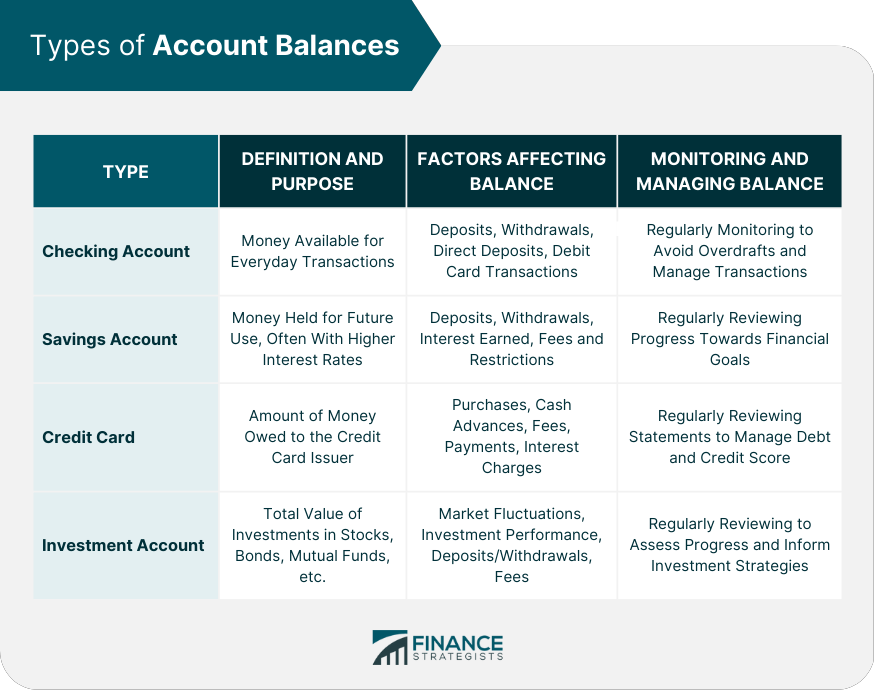

An account balance is the amount of money available in a financial account, such as checking, savings, credit card, or investment accounts. It represents the net difference between credits and debits, reflecting the total financial transactions processed through the account. Understanding and monitoring account balances are essential for maintaining financial health, avoiding fees, and detecting unauthorized transactions. Regularly reviewing account balances also helps assess progress towards financial goals and enables better decision-making regarding spending, saving, and investing. Account balances vary based on the type of account and the financial institution. Common types include checking, savings, credit card, and investment account balances. A checking account balance is the amount of money available in a checking account. Checking accounts are primarily used for everyday transactions, such as bill payments, purchases, and ATM withdrawals. The checking account balance fluctuates based on deposits, withdrawals, and other transactions, including direct deposits, check payments, debit card transactions, and electronic fund transfers. Regularly monitoring checking account balances is essential to avoid overdrafts and ensure sufficient funds for necessary transactions. Online and mobile banking tools can assist in tracking account activity and managing checking account balances. A savings account balance is the amount of money available in a savings account. Savings accounts are designed to hold funds for future use and typically offer higher interest rates compared to checking accounts. The savings account balance is affected by deposits, withdrawals, and interest earned on the account balance. The interest rate, account fees, and any account restrictions may also impact the account balance. Regularly reviewing savings account balances helps track progress towards financial goals and ensures that funds are available for emergencies or planned expenses. Utilizing online and mobile banking tools can assist in managing savings account balances. A credit card account balance is the amount of money owed to the credit card issuer. This balance represents the total of all purchases, fees, interest charges, and other transactions made using the credit card. Credit card account balances are affected by purchases, cash advances, balance transfers, fees, and interest charges. Payments made towards the account balance and any credits or adjustments will also impact the balance. Monitoring credit card account balances is crucial for managing debt, avoiding late fees, and maintaining a healthy credit score. Regularly reviewing account statements and utilizing online and mobile banking tools can assist in managing credit card account balances. An investment account balance is the total value of investments held in an investment account, such as stocks, bonds, mutual funds, and other securities. Investment accounts are used to grow wealth over time through capital appreciation and income generation. Investment account balances are affected by market fluctuations, investment performance, deposits, withdrawals, fees, and other account activities. Regularly reviewing investment account balances helps assess progress towards financial goals and enables informed decision-making regarding investment strategies. Utilizing online investment platforms and working with financial advisors can assist in managing investment account balances. Regularly monitoring account balances helps avoid overdraft fees, which can be costly and negatively impact your credit score. By ensuring sufficient funds are available in your account for transactions, you can avoid the fees and financial stress associated with overdrafts. Monitoring account balances can help identify unauthorized transactions, such as fraud or identity theft. By reviewing your account activity regularly, you can quickly detect and report suspicious transactions to your financial institution, minimizing potential losses. Regularly reviewing your account balances helps maintain accurate financial records, which is essential for budgeting, tax preparation, and financial planning. Accurate records can also assist in resolving any discrepancies or disputes with financial institutions. Monitoring account balances allows you to assess your overall financial health and progress towards financial goals, such as saving for a down payment on a home or building an emergency fund. Regular reviews can also inform decisions regarding spending, saving, and investing. Regularly reviewing account statements is a fundamental strategy for managing account balances. Statements provide detailed information on account activity, allowing you to identify potential issues and track your financial progress. Mobile banking apps and alerts can help you manage account balances more efficiently. These tools provide real-time access to account information, enabling you to monitor account activity and receive notifications of low balances or suspicious transactions. Creating and maintaining a budget is a key strategy for managing account balances. A budget helps you allocate funds to various expenses, ensuring that you maintain a healthy balance in your accounts and avoid overspending. Consolidating accounts, such as combining checking and savings accounts at a single financial institution, can help simplify account management and make it easier to monitor account balances. Setting up automatic transfers and payments can help manage account balances by ensuring that funds are regularly moved between accounts or applied to bills, reducing the risk of overdrafts or missed payments. Overdrafts and insufficient funds are common issues related to account balances. These issues can result in fees, declined transactions, and negative impacts on your credit score. Regularly monitoring account balances and maintaining a budget can help avoid these issues. Credit card debt and high balances can negatively affect your credit score and result in costly interest charges. Monitoring credit card account balances and practicing responsible spending habits can help manage debt and maintain healthy credit. Investment account balances may fluctuate due to market conditions and investment performance. Regularly reviewing investment accounts and working with a financial advisor can help you navigate market fluctuations and maintain a long-term investment strategy. Dormant or inactive accounts can result in account fees, lost interest, or even account closure. Monitoring account balances and maintaining activity in your accounts can help avoid these issues. Focusing on debt repayment and savings can help maintain healthy account balances and improve your overall financial health. Prioritize paying off high-interest debt and building an emergency fund to ensure financial stability. Reviewing and adjusting financial goals regularly can help you stay on track with your financial plans and maintain healthy account balances. As your financial situation changes, adjust your goals and budget accordingly. Practicing responsible spending habits, such as avoiding impulse purchases and living within your means, can help maintain healthy account balances and reduce financial stress. Seeking professional financial advice when needed can help you manage account balances more effectively and make informed decisions about your finances. Financial advisors and planners can provide personalized guidance on budgeting, investing, and other financial matters. Understanding account balances is crucial for maintaining financial health, making informed decisions about spending, saving, and investing, and tracking progress towards financial goals. Regularly monitoring account balances can also help avoid fees, detect unauthorized transactions, and maintain accurate financial records. Effective strategies for managing account balances include regularly reviewing account statements, utilizing mobile banking apps and alerts, creating and maintaining a budget, consolidating accounts when necessary, and establishing automatic transfers and payments. To achieve long-term financial success, it is essential to remain committed to ongoing financial management and monitoring. By regularly reviewing your account balances, adjusting your financial goals as needed, and practicing responsible spending habits, you can maintain healthy account balances and work towards a more secure financial future.What Is an Account Balance?

Types of Account Balances

Checking Account Balance

Definition and Purpose

Factors Affecting Checking Account Balance

Monitoring and Managing Checking Account Balance

Savings Account Balance

Definition and Purpose

Factors Affecting Savings Account Balance

Monitoring and Managing Savings Account Balance

Credit Card Account Balance

Definition and Purpose

Factors Affecting Credit Card Account Balance

Monitoring and Managing Credit Card Account Balance

Investment Account Balance

Definition and Purpose

Factors Affecting Investment Account Balance

Monitoring and Managing Investment Account Balance

Importance of Monitoring Account Balances

Avoiding Overdraft Fees

Detecting Unauthorized Transactions

Maintaining Accurate Financial Records

Assessing Financial Health and Progress Towards Goals

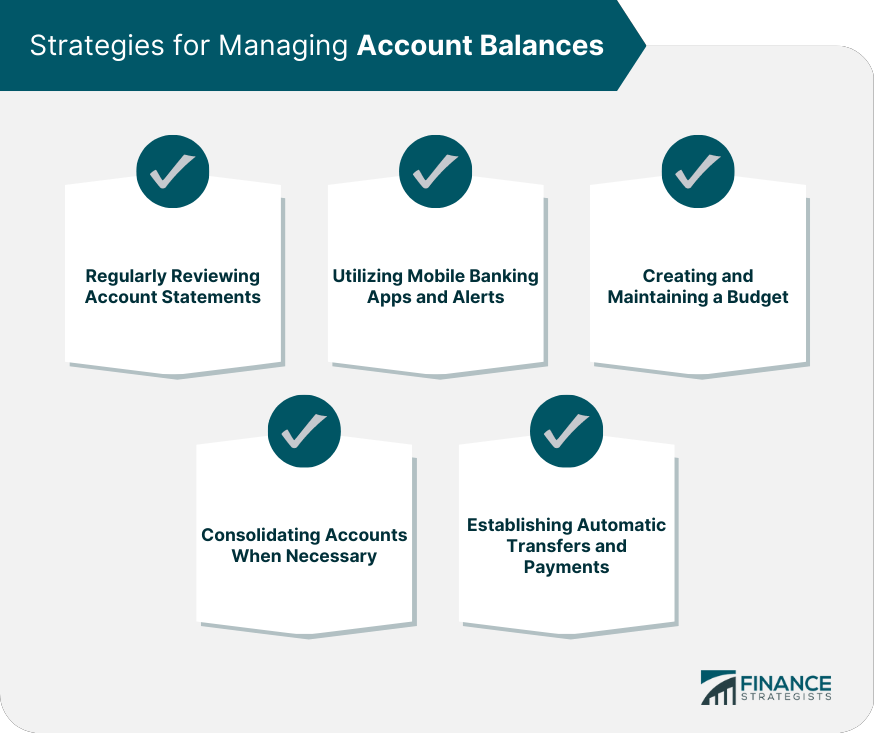

Strategies for Managing Account Balances

Regularly Reviewing Account Statements

Utilizing Mobile Banking Apps and Alerts

Creating and Maintaining a Budget

Consolidating Accounts When Necessary

Establishing Automatic Transfers and Payments

Common Issues Related to Account Balances

Overdrafts and Insufficient Funds

Credit Card Debt and High Balances

Fluctuations in Investment Account Balances

Dormant or Inactive Accounts

Tips for Maintaining Healthy Account Balances

Prioritizing Debt Repayment and Savings

Regularly Reviewing and Adjusting Financial Goals

Practicing Responsible Spending Habits

Seeking Professional Financial Advice When Needed

Conclusion

Account Balance FAQs

An account balance is the amount of money in a financial account at a given point in time, taking into account all deposits and withdrawals.

An account balance is calculated by subtracting the total amount of withdrawals and fees from the total amount of deposits and interest earned in the account.

Any type of financial account that holds money, such as checking accounts, savings accounts, investment accounts, and credit card accounts, will have a balance.

Monitoring account balances is important to ensure that there is enough money to cover expenses, avoid overdraft fees, prevent fraud or unauthorized transactions, and keep track of progress towards financial goals.

Account balances can be managed effectively by regularly reviewing statements, tracking spending and income, setting up alerts for low balances or unusual activity, automating savings and bill payments, and seeking guidance from financial professionals if needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.