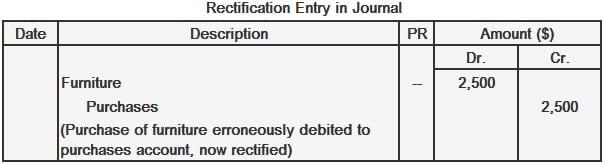

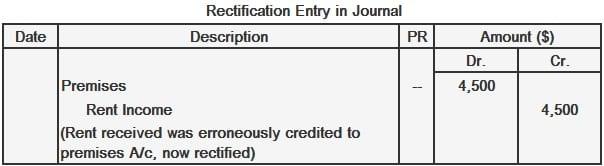

Errors of principle arise due to a bookkeeper's or an accountant's improper understanding of accounting and its core principles. These errors resemble errors of commission except in one respect: errors of commission usually lead to oversight whereas errors of principle are caused by a lack of knowledge of accounting principles. The common error is the treatment of capital expenditure as revenue expenditure (or vice versa). Capital expenditure is expenditure on purchasing fixed assets, whereas revenue expenditure is incurred in the day-to-day running of the business. For example, the purchase of a motor car is a capital expenditure while the purchase of fuel for the car is a revenue expenditure. As with errors of commission, errors of principle have the following effects on accounts: Rectification entries for errors of principle are the same as rectification entries for errors of commission. That is to say, if an irrelevant account has been debited instead of the correct account: If an irrelevant account has been credited instead of the correct account: Some furniture was bought on credit for $2,500 for office use. It was debited to the purchases account. (This means that a capital expenditure is being treated as revenue expenditure.) Rent received from a tenant, $4,500, was credited to a premises account. (This means that a revenue receipt is being treated as a capital receipt.)Effect on Accounts

Errors of Principle: Rectification Entry

Example

Errors of Principle FAQs

If you fail to make a rectification entry (a double entry), the books of account will be out of balance, i.E., Not in equilibrium.

Since an asset has been wrongly valued, the assets value will be too high and the equity section of the balance sheet would be overstated.

As with errors of commission, if an expense has been wrongly debited, there would be no impact on the income statement. The income statement only includes relevant items. However, it may affect other financial statements depending upon whether revenue or capital is affected. For example, if an asset is wrongly valued or assets are written down, the balance sheet will be affected.

No impact. The income statement will not include this item because it is irrelevant to the company’s operations and very existence. It may affect other financial statements depending upon whether revenue or capital is affected. For example, if an asset is written up, the balance sheet will be affected.

In order to prevent errors of principle from occurring again, managers should make sure that all transactions are recorded correctly. This can be achieved through better communication and supervision as well as making sure everyone knows what is expected of them.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.