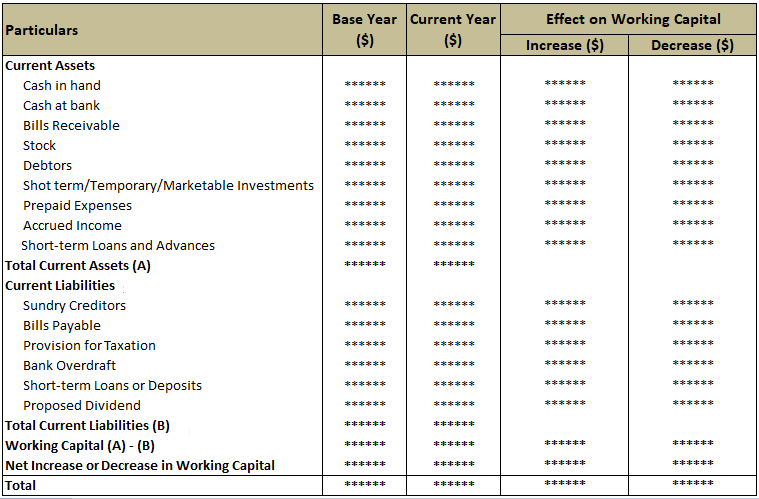

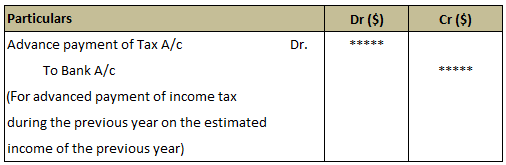

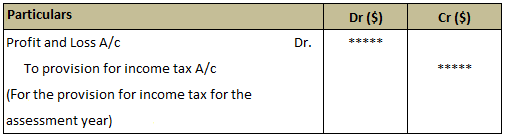

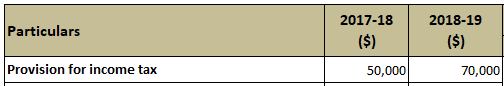

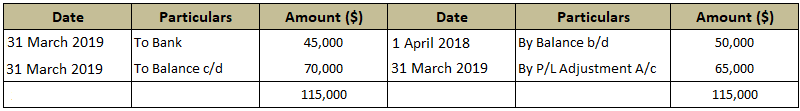

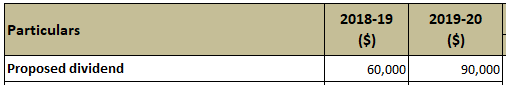

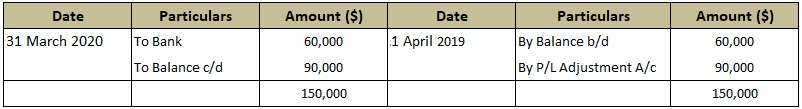

A statement of changes in working capital is prepared by recording changes in current assets and current liabilities during the accounting period. Working capital during this period is bound to change due to an increase or decrease in the current assets and current liabilities. A statement of changes in working capital is prepared to measure the increase or decrease in the individual items of current assets and current liabilities. It also shows the net increase or decrease in the working capital during the accounting period. A convenient format is used to depict the changes in working capital, as shown below. Format of a Statement of Changes in Working Capital Before preparing a statement of changes in working capital, the following important notes should be borne in mind: Investments of a short-term nature (i.e., held for one year or less) are called marketable securities. They are the current assets of the enterprise, which are automatically adjusted through the statement of changes in working capital. Therefore, marketable securities do not require any separate treatment in a statement of changes in working capital. By contrast, trades of a long-term nature, being fixed assets (i.e., held for more than one year with the intention of earning regular income in the form of interest or dividends) require separate treatment. If the closing balance of a long-term investment is lower than the opening balance, the difference is the application of funds (certain investments are bought as income-yielding securities for the long-term). As this is not adjusted automatically in the statement of changes in working capital (not being a current asset), separate treatment is required. Enterprises must pay income tax. Income tax is payable on the income of the previous year during the assessment year. However, income tax departments insist that tax should be paid during the previous year itself on the estimated income to be earned on the principle of pay as you earn. The tax payable during the assessment year, if paid in the previous year, is called an advance payment of income tax. The entry passed in the books for the advance payment of tax is: Income tax is a charge on the profit and loss account of an enterprise. The enterprise makes a provision for tax payable on a self-assessment basis. The estimated liability for tax payable on self-assessment is recorded in the books with the following entry: Either of the following two methods can be used to treat this item: Note: No adjustment is required at the time of preparing the profit and loss adjustment account or statement of funds from operations. To find out funds from operations, the difference between the opening balance on the credit side, the closing balance, and the tax paid on the debit side should be debited to the profit and loss adjustment account. This difference is found by recording items in the worksheet. From the following information find out: Further information is given in the table below. Income tax paid during the year 2018-19 in respect of the year 2017-18 is $45,000. It is treated as a non-current liability. The provision for income tax account is shown below: Provision for Income tax Account The answers to the first and second questions in this example are the following: Generally, provision for bad debts is deducted from sundry debtors and the net amount is shown in the statement of changes in working capital. If this is not the case, then it can be treated as a current liability and can be shown in the changes in working capital under current liability. The provision for bad debts will be treated as surplus when all debtors are good. To calculate funds from operation, the difference between the closing and opening balances of provision for bad debts shall be taken into account. An interim dividend is paid between the two general body meetings of the company during the accounting period. It is paid during the year/period and should be shown as application of funds. It should be taken into account when calculating funds from operations. Dividends are proposed or recommended by the board of directors to be approved by the shareholders in the general body meeting. The treatment of the proposed dividend is similar to the provision for taxation (i.e., treat it as a non-current or current liability). However, a proposed dividend is preferably treated as a non-current liability, and it is not shown in the statement of changes in working capital. Instead, it is shown as application of funds in the fund flow statement. In the worksheet, the proposed dividend account is prepared by crediting the opening balance and debiting the closing balance. The difference between the two sides is debited to the profit and loss adjustment account to determine funds from operations. Example: Treating Proposed Dividend as a Non-current Liability From the following information, calculate: The proposed dividend for the year 2018-19 was paid during the year 2019-20. A provision for income tax account is shown below: Provision for Income Tax Account The answers to the two questions in this example are: The proposed dividend is shown in the statement of changes in working capital. The payment of the proposed dividend during the current year should not be shown in the fund flow statement. Note: While calculating the funds from operations, no adjustment is required to be done in the profit and loss adjustment account.What Is the Statement of Changes in Working Capital?

Purpose of Preparing the Statement

Steps to Follow to Prepare a Statement of Changes in Working Capital

Now, ascertain the difference in the current assets between the two periods. Enter the difference in the increase or decrease column, depending on the situation.

In turn, identify current liabilities and enter them under the heading of current liabilities. Then, enter the amount of current liabilities for the base year and current year in the respective columns.

Add up the current assets and current liabilities for the previous year and current year. Denote the total current assets by A and current liabilities by B.

Calculate working capital for both the current period and base period by subtracting current liabilities (B) from current assets (A).

If the working capital of the current year is greater than the working capital of the previous year, enter the difference in working capital in the previous year.

In the relevant column, enter the increase in working capital against the amount written.

If the working capital of the current year is less than the working capital of the previous year, enter the difference in working capital in the current year.

In the relevant column, enter the decrease in working capital against the amount written.Items Requiring Special Attention While Preparing a Statement of Changes in Working Capital

1. Investments

2. Advance Payment of Income Tax

3. Provision for taxation

Payment of tax during the year will not appear as application of funds in the fund flow statement because such payments affect two current accounts (i.e., cash and provision for taxation).

In this case, the payment of tax made during the current year should be shown as application of funds in the fund flow statement.Example: Application of Funds

Solution

4. Provision For Bad Debts

5. Interim Dividend

6. Proposed Dividend

Solution

When it is treated as a current liability:

Statement of Changes in Working Capital FAQs

A statement of changes in working capital is prepared by recording changes in current assets and current liabilities during the accounting period.

A statement of changes in working capital is prepared to measure the increase or decrease in the individual items of current assets and current liabilities. It also shows the net increase or decrease in the working capital during the accounting period.

The current assets and current liabilities are included in the statement of changes in working capital.

The statement of changes in working capital is calculated by subtracting the current liabilities from the current assets. This gives you the net working capital for the period.

The statement of changes in working capital can be used to help you identify areas where your company may be struggling financially. It can also help you track trends over time, so you can make adjustments as needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.