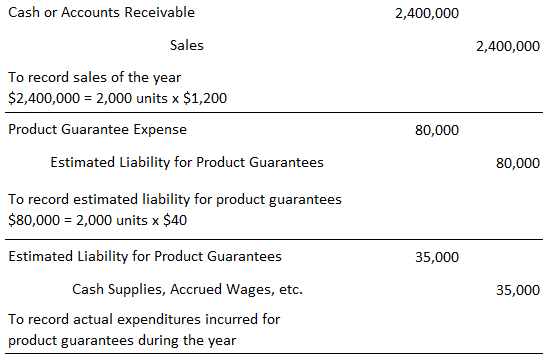

Contingent liabilities are potential liabilities that may or may not occur depending on future events. A contingent liability is the result of an existing condition or situation whose final resolution depends on some future event. Generally, the amount of these liabilities must be estimated; the actual amount cannot be determined until the event that confirms the liability occurs. Furthermore, in many cases, the actual payee of the liability is not known until the future event occurs. Examples of contingent liabilities include product warranties and guarantees, pending or threatened litigation, and the guarantee of others’ indebtedness. In all these situations, a past event has occurred that may give rise to liability depending on some future event. For example, suppose that when General Motors sells a car, it gives the purchaser a 12,000-mile or 12-month guarantee against defects. Thus, an event—the sale of a car—has taken place. However, the actual amount of the liability and the person to whom it will be paid are dependent on some future action: namely, the customer eventually presenting the automobile for repair. Under the generally accepted accounting principles (GAAP), contingent liabilities are recorded as actual liabilities only if the potential liability is probable and its amount can be reasonably estimated. An automobile guarantee or other product warranties are examples of contingent liabilities that, are usually recorded on a company’s books. Past experience indicates that a certain percentage of products will be defective, and past experience can also be used to reasonably estimate the amount of the future expenditure required by the warranty. The matching convention requires the recording of the expense in the period of the sale, not when the repair is made. To illustrate, assume that Micro Printing Company manufactures and sells high-speed laser printers for personal computers. The retail price per unit is $1,200, and each printer is guaranteed for 3 years; that is, the firm will repair the unit free of charge during this period. During the 2024 calendar year, the firm sold 2,000 printers. Past experience indicates that Micro Printing will incur an average of $40 in repair expense for each printer sold. Finally, during 2024, the company incurred $35,000 of warranty expenditures related to these printers. The following summary journal entries were made by Micro Printing Company in 2024 to reflect these events: Each accounting period in this cycle is repeated. As the firm makes sales, an estimated liability is accrued. And as the guarantee expenditures are made by the firm, the liability is debited and the appropriate accounts are credited. Contingent liabilities that are not probable and/or whose amount cannot be reasonably estimated are not accrued on the company’s books. Instead, they are usually disclosed in the footnotes to the financial statements. These types of contingencies usually include pending litigation and guarantees of indebtedness that exist when a company guarantees the collectability of a receivable that it has discounted at the bank. The following example taken from a recent annual report of Sears, Roebuck, and Co. shows how such contingent liabilities are disclosed:Contingent Liabilities: Definition

Contingent Liabilities: Explanation

Examples of Contingent Liabilities

Contingent Liabilities That Are Accrued

Contingent Liabilities That Are Not Accrued

Various legal actions and governmental proceedings are pending against Sears, Roebuck, and Co. and its subsidiaries, many involving ordinary routine litigation incidental to the business engaged in.

Other matters contain allegations that are non-routine and involve compensatory, punitive, or anti-trust treble damage claims in very large amounts, as well as other types of relief.

The consequences of these matters are not presently determinable but, in the opinion of management, the ultimate liability resulting, if any, will not have a material effect on the shareholders' equity in the company.

Contingent Liabilities FAQs

A contingent liability is a potential obligation that depends on the occurrence or non-occurrence of one or more events in the future. If the event occurs, the company may be required to make a payment; if it does not occur, the company will not be required to make a payment.

Some examples of contingent liabilities include product warranties, environmental remediation costs, and litigation settlements.

Companies account for contingent liabilities by recording a provision in their Financial Statements. The amount of the provision is based on the best estimate of the amount that the company will ultimately be required to pay.

The disclosure requirements for contingent liabilities are set forth in accounting standards. In general, companies must disclose the nature of the contingency and the expected timing and amount of any potential payments.

Companies can mitigate the risks associated with contingent liabilities by maintaining adequate insurance coverage and establishing reserves.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.