A debenture is an instrument issued by a company that acknowledges its debts to the holder under its seal. A debenture is a loan certificate issued by the company to its holders. Instead of borrowing entire funds from an individual, a company can divide the funds into certain small denominations or parts (i.e., debentures). Debentures carry interest at a certain percent (e.g., 8%). As it is a loan taken by a company, it is repaid after a specified period or at the option of the company as per the terms of the issue. There are no legal restrictions on the price for which debentures are issued. Debentures may be issued at par, at discount, or at premium, as in the case of shares. Debenture holders are a company's creditors. They regularly receive interest on their debentures at a fixed rate. It is usual practice to prefix the rate before debentures (i.e., 12% debentures). In the event of the dissolution of the company, debenture holders have priority over shareholders as to their interest, as well as of their loan. Debenture holders are not concerned with the management of the company. Also, they are not involved in the administration and control of the company.

What Is a Debenture?

Example

Suppose that a company is seeking to borrow $1,000,000 as a loan by issuing debentures. To do so, it can issue debentures of $100 each (i.e., 10,000 debentures will be issued). For $1,000 debentures, only 1,000 debentures will be required for the loan of $1,000,000.

Purpose of Debentures

Debentures serve a pivotal role in capital markets. Companies and governments issue them as a means to raise long-term funds without diluting ownership, as would be the case with issuing equity or shares.

Whether it's to finance expansion projects, meet operational needs, or refinance existing debt, debentures offer a structured way of procuring necessary funds.

From the perspective of investors, they can be an attractive avenue of investment, often offering higher interest rates than more traditional, secured instruments, and acting as a potential source of regular income.

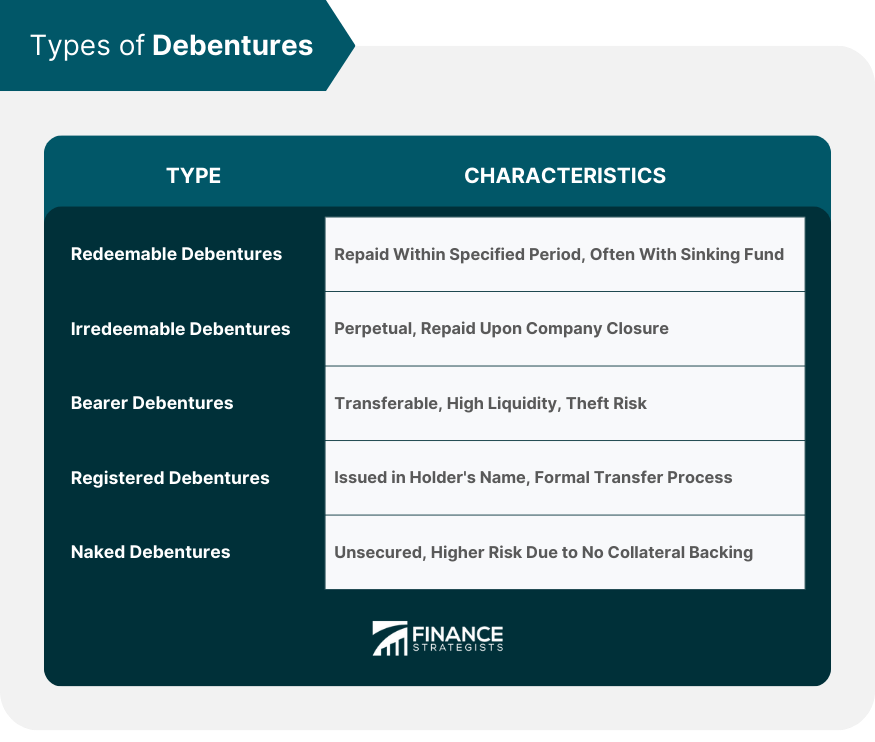

Types of Debentures

Debentures are classified as:

1. Redeemable Debentures

The amount of the debentures is to be repaid within the period specified in the terms of their issue.

These debentures come with a clear maturity date, post which they're slated to be repaid. Companies are obligated to repay the principal amount to debenture holders on this maturity date.

Often, a sinking fund is set up to ensure repayment, where the company sets aside a certain sum each year to repay these debentures.

2. Irredeemable Debentures

These are perpetual debentures. The company has no right to make the payment of the principal of these debentures during its lifetime. These debentures are repaid in case of the company's closure.

Also known as perpetual debentures, these instruments do not come with any specified maturity date. They can, theoretically, go on indefinitely, and the issuing company is not required to repay the principal amount.

However, given the perpetual nature of the debt, regulatory frameworks in many countries have become stringent about the issuance of such debentures.

3. Bearer Debentures

These debentures are transferable by mere delivery. The name of the holder is not registered with the company.

These are the exact opposite of registered debentures. There's no record of the holder's name in the company's books. Instead, possession equates to ownership.

Interest and principal repayments are made to whoever presents the debenture certificate.

This feature makes them easily transferable and highly liquid, but it also comes with the risks associated with loss or theft of the physical certificate.

4. Registered Debentures

These debentures are not transferable by mere delivery. The names of the debenture holders are registered with the company.

Registered debentures are issued in the name of the holder. All details, including interest payments and repayment of the principal upon maturity, are directed towards the registered holder.

Any transfer of ownership requires a formal process, including updating the company's register of debenture holders.

5. Naked Debentures

These debentures are not mortgaged and they are issued without any charge on the company's assets. The issue of these debentures is not popular with companies.

Also known as unsecured debentures, diverge from the traditional debenture structure. Unlike secured debentures, naked debentures are not backed by any specific company assets, making them unsecured debt instruments.

These debentures are issued without a specific charge or lien on the company's assets, which means that, in the event of default or bankruptcy, holders of naked debentures do not have a direct claim on particular assets for repayment.

The issuance of naked debentures is typically less common among companies due to the higher level of risk they pose for investors.

Since these debentures lack collateral backing, investors who hold naked debentures are more exposed to the company's creditworthiness and financial health.

6. Secured or Mortgaged Debentures

These debentures are secured by a charge on the company's assets. This charge may be fixed or floating.

Secured debentures, also known as mortgage debentures, are backed by assets or collateral.

This collateral acts as a security net, ensuring that, in case of default by the issuer, the debenture holders have a claim over the specified assets.

The presence of collateral often makes these debentures more attractive to risk-averse investors, leading to a higher demand and, in turn, lower interest rates offered by issuers.

7. Collateral Debentures

Debentures may also be issued to banks and financial institutions as an additional or subsidiary security, in addition to certain principal security.

If the company does not pay loan interest and the principal security falls short, lending institutions can exercise their right as debenture holders.

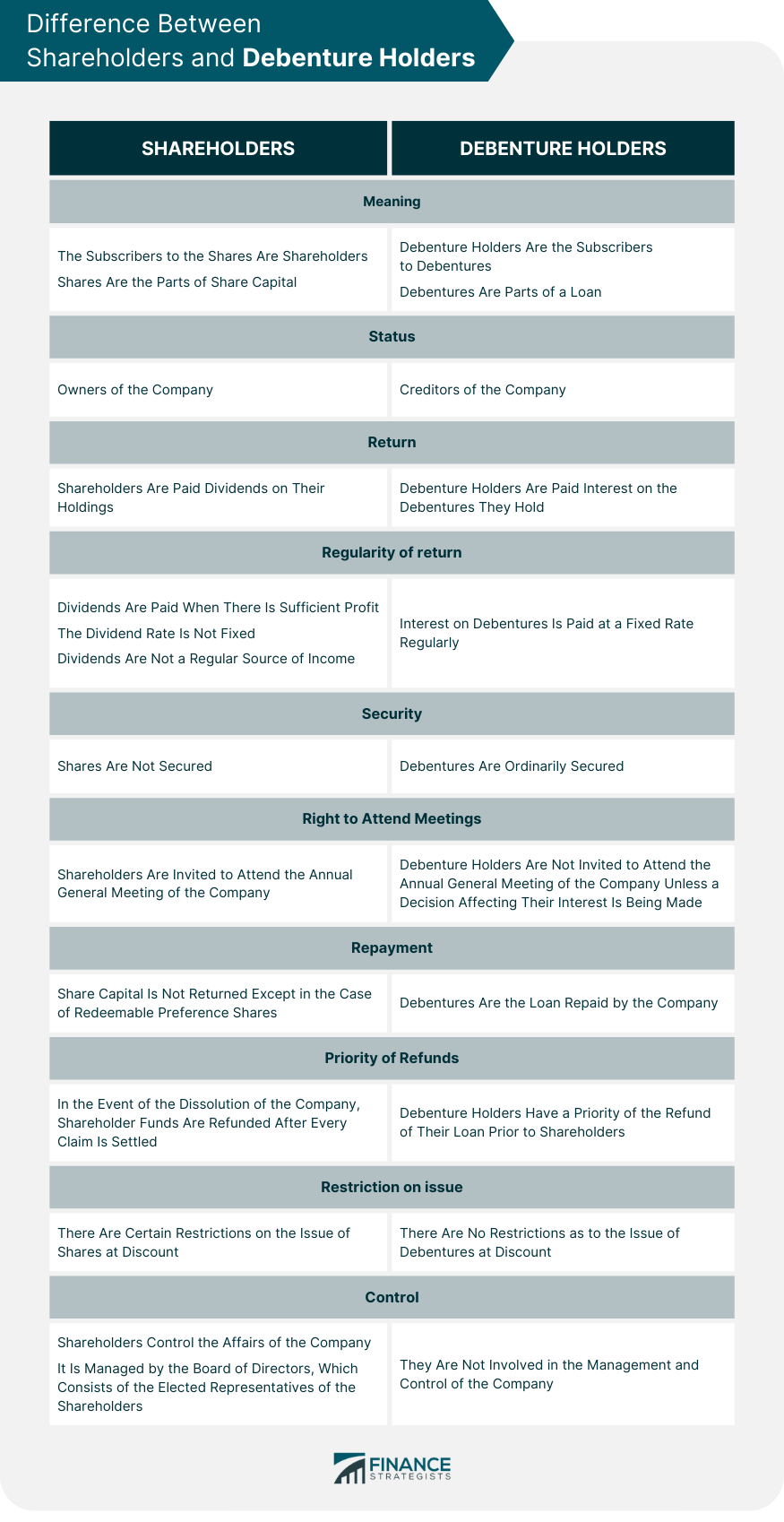

Difference Between Shareholders and Debenture Holders

The main differences between shareholders and debenture holders are summarized in the table below.

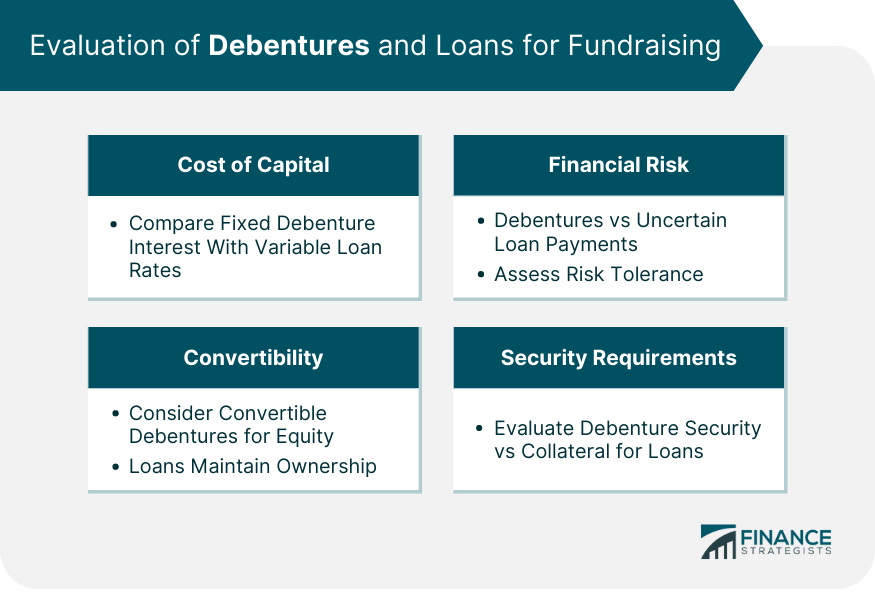

Evaluation of Funds Raising Through Debentures/Loans

Raising funds is a fundamental endeavor for businesses seeking growth and expansion. In this pursuit, two prominent options are often considered: debentures and loans.

Conducting a comprehensive evaluation of these avenues involves a meticulous analysis of several key factors.

Cost of Capital

Debentures entail fixed interest payments, irrespective of the company's performance, while loans involve interest rates that are contingent on market conditions and the company's creditworthiness.

To make an informed choice, it's essential to compare the total interest costs that will accrue over the repayment period.

Financial Risk

Debentures mandate regular interest payments, which can impact the stability of cash flow. Loans, with variable interest rates, may introduce uncertainty into payment obligations.

Evaluating risk tolerance and projecting the company's financial trajectory will aid in managing potential risks.

Convertibility

Businesses exploring potential equity conversion may lean towards convertible debentures.

Conversely, loans maintain the company's ownership structure, devoid of equity participation.

The decision hinges on whether offering equity is aligned with the company's strategic goals.

Security Requirements

Debentures can be either secured or unsecured, influencing investor confidence and interest rates.

Loans often require collateral, influencing the terms of borrowing. Evaluating available assets and gauging their eligibility for collateral is pivotal.

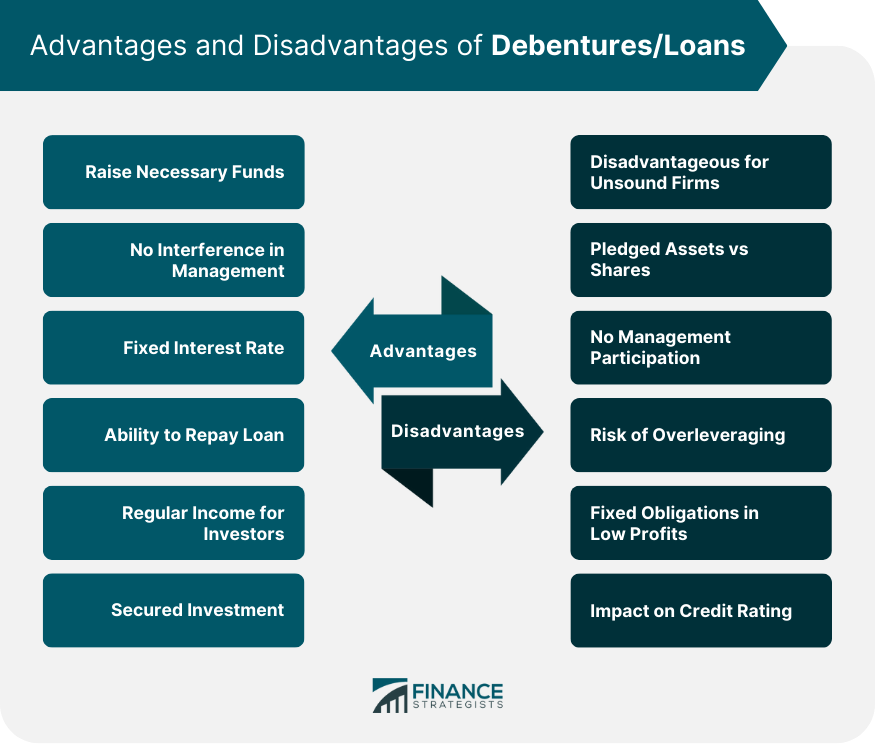

Advantages/Merits of Fundraising Through Debentures/Loans

1. Availability of necessary funds: The company can raise funds by the issue of debentures if funds are not available by the issue of shares.

2. No interference in management: Debenture holders do not have voting rights, which means they cannot participate in the management of the company.

3. Fixed rate of interest: The company has to pay interest at a fixed rate even if its rate of earnings and dividends is comparatively higher.

4. Ability to return loan: The company can return funds to debenture holders as per agreement and relieve itself from the burden of the loan.

5. Regular source of income: Investors receive fixed and regular interest at the agreed rate, irrespective of whether the company earns a profit or suffers a loss.

6. Safe and secured investment: Debentures are issued against assets as security, meaning holders have charge of the firm's assets. Hence, the investment is safe because if the company is dissolved, funds may be realized by the disposal of assets pledged.

Disadvantages/Demerits of Fundraising Through Debentures/Loans

Debentures may be disadvantageous for the following reasons:

1. Disadvantageous for financially unsound companies: The company will be required to pay interest regularly at a fixed rate, even if it has been suffering losses.

2. Pledging assets: Funds are available, after pledging assets as security, which would have been available without mortgaging assets by issuing shares.

3. No participation in management: Debenture holders do not have voting rights. They cannot participate in the company's management despite supplying funds to the company.

4. Risk of Overleveraging: Raising funds through debentures or loans can lead to overleveraging, where a company accumulates excessive debt.

5. Fixed Financial Obligations: Both debentures and loans entail fixed interest payments, which can become burdensome during periods of low profitability.

5. Impact on Credit Rating: Depending heavily on debentures or loans might negatively influence a company's credit rating. High debt levels can raise concerns among credit rating agencies and lenders.

Conclusion

A debenture is a financial instrument issued by a company that signifies its debt obligations to the holder.

It operates as a loan certificate divided into smaller denominations, allowing companies to secure funds while avoiding complete ownership dilution.

Debentures hold paramount importance in the capital markets, offering businesses a structured way to raise long-term funds.

However, their issuance demands careful consideration of factors like cost, risk, convertibility, and collateral.

While advantageous due to fixed financial obligations and potential regular income for investors, debentures come with drawbacks.

Companies may face increased financial risk and the potential of overleveraging. The issuance can impact credit ratings and restrict future borrowing options.

Consequently, businesses must meticulously evaluate these merits and demerits to make informed decisions that align with their financial goals and risk tolerance.

Debenture FAQs

A Debenture is a type of debt security that companies use to raise money from investors. The company pledges its assets as collateral for the loan, and in return, the investor receives a regular stream of interest payments. Debentures are considered a safer investment than stocks, as they are backed by the assets of the company.

There are a few reasons why a company might choose to issue Debentures instead of shares. First, companies can raise more money by issuing Debentures than they can by issuing shares. Additionally, Debenture holders do not have voting rights, so they cannot interfere with the company's management.

Debenture holders are creditors because they have lent money to the company through the sale of Debentures. Creditor means an entity that has a claim to receive money from another. In this case, it would be an individual who has purchased a Debenture from the company.

A shareholder refers to someone who owns part of a company, as well as receives dividends each year from the business's earnings. In this case, shareholders have invested money into the company by purchasing shares from it.

Debentures are considered riskier investments than stocks or fixed-income securities, because they are backed by the assets of the company. If the company goes bankrupt, Debenture holders will be repaid last after other creditors have been paid.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.