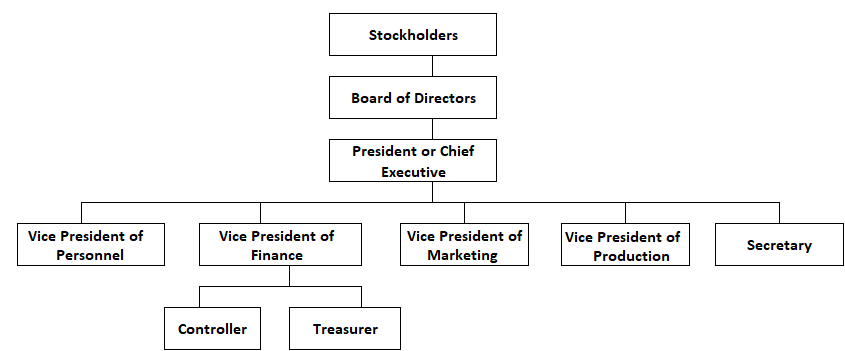

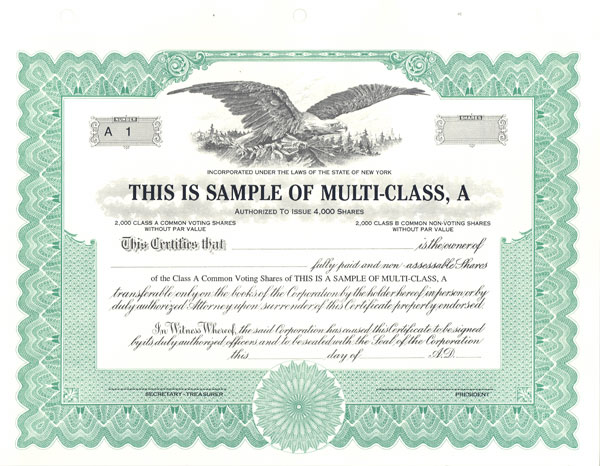

A corporation is a separate body, authorized by law, owned by one or more persons, and having its own rights, privileges, and obligations distinct from those of its owner(s). In effect, under the Constitution of the United States, a corporation is a separate legal entity with a continuous life that has rights and obligations similar to those of an individual. This means that a corporation can sue or be sued and does not go out of existence with the death of an owner. A corporation has certain characteristics that give it a number of advantages over other forms of business organizations. These advantages include limited liability for shareholders, transferability of ownership, ease of capital formation, and professional management. A corporation is responsible for its own obligations. Its creditors can look only to the assets of the corporation to satisfy their claims. The owners' total liability is generally limited to the amount they have invested in the corporation. Therefore, if you invested $5,000 in a corporation, your liability would be limited to that investment regardless of the debts the corporation may eventually incur. However, in many smaller corporations owned by families or a few individuals, the shareholders are often required to guarantee corporate loans from banks and other creditors. Ownership in a corporation is evidenced by a share of stock. These shares are generally transferable without any restrictions. Large stock exchanges such as the New York Stock Exchange and other American stock exchanges, as well as regional exchanges, exist to facilitate the exchange of stock between individuals. Once the stock of a corporation is issued, the corporation is not affected by subsequent stock transactions among individual shareholders, other than the fact that its list of shareholders will change. Limited liability and transferability of ownership make it easier for a corporation to raise capital than is the case for sole proprietorships and partnerships. Many individuals can invest small amounts of capital that, in total, will meet the large capital needs of a major corporation. It is attractive to individuals to invest in corporations because they know the amount of their total risk and are usually able to liquidate their investment when they desire. In a large, publicly held corporation, the owners generally have no direct management control. They give this control to the corporation's president and other senior officers. This separation between ownership and control allows corporations to attract top-level professional management. In most sole proprietorships and partnerships, the owner is also the manager. Consequently, an owner who has excellent engineering skills may not have the necessary management skills to operate a business successfully. Some of the same corporate characteristics that provide advantages to incorporating may also result in disadvantages. These disadvantages are especially relevant to smaller businesses. Double taxation is one of the major disadvantages of a corporation. The earnings of a corporation are subject to taxes of up to 46%. When corporate earnings are distributed to stockholders in the form of cash dividends, these dividends are not deductible by the corporation but are taxable to the recipient. In effect, corporate earnings are taxed twice: once at the corporate level and once at the individual shareholder level. Corporations must be chartered by a state and, therefore, must comply with both state and federal regulations. Several reports and documents must be filed with state and federal agencies. For smaller companies, the cost of complying with these regulations may outweigh the other benefits of the corporate form of business organization. Although government regulation applies to all forms of business enterprise, generally it is not as great a factor for sole proprietorships and partnerships. For smaller companies, the limited liability feature of a corporation may be a disadvantage in raising capital. Due to this feature, creditors have claims against only the assets of a corporation. Thus, if a corporation defaults, the creditors have no recourse against the owners. As a result, loans from bankers and other creditors are often limited to the amount of security offered by the corporation, or in other cases, the shareholders may have to sign an agreement pledging their own assets as security. In other situations, the owners of a small corporation may raise capital with the help of venture capitalists. A venture capitalist is an individual or group of individuals who provide capital to growing and emerging firms. In return for their capital, these individuals usually demand an equity position in the firm. Thus, the original owners may have to give up their control of the corporation as the price of obtaining capital. The procedures to form a corporation and subsequently to conduct business are a function of state law, and as you might expect, all states have somewhat different laws. For example, historically it has been easier to incorporate in some states such as Delaware than in other states such as California. To a large extent, this has been because of the regulatory environment in California. The following discussion is thus based on the general procedures found in most states. The first step in forming a corporation is for at least three individuals—generally the corporate president, vice-president, and secretary-treasurer—to file an application with the appropriate state official, often called the Secretary of State. Among the items included in the application are the articles of incorporation, which list: Once the articles of incorporation have been approved by the appropriate state official, they are often referred to as the corporate charter. During the organization process, a corporation incurs certain costs. These include filing and incorporation fees to the state, attorney's fees, promotion fees, printing and engraving fees, and similar items. These costs all are necessary to get the corporation started. Because they are considered to have future benefits, they are capitalized and are referred to as organization costs. These organization costs are usually listed in the Other Assets section of the balance sheet. Although these costs benefit the corporation over its entire life (which is considered to be indefinite under the going-concern assumption), they are normally written off over a five-year period of time. This is because the income tax laws allow these costs to be written off over a minimum of five years. Although accountants do not necessarily follow tax laws in setting accounting principles, they do so in this case because organization costs are usually not material. Immediately after the corporation's charter is issued, the shareholders must organize the firm in order to conduct future business. A board of directors must be elected, which subsequently appoints the new officers of the corporation. Corporate bylaws are drafted that establish rules of order for the operation of the new corporation. The below example, which presents a typical corporate organization chart, shows the relationship among the stockholders, the board of directors, and senior corporate management. Stockholders are the owners of the corporation. Their ownership is evidenced by stock certificates. A sample stock certificate is shown below. A stock certificate is a legal document that shows the number, type, and par value (if any) of the shares issued by the corporation. Stock certificates are serially numbered and may include other data required by state laws. In large corporations, the shareholders do not participate in the day-to-day operations of the business. However, they elect the board of directors and vote on important issues at the annual stockholders' meeting. The board of directors is charged with establishing broad corporate policies and appointing senior corporate management. However, stockholders do have certain rights, which include those discussed below. The board of directors and the chairperson of the board are elected by the stockholders. The board usually consists of senior management and outside members. Outside members are individuals who are not otherwise employed by the company and thus are independent of senior management. In recent years, it has become commonplace for a majority of the board to be made up of these outside members. The board's primary function is to determine general corporate policies and appoint senior management. The board is also charged with protecting the interests of stockholders and creditors. The corporation's senior management is appointed by the board. Obviously, the primary function of senior management is to conduct the day-to-day operations of the company. The organization chart shown earlier in this article indicates some of the typical officers found in general management. Clearly, the designations and functions of these individuals depend on the specific needs and organization of the company.Advantages of Corporations

Limited Liability of the Shareholders

Transferability of Ownership

Ease of Capital Formation

Professional Management

Disadvantages of Corporations

Double Taxation

Government Regulation

Limited Liability

Formation and Organization of a Corporation

Forming a Corporation

1. The name and place of business of the corporation

2. The main purpose of the business

3. The names of the principal officers of the corporation

4. The names of the original stockholders

5. The type of stock to be issued, the number of authorized shares, their par value (if any), and their dividend and voting rights

Organization Costs

Organizing the Corporation

Typical Corporation Organization Chart

Stockholders

The number of votes is based on the number of shares owned. Stockholders who do not attend the meetings are able to vote through a proxy.

A proxy gives another individual or individuals, usually the current management, the right to vote the shares in the manner they deem best.

Remember that stockholders' interest is a residual one and that they are entitled only to the remaining assets after all the claims of the creditors and other equity holders have been satisfied.

This right ensures that the ownership of the current stockholders is not diluted by the issue of additional shares.

To illustrate, assume that Mark Wilson owns 5% of the outstanding shares of the Ironside Corporation.

If the corporation decides to issue 100,000 new shares, Mark Wilson will have the right to purchase 5,000 (100,000 x 0.05) additional shares.

Of course, Wilson doesn't have to purchase these shares. Stockholders often waive this right in order to facilitate mergers that require the issuance of additional shares.

Such limitations, if and when they exist, are clearly noted on the stock certificate.Board of Directors and Senior Management

Corporation FAQs

The corporation is a separate entity recognized by law as having rights and responsibilities different from those of its shareholders, directors, and employees. A corporation has the power to enter into contracts and own property in its own name. The owners (shareholders) of a corporation have limited liability and the company is taxed separately from its owners.

The advantages of a corporation are as follows:- limited liability of the shareholders- transferability of ownership- ease of capital formation- professional management

The disadvantages of a corporation are as follows:- double taxation- government regulation- limited liability

Corporations are formed by filing a document called the "Articles of Incorporation" with a state agency. The company name should not be too similar to an existing business that may avoid confusion in the marketplace.

The typical corporation organization chart is made up of the following positions:- stockholders- board of directors and senior management- president/CEO

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.