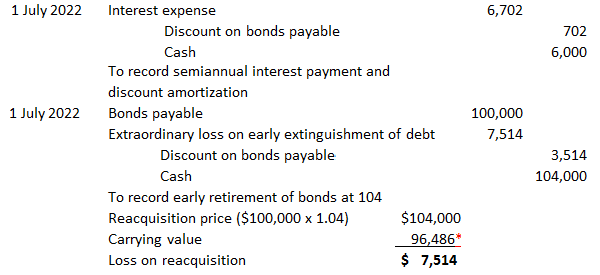

The retirement of debt before maturity is called the early extinguishment of debt. Early extinguishment of debt occurs whenever a firm's long-term debt is retired before maturity. Management can accomplish this extinguishment by repurchasing the bonds in the market. Other bonds are callable and give the issuing corporation the right to buy back the bonds before maturity at a specified price. This price is usually set above the par or face value of the bond because the bondholder will be foregoing future interest income. The amount above par is often referred to as a call premium. The early extinguishment of long-term debt is a financing decision made by management. It depends on such factors as cash flows and past, existing, and anticipated interest rates. For example, it may be advantageous for a firm to repurchase bonds if market interest rates have risen since the original bond issue date. To demonstrate, assume that the Tracy Hospital Company issued $50,000, 20-year bonds at the face at the beginning of 2012. Given that the bonds were issued at face or par, we can assume that at that time the market interest rates were equivalent to the stated rates for this type of bond. By the beginning of 2020, interest rates rose to 10%, and as a result, the market value of the bonds decreased to $36,201. Therefore, the Tracy Hospital Company repurchased all the bonds on the open market for that amount and liquidated a $50,000 debt for only $36,201. This situation occurred often in the late 1970s and early 1980s when market interest rates rose and many firms retired their debt early. When a firm extinguishes its debt prior to maturity, there will be a gain or loss. This gain or loss is the difference between the reacquisition price and the carrying value of the bonds. In the example of the Tracy Hospital bonds, the firm would record a gain of $13,799, or $50,000 less the reacquisition price of $36,201. Before recording the gain or loss, the carrying value must be adjusted for any discount or premium amortization up to the date the bonds are retired. If the carrying value exceeds the reacquisition price, there is a gain; and conversely, if the reacquisition price exceeds the carrying value, there is a loss. Under current accounting practices, this gain or loss is considered extraordinary and must be shown as a separate item on the income statement. To illustrate the accounting process for the early extinguishment of debt, assume that $100,000 12%, 5-year term bonds that were issued at a discount of $7,024 by the Valenzuela Corporation (see the data here) were called on 1 July 2022. The bonds were reacquired at a price of 104. The firm uses the straight-line method of amortization. Shown below are the entries to record the payment of interest and the amortization of the discount, as well as the retirement of the bonds (see Exhibit B in the straight-line method of amortization for the necessary data). * see (see the data in issue of bonds at a discount) The first entry records the interest payment and the discount amortization from 2 January 2022 to 1 July 2022. The second entry records the actual extinguishment of the debt. There is a loss in this case because the reacquisition price exceeds the carrying value of the bonds.Early Extinguishment of Debt: Definition

Early Extinguishment of Debt: Explanation

Example: Accounting for the Early Extinguishment of Debt

Early Extinguishment of Debt FAQs

Early extinguishments of debt are generally recognized on an earnings statement as extraordinary items. When there is a gain, it will be shown under other income; and when there is a loss, it will be shown as either extraordinary loss or another expense (see also extraordinary items).

If the reacquisition price is lower than the carrying value, there will be a loss to recognize as an extraordinary item. The entry to record such a transaction would be to debit other expense and credit unamortized discount for the difference.

The reacquisition price is generally considered to be par or face value if this value is equal to the carrying value of the debt being retired. However, some firms retire their debt even when it has a market value higher than par in order to realize the tax benefits of recognizing a loss.

When a corporation realizes either a gain or loss on an early extinguishment of debt, it will be taxed as if it were equity. Generally, firms that have realized gains do not have to pay any taxes because these are considered extraordinary items. However, firms may take advantage of the loss to pay some of their regular tax obligation if it is more advantageous than the extraordinary loss.

If the firm has realized a gain by paying off debt for less than its carrying value, it would be shown as other income. If there is a loss, then this will be shown as either extraordinary loss or another expense.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.