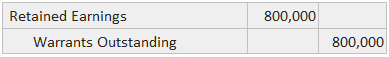

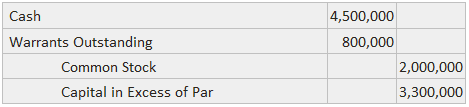

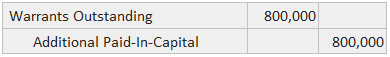

Corporations occasionally issue a special kind of equity security known as a warrant. The holder of a warrant has the right to purchase a specified number of shares of stock at a stated price before an expiration date. Warrants, which are also known as stock rights and stock options, are often marketable and traded on exchanges. The value of warrants derives from three sources. For these three reasons, the market value of traded options typically exceeds the discount below the stock's market value represented by the option price. Indeed, when the option price is equal to or greater than the stock price, there is no discount. However, generally, the warrant will still have some market value due to the potential to earn a higher rate of return and limit the holder's loss. Three common reasons for issuing warrants are: Once issued, warrants remain outstanding until they are exercised or lapse. If they are outstanding, disclosures should be provided about their terms and other features. A journal entry is needed for warrants because the issuance of the warrant represents a sacrifice for the firm. Theoretically, the amount used in the entry should be the aggregate market value of the rights. If a reliable measure is not available, a rough estimate of market value can be made by deducting the option price from the stock's fair value. If there is no market value for the option and the option price exceeds the stock's market value, the accountant is led to conclude that no sacrifice has occurred. As such, no entry would be recorded in this case. The account credited in the entry is a special stockholders' equity account known as warrants outstanding. This item is a component of stockholders' equity (even though it represents claims held by non-owners) because the claims arise through ownership rights. The account to debit depends on the situation. If cash is received, then the cash account should be debited. If services are received from employees, then the compensation expense account should be debited. If services are to be received in the future, then the deferred compensation expense account should be debited. If the warrants are distributed to stockholders like a dividend, then retained earnings should be debited. On the day that the warrants are exercised (i.e., the exercise date), the collection of cash and the closing of the warrants outstanding account should be recorded. The total credit equals the sum of the cash received and the carrying value of the warrants. If the warrants lapse, their account is closed to additional paid-in-capital. For example, suppose that the Sample Company issues warrant to its stockholders for 100,000 shares of its $20 par value common stock. The market value of the stock is $50 and the option price allows the holder to buy a share for only $45. The warrants are soon sold separately for $8 each. The journal entry for the above example would be made to record the issuance of the warrants as follows: When the warrants are exercised, the following entry would be made (assuming that all warrants are exercised at the same time): The credits to the equity accounts are the same as those that would be made if the shares had been sold for $53 each ($45 cash + $8 per warrant). If all the warrants lapse, the following entry would be made: In the event that a stock split or dividend occurs while warrants are outstanding, the number of warrants and the option price per share are adjusted in proportion to the size of the split or dividend.What Are Warrants?

Sources of Warrants

Thus, for example, if a warrant allows the holder to buy a share of stock worth $100 for only $70, then the warrant itself should be worth at least $30.

In the above example, both the holder of a share of stock and the holder of a warrant enjoy a gain of $1 for each dollar increase in the value of the share. However, the shareholder has $100 invested, while the warrant holder invests only $30.

That is to say, the warrant holder can lose no more than the value of the option, whereas the stockholder may lose the full value of the stock.Reasons for Issuing Warrants

Journal Entries for Warrants

Warrants FAQs

A warrant is a security that provides the holder with the option to purchase stock.

The value of warrants derives from three sources. First, the option price for the purchase of shares stated in the warrant may be less than the market value of the shares. The second reason that the warrant has value is the potentially higher rate of return that can be earned from an increase in stock value. The third reason that the warrant has value lies in the fact that it acts to limit the holder’s loss if the stock declines in value. That is to say, the warrant holder can lose no more than the value of the option, whereas the stockholder may lose the full value of the stock.

Three common reasons for issuing warrants are: 1. To compensate employees: warrants are given to employees in place of cash. 2. To provide a return to the place of distributing cash or shares: to achieve this, the corporation may issue warrants to its stockholders as a dividend. 3. To improve the marketability of other securities.

Usually, accounting for the issuance of warrants is straightforward. This process involves recognizing the compensation received in exchange for creating a balance in the warrant’s account.

The exercise of a warrant results in one entry, which credits cash and debits the warrant’s account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.