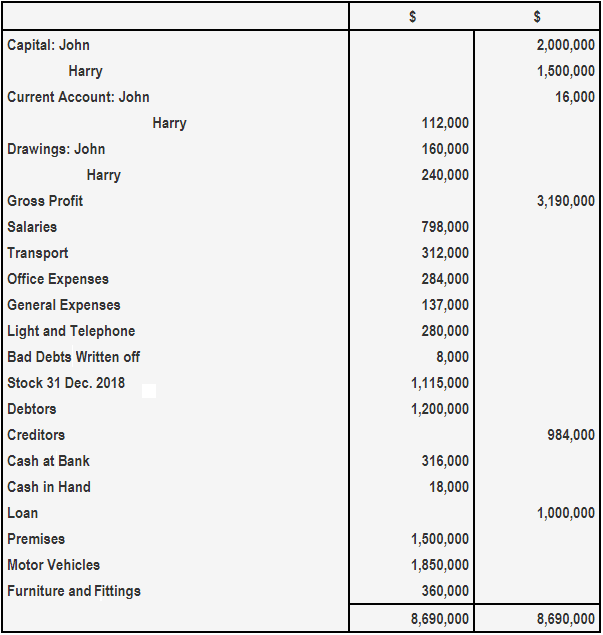

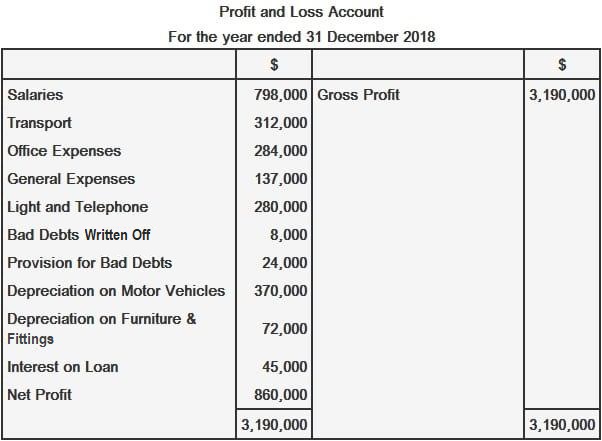

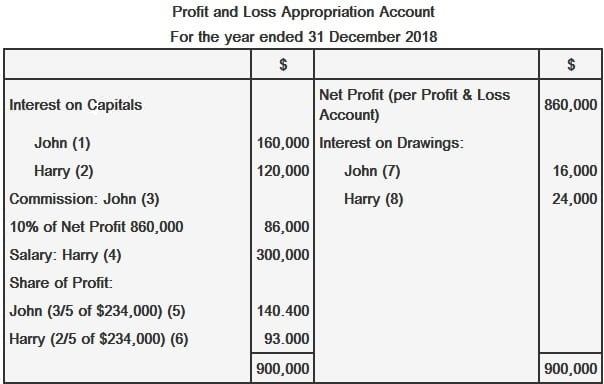

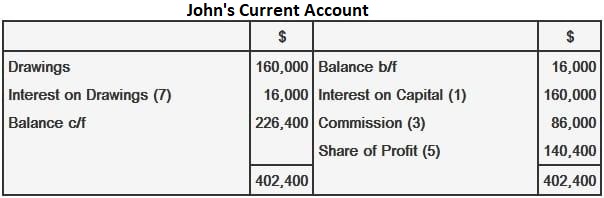

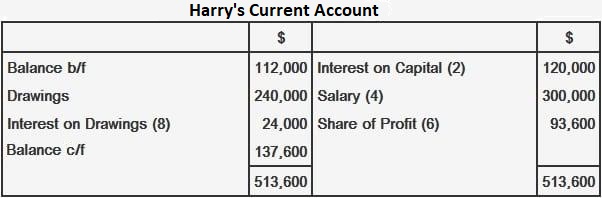

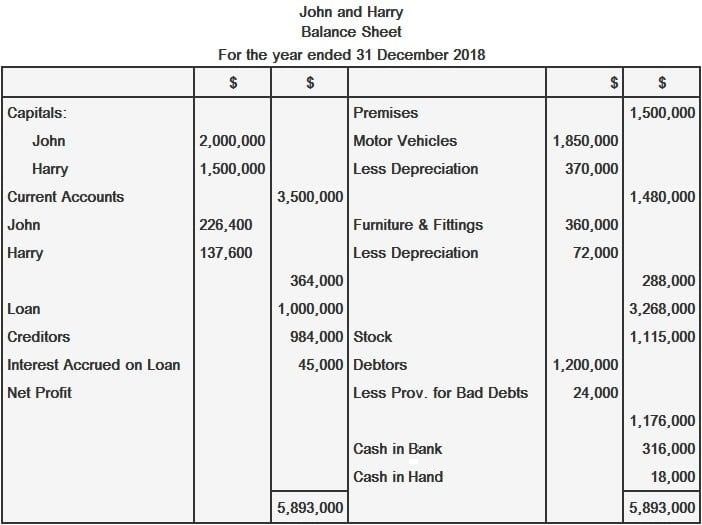

Profits or losses made by a firm should be divided among its partners per the provision of their partnership deed. However, if there is no written or oral agreement among the partners, the law prescribes that partners should share profits and losses equally. Under the law, no partner is entitled to get anything out of their firm except a share in profits. Thus, whatever benefits or allowances the partners may be entitled to by the provisions of their partnership deed must be given to them out of the firm’s profits only. This statement implies that no allowance or benefit allowed to a partner can be debited to the firm’s profit and loss account. If one of the partners is active and their partnership deed allows them a salary of, say, $600,000 per annum, this sum cannot be debited to the profit and loss account as an expense. The law does not recognize any payment made to a partner by their firm as an expense. At the end of each financial year, after the firm’s net profit (or loss) has been ascertained, i.e., after the firm’s trading and profit and loss account (or income statement) has been prepared, the profit and loss appropriation account is readied. The profit and loss appropriation account indicates the distribution of profit or loss among the partners. Net profit is transferred from the profit and loss account to the profit and loss appropriation account by: In case of a net loss: Any benefit or allowance made to a partner (e.g., interest on fixed capitals, salary, commission, bonus, and so on) is: Any charge made by the firm on the partners (e.g. ,interest on drawings) is: Following the above adjustments, the balance left on the profit and loss appropriation account represents a distributable profit or loss. If the balance is a credit balance, it is a distributable profit which is: If the balance left on the profit and loss appropriation account after the various appropriations is a debit balance, it is a distributable loss which should be: The balances left in the ledger of John and Harry after they prepared their trading account for the year ending 31 December 2018 are given below. Based on these balances and additional information, prepare: Additional Information Preliminary Calculations Depreciation on motor vehicles: 20% on $1,850,000 = $370,000 Depreciation on furniture and fittings: 20% on $360,000 = $72,000 Provisions for Bad Debts: 2% of $1,200,000 = $24,000 Interest on Loan (for half a year): 1/2 x 9% of $1,000,000 = $45,000 Interest on Capitals: John: 8% of $2,000,000 = $160,000. Harry: 8% of $1,500,000 = $120,000. Interest on Drawings: John: 10% on $160,000 = $16,000. Harry: 10% on $240,000 = $24,000. Harry’s Salary: $25,000 per month x 12 = $300,000 for the year.Example

Solution

Distribution of Profit and Losses in a Partnership FAQs

The distribution of profits and losses among partners is typically determined by the partnership agreement, which should include provisions for the amount each partner contributes to the business, their ownership percentages, and how any profits or losses will be shared among them.

Partnerships typically distribute profits and losses between partners according to their ownership percentages, or as specified in the partnership agreement. For example, if Partner A owns 60% of the business and Partner B owns 40%, then any profits will be distributed accordingly (60/40).

Yes, generally speaking, all partners are jointly responsible for any debts incurred by the partnership unless otherwise stated in the partnership agreement. Each partner is personally responsible for their portion of the debt and can be held liable if they fail to make payments on time.

In most cases, the partnership itself is not subject to tax; it is merely a pass-through entity with income and losses reported on each partner's tax return. Thus, all profits and losses are taxed at each partner’s rate based on their ownership percentage.

Yes, depending on the type of business entity and other factors, partners may be able to claim certain deductions related to their share of profits and losses in a partnership such as depreciation, amortization expenses, etc. However, it is best to consult a tax professional to determine the exact deductions that can be claimed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.