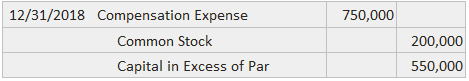

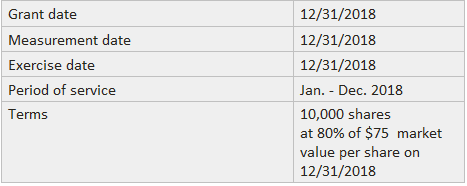

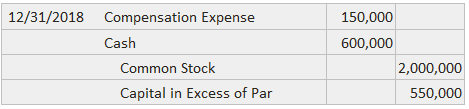

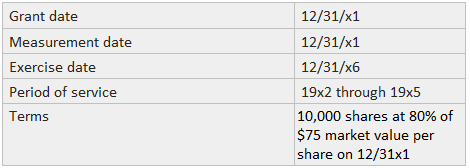

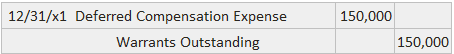

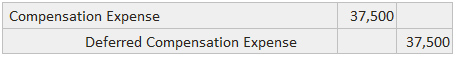

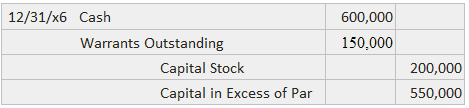

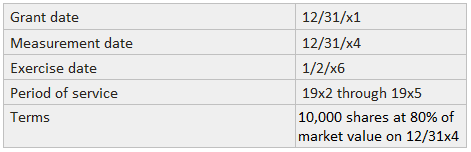

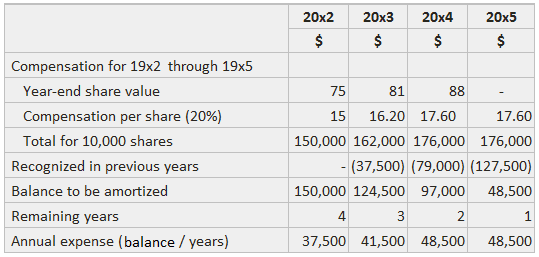

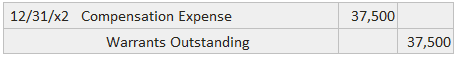

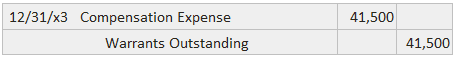

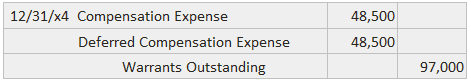

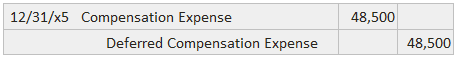

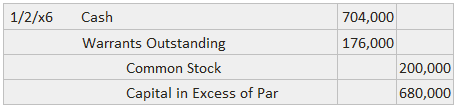

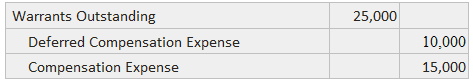

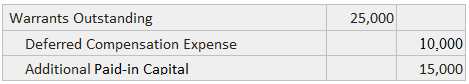

As a method of aligning the goals of employees and stockholders, many corporations provide their key employees with part of their compensation either in the form of equity securities or based on the value of the firm's stock. Compensation can be provided through shares of stock, warrants, and stock appreciation rights. There are four criteria for determining whether the granting of the securities actually constitutes compensation. Specifically, if a particular plan possesses any one of the four characteristics shown in the next section, it is deemed to be compensatory. If a plan is non-compensatory, all issuances of securities are recorded normally and no compensation expense is reported. Accounting for compensatory plans raises the following questions: The preferred measure of compensation is the market value of the options. However, no market typically exists for these warrants because they are not usually transferable and are frequently subject to other restrictions. If a quoted market price for the stock is not available, an estimate should be used. Another substantive measurement issue involves identifying the date on which the amount is to be determined. Since market value can change significantly, the date selected can produce substantial differences in the amount reported. The approach is consistent with historical cost measurement in that the date used is the one on which the firm is committed to making the sacrifice of foregoing alternative uses of the stock. That is to say, the approach holds that expense is incurred (and best measured) when the corporation effectively gives up its right to issue its shares elsewhere The measurement date is the date on which both the number of shares and the price are established. In many cases, the measurement date is the same date on which the employee is granted the right to obtain the shares. In other situations, the measurement date follows the grant date because the plan is variable, such that either the number of shares or the option price or will not be known until future events occur. This postponement of the measurement date, however, does not preclude reporting estimated compensation expense in the periods between the granting and measurement dates. The mechanics of these procedures are demonstrated in the following section. As with other expenses, compensation costs should be assigned to the time period in which the firm receives the benefit from the sacrifice. If compensation for past or current services is paid with equity securities, the expense should be recorded and reported in the current period. If the compensation will not be earned until future periods, the expense should be reported in those periods. If a present sacrifice is made to secure those future services, an account entitled Deferred Compensation Expense should be created and amortized as the services are performed. The entries for recognizing compensation expense are explained below using several example situations. Perhaps the simplest situation occurs when an employee is compensated for past services with an outright grant of shares of stock. Suppose that on 31 December 2018, Sample Company gives a group of executives 10,000 shares of its $20 par value common stock for services rendered in 2018. On the date of grant, which is also the measurement date, the stock has a listed market value of $75 per share. This entry would be recorded: The equity accounts are credited just as if the stock were sold for cash. The situation is slightly more complicated if the executives are allowed to purchase the share at 80% of the market value. The reason for this is that the compensation for past services equals only 20% of the $75 value of the stock ($15 per share). To summarize the facts for this example: The following entry would be recorded in the journal: A more typical arrangement calls for warrants to be exercisable only after future services are rendered. This postponement is intended to encourage employees to take steps to increase the market value of the stock. Suppose that Sample Company grants warrants for 10,000 shares on 31 December 2021. The warrants require the executives to pay 80% of the present market value of $75 per share, but cannot be exercised until 2 January 2026. It is clear from the arrangement that the compensation is for the next four years' services. This summary presents the basic facts: The significant difference, in this case, is that the present sacrifice is made for future benefits. Matching the expense with the periods requires it to be deferred and amortized over the next four years. For this example, the annual expense equals $37,500 ($150,000 / 4 years). On the date of the grant, this journal entry would be recorded: The Deferred Compensation Expense account should be reported as contra to the Warrants Outstanding account in stockholders' equity rather than as an asset. The apparent reason for this treatment is that the firm has not yet paid for the services and has not yet received them. On 31 December of each year from 2018 through 2022, this journal entry would be recorded: Thus, the balance of the deferred account will be reduced to zero on 31 December 2022. If the warrants are exercised on 2 January 2023, this entry would be recorded: It should be noted that the entry is made without considering the stock's market value on the exercise date. The calculations become more complex when the arrangement does not fix either the number of shares or the price per share (or both) until some date following the date of grant. According to best practices for reporting income, the uncertainty should not preclude charging the periods of service with estimated amounts of compensation expense. The total amount should be based on the value of the stock at the end of each year until the date of measurement is reached. Any changes in the estimated total are to be included in the current and future years rather than retroactively. This situation can be demonstrated by modifying Sample Company's arrangement such that the option price on the 10,000 shares is stated as 80% of the market value on 31 December 2021 instead of 31 December 2018. This new date is the measurement date because it is the first day on which both the quantity and price are fixed. The facts are summarized below: The following example shows the calculation of the estimated total and annual compensation expense. The total is estimated at the end of 2019 using the current market value. Only one-fourth is assigned as the expense to that year. The total is again estimated at the end of 2020, but it is reduced by the amount previously recognized in 2019 before being spread over the three years. At the end of 2021, the total can be calculated without estimation. This balance is reduced by the prior years' expenses and is amortized over 2021 and 2022. No new calculations are needed for 2022. It should be observed that this approach could result in a negative expense This would happen, for example, in later years if the market value first increased and then declined, so far such that prior years' charges exceeded the total compensation. In this case, no entry is made in the Deferred Compensation Expense account until the measurement date is reached. As a practical matter, the omission also simplifies the accommodation of changes in the estimate. Thus, Sample Company would record no entry on the date of grant (31 December 2021). At the end of 2022, the following journal entry would be recorded: The next year would require the following entry: The amount includes the adjustment for the inaccuracy in 2022's estimated expense. At the end of 2024, the total expense can be determined and adjusted to compute the amount to be amortized in 2024 and 2025. The year-end entry also recognizes the deferred compensation expense because the measurement date has been reached. The journal entry would be: At this point, the balance in the Warrants Outstanding account is $176,000, which is the sum of the three credit entries ($37,500 + $14,500 + $97,000). The increase in owners' equity is this balance less the deferred compensation expense ($48,500), or $127,500. This amount also equals the three years' expenses ($37,500 + $41,500 + $48,500). At the end of 2025, the following journal entry is recorded as follows to amortize the remainder of the deferral: The equity account reflects a sale for $88 per share. If warrants granted under a compensatory plan are not exercised, the treatment of the lapse depends on the reason for their not being used. If the employee fails to meet the requirements of the agreement (such as not remaining employed), the Warrants Outstanding and Deferred Compensation Expense accounts should be closed. Any difference between the balances of the two accounts should be credited to Compensation Expense. For example, if $25,000 of warrants are forfeited when an employee quits and the balance of Deferred Compensation Expense is $10,000, this entry would be made: This procedure is used because the firm did not receive the service for which it was paying. If, on the other hand, the employee chooses not to exercise the right, the Warrants Outstanding and Deferred Compensation Expense accounts are closed. Any difference is credited to Additional Paid-In Capital. If $25,000 of warrants lapse for this reason and the balance of the Deferred Compensation Expense is $10,000, this entry is made: This procedure is used because the firm did actually receive the services but did not have to pay for them. In addition to the items presented on the income statement and balance sheet, further disclosures are required when the firm uses equity securities to compensate its employees. Disclosure should be made as to the status of the (compensatory) plan at the end of the period, including the number of shares under option, the option price, and the number of shares as to which options were exercisable. As to options exercised during the period, disclosures should be made regarding the number of shares involved and their option price. When different plans operate simultaneously, the disclosures can be fairly complex. For firms registering with the Securities and Exchange Commission (SEC), even more, information must be provided.Characteristics of Equity Compensation

Characteristics

Rationale

1. Securities are not offered to all employees

The plan is provided as special compensation to a special group of employees for their unique services

2. Securities are not offered proportionally to employees' salaries

Same as number 1

3. Warrants cannot be exercised within a reasonable period of time

The plan is designed to reward employees for the length of service

4. The discount on the price of the securities is more than a reasonable amount

The plan causes the firm to incur a sacrifice

Measurement of Equity Compensation

Assignment of Expense to Time Periods

Measurement on Grant Date

Deferred Realization

Measurement Date After Grant Date

Recording Lapsed Warrants

Equity Compensation FAQs

Equity compensation refers to the use of company stock or shares ownership as an employee benefit.

There are many reasons why using equity compensation is beneficial for companies and their employees including: - Gain in job satisfaction due to greater level of investment in employment success - Gain in productivity as a result of alignment between personal interests and those of the employer - Gain in loyalty as employees have more reason to increase company profitability

The primary mechanics of equity compensation are: - securities are not offered to all employees - securities are not offered proportionally to employees’ salaries - warrants cannot be exercised within a reasonable period of time - the discount on the price of the securities is more than a reasonable amount

An employer might display one or more of these signs: - plans for employee ownership, not just senior management - discussions about the need for a larger cash component in compensation - acquisition of other companies which have similar types of equity compensation plans

An example of equity compensation is the use of “restricted stock” which is not available to all employees and cannot be sold for a certain period of time. The restricted time frame can vary based on whether or not it has vested or unvested. Vesting occurs when an employee completes the required service term with the company and becomes eligible to retain the restricted stock.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.