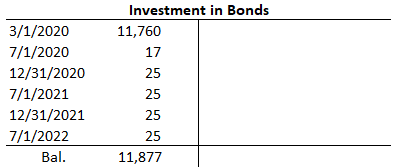

Investors often sell bonds prior to their maturity. To record this sale, debit the cash account for the net proceeds received (sale price less commission and fees). The investment in bonds account is also credited for the net carrying value of the bonds, and a gain or loss is recorded for the difference between the cash proceeds and the carrying value of the bonds. If the bonds are sold between interest dates, the seller also receives the interest that has accrued since the last interest date. To illustrate, assume that the Cinzano Corporation decides to sell its bonds on 1 October 2022 for $11,500 plus accrued interest. As of the last interest date, 1 July 2022, the balance in the investment in bonds account is $11,877, as shown in the T-account below: There is a corresponding credit of $300 to the interest revenue account. This represents the cash portion of the interest revenue, and the $12 from the previous 1 October 2023 entry represents the amortized discount portion. Thus over the 3-month period from 1 July to 1 October, interest revenue of $312 was earned by the Cinzano Corporation. Again, the loss is the difference between the carrying value of the bond and the sale price of $11,500, excluding interest.Explanation

Example

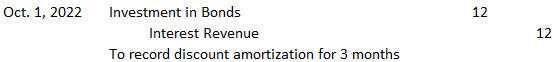

The first step is to record discount amortization for the three months from 1 July to 1 October 2022. This amounts to $12 ($4.14 x 3 = $12.42, rounded to $12) and it is recorded as follows:

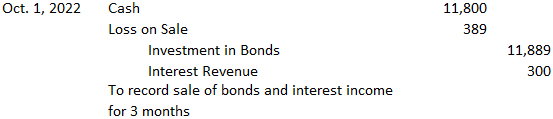

After this entry, the investment in bonds account now has a balance of $11,889 ($11,877 + $12). Because the firm sold the bonds for $11,500, it suffered a $389 loss, which is recorded as follows:

The cash proceeds of $11,800 represent the sale price of $11,500 plus 3 months' accrued interest of $300 ($12,000 x 5% x 3/6) that the buyer is paying the Cinzano Corporation.

Sale of Bonds Prior to Maturity FAQs

Discounts on bonds sold prior to maturity are amortized like bond discounts.

If a bond is sold between interest payment dates, there will be no change in the cash account, but there will be changes in the bond discount or premium, interest revenue and bond carrying amounts.

Gain or loss on sale of bonds is treated like other fixed income security gains or losses - it decreases other comprehensive income. It is not considered part of ordinary income nor is it part of interest income.

If a bond is sold for more than the carrying value, there will be a capital gain and if it's sold for less than its carrying value, there will be a capital loss. Depending on whether the bonds were held for trading or available for sale, there may be a corresponding gain or loss in the income statement.

The bond discount and premium accounts are adjusted on the date of sale. If bonds are sold after interest payment dates during which no interest was accrued, then no adjustment is made to the bond discount account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.