Due to the estimates and judgments involved when calculating depreciation (as well as amortization and depletion), it is inevitable that facts in subsequent years will show that some of the original projections and assumptions were incorrect.

Changes in Service Life

If the originally selected service life of an asset is sufficiently incorrect that future years' reported income will be materially misstated, GAAP call for the firm to account for the correction as a change in estimate.

To avoid manipulations, GAAP call for the book value (adjusted for salvage) remaining at the date of the change to be spread over the revised estimated life of the asset.

Example

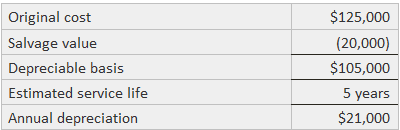

Suppose that an asset was purchased on 4 January 2021 and was depreciated on a straight-line basis as follows:

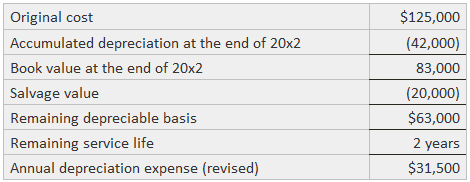

During 2023, it was determined that the asset would be sold for $20,000 at the end of 2024 instead of the end of 2025. The book value as of the end of 2022 effectively becomes the new cost of the asset, and the new service life is two years.

The depreciation expense for 2023 and 2024 is, therefore, as follows:

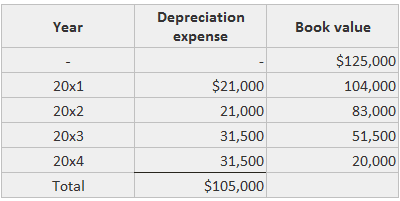

The following example shows the annual depreciation charges over the asset's four-year life.

Annual depreciation expense when life is shortened to four years beginning with 2023:

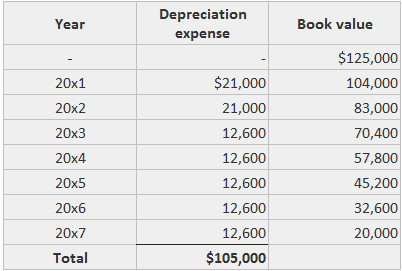

The below example shows the amounts that would have been recorded if the life was extended from 2023 until the end of 2027.

The revised annual charge ($12,600) is found by dividing the number of years in the new life (five years) into the remaining depreciable basis ($63,000).

Annual depreciation expense when life is extended to seven years beginning with 2023:

If a declining balance method was being used, a new rate would be computed for the remaining life by multiplying the new straight-line rate by the appropriate multiplier (1.25, 1.50, or 2.00).

If the sum of the years' digits was being applied, a new denominator would be computed as the sum of the digits from one to the number of years in the revised life. The numerator would start again at that same number.

Changes in Salvage Value

If the original estimated salvage value is sufficiently incorrect such that it causes financial statements to be materially misleading, the firm should prepare a prospectively revised depreciation schedule.

In the new schedule, the new salvage value should be deducted from the book value of the asset.

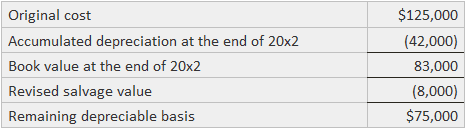

Suppose that the salvage value of the asset described above is reduced in 2023. The following results would be achieved:

Thus, the charge for each of the remaining three years would be $25,000.

Change in Method

If the firm's management decides to change its choice of depreciation method, the change is considered to be more substantive and the accounting procedure is more complex.

To avoid the complexities, many firms adopt an incremental approach to changing the method.

That is to say, assets acquired after the change are depreciated under the new method while the old assets are depreciated under the old method.

A note such as this one may be used to disclose the change:

Property additions subsequent to October 1, 2021, are depreciated by the straight-line method.

Property acquired prior to that date is depreciated by the declining balance method. The effect of this change was to increase net income and net income per share by $850,000 and $0.75.

This approach is acceptable even though it violates consistency in reporting. To be more thorough, many companies introduce a comprehensive change wherein depreciation on old assets is computed under the new method.

Depreciation and Changes in Estimates and Method FAQs

The Depreciation charge for each accounting period will be different. Depreciation expense in any period is based on the cost or carrying value, minus accumulated Depreciation plus the estimated residual value at that date. Therefore, if the estimated service life changes, then both the rate and total amount of Depreciation expense will be different.

Depreciation methods that allow for a residual value generally estimate this amount at the end of the useful life. The amount can be based on historical experience, estimates provided by outside experts, or other means.

Once you make a Depreciation decision, that assumption is locked in unless you go through the process of changing it. Changing estimates related to residual value or useful life are causes for changing Depreciation practices. Other changes can be made as well.

A change in business conditions might call for a change in assumptions about expected lives or future selling prices, for example. If a business is in doubt about the accuracy of its assumptions, it might record a loss from a change in accounting estimate.

In addition to providing tax advisory services, accounting firms often provide significant non-tax functions to their clients. The accounting firm may lead the process of managing Depreciation, including setting the assumptions that go into calculating future Depreciation charges.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.