Opening a bank account in the US is a straightforward process, available to residents, non-residents, and businesses. It typically starts with choosing a type of account - commonly checking, savings, or a combination of both. Once the account type is decided, the next step is selecting a banking institution based on factors like fees, interest rates, and additional services. After that, the account opening procedure involves providing identification, which includes a Social Security Number (SSN) for residents or Individual Taxpayer Identification Number (ITIN) for non-residents. Non-residents also need a valid foreign passport and proof of address. In most cases, a minimum deposit may be required. With the rise of digital banking, this process can often be completed online. However, some banks may require you to visit a branch in person. It's important to understand the account's terms and conditions to avoid unnecessary fees and penalties. Whether you're a foreign student studying in the U.S., an international worker, or a new immigrant, you may find yourself in need of a bank account but without an SSN. It might seem like an impossible situation, but rest assured, there are alternatives. These options can offer a lifeline to those who require financial services but are currently outside the typical SSN framework. An ITIN is a tax processing number issued by the Internal Revenue Service (IRS). It's intended for individuals who are obligated to pay U.S. taxes but do not qualify for an SSN, like non-resident aliens or resident aliens who need to file a tax return. An ITIN can also be used as a form of identification when opening a bank account. While it isn’t a substitute for an SSN in all situations, it certainly bridges the gap in many banking scenarios. Furthermore, obtaining an ITIN can also help demonstrate a financial footprint in the U.S. To obtain an ITIN, you'll need to complete Form W-7, IRS Application for Individual Taxpayer Identification Number, and provide proof of your identity and foreign status. Once the application is approved, you'll receive your ITIN by mail. This process is straightforward, but it's vital to ensure all documentation is accurate to prevent delays. A foreign passport can also serve as a form of identification when you don't have an SSN. Banks often accept passports as they are globally recognized identification documents. This universal acceptance highlights the importance and credibility of passports. However, using a passport might require additional supporting documents, like a visa, to verify your status in the country. It's essential to keep your passport updated and in good condition to avoid potential issues. If you're an immigrant living in the U.S., you might possess an Alien Registration Card, also known as a Green Card. This card has a unique number that can be used as a form of identification when opening a bank account. The Alien Identification Card not only signifies your residency status but also affirms your rights to certain benefits, including the ability to work and, in this case, access banking services. Ensure you have this card on hand when you head to the bank and make certain it hasn’t expired. Several major banks in the U.S. are open to providing services to non-SSN holders. Banks like Chase, Bank of America, and Wells Fargo allow customers to open an account with an ITIN or foreign passport. It's advisable to call ahead and speak with a representative about the requirements and process. These large institutions often have resources and personnel specifically trained to assist customers in unique situations, ensuring a smoother experience. Community banks often pride themselves on serving their local population, which might include a significant number of non-SSN holders. They may be more flexible in their requirements and more willing to work with you to get your account open. Since they operate on a smaller scale, community banks can often provide more personalized service, understanding the specific needs and challenges faced by local residents. Credit unions are another great option. Like community banks, they are often more accommodating to the unique needs of their members. However, joining a credit union usually requires a membership, which may have its own set of requirements. Given that credit unions are member-owned, they often prioritize the welfare of their members, making them a potentially beneficial choice for those without an SSN. In the digital age, online banks offer convenience and simplicity. Some online banks, like Chime, allow customers to open an account without an SSN. However, you will need to verify your identity through other means. The absence of physical branches means you'll handle most tasks digitally, so it's crucial to be comfortable with online platforms and ensure you have secure internet access. You may encounter some pushback or confusion when trying to open an account without an SSN, especially if the bank staff aren't familiar with the alternative methods. If this happens, patience and clear communication will be your allies. Ask to speak with a manager or someone who specializes in new accounts. Remember, you are not the only one in this situation, and others have successfully navigated this path before. Banks in the U.S. must comply with the USA PATRIOT Act, which includes verifying the identity of anyone opening an account. While this law has made it more challenging for those without an SSN, it's not impossible. The Act allows for other forms of identification, including the alternatives mentioned earlier. The legislation is primarily geared towards preventing illegal activities, so as long as you provide the necessary legitimate documentation, you should be in the clear. The KYC process is part of the bank's effort to verify your identity and assess potential risks. This process is more complex for those without an SSN, so be prepared to provide additional information and documentation. The main goal of KYC is to ensure that the financial institution understands the nature and purpose of the customer relationship, which, in turn, helps minimize risks. Basic account management includes regularly checking your balance, reviewing your transactions for any discrepancies, and ensuring that any fees are understood and accounted for. Staying on top of these basics not only helps in avoiding potential fees but also in building a healthy financial record. Should any banking issues arise, like unauthorized transactions or lost/stolen cards, promptly contact your bank. Even without an SSN, your bank should be able to assist you with these common issues. Taking immediate action can prevent further complications and potential financial losses. Securing additional services like credit cards or loans might be more challenging without an SSN. However, some banks offer credit cards and loans to those with an ITIN. Start by asking your bank about these services and if they can be made available to you. Building a good banking history can pave the way for more financial opportunities in the future. Opening a bank account in the U.S. without an SSN may present some hurdles, but it's not an impossible task. Multiple alternatives, including ITINs, foreign passports, and Alien Identification Card numbers, can be used as forms of identification, providing a lifeline to those needing banking services but lacking an SSN. When choosing a bank, options vary from major national banks to local community banks, credit unions, and online banks, each with their unique benefits and potential drawbacks. Navigating the challenges can be eased by understanding the requirements of the USA PATRIOT Act and KYC process. Once your account is open, mastering basic account management, dealing promptly with banking issues, and exploring additional banking services can ensure a smoother financial journey. The experience may seem daunting initially, but the benefits and potential financial growth make the effort worthwhile.Overview of Opening a Bank Account

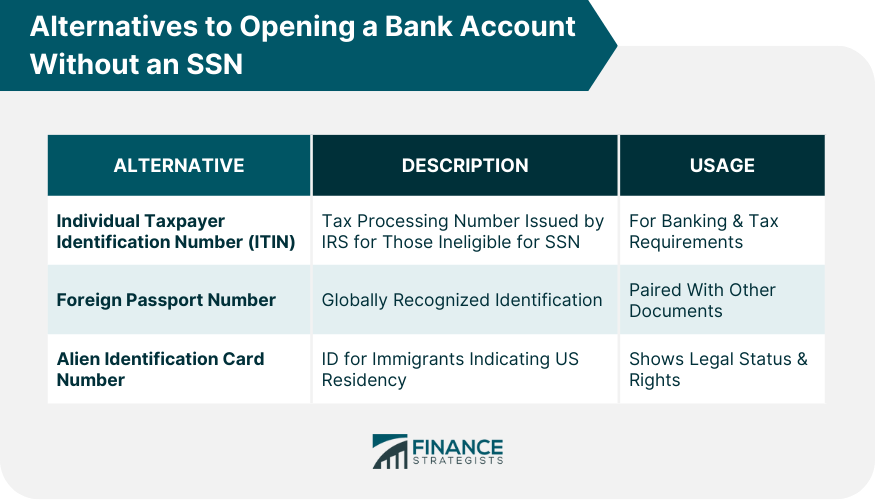

Alternatives to Opening a Bank Account Without an SSN

Individual Taxpayer Identification Number (ITIN)

Foreign Passport Number

Alien Identification Card Number

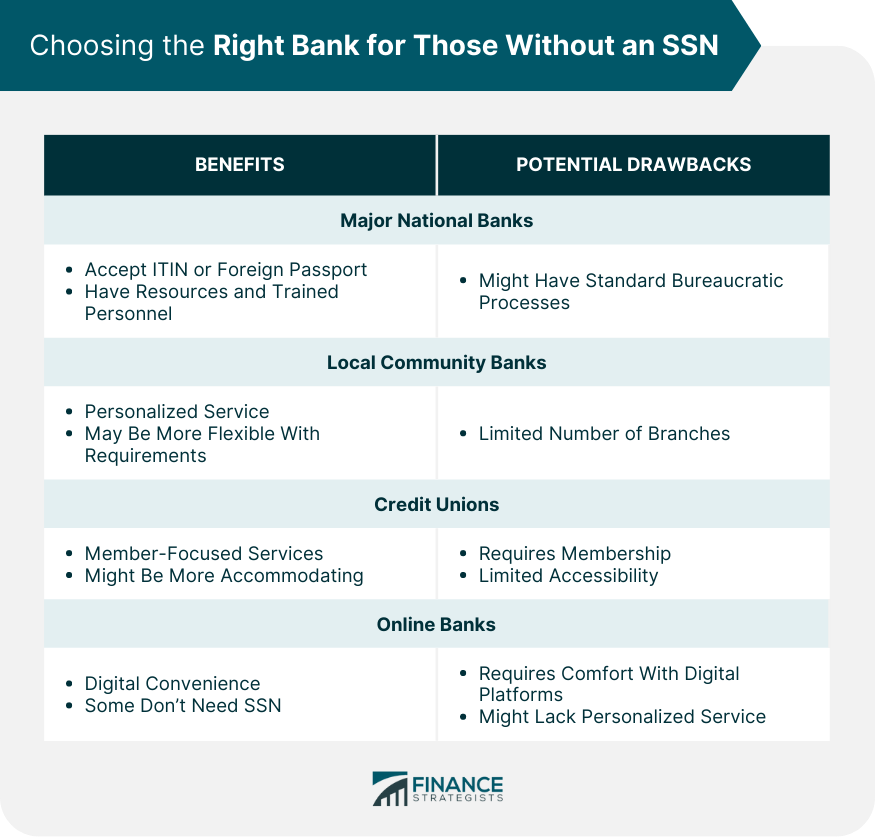

Choosing the Right Bank

Major National Banks

Local Community Banks

Credit Unions

Online Banks

What to Expect When Opening a Bank Account Without an SSN

Challenges

USA PATRIOT Act

Know Your Customer (KYC) Process

Managing a Bank Account Without an SSN

Learn Basic Account Management

Deal With Common Banking Issues

Secure Additional Banking Services

Bottom Line

Alternatives to Opening a Bank Account Without an SSN FAQs

Yes, you can use alternatives such as ITIN, foreign passport, or an Alien Identification Card Number.

An ITIN is a tax processing number issued by the IRS for those ineligible for an SSN, and it can be used to open a bank account.

Yes, many major banks like Chase and Bank of America allow account opening with an ITIN or foreign passport.

You may encounter pushback, need to navigate the USA PATRIOT Act requirements, and undergo an extensive KYC process.

It might be more challenging, but some banks offer credit cards and loans to individuals with an ITIN.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.