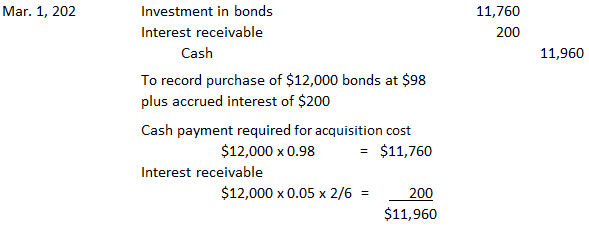

Accounting for bonds for investors is similar to the approach used for issuers. The difference is that an investor records an asset, where the bond is an investment rather than a liability. A company's account for Investment in Bonds can be classified as either a current asset or a long-term investment, depending on the marketability of the bonds and management's intention as to when the bonds will be converted into cash. Therefore, bonds can be purchased to invest idle cash on a short-term basis, to make a long-term investment in another company, or to accumulate funds for future expansion plans. The acquisition price of bonds includes their purchase price, brokerage commission, and any other costs related to the purchase. Bonds may be purchased at their face value, at a discount or premium, and at or between interest dates. In practice, the debit to the Investment in Bonds account is made at cost, including all acquisition costs but excluding the accrued interest element. A separate account is not maintained for the premium or discount. This practice varies from the accounting procedures used by the issuer and the recommendation found in official pronouncements. However, the investor seldom purchases an entire bond issue, and the amount of the discount or premium is not material. If bonds are purchased between interest dates, the investor must pay the issuer or the previous bondholder for any interest accrued since the last interest date. This is because the purchaser will collect the full six months' interest on the next interest date. To illustrate these procedures, assume that the Cinzano Corporation purchased 12 $1,000, 10%, 5-year bonds on 1 March 2020. The bonds were dated 1 January 2020. The total face value of the bonds was $12,000. The bonds pay interest semi-annually on 2 January and 1 July and were purchased at a price of $98. The entry below is made to record this investment: The Investment in Bonds account is recorded at $11,760, net of the discount of $240 (12,000 - $11,760). The figure of $11,760 also represents the carrying value of the bonds at their purchase date. As shown above, Interest Receivable is debited for the two months' interest that has accrued since the last payment date on 2 January. The receivable is debited because the investor will receive all six months' interest on 1 July 2020.Accounting for the Acquisition of Bonds

Example

Accounting for the Acquisition of Bonds FAQs

In some cases, an investor will invest in a bond issue but not buy the entire issue. In those instances, accrued interest would be recorded as of the date of purchase for any partial purchases up to one-half the face value of the bonds or notes.

Bonds that are already outstanding will decline in value to the extent that their coupon rate is less than current yields. However, if an investor holds a bond until maturity, the difference between the yield at purchase and current yield will not affect its value.

No, only when the investor receives payment from the issuer does it recognize interest revenue. This date is usually when payment for an entire issue has been collected and not necessarily when money is received. If this was done, there would be significant Cash Flow problems, since revenue would be recognized before the investor has received funds.

No, it is not permissible to enter into a forward contract with another party when buying bonds during an on-behalf-of transaction. In these cases, the firm cannot make cash payments to the issuer.

Some investors do not use separate accounts to record bond premiums or discounts, while others keep all premium/discount bonds in one account. This makes sense since interest income is always based on the carrying value of the securities (not their amortized cost basis, which includes the premium or discount).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.