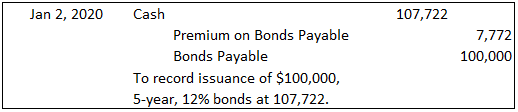

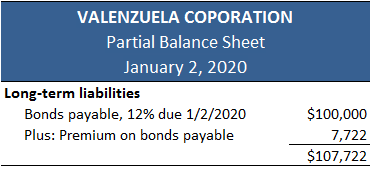

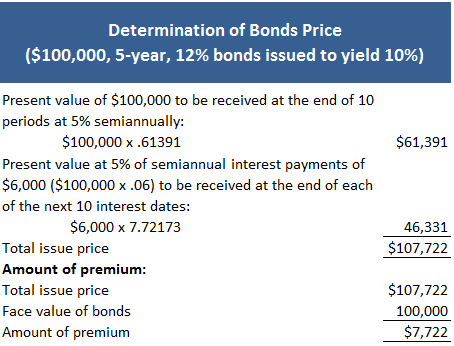

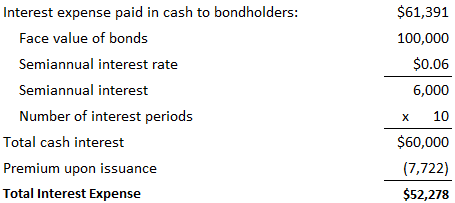

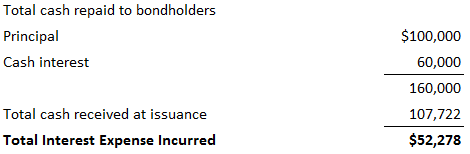

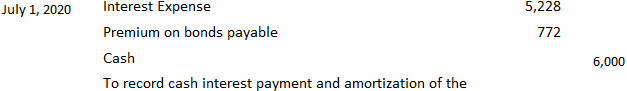

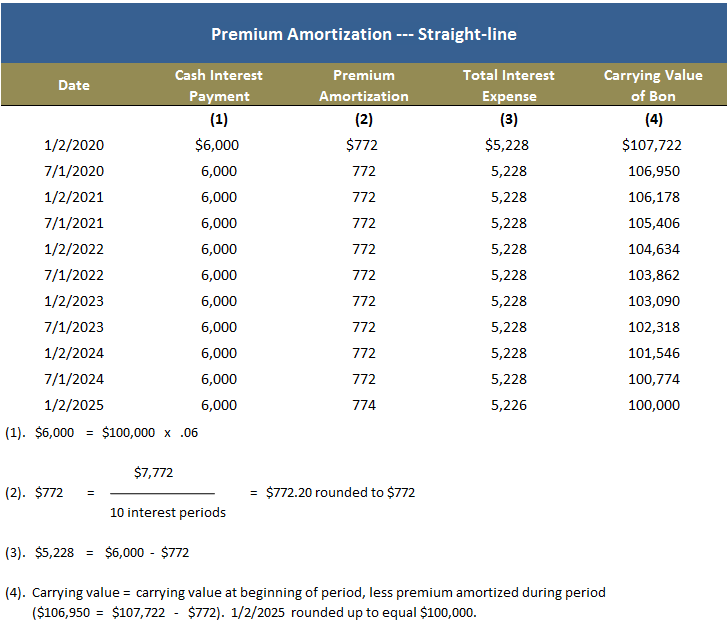

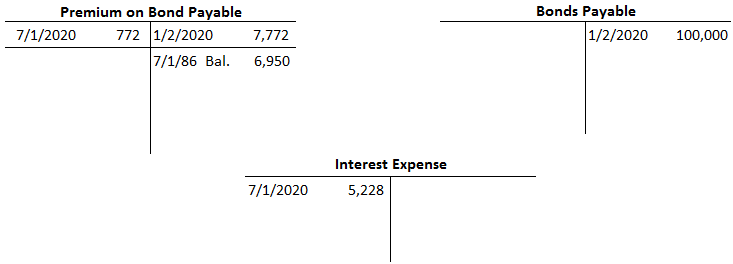

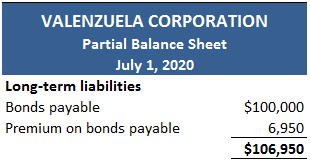

This example shows how to account for bonds issued at a premium. Suppose that on 2 January 2020, Valenzuela Corporation issued $100,000, 5-year, 12% term bonds. Interest is payable semi-annually on 2 January and 1 July. In this case, however, the bonds are issued when the prevailing market interest rate for such investments is 10%. The bonds, therefore, are issued at a premium to yield 10% and are sold at a price of $107,722. The entry to record this bond issue is: This entry is similar to the entry made when recording bonds issued at a discount; the difference is that, in this case, a premium account is involved. Cash is debited for the entire proceeds, and the bonds payable account is credited for the face amount of the bonds. The difference, in this case, is a credit to the premium bonds account of $7,722. The premium on bonds payable account is called an adjunct account because it is added to the bonds payable account to determine the carrying value of the bonds. To illustrate, consider the following balance sheet from Valenzuela Corporation prepared on 2 January 2020 immediately after the bonds were issued. Under the long-term liabilities section, we have: This section explains how to use present value techniques to determine the price of bonds issued at premium. If you haven't yet covered the present value concept, you can skip straight ahead to the next section. The table below shows how to determine the price of Valenzuela Corporation's 5-year, 12% bonds issued to yield. The calculations are similar to those used in the discount example in Accounting for Bonds Issued at a Discount. The key difference is that the cash flows are discounted at the semi-annual yield rate of 5%. In effect, the premium should be thought of as a reduction in interest expense that should be amortized over the life of the bond. The bonds were issued at a premium because the stated interest rate exceeded the prevailing market rate. The bondholders receive $6,000 ($100,000 x .06) every 6 months when comparable investments were yielding only 10% and paying $5,000 ($100,000 x .05) every 6 months. The premium of $7,722 represents the present value of the $1,000 difference that the bondholders will receive in each of the next 10 interest periods. Since bonds are an attractive investment, the price was bidded up to $107,722, and the premium of $7,722 is considered a reduction of interest expense. Although the borrower receives all of the funds at the time of the issue, the matching convention requires that it be recognized over the life of the bond. After issuing the bonds at premium, the total interest expense incurred by Valenzuela Corporation over the 5-year life of the bonds is $52,278, which is calculated as follows: Another way to view this is to consider what the company will ultimately repay the bondholders versus what it received at the time of issue. This calculation is shown below: The premium of $7,722 is amortized using either the straight-line method or the effective interest method. An overview of these methods, using discount and premium examples, is given below. Under the straight-line method, the premium of $7,722 is amortized over 10 interest periods at a rate of $772 ($7,722 / 10) per period. Thus, the total interest expense for each period is $5,228, which consists of the $6,000 cash interest less the premium amortization of $772. Another way to calculate the $5,228 is to divide the total interest cost of $52,278, as just calculated, into the 10 interest periods of the bond's life. The table below presents an amortization schedule for this bond issue using the straight-line method. The journal entry made on 1 July 2020, as well as each interest payment date thereafter, is the following: The effect of this and subsequent entries is to decrease the carrying value of the bonds. This is because the premium account is reduced each period. By the time the bonds reach maturity, their carrying value will have been reduced to their face value of $100,000. The relevant T accounts, along with a partial balance sheet as of 1 July 2020, are presented below.Accounting for Bonds Issued at a Premium

Using Present Value to Determine Bond Prices

The Nature of the Premium Account

Amortizing the Premium

Straight-Line Method

Bonds Issued at a Premium FAQs

The term bonds issued at a premium is a newly issued debt that is sold at a price above par. When a bond is issued at a premium, the company typically chooses to amortize the premium paid by the straight-line method over the term of the bond.

The bond is issued at a premium in order to create an immediate capital gain for the issuer. The company typically chooses to issue the bond when it has exhausted most or all of its current sources of financing, but still needs additional funds in the short run.

Present value is the amount that must be invested now, at a given rate of interest, to produce a given future value.

The premium should be thought of as a reduction in interest expense that should be amortized over the life of the bond. The bonds were issued at a premium because the stated interest rate exceeded the prevailing market rate.

The company chose to create a premium account, rather than write off the difference in Cash Flows over the life of the bond since it would like to maintain its financial leverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.