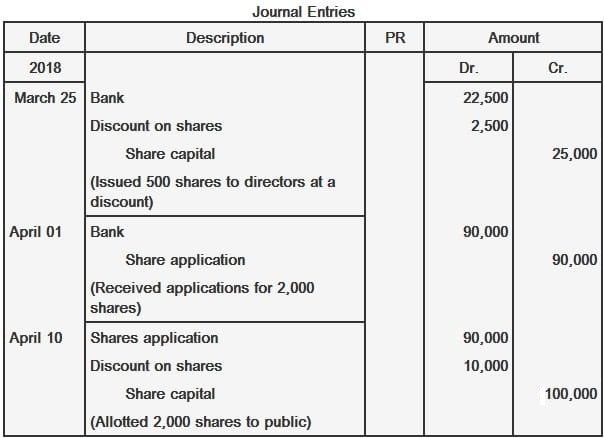

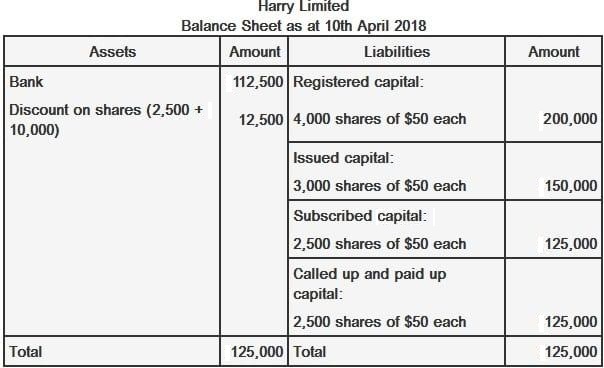

Shares issued at a discount are priced less than the face value. It is lawful for a company to issue shares at a discount if several conditions are met. The first condition is that the issue of the shares at a discount must be authorized by a resolution passed at the company's general meeting, and it must be sanctioned by the authority. Second, the above-mentioned resolution must specify the maximum rate of discount (not exceeding 10% or a higher rate fixed by the authority) at which the shares are to be issued. The third condition is that at the date of issue, not less than one year must have elapsed since the date on which the company was entitled to commence business. The final condition is that the shares to be issued at a discount must be issued within 60 days after the date on which the issue was sanctioned by the authority (or within an extended period allowed by the authority). Discount on the issue of shares should not be mixed with the share capital. Instead, it should be debited to a separate account known as a share discount account. It is shown as a separate item on the asset side of the balance sheet. If shares are issued to the company's directors or underwriters at a discount, the accounting entries should be made as follows: If the shares are issued at a discount to the general public, then the following entries should be made: If shares are issued at a discount to the promoters in consideration of their services, the entries should look like the following: Harry Limited has an authorized capital of $200,000 divided into 4,000 shares at $50 per share. The company has taken the necessary steps to issue 3,000 shares at a discount of 10%. Out of these, 500 shares were issued to directors on 25 March 2018, and 2,500 shares were issued to the general public. Applications were received for 2,000 shares on 1 April 2018. The directors allotted these shares on 10 April 2018. Required: Record the journal entries and prepare the balance sheet.Definition and Explanation

Accounting Entries for Issue of Shares at Discount

Bank ----------------------------------------------- Dr

Discount on shares ---------------------------- Dr

Share capital -----------------------------------------------Cr.

Bank ----------------------------------------------- Dr.

Share application ----------------------------------------------- Cr.

Share application ----------------------------------------------- Dr.

Discount on shares --------------------------------------------- Dr.

Share capital ----------------------------------------------------------- Cr.

Preliminary expenses ----------------------------------------------- Dr.

Discount on shares -------------------------------------------------- Dr.

Share capital ----------------------------------------------------------- Cr.

Example

Issue of Shares at Discount FAQs

When a company issues shares of face value more than the par value of the share at a discount, then it is termed as issue of shares at discount.

It is lawful for a company to issue shares at a discount if several conditions are met. The first condition is that the issue of the shares at a discount must be authorized by a resolution passed at the company’s general meeting, and it must be sanctioned by the authority. Second, the above-mentioned resolution must specify the maximum rate of discount at which the shares are to be issued. The third condition is that at the date of issue, not less than one year must have elapsed since the date on which the company was entitled to commence business. The final condition is that the shares to be issued at a discount must be issued within 60 days after the date on which the issue was sanctioned by the authority.

One of the main advantages of issuing shares at a discount is that it helps in raising capital for business expansion with minimal sacrifice in the company’s equity.

The discount on the issue of shares should not be mixed with the share capital. Instead, it should be debited to a separate account known as a share discount account. It is shown as a separate item on the asset side of the balance sheet.

The deficits in share capital cannot be treated like discounts on shares. If any deficit still exists, then the company has to carry forward the amount and set it off against the capital whenever profits are made.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.