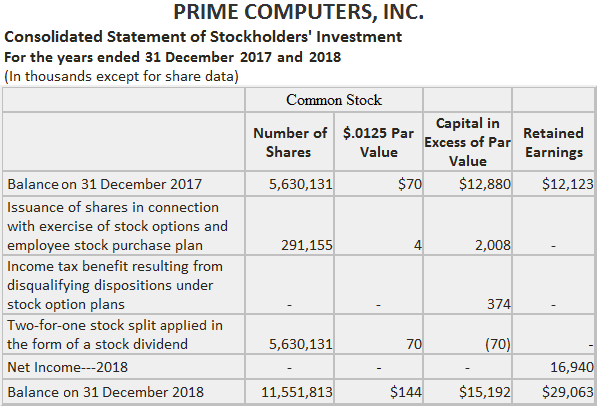

A stock split occurs when a company increases the number of outstanding shares with a proportional decrease in the par or stated value. A stock split happens when a corporation increases the number of its common shares and proportionally decreases its par or stated value. The end result is a doubling, tripling, or quadrupling of the number of outstanding shares and a corresponding decrease in the market price per share of the stock. This price decrease is the main reason that a corporation decides to split its stock. When the market price per share is too high, investors may lose interest because it is most economical to purchase stock in round lots of 100. A stock price that is too high makes round-lot purchases impossible for some potential investors. For example, if a firm's stock is currently selling for $240 and the firm splits its stock 4 for 1, the price per share will fall to around $60. Thus, it takes only $6,000 rather than $24,000 to purchase 100 shares. Depending on the circumstances, the board of directors of a corporation may wish to take steps that will change the number of outstanding shares of stock without affecting the firm's assets or liabilities. Large increases in the number of shares are achieved through stock splits and large stock dividends. The purpose of these activities is generally to stimulate activity in the stock by reducing the trading value of each share, with the ultimate goal of increasing the total value of the shares. Small increases in the number of shares are accomplished through small stock dividends and are distributed in order to provide stockholders with a symbolic return on their investment that does not require a cash distribution. Achieving an increase in the number of shares by a formal stock split necessitates a potentially difficult legal process, primarily because the action requires an amendment of the corporate charter granted by the authorities. In particular, the corporation must obtain a change in the par value (if any) and an increase in the number of authorized shares. Approval must be obtained not only from the state authority but also from the stockholders through a vote. Because there is no change in either the total stockholders' equity or any of the individual components, it is not appropriate for a journal entry to be recorded at the time that a formal split is made. However, when financial statements are issued, the information regarding the stock split and the new par value per share must be disclosed. Disclosures related to prior years should be restated retroactively to include the effects of the split. For example, if a stock split happens, the prior year's earnings per share figure should be altered to account for the larger number of shares. When a significant increase in shares is accomplished by declaring a large stock dividend, this may be described as a split instead of a dividend. As a compromise, the action can be described as a stock split effected in the form of a dividend. While a large stock dividend has the same purpose as a stock split, it is more easily executed than a split when there is a sufficient number of authorized and unissued shares. Instead of going through the legal steps required for a split, the board of directors can simply declare a large stock dividend and distribute the shares to the stockholders. The accounting for a stock dividend is based on the form of the transaction rather than its substance. For this reason, the practice is more complicated compared to the practice used for a split. Since the number of outstanding shares has changed but the par value per share (or its equivalent) remains the same, there must be a credit to the capital stock account equal to the par value of the newly issued shares. While there has been no disagreement concerning the amount to be used or the account to be credited, accounting practice shows two different accounts being debited. Some firms debit the full amount to the Retained Earnings account in order to reflect the fact that the new shares were distributed as a dividend. When state law requires a transfer, under the circumstances of a split effected as a dividend there is no need to capitalize retained earnings, other than to the extent occasioned by legal requirements. As an alternative to debiting Retained Earnings (if allowed by state law), some firms choose to debit Additional Paid-In Capital or Capital in Excess of par. The reasoning behind the approach is that it does not alter the total amount of paid-in-capital or retained earnings and thus more clearly reflects the split nature of the stock dividend. The actual practice seems to be mixed between these two approaches. The choice of one or the other has little impact on the description of the firm's financial position provided in the balance sheet. To demonstrate the process of accounting for stock splits, suppose that the Moreno Corporation's stockholders' equity accounts are as below. The corporation's stock is currently selling at $90 per share. The firm decides to issue a 3-for-1 stock split. As a result, the corporation reduces the par value of its stock from $15 to $5 and increases the number of shares issued and outstanding from 50,000 to 150,000. Although no journal entry is required, some firms will make a memorandum entry noting the stock split. Immediately after the stock split, the Moreno Corporation's stockholders' equity accounts are: Comparing Moreno's stockholders' equity accounts before and after the stock split, no change has occurred in either total stockholders' equity or the individual components. Only the par value and the number of issued and outstanding shares are different. From the investor's viewpoint, each stockholder receives two additional shares for each share owned. In effect, the old shares are canceled and shares with the new par value are issued. Because the price of the firm's stock is likely to fall to $30, the total market value of each stockholder's investment immediately after the split will be about the same as it was before the split. Stock splits and large stock dividends are quite similar. They both serve to reduce the market price per share and increase the number of shares issued and outstanding. In each circumstance, total stockholders' equity remains the same because there has been neither an increase nor a decrease in the entity's net assets. For example, a 2-for-1 stock split is similar to a 100% stock dividend. In both cases, the number of shares issued and outstanding doubles, and the market price per share will fall accordingly. However, if this event is a stock dividend, the stock's par or stated value will not change, but Retained Earnings will decrease and Common Stock will increase. If the event is a stock split, there is no change in either Retained Earnings or Common Stock, only a decrease in par value and an increase in the number of issued and outstanding shares. Stock dividends and stock splits affect the number of common shares outstanding, which in turn influences the earnings per share (EPS) calculation. The current year's EPS is calculated based on the number of common shares after any stock dividends and splits. This means that when comparative statements are issued, or 5- and 10-year summaries are presented, the number of common shares on which EPS is in these statements must be retroactively adjusted for these dividends or splits. This ensures that the EPS figures will be comparable. These points regarding stock splits and EPS are illustrated in the following note taken from an Atlantic Richfield annual report: This example shows the disclosure of a stock split effected in the form of a stock dividend by Prime Computer, Inc. In February 2018, the Board of Directors approved a 2-for-1 split of the company's common stock in the form of a 100% stock dividend. To effect the split, the stockholders approved an increase in the authorized common stock from 10,000,000 to 25,000,000 shares. All references to per-share data and stock option data have been adjusted to reflect this stock split.Stock Split: Definition

Stock Split: Explanation

Stock Splits Effected as Stock Dividends

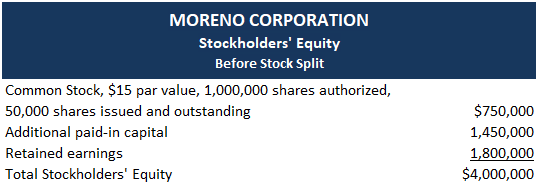

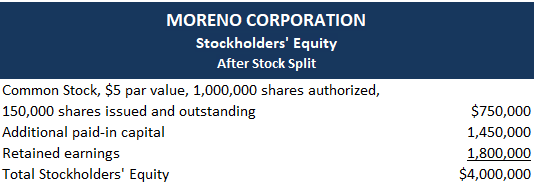

Accounting for Stock Splits

Similarities Between Stock Splits and Large Stock Dividends

Note 2: Common Stock

On 6 May 1980, the shareholders approved a proposal that the common stock of Atlantic Richfield be split, on the basis of two shares for one, by an amendment to the Articles of Incorporation by which:

(a) Atlantic Richfield's authorized common stock would be increased from 150,000,000 shares having a par value of $5.00 per share to 300,000,000 shares having a par value of $2.50 per share, and

(b) each issued share of common stock having a par value of $5.00 per share outstanding would be reclassified as two shares of common stock having a par value of $2.50 per share.

The amendment became effective on 9 May, with distribution of shares on 30 June 1980.

Aggregate and per share data included in Atlantic Richfield's Consolidated Financial Statement and Notes to Consolidated Financial Statements have been restated for the stock split.Example: Disclosure of Stock Split

Stock Split FAQs

A Stock Split occurs when a company increases the number of outstanding shares with a proportional decrease in the par or stated value.

There are several reasons why companies might choose to split their stocks: 1) To make the company's stock more affordable and attractive to small investors. When a company has many low-priced shares outstanding, it can be difficult for retail investors to purchase enough shares to make a meaningful investment. A Stock Split makes each share more affordable and easier to purchase. 2) To increase the liquidity of the company's stock. When a company has a large number of shares outstanding, it can be difficult for investors to find buyers and sellers when they want to trade their shares. A Stock Split increases the liquidity of the company's stock by making it easier for investors to buy and sell shares. 3) To increase the price of the company's stock. Some companies believe that a higher stock price will attract more investors and result in increased shareholder value. A Stock Split can help achieve this goal.

There are several benefits to a Stock Split: 1) Increased liquidity. As mentioned above, a Stock Split makes it easier for investors to buy and sell shares, which can lead to increased liquidity for the company's stock. 2) Increased market capitalization. A Stock Split results in an increase in the number of shares outstanding, which can lead to an increase in the company's market capitalization. 3) Attractiveness to small investors. As mentioned above, a Stock Split makes the company's stock more affordable and attractive to small investors. 4) Possible signaling effect. Some companies believe that a Stock Split is a positive signal to the market, indicating that the company is doing well and is confident about its future prospects. This can lead to an increase in demand for the company's stock.

There are a few potential drawbacks to a Stock Split: 1) Increased costs. A Stock Split will result in an increase in the number of shares outstanding, which can lead to higher printing and administrative costs for the company. 2) Limited impact. A Stock Split may have only a limited impact on the company's share price, especially if the market perceives it as a purely cosmetic change. 3) Poorly timed splits can be negative signals. If a company announces a Stock Split when its share price is already high, it may be interpreted as a sign that the company is overvalued. This could lead to a sell-off of the company's stock.

There are two methods that are commonly used in accounting for Stock Splits. The first is called the par value method, which calls for the adjustment of the Retained Earnings account by decreasing it by an amount equal to the par value of the common shares issued (e.g., if stock was split 1-for-5, you would adjust Retained Earnings by 1/5 of the par value). The second method, and the more recent standard, is referred to as the market value method, which calls for the adjustment of Retained Earnings by an amount equal to what each issued share would have been worth immediately prior to the split (e.g., if stock was split 1-for-5, you would adjust Retained Earnings by multiplying the number of issued shares by the per-share price immediately prior to the split).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.