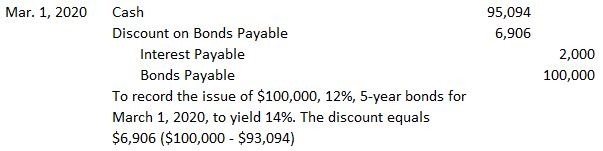

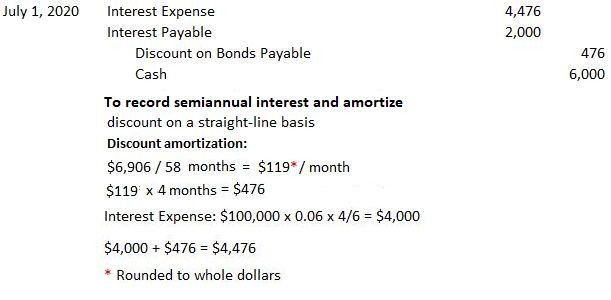

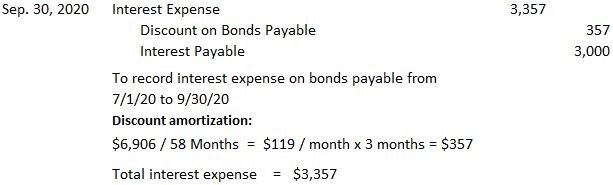

Aside from the basic concepts and procedures related to the issuance and subsequent accounting for bonds payable, there are other issues concerning bonds that all accountants need to be familiar with. Bonds are likely to be sold between interest dates at either a discount or a premium. When this occurs, the discount or premium and the accrued interest must be accounted for separately. To demonstrate, assume that the Valenzuela Corporation issues $100,000, 12%, 5-year term bonds on 1 March 2020. The bonds are dated 1 January 2020. They are issued at a discount to yield 14% and pay interest semiannually on 2 January and 1 July. The price of the bonds net of the discount is $93,094, and the accrued interest is $2,000 ($100,000 x 0.06 x 2/6 = $2,000). The entry to record this issue is: The discount of $6,906 is the difference between the face value of the bond and the issue price net of the interest of $93,094. The bonds payable are recorded at their face value of $100,000. When the first interest payment is made, the below entry is passed (assuming straight-line amortization). Subsequent interest payments and discount amortization should be made in the usual way. It is likely that the issuing firm's year-end will not coincide with an interest payment date. We showed the proper accounting procedures to handle this situation when bonds are issued at par. It is a simple extension to handle premiums or discounts in this situation. To demonstrate, we will again use the data from Valenzuela Corporation presented above. However, we will assume that the company's year-end is 30 September. An adjusting entry must be made on this date to record an interest accrual of three months since the last interest payment date is on 1 July 2020. The entry, assuming straight-line amortization, is: When a corporation issues bonds, various expenses are incurred. Examples are printing, engraving, legal, and accounting costs. Furthermore, many bonds are marketed through investment bankers who receive a commission for underwriting the bond issue. These costs result in the issuers receiving less cash than they otherwise would. Under current accounting principles, these costs are accumulated in a non-current asset account called Bond Issue Costs. They are amortized over the life of the bond on a straight-line basis.Bonds Issued at a Premium or Discount Between Interest Dates

In this example, the cash proceeds that the firm receives of $95,094 consist of the proceeds from the bond of $93,094 plus the accrued interest of $2,000.

It's worth noting that the discount is amortized over only 58 months, or 4 years and 10 months, not 5 years. This is because the bonds had a remaining life of only 58 months when they were issued on 1 March 2020.Year-End Accruals of Interest Expense

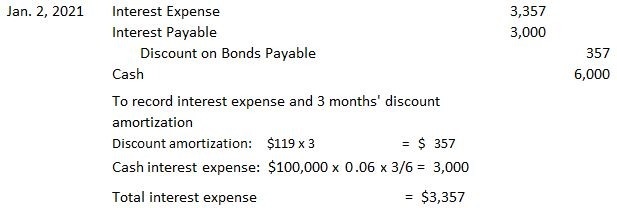

As this entry shows, the cash interest must be accrued and the discount should be amortized for three months. On 2 January 2021, when the interest is paid, the following entry is made:

In this entry, the Interest Payable account is debited and the Interest Expense account is recorded for the three-month period from 1 October 2020 to 2 January 2021. The Discount on Bonds Payable is also amortized for the same three-month period.Bond Issue Costs

Issues Related to Bonds Payable FAQs

There are three types of bonds payable: corporate, municipal, and revenue.

Companies issue bonds by selling them to investors in the bond market.

Revenue bonds are backed by the revenue generated by a particular project, such as a toll bridge or airport. This makes them less risky for investors since they are not dependent on the credit of the municipality or company issuing the bond.

The risks of investing in bonds include the risk of default and the risk of interest rates rising, which would cause the value of the bond to fall.

A bond default occurs when the issuer of a bond fails to make timely payments of interest or principal. This can lead to investors losing some or all of their investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.