Most accountants treat the acquisition of an asset and the task of acquiring funds to pay for the acquisition as separate and unrelated events.

The GAAP departs from that convention only in terms of interest incurred while the asset is under construction, excluding interest incurred during its useful life. That is, interest incurred in preparing the asset for use is regarded as a cost of the asset.

Applicability

The capitalization of interest applies to non-inventory assets produced where three factors are present.

First, the firm must have incurred actual interest charges during the period, either on debt specifically obtained for the project or on debt that could have been retired if the funds used in the project had been applied for that purpose.

Second, the firm's expenditures on the project must have involved payments of cash, exchanges of other assets, or the creation of interest-bearing debt.

In other words, the firm must have made commitments of resources that could have been avoided or redirected into retirement of debt such that interest charges could have been reduced.

Third, these expenditures must have been made while the asset was undergoing preparation for use, including activities such as planning, obtaining government permits, and actual construction.

This requirement forbids capitalization of interest during extended periods of inactivity when nothing is being done to prepare the asset for use.

Expenditure Base

The amount of interest that can be capitalized is found by applying appropriate interest rates to the average amount of accumulated expenditures.

To calculate this average amount (known as the expenditure base), the firm begins with the cost of the asset and deducts from that amount any expenditures that were made in the form of accrued liabilities or other non-interest-bearing debt.

After making this calculation, the remainder represents the resources committed to the acquisition of the asset.

The next step is to work out the average commitment during the covered time period. This is determined simply by taking one-half of the sum of the beginning and ending net expenditures.

The statement does not specify whether the average should be annual, quarterly, or monthly. The approach chosen should be selected to provide a close approximation of the typical amount committed throughout the period.

This expenditure base can be divided further into two segments if interest is attributable to both specific and general debt.

That is to say, part of the expenditure base may be financed by funds acquired specifically for the project, while the remainder of the funds came from other sources unrelated to the project.

When this condition exists, the expenditure base is partitioned before applying the appropriate interest rates.

Interest Rates

If debt financing has been obtained specifically for the construction, its interest rate should be multiplied by that portion of the expenditure base derived from that debt.

If amounts in excess of those borrowed funds have been spent, their balance should be multiplied by an average interest rate from general debt obligations.

The purpose of this calculation is to determine the amount of interest that could have been avoided if the expenditures had not been made.

Example

Suppose that Sample Company begins construction of a two-year project on 3 January 20x1.

During 20x1, the company incurs a total cost of $400,000. At the end of the year, it has recognized non-interest-bearing liabilities (such as accounts payable) for $100,000 of that amount.

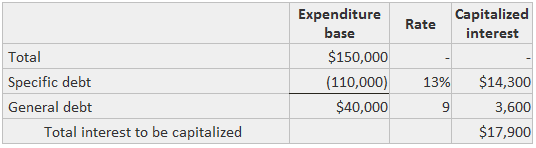

The year-end expenditure base is thus $300,000, or $400,000 less $100,000. The average accumulated expenditures for 20x1 are $150,000, or one-half of the sum of the beginning and ending totals ($0 plus $300,000).

Of that amount, $110,000 was raised through specific borrowing at 13%. The remainder was financed out of nonspecific borrowing with a rate of 9%.

The amount of capitalizable interest is computed as follows:

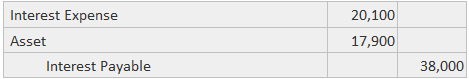

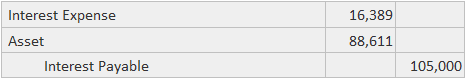

If the total interest costs incurred (but unpaid) for the year are $38,000, the following journal entry would be recorded at the end of the year:

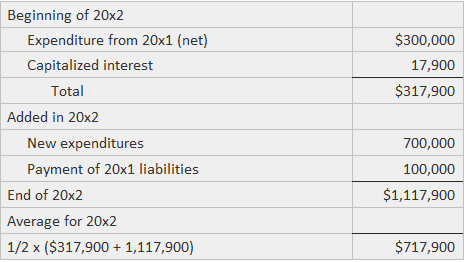

Thus, $17,900 would also be added to the expenditure base. Therefore, the balance at the beginning of 20x2 would be $317,900.

Suppose that new expenditures of $700,000 are incurred in 20x2. Also, suppose that all the non-interest-bearing debt is paid off and that the project is completed on 30 December. The average expenditure base would be computed as follows:

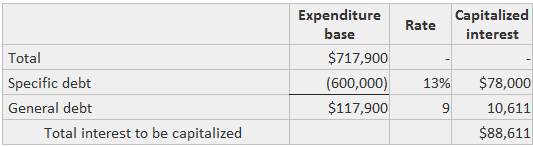

Of this $717,900, suppose that $600,000 is financed by the 13% specific loan and the balance from the 9 percent general debt. In this case, the capitalizable interest is:

If the total interest costs for the year are unpaid and equal to $105,000, this journal entry would be recorded:

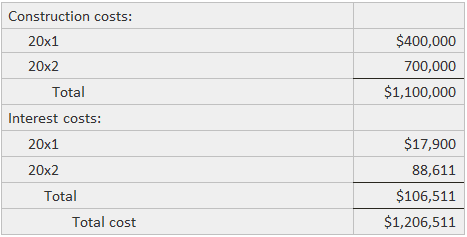

The total cost of the asset can be computed as shown below:

The effect of capitalization is to present higher reported earnings during the period of construction. This is achieved by not expensing part of the interest cost and lowering earnings in later years through higher depreciation.

Whether these results represent a better picture or a distortion depends upon one's judgment as to whether interest is a necessary cost of making an asset ready for use.

The following example shows a note disclosure made by Boise Cascade Corporation that is related to the capitalization of interest.

Bios Cascade Corporation Summary of Significant Accounting Policies

Property

Interest is normally expensed as incurred, except when it is incurred in conjunction with major capital additions. In this case, it is capitalized as part of the asset cost.

Interest capitalized on major capital additions is determined by applying current interest rates to the funds needed to finance the construction.

Interest of $12,981,000 and $2,106,000 was capitalized during 2018 and 2017, increasing earnings per share by 25% and 4%, respectively. The amortization of interest capitalized in prior years did not significantly affect income for the periods.

Capitalization of Interest Cost During the Construction of Assets FAQs

According to the aicpa statement of position 97-2, "interest is capitalized during construction when it relates to major additions or improvements."

Any costs associated with an asset that are greater than 10% of the total cost fall under this definition. However, some companies have stricter requirements, while others choose to capitalize any interest related to construction.

I believe that interest should be expensed when it is not part of major additions or improvements to an asset because it may be misleading for investors. However, this decision is up to the companies you are looking at investing in and whether they choose to capitalize interest expenses during construction.

Interest must be capitalized until the date the asset is placed in service. Once this occurs, a company should add back any previously capitalized interest to net income so they can get a more accurate picture of their earnings. If a company does not add back the interest, it can be very misleading to investors.

The following example assumes that the project began in 2015 and finished at the end of 2016. During this period, $100,000 would have been capitalized in 2015, another $200,000 in 2016, and $50,000 in 2017.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.