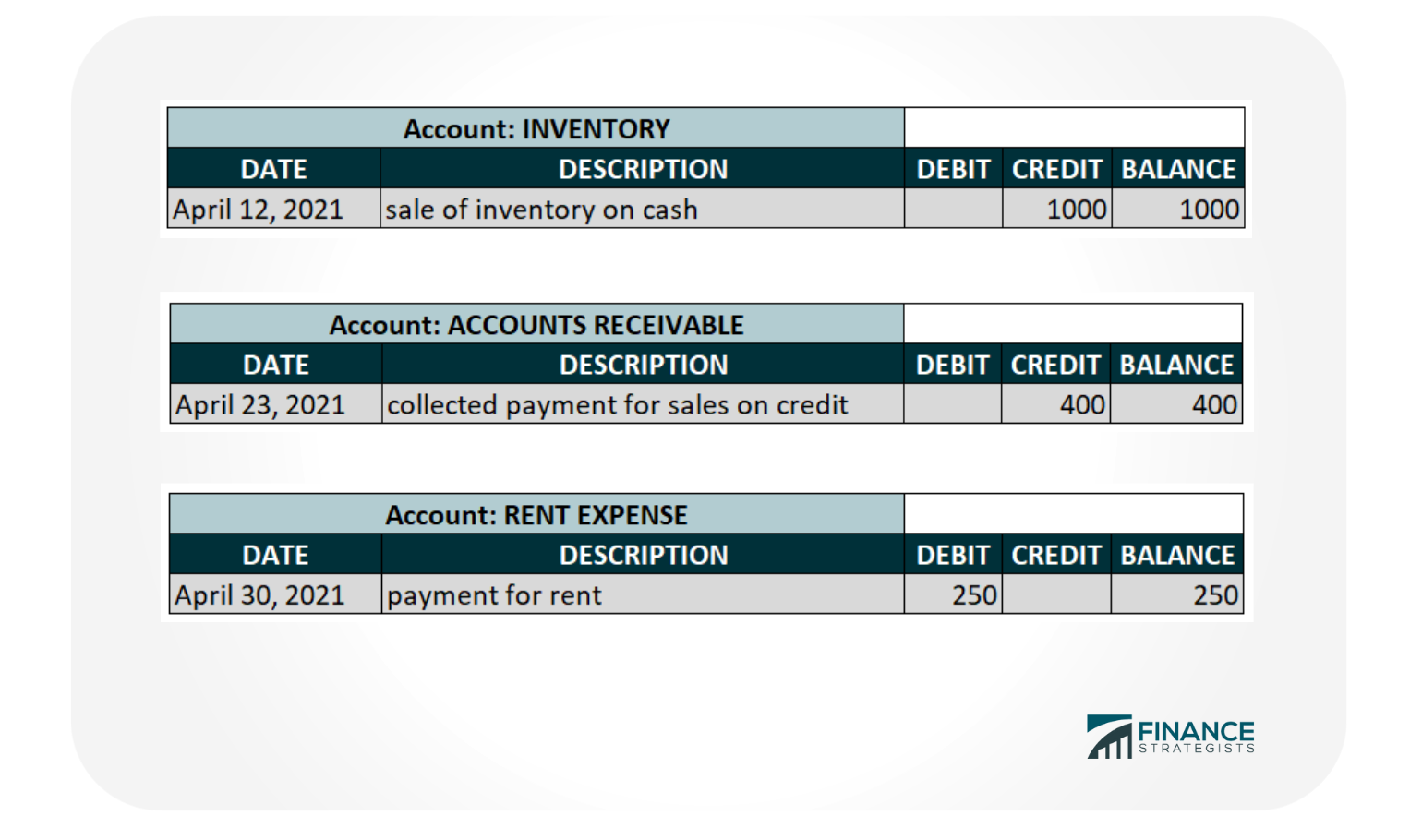

An accounting ledger refers to a financial record book where accounting transactions are recorded. A ledger holds the accounts for a business or individual so that they can keep track of their financial situation. It is considered to be the single source of truth when it comes to finances. Basically, a ledger is where all journal entries are being summed up with the specific account names drawn from the chart of accounts used as a heading. Financial transactions posted into the ledger are broken down by type into specific accounts whether they are classified as assets, liabilities, equity, expenses, and revenues. The purpose of an accounting ledger is to provide users with a record of financial transactions as well as a means to generate key business reports such as balance sheets, cash flow statements, and income statements. The accounting ledger provides users with the ability to keep tabs on their finances. It is broken down into several different accounts that show what assets are, liabilities and equity, revenues/income, and expenses/costs. This helps give insight into how much profit or loss is being made within a certain time period. Ledgers also provide the ability to enter financial transactions so that they may be posted up into various accounts. Here’s how to prepare a ledger: Transactions: On April 12, 2021, Ayra’s Merchandise sold inventory amounting to $1000 to its customer for cash. On April 23, 2021, Ayra’s Merchandise received cash in the amount of $400 as payment from one of its customers. On April 30, 2021, Ayra’s Merchandise paid rent in cash for $250. The journal entries for these transactions will look like this: To post the same transactions into the ledger, we draw the same details from the journal. The ledgers will look like this: Below are the three types of ledgers: A sales ledger is a type of accounting ledger that is used in businesses to keep track of all their sales and revenue. This ledger shows the total amount collected from each customer. This will be helpful when it comes time to prepare reports such as cash flow statements and income statements which require users to provide information on the money they’ve brought in from customers through sales. A purchase ledger is used to keep track of all the purchases made by a business. This may include parts, supplies, equipment, and inventory for their products. This will be helpful when it comes time to prepare reports such as cash flow statements and balance sheets which require users to provide information on their expenses. A general ledger is used in businesses that sell services or products. It’s considered to be the heart of all their business transactions since it provides users with the ability to gather information on sales, purchases, and cash flow. This single ledger holds all financial transactions for a business so that it may prepare relevant reports easily. A general ledger has two types: nominal and private ledger. A nominal ledger is what its name implies-it’s a ledger that uses only nominal accounts. These are accounts that do not hold any real cash balance but mostly show transactions for revenues, costs, and expenses. This type of general ledger can be used by sole traders who sell their own services or products to customers. A private ledger is where accounts of confidential nature are recorded. These accounts may include capital, salaries, drawings, etc. A private ledger may only be accessed by selected individuals. A ledger provides users with the ability to keep track of their financial transactions. It is divided into several different accounts that show what assets are, liabilities and equity, revenues/income, and expenses/costs. This helps give insight into how much profit or loss is being made within a certain time period. Ledgers also provide the ability to prepare reports such as balance sheets and cash flow statements which can be used by business owners, managers, and employees for decision-making purposes. With the help of ledgers, users can gain a better idea of what is going on inside their company so they may make more informed decisions and effectively manage their finances.What Is an Accounting Ledger?

What Is the Purpose of an Accounting Ledger?

Preparing a Ledger

1. Once you are done recording financial transactions in the journal, the next step will be to transfer these transactions into the ledger.

2. Simply move each journal entry to its corresponding account into the ledger.

3. Make sure to use the same amounts for each debit and credit transaction taken from the journal. An imbalanced debit and credit posting will result in inaccurate books and financial statements.

4. Calculate account balances in the ledger.

Example

Types of Ledgers

Sales Ledger

Purchase Ledger

General Ledger

Final Thoughts

Accounting Ledger FAQs

The main purpose of an accounting ledger is to keep track of all financial transactions that have taken place within a business. It allows users to gather information on sales, purchases, and cash flow which can be used for reports such as balance sheets and income statements.

Users can prepare an accounting ledger by first gathering all their financial transaction details from journals and then drawing the same details into separate columns on the ledgers. To gather journal information, users must understand debits and credits. Once they have done so, it will be much easier for them to post transactions correctly onto ledgers.

There are three main types of accounting ledgers: sales, purchase, and general. Sales ledgers are used to keep track of all the money being collected from customers. Purchase ledgers are used to keep track of all expenses made by a business. General ledgers are what their name implies-a summary ledger that provides information on all transactions made by a business.

A nominal ledger houses all nominal accounts such as rent, depreciation, sales, etc. A private ledger has access restricted to specific individuals only for confidentiality purposes.

No, businesses don’t need to prepare an accounting ledger. However, they can provide users with more insight into their financial transactions which may give them the ability to make better decisions as managers or owners of a business.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.