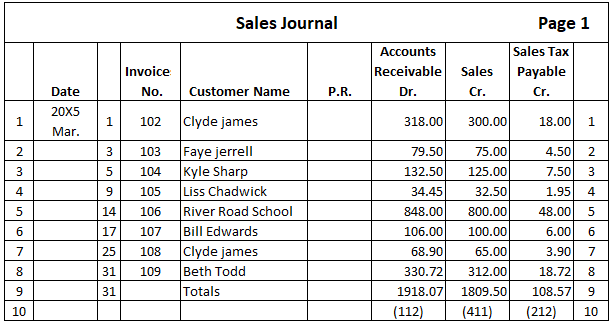

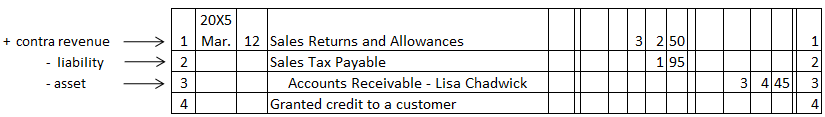

Sellers collect a sales tax from their customers whenever transactions are made. This tax is later paid to the appropriate tax official in the state government. Most state governments and some county and city governments levy a tax on the retail price of goods and services sold to the end-user. This tax is called sales tax. The rates charged for sales taxes range from a low of 3% to a high of 11%, depending on the state. To illustrate the process of accounting for sale tax, let's consider Angie Shaffer, the owner of a Surf-N-Sand Shop on Tybee Island, Georgia. The sales tax rate on Tybee Island is 6%. Therefore, after Angie recently sold a $200 surfboard, she collected a sales tax of $12 (0.06 x $200). Accordingly, the customer paid Angie $212 for a $200 purchase. The following general journal entry records the sale. Notice that the amount of sales tax is recorded in the Sales Tax Payable account. Had the sale been on credit, the entry would be the same, except that the debit would have been to Accounts Receivable and the individual customer's account instead of to the Cash account. Most states require sales taxes collected during the month to be sent to the appropriate state office by the middle of the following month. To record this, a debit is made to the Sales Tax Payable account (to decrease the merchant's liability for these taxes), and a credit is made to the Cash account. To illustrate, we'll continue using the above example of Angie's Surf-N-Sand Shop. In July 2020, Angie's store recorded total sales of $60,000. Since the sales tax rate in the area is 6%, $3,600 (0.06 x $60,000) in sales taxes was collected on these sales. In Georgia, sales taxes collected in one month must be sent to the State Department of Revenue by the twentieth day of the next month. Therefore, Angie prepared the sales tax report shown below. The following journal entry was made to record the payment of the taxes. Notice that Angie was allowed to keep a small percentage of the sales taxes collected as her fee for collecting the taxes and sending them in. She records this fee ($375) as miscellaneous income. Had Angie been in a state that did not allow the merchant to keep a portion of the taxes as a fee, her entry would have been as follows: As we know, credit sales subject to a sales tax can be recorded in a general journal. If the volume of credit sales is large, however, more efficient use of journalizing and posting time can be made by expanding a one-column sales journal to three columns: The total amount to be received from a sale (selling price plus sale tax) is entered in the Accounts Receivable debit column. The amount of the sale is entered in the Sale Credit column. Finally, the amount of sales tax charged on the sale is entered in the Sales Tax Payable Credit column. To illustrate the use of a three-column sales journal, we will use the example of Jervis Gift Shop, a retailer. The March 20x5 sales journal of Jervis Gift Shop is presented as follows: Notice the account numbers written in parentheses directly below the column totals in the above figure. The account number shows that the column totals were posted to the general ledger. The checkmarks in the P.R. column mean that the individual amounts were posted to customers' accounts in the accounts receivable ledger. If a customer returns merchandise on which a sales tax was charged, the amount of sales tax must also be returned to the customer. To illustrate this, look again at the sales journal of Jarvis Gift Shop. On 12 March, Lisa Chadwick returned merchandise she bought on 9 March for $32.50 plus $1.95 sales tax. The following general journal entry was made to record the return.Sales Tax: Definition

Sales Tax: Explanation

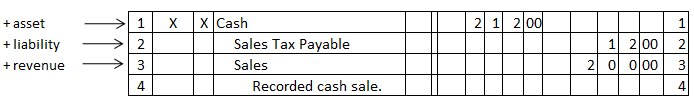

Accounting for Sales Tax

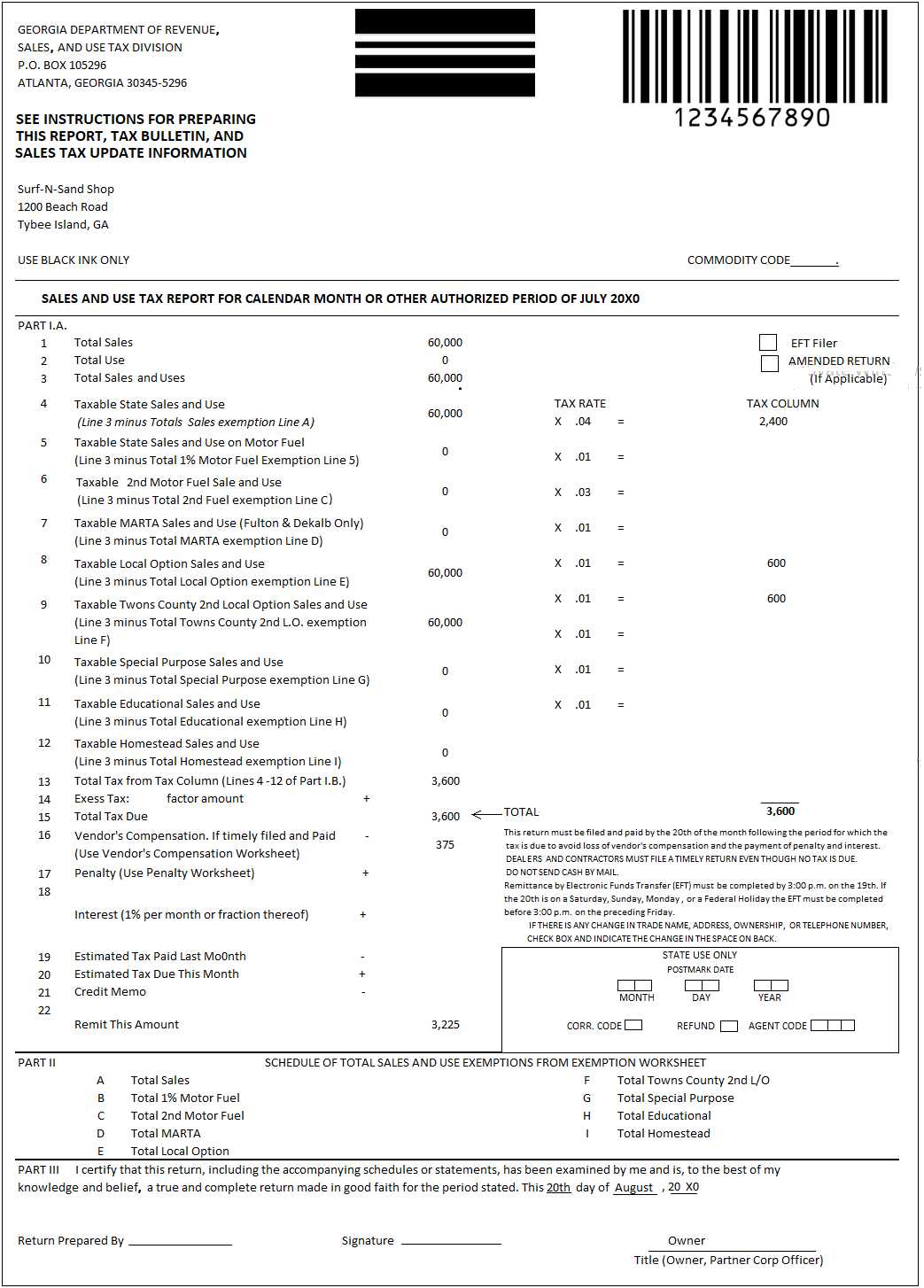

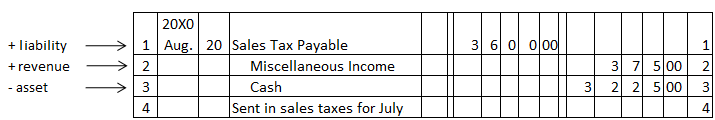

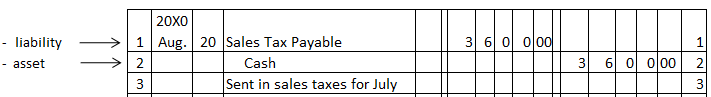

Reporting Sales Taxes Collected

Example

Recording Sales Tax in the Sales Journal

Sales Returns Involving a Sales Tax

Accounting for Sales Tax FAQs

A cash discount is an amount deducted from the stated selling price of an item at time of purchase. Sales Tax is an additional charge levied by states on the retailer who then passes it to the customer.

The seller currently collects sales tax for certain products and services.

Sales tax is collected on every sale that’s taxable (this includes most retail sales).

To determine the taxable price, multiply the list price by the state's percentage of taxation and add any additional local taxes.

Generally speaking, a cash discount is deducted from a merchant's gross revenue whereas sales tax and VAT are levied on a merchant's gross revenue.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.