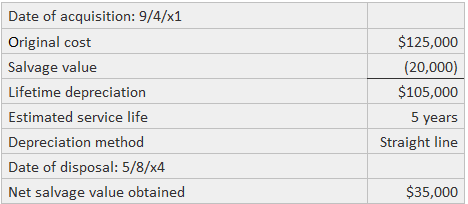

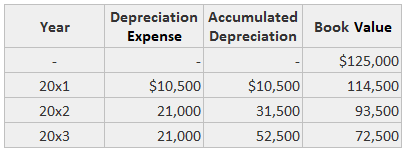

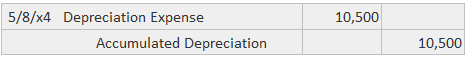

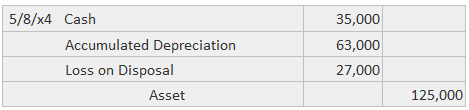

When accounting for the disposal of operating assets, the firm should record a gain or loss for the difference between the net salvage proceeds and the asset's book value as of the disposal date. It should be noted that any gain or loss from disposing of an asset is only an adjustment to income caused by inaccurate estimates of salvage value or service life. To measure the gain or loss and operating income, the book value should be adjusted by the partial year's depreciation expense prior to recording the disposal. For example, consider this asset: The book value as of 31 December 2023 is computed under the half-year convention for partial year's depreciation as follows: The following journal entry would be made to record the depreciation for the first half of 2024 (one-half year's depreciation): In addition, the journal entry below would be made to record the disposal (note that the amount of accumulated depreciation is the sum of $52,500 and $10,500). In practice, these two journal entries are likely to be combined. The net gain or loss on all disposals should appear separately in the income statement only if the amount is material. If the disposal removes a significant segment of operating capacity, it should be reported as a discontinued operation. The SCFP should identify the amount of working capital provided by disposals ($35,000 for the example above) and should adjust the income figure for any gains or losses to present the amount of working capital provided by operating activities alone. If the seller accepts a note receivable from the buyer, the realistic interest rate should be used to determine the selling price of the asset. If the seller accepts another asset in exchange, there may or may not be a gain or loss on the exchange. If the disposal occurs as a result of a casualty, such as theft, fire, or storm damage, the cash settlement received from insurance is added to the proceeds.Disposal of Operating Assets: Explanation

Example

Disposal of Operating Assets FAQs

When accounting for the disposal of operating assets, a gain or loss must be recorded as if the asset were sold for its net Salvage Value.

The book value of the disposed-of asset should be adjusted by a partial year’s Depreciation to determine the amount of gain or loss. In addition, any gain or loss from disposing of an asset is only an adjustment to income caused by inaccurate estimates of Salvage Value or service life.

The net gain or loss on all disposals should appear separately in the income statement only if the amount is material. Any gain or loss from disposing of an asset is only an adjustment to income caused by inaccurate estimates of Salvage Value or service life. To measure the gain or loss and operating income, the book value should be adjusted by the partial year’s Depreciation.

Any cash settlement received from insurance is added to the proceeds. The net estimate of property damage, which is the cash settlement less insurance received, is also added to the proceeds.

Purchased goodwill, franchises, patents, licenses, and trademarks do not qualify for sale treatment because they have no real market value. The recovery of an asset through its operation does not justify its disposal.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.