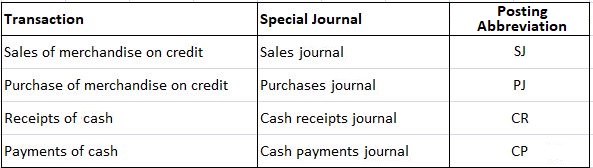

Special journals handle specific transactions such as cash receipts or sales. The use of special journals significantly reduces the time required to record transactions and post them to the ledgers. Most of the firm’s transactions can be classified into four groups. These groups, as well as the special journal used to record the appropriate transactions, are shown below: In small businesses, where transactions occur infrequently, each transaction is recorded in a general journal and then posted to the related accounts in the general ledger. A single journal is satisfactory for small business enterprises where the transaction volume is usually small. In large businesses, where transactions of various categories occur hundreds or thousands of times each month, it is inconvenient to record them in the general journal. Furthermore, it can prove impossible for one bookkeeper/accountant to journalize all the transactions of a large business in one journal. To overcome this problem, the journal is split into sub-journals called special journals, which are designed to record transactions of a specific nature. Special journals are only required for frequent or repetitive transactions. For example, a business concern has many transactions in which cash is received and many in which cash is paid out. One special journal will record cash receipts, and another will record cash payments. If a particular transaction does not fit into one of the above groups, it is recorded in the general journal. This journal is the type we have been using up to this point. However, for many firms, most transactions can be recorded in special journals. For illustrative purposes, the following discussion is based on a manual accounting system. Therefore, one or more individuals must record the transactions by hand in the appropriate journals. These transactions must then be posted by hand to the appropriate general and subsidiary ledgers. The widespread use of microcomputers has enabled even small firms to automate their accounting systems. The special journals that we will illustrate are examples of those found in many manually kept books, but they are not the only types used. Many firms design their specialized journals to meet their particular needs. The number of special journals used by a business concern depends upon the size and needs of a particular enterprise. We shall discuss six commonly used special journals. These are: Entries that are not repetitive are recorded in the general journal. Examples of such entries are adjusting entries, closing entries, transferring entries, and correcting entries. Maintaining special journals for repetitive transactions offers many advantages to business organizations, such as: Adopting special journals means recording business transactions can be entrusted to several employees, similar to the division of labor that increases the efficiency of bookkeepers or accountants. Each special journal is handled by a particular person, who will become familiar with the work assigned to them. Such an approach potentially reduces bookkeeping errors. In special journals, each transaction is recorded in a single line designed to provide all the necessary information. For example, a merchandise purchase is recorded on a single line that registers credit to the supplier’s account, the supplier’s name, the date and the amount, and any other desired information. Special journals eliminate individual posting. Only one posting for the total amount is made to the relevant ledger account at the end of the month or another appropriate period. For example, if a firm has 2,000 purchases on account during the month, the purchases account will be debited once, not 2,000 times. Special journals record transactions chronologically, which reduces the chances of fraudulent alteration in an account. Moreover, a particular person is responsible for its correctness. Special journals afford better control because these journals divide work so that no employee has conflicting responsibilities. In special journals, journalizing can be done by a number of employees simultaneously rather than one employee, thus the business transactions can be written up much more quickly. Special journals allow the recoding of numerous repetitive transactions in one journal in one line. Such an approach may save book-keeping expenses and labor. One journal records similar transactions, which simplifies future references to any of them. Separation of duties is an integral aspect of internal control. If possible, different individuals should record transactions in each of the special journals. Depending on the size and the complexity of the accounting department, a total separation of duties may not be possible. However, not all accounting personnel should have access to the general journal. This journal should record non-routine transactions, and many of these transactions should be approved by the head of the accounting department or by someone with similar authority. On the other hand, routine transactions are recorded in special journals and do not require authorization.Special Journals: Definition

Special Journals: Explanation

Types of Special Journals

Advantages of Special Journals

Increase in Efficiency

Reduction in Errors

Reduction in Detailed Recording

Reduction in Detailed Posting

Reduces the Chances of Fraud

Better Internal Control

Time Savings

Savings in Bookkeeping Expenses

Future References

Internal Control and Special Journals

Special Journals FAQs

A special journal is a set of journals used to record same type of transactions. For example, if the company experiences 10,000 sales transactions, it may create one or more than one sales journal to post such entries accordingly. It reduces clerical work and gives employees less responsibilities.

There are three types of special journals - the sales journal, the purchases journal and the cash receipts journal. The sales journal usually contains credit transactions while it is debited for credit purchases. The purchases journal usually contains debit transactions while it is credited for debit purchases.

Examples of each special journal are as follows.The sales journal contains entries for credit purchases, whereas the credit purchases journal is debited with these transactions. The cash receipts journal contains credit transactions while it is debited with debit transactions. The accounts receivable ledger account is credited with these amounts.

General journals record all transactions, whether routine or non-routine. Each general journal is made up of daily entries which are summarized at the end of the month to post them in special journals. The ledger accounts where these postings are recorded differ for various types of special journals. Transactions recorded in special journals are subject to pre-transaction authorization.

Pre-transaction authorization means that transactions for certain types of accounts are authorized before their recording.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.