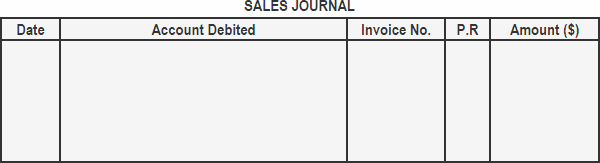

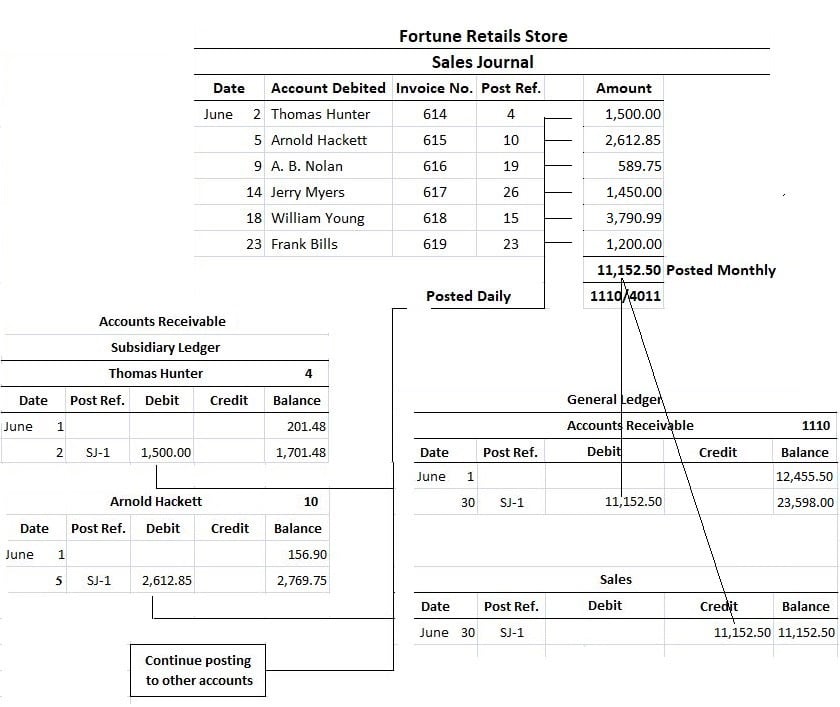

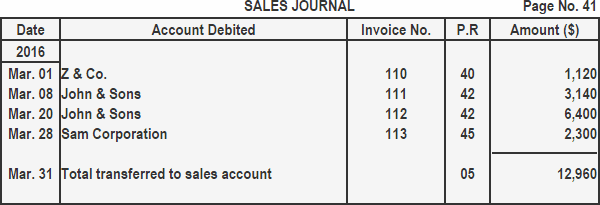

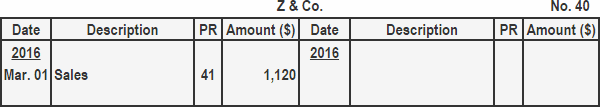

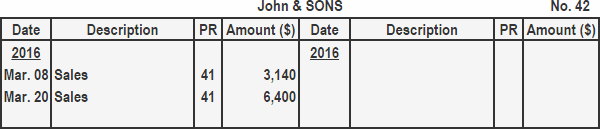

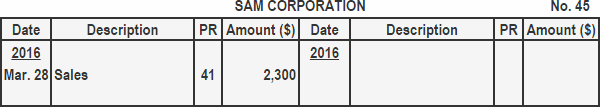

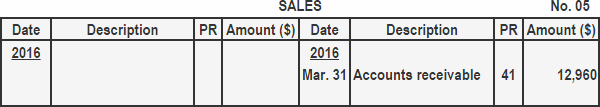

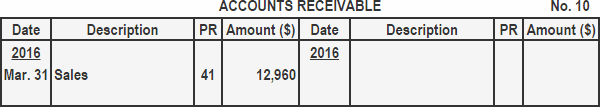

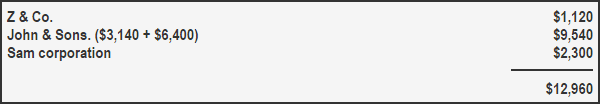

A sales journal is used to record the merchandise sold on account. Any entry relating to the sale of merchandise for cash is recorded in the cash receipts journal. Just like the purchases journal, only credit sales are recorded when preparing a sales journal. Cash sales are recorded in the cash book. It should be noted that sales of goods are recorded in the sales journal. However, sales of assets such as land, building, and furniture are not recorded in the sales journal because they are sold infrequently. On the other hand, assets sold in cash are recorded in the cash book and the sales of assets on credit are recorded in the proper journal. The sales journal has five columns to record the necessary information relating to credit sales. Its format is given below. An overview of the columns in the sales journal is given as follows: Entries from the sales journal are posted to the accounts receivable subsidiary ledger and general ledger. The posting procedure is explained below. At the end of each month (or at fixed intervals), the amount column of the sales journal is added and the total is posted as a debit to accounts receivable and a credit to the sales account in the general ledger. In turn, the individual entries in the sales journal are posted to the respective accounts in the accounts receivable subsidiary ledger. The sales journal, sometimes called the credit sales journal, is used to record all sales made on account. The sales journal for the Fortune Store is shown below. All the sales on account for June are shown in this journal; cash sales are recorded in the cash receipts journal. Sales invoices are the primary inputs into the sales journal. In this example, we will assume that all sales are made on terms of 2/10, n/30 and that the gross method is used to record sales discounts. In this way, each account receivable is shown at its full amount. Since the sales journal is used exclusively to record credit sales, the last column (i.e., the amount column) represents both a debit to accounts receivable and a credit to sales. The example below also shows how postings are made from the sales journal to both the subsidiary and general ledger accounts. Each individual sale is posted to its appropriate subsidiary account. After the posting, the account number or a check is placed in the post reference (Post Ref.) column. The Post Ref. column in the subsidiary ledger and controlling accounts is labeled SJ-1 to represent page 1 of the sales journal. Postings to the subsidiary ledger should be made daily to ensure that management has up-to-date knowledge about how much each customer owes. This knowledge can be used to ensure that individual customers have not exceeded their credit limits. At the end of the month, the amount column in the journal is totaled. This total is then posted as a debit in the accounts receivable control account and as a credit to the general ledger sales account. In the illustration shown in the example below, the total of the amount column is $11,152.50. The numbers under this amount are the account numbers for accounts receivable (1,110) and sales (4,011). Finally, at the end of the month, the accounts receivable trial balance is prepared. Transactions relating to the sale of merchandise on account completed by Crescent Company during the month of March 2016 are shown below: Mar. 01: Sold merchandise on account to Z & Co. $1,120, invoice No. 110 Mar. 08: Sold merchandise on account to John & Sons $3,140, invoice No. 111 Mar. 20: Sold merchandise on account to John & Sons $6,400, invoice No. 112 Mar. 28: Sold merchandise on account to Sam Corporation $2,300, invoice No. 113 Required: 1. Sales journal 2(a). Accounts receivable subsidiary ledger 2(b). General ledger 3. Schedule of accounts receivable Using a sales journal significantly decreases the amount of work needed to record transactions in a manual system. Only one line is needed to record each transaction. It also is not necessary to write an explanation of the transaction because only credit sales are recorded. Finally, the amount of time needed to post entries is reduced. Although each transaction must be posted to the subsidiary accounts receivable ledger, only the totals for the month have to be posted to the general ledger accounts. If a general journal is used to record credit sales, each transaction must be posted to both the subsidiary and the general ledger accounts. Even for a firm with only several hundred sales a month, using a sales journal can save considerable time.Sales Journal: Definition

Sales Journal: Explanation

Format of Sales Journal

Posting Entries From Sales Journal to Ledgers

Example

Example

Solution

Advantages

Sales Journal FAQs

A sales journal is used to record the merchandise sold on account. Any entry relating to the sale of merchandise for cash is recorded in the cash receipts journal.

Just like the purchases journal, only credit sales are recorded when preparing a sales journal. Cash sales are recorded in the cash book. On the other hand, assets sold in cash are recorded in the cash book and the sales of assets on credit are recorded in the proper journal.

The sales journal has five columns to record the necessary information relating to credit sales: - date column- account debited column- invoice number column- posting reference column- amount column

Entries from the sales journal are posted to the Accounts Receivable subsidiary ledger and General Ledger. At the end of each month (or at fixed intervals), the amount column of the sales journal is added and the total is posted as a debit to Accounts Receivable and a credit to the sales account in the General Ledger.In turn, the individual entries in the sales journal are posted to the respective accounts in the Accounts Receivable subsidiary ledger.

Using a sales journal significantly decreases the amount of work needed to record transactions in a manual system. Only one line is needed to record each transaction. It also is not necessary to write an explanation of the transaction because only credit sales are recorded.Finally, the amount of time needed to post entries is reduced. Although each transaction must be posted to the subsidiary Accounts Receivable ledger, only the totals for the month have to be posted to the General Ledger accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.