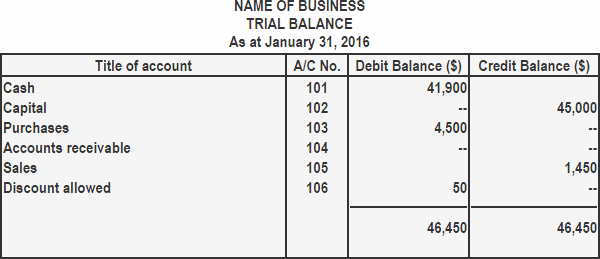

A trial balance is a statement prepared to ensure that the transactions for a period have been duly recorded in the journal and properly posted to the relevant ledger accounts. A trial balance has debit and credit columns to record the balances extracted from ledger accounts with a view to testing the arithmetical accuracy of the books of accounts. In simple terms, a trial balance is a list of all balances of ledger accounts. If the entries are made on the correct side of the relevant ledger accounts and there is no arithmetical error in the balancing process, the total of all debit balances should equal the total of all credit balances, as listed in the trial balance. In other words, the total of the debit column and the total of the credit column of the trial balance should agree. This agreement proves that: If the debit and credit columns of the trial balance do not agree, this indicates the presence of one or more errors in the journal or ledger. These errors should be identified and rectified before moving on. The agreement of the debit and credit columns of a trial balance does not stand as conclusive proof of correctness. A trial balance may agree and yet there may be one or more errors in the books of accounts. For example, if a journal entry has been omitted, the debit and credit columns of the trial balance will still agree. The trial balance is prepared using a loose sheet of paper. It can be prepared at any time—whenever it is desired—to check the arithmetical accuracy of the books of accounts. However, trial balances are mostly prepared at the end of an accounting period. Under this method, the following procedure is used to draw up a trial balance: 1. The name of each account is recorded, along with a serial number A trial balance consists of four columns. The format of a trial balance is shown below. The procedure used to list account balances in the trial balance involves: Using the ledger accounts mentioned in this description of the standard form of ledger accounts, an example of a trial balance is shown below.Preparation of Trial Balance Using Balance Method

2. The total balances of all accounts are calculated

3. Debit balances are written in the debit column, and credit balances are written in the credit column of the trial balance

4. The total of the debit and credit columns of the trial balance is calculated (the total of both columns should be equal)

Format and Method of Preparation

1. In the first column, record the account titles in numerical order (the order in which accounts appear in the ledger)

2. Record the account numbers in the second column

3. Record the balances of each account (debit balances in the debit column and credit balances in the credit column)

4. Add the debit and credit columns

5. Compare the totals of the two columns

Example

Preparation of Trial Balance Using Balance Method FAQs

A Trial Balance can be prepared at any time. It can be prepared when the accounts are closed every month, quarter or year. It may also be necessary to prepare a Trial Balance when errors and omissions in the books of accounts are detected.

The Trial Balance is prepared in the form of a T-form.

The "T" form is the simplest form of Trial Balance sheet.

Yes, it can be prepared at any time. But it is primarily prepared at the end of an Accounting Cycle.

In the debit column.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.