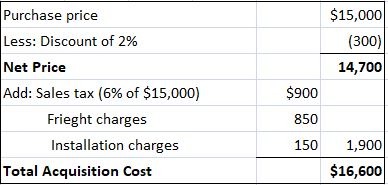

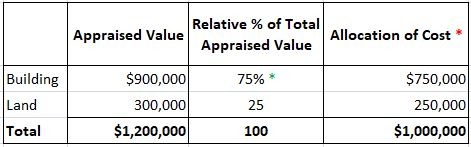

According to the Financial Accounting Standards Board (FASB), the historical cost of acquiring an asset includes the costs necessarily incurred to bring it to the condition and location necessary for its intended use. In terms of property, plant, and equipment, this means that all the reasonable and necessary costs required to get an asset to its location and ready for use are included in the acquisition cost. For example, the acquisition cost of equipment includes any transportation charges, insurance in transit, installation, testing costs, and normal repairs before putting the asset into service. All of these costs are necessary to bring the equipment to a location and condition to make it ready for its intended use. However, the acquisition cost does not include unexpected costs, such as the cost of repairing damage incurred in transportation, purchase discounts lost, or, in most cases, interest costs. These costs, as well as normal repairs and maintenance expenses incurred in subsequent periods, are considered period expenses when incurred. Each type of asset within the property, plant, and equipment category has special conventions regarding the particular items that should be included in the asset's acquisition cost. As a case in point, when land is purchased, various incidental costs that must be included in its total acquisition cost include real estate commissions, title fees, legal fees, draining, grading, and clearing costs, and delinquent property taxes. However, in many cases, the accountant's judgment must be used to determine which items should be capitalized. When property, plant, and equipment are purchased for cash, the acquisition price is easy to determine. It is the asset's net cash equivalent price paid plus all other costs necessary to get the asset ready to use. To illustrate, assume the Miller Company purchases a lathe from the Arnold Company. The price of the lathe is $15,000, and the terms of sale are 2/10, n/30. Sales tax is 6%, freight charges are $850, and installation costs are $150. The total acquisition cost of the equipment is $16,600, computed as follows: If the discount is not taken, the $300 should not be included in the cost of the equipment but instead should be considered as an interest expense. There are a variety of ways in which an enterprise can acquire property, plant, and equipment other than by direct cash purchase. These include basket purchases, noncash exchanges such as in exchange for the firm's own capital stock, donation, and self-construction. The determination of cost in these types of acquisitions is often more difficult than in straightforward cash exchanges and thus warrants special attention. Whether or not the purchase is for cash, a firm's property, plant, and equipment are often purchased together in one lump sum. For example, when an existing building is purchased, the land on which that building is situated is also usually purchased. The agreed-upon purchase price represents the total cost of both the building and the land, and in many cases, the total purchase price is more or less than the individual fair market values of the building and the land. As a result, the total purchase price must be allocated between the individual assets. This is especially important because the building is subject to depreciation, but the land is not. The allocation is often based on appraisals or property records. To illustrate, assume that the H. Jones Company purchases an existing office building and the site land. The total purchase price is $1 million. An independent appraiser determines that the building and land have fair market values of $900,000 and $300,000, respectively. The $1 million purchase price is allocated as follows: * $900,000 / $1,200,000 = 75%

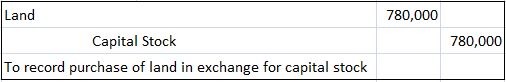

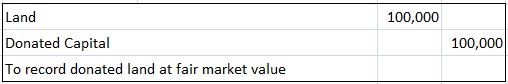

* Percentages x $1,000,000 = Purchase price As this example illustrates, the acquisition cost is the basis for recording assets, even though their individual appraised values may be higher. In some situations, property, plant, or equipment is purchased through non-cash transactions. For example, a firm may purchase land and, in exchange, issue the firm's stock to the seller. In these transactions, the application of the cost method requires that the acquisition price of the asset be equal to any cash given, plus the fair market value of any non-cash consideration given. However, if it is difficult or impossible to determine with reasonable accuracy the fair market value of the non-cash consideration, the market value of the particular asset that is purchased should be used. To illustrate, assume the Orange Company, a larger public company, purchases site land in downtown Los Angeles on which to build its corporate office. In exchange for the land, the Orange Company issues 10,000 shares of its capital stock to the seller. At the time of the transaction, Orange Company's stock is selling on a national exchange for $78 per share. To record this transaction, the Orange Company makes the following entry: If the stock of Orange Company is not traded on an exchange and it is otherwise difficult to determine its fair market value, then the land should be recorded at its fair market value. There are circumstances in which an enterprise may acquire its property, plant, or equipment through donation. For example, in order to entice General Motors or any other large corporation to locate within its boundaries, a city may give the company the site land on which to build its plant. In these rare situations, if the historical cost principle were strictly followed, accountants would assign a zero cost to the land. Because this would be clearly misleading, accountants record the asset at its fair market value at the time it is received. The credit portion of the entry is to a stockholders' equity account: Donated Capital. To illustrate, assume that the WLH Corporation acquires at no cost 100 acres of land from the city of Lost Acres. At the time of the donation, the land is appraised at a fair market value of $100,000. To record this transaction, the WLH Corporation makes the following entry: In some circumstances, a building or a piece of equipment is constructed by the enterprise itself. These assets are named self-constructed assets. The acquisition costs of these assets include materials and labor used directly in the construction process as well as a portion of overhead. Overhead costs include supervisory labor, utilities, and depreciation on the factory building. Interest is the time value of money and, as such, is generally considered an expense in the period incurred. Thus, when property, plant, or equipment is purchased through the issuance of a note, the interest related to that note is expensed when incurred. However, in 1979 the FASB issued Statement 34, which requires that in limited circumstances interest be capitalized and thus be included in the acquisition cost of certain non-current, non-monetary assets. In particular, Statement 34 requires that when an enterprise constructs its own assets or has another entity construct an asset for it, and when there is an extended period to get it ready for use, interest incurred in the construction should be capitalized as part of the acquisition or production cost of the asset. Needless to say, the rules relating to capitalized interest are complex.Cash Acquisitions

Other Methods of Acquiring Property, Plant, and Equipment

Basket or Group Purchases

Example

Non-cash Exchanges

Example

Acquisition Through Donation

Example

Self-Constructed Assets

Capitalization of Interest

How to Measure the Acquisition Cost of Property, Plant and Equipment FAQs

Acquisition costs are the expenses to acquire property, plant & equipment. These costs should be capitalized as part of the accounting for obtaining the asset.

Yes. If a business manufactures its own product that it sells later, then the cost of labor and materials to produce the product must be capitalized. If a company purchases and resells a product, then these costs should be expensed as incurred.

Interest that is paid on debt to finance the purchase of plant and equipment acquisitions must be expensed as incurred. The same goes for interest on rental payments for the use of property. If a company uses its own equity to purchase or produce plant and equipment, then that interest must be capitalized and added to the cost of the asset.

An example of an intangible asset would be a patent, copyright, franchise license, or trademark.

The cost of property, plant or equipment includes the purchase price plus any costs required to get the asset ready for use. Acquisition costs are not depreciated but are reviewed for impairment on a regular basis. The capitalized interest concept only applies to self-constructed assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.