Joint bank accounts can be beneficial for a marriage, fostering financial transparency and enhancing trust. They allow for streamlined management of shared expenses, making it easier to handle bills, mortgages, and other financial obligations. They also enable couples to work towards mutual financial goals, such as saving for a house, a vacation, or a child's education. Moreover, in case of emergencies or unexpected expenses, having a joint account can provide quick access to necessary funds. However, there are potential downsides. Joint accounts require clear communication and understanding, as both partners have equal access to funds. Disagreements over spending habits or financial priorities can lead to conflicts. Additionally, in the unfortunate event of a separation or divorce, dividing assets into a joint account can be a complex process. So, whether a joint bank account is good for your marriage depends largely on your unique circumstances, financial habits, and the level of communication and trust in your relationship. Open and honest communication is key in making this decision. Discuss your financial habits, goals, and expectations. Consider consulting a financial advisor to guide you through this process. Understand your and your partner's financial behaviors. Is one of you a saver while the other is a spender? Do your financial habits align with your shared goals? These considerations can inform your decision. Consider your long-term financial goals. Joint accounts can facilitate saving for shared objectives like buying a house or planning for retirement. Evaluate how a joint account fits into your long-term financial plans. Financial compatibility is as crucial as emotional compatibility in a marriage. Understanding each other's financial habits, goals, and attitudes toward money can go a long way in avoiding disagreements. Joint accounts can help understand and adapt to each other's financial style, but it is essential to have these discussions early and often. Establishing clear individual and mutual financial goals is vital. These goals will guide your financial decisions and strategies. Whether it's saving for a vacation, buying a home, or planning for retirement, having a shared vision can help in effective financial planning. Differences in spending habits can lead to disagreements, especially when sharing a joint account. It's important to understand and respect each other's financial perspectives. Establishing some ground rules for expenditures can help in managing these differences. 1. Conversations to Have Before Opening a Joint Account: Before opening a joint account, discuss your financial habits, expectations, and goals. Decide on how bills will be paid, how savings will be managed, and how big spending decisions will be made. 2. Choose the Right Bank and Account Type: Consider the benefits and limitations of different banks and account types. Look at factors like minimum balance requirements, fees, interest rates, and access to branches or ATMs. 3. Understand the Terms and Conditions: Before signing any agreement, understand the terms and conditions associated with the account. Know your rights, obligations, and the procedures for handling disputes or the death of a partner. Set some ground rules for spending and saving. Define what constitutes a big purchase and agree on how much to save each month. These rules can help manage expectations and prevent misunderstandings. Have regular financial meetings to discuss your budget, spending, savings, and financial goals. These check-ins can help keep your financial plans on track and allow for adjustments as needed. Despite your best efforts, disagreements may arise. Agree on a process for resolving financial disputes. This might involve open discussions, compromise, or seeking advice from a financial counselor or advisor. Joint bank accounts can act as a catalyst for transparent conversations around money. They necessitate discussions about earnings, spending, saving, and financial goals, thus promoting honesty and openness. A joint account can facilitate a comprehensive understanding of your collective financial landscape and foster a collaborative environment. In a joint account, all transactions are visible to both parties. This transparency may enhance trust as neither partner can make significant financial moves in secret. Over time, this can build stronger ties between spouses, as mutual trust is a cornerstone of any successful marriage. When both parties are involved in managing a shared bank account, it necessitates cooperation. Decisions about large purchases, investments, and savings goals must be made together. This encourages a collaborative approach to financial management, which can be beneficial in other aspects of the relationship too. Financial disagreements are one of the leading causes of marital strife. With a joint account, differences in spending habits and financial decision-making can become more prominent. One partner's frivolous spending or the other's overly conservative approach might lead to conflicts. A joint bank account can limit personal financial freedom. Some individuals may feel restricted, having to discuss and agree upon all financial decisions. This lack of autonomy might cause resentment or friction between partners. In unfortunate events like separation or divorce, a joint bank account can complicate matters. The division of funds can become contentious and legally complex. Additionally, one partner could potentially drain the account, leaving the other in financial distress. An alternative to a joint account is keeping separate accounts. This allows for financial independence and can reduce conflicts arising from different spending habits. However, it may also limit financial transparency and make collective financial planning more challenging. A hybrid approach can be the best of both worlds. Couples can maintain separate accounts for personal spending while having a joint account for shared expenses and savings. This method allows for financial independence while still encouraging collaboration and transparency. The decision to have a joint bank account in marriage is highly personal and depends on many factors. It can facilitate open communication, foster financial transparency and encourage collaboration. However, it also comes with potential challenges like financial disagreements, restrictions on individual financial autonomy, and complications in the event of a separation. Some couples might prefer keeping separate accounts or using a hybrid approach. No matter the choice, open communication, understanding each other's financial habits, and shared financial planning are crucial. Regular check-ins, agreed-upon rules, and a plan for dispute resolution can help manage a joint account effectively. Ultimately, the goal is to make financial decisions that strengthen the marriage and support the shared vision of the future.Are Joint Bank Accounts Good for Your Marriage?

How to Decide Whether a Joint Bank Account Is Right for Your Marriage

Discussion and Communication

Assessing Financial Behaviors and Habits

Long-Term Financial Planning

Understanding Individual Financial Styles

Importance of Financial Compatibility

Determining Your Individual and Mutual Financial Goals

Navigating Differences in Spending Habits

Steps to Set up a Joint Bank Account

How to Manage a Joint Bank Account in a Marriage

Establish Rules for Spending and Saving

Have Regular Financial Check-Ins

Deal With Potential Disputes

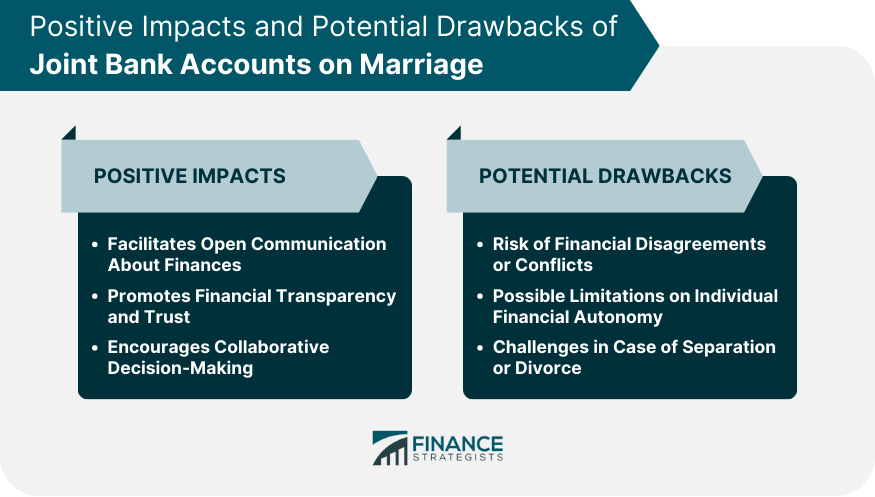

Positive Impacts of Joint Bank Accounts on Marriage

Facilitates Open Communication About Finances

Promotes Financial Transparency and Trust

Encourages Collaborative Decision-Making

Potential Drawbacks of Joint Bank Accounts in Marriage

Risk of Financial Disagreements or Conflicts

Possible Limitations on Individual Financial Autonomy

Challenges in Case of Separation or Divorce

Alternatives to Joint Bank Accounts

Maintain Separate Accounts

Use a Hybrid Approach (Separate and Joint Accounts)

Conclusion

Are Joint Bank Accounts Good for Your Marriage? FAQs

Yes, a joint bank account can improve communication by necessitating open discussions about earnings, spending, saving, and financial goals. This encourages honesty and collaboration in managing finances.

Some potential drawbacks include the risk of financial disagreements, limitations on individual financial autonomy, and challenges in the event of separation or divorce. Each partner's spending habits are clearly visible, which can lead to conflicts if not managed properly.

Maintaining separate accounts can be a good alternative for couples who value financial independence and want to avoid conflicts arising from different spending habits. However, this might limit financial transparency and make collective financial planning more challenging.

Open and honest communication is key in making this decision. Discuss your financial habits, goals, and expectations together. Also, consider your long-term financial plans and how a joint account fits into these plans.

Before opening a joint account, have in-depth discussions about your financial habits, expectations, and goals. Choose the right bank and account type that suits your needs, and make sure to understand the terms and conditions associated with the account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.