A bank account deposit is the act of placing money into a bank account, either in a checking or savings format, for safekeeping and potential interest earnings. Deposits, which can be made via cash, checks, or electronic transfers, differ in their processing time and fund availability. For instance, cash deposits are usually instantly accessible, while checks and transfers may require time to clear. Deposits serve multiple purposes. They provide a safe storage for funds, simplify financial management, and allow for the accumulation of money for future needs. Moreover, they are integral to the banking system, as banks utilize deposited funds to finance loans for other clients, offering interest in return. This is how banks foster monetary circulation in the economy, mediating between savers and borrowers. When you deposit cash or a check at a bank branch, you'll fill out a deposit slip and hand it to a teller along with your deposit. The teller will then process the deposit and give you a receipt. This traditional method of depositing is secure and enables you to receive instant confirmation of the transaction. Many banks now offer mobile and online deposit options. You can deposit checks by taking a photo with your smartphone and uploading it through your bank's app. For online transfers, you can move money from one account to another electronically. These options provide the convenience of depositing from anywhere, anytime, greatly enhancing banking accessibility and flexibility. Direct deposit is a form of electronic transfer where funds are deposited directly into your bank account. This is often used by employers for paychecks. Wire transfers are similar, but they can move funds between different banks and are typically used for larger amounts. These types of deposits reduce the need for physical checks and can streamline financial management, especially for recurring transactions. After you make a deposit, there may be a delay before you can access your funds. This depends on both bank policies and federal regulations. These delays, often referred to as "hold periods," serve various purposes including fraud prevention and ensuring the transferred funds clear properly. Banks have policies that determine when funds from different types of deposits become available. These policies are subject to federal regulations, which set maximum time limits for fund availability. Banks often have a tiered policy where larger deposits may be subject to longer hold times to mitigate potential risks. Weekends and holidays can delay fund availability because they're not considered business days. If you deposit a check on Friday, for example, the funds may not be available until the following week. Therefore, planning your significant transactions around the bank's operating days can help prevent untimely inconveniences. Cash deposits are straightforward: you simply hand over your cash to a bank teller or deposit it at an ATM. There are generally no limits on the amount of cash you can deposit, and the funds are usually available immediately. While this method is simple and direct, it may not always be convenient or safe to handle large amounts of cash. Depositing a check involves endorsing it, filling out a deposit slip, and giving it to a teller or depositing it at an ATM. There can be delays while the bank verifies the check and the funds clear. Though somewhat old-fashioned, checks remain a common form of payment, especially for large amounts or formal transactions. Electronic transfers include direct deposits, wire transfers, and online transfers. These are convenient but may have fees, especially for wire transfers. Direct deposits and online transfers are often free, but they can take a couple of days to process. As society continues to digitalize, electronic transfers are becoming an increasingly common mode of deposit due to their convenience and speed. One of the most common deposit issues is a bounced check. This occurs when there are insufficient funds in the account of the person who wrote the check. Other errors, like depositing a check twice, can also cause issues. These scenarios underscore the importance of clear communication and trust in financial transactions. Even when everything goes smoothly, delays in fund availability can still occur. This can be due to the type of deposit, the amount, or bank policies and regulations. Being aware of the standard processing times for each deposit type can help manage your expectations and plan your finances accordingly. If you encounter a deposit issue, the first step is to contact your bank. They can provide information about the problem and help resolve it. If the issue involves a bounced check, you may also need to contact the person who wrote the check. Banks have dedicated support services designed to help customers resolve such issues. To prevent deposit issues, it's essential to understand the deposit policies of your bank. It's also helpful to keep track of your deposits and balances and to make deposits promptly to avoid delays. Regularly updating your knowledge about your bank's policies and maintaining an organized record of your transactions can go a long way in preventing deposit-related issues. Banks pay interest on your deposits as a way of thanking you for letting them use your money. The interest rate varies from bank to bank and can also depend on the type of account. To maximize your earnings, it's worth comparing interest rates across different banks. Online banks often offer higher interest rates than traditional banks because they have lower overhead costs. Understanding how interest is calculated can allow you to optimize your saving strategies and maximize your earnings. Furthermore, shopping around for the best interest rates can make a significant difference in the growth of your savings over time. To ensure the safety of your deposits, use strong, unique passwords for online banking and regularly monitor your account for any suspicious activity. Implementing multi-factor authentication and keeping your contact information updated can also help increase the security of your bank account. The FDIC insures deposits at member banks up to $250,000 per depositor, per bank. This means that even if your bank fails, your deposits are still safe up to this limit. This federal protection is a cornerstone of the U.S. banking system and provides a vital safety net for depositors' funds. Bank account deposits are more than just a way to store your money. They're an integral part of your financial health and the broader economy. By understanding how they work, you can make smarter financial decisions, avoid potential pitfalls, and maximize your money's potential. Bank account deposits, the process of placing money into a bank account, are an essential element in financial management. These deposits, which can be made in various forms such as cash, checks, or electronic transfers, provide a safe storage for funds and contribute to economic circulation by allowing banks to finance loans. Despite their inherent benefits, there can be challenges, including processing delays or errors like bounced checks. These can be mitigated by understanding bank policies, anticipating potential hold periods, and maintaining open communication with the bank. To fully maximize the benefits of bank account deposits, individuals are encouraged to compare interest rates across banks, ensure secure transactions, and recognize the role of FDIC in insuring their funds. With careful planning and understanding, the depositing process can be seamlessly integrated into one's financial strategy, bringing about both security and growth.What Is a Bank Account Deposit?

How Bank Account Deposits Work

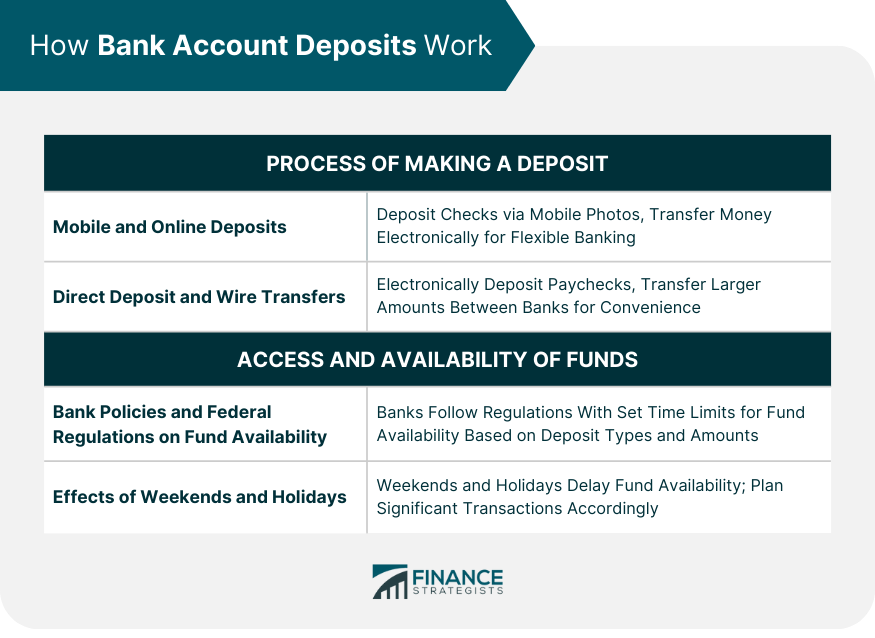

Process of Making a Deposit

Deposits Through a Bank Branch

Mobile and Online Deposits

Direct Deposit and Wire Transfers

Access and Availability of Funds

Bank Policies and Federal Regulations on Fund Availability

Effects of Weekends and Holidays

Types of Bank Account Deposits

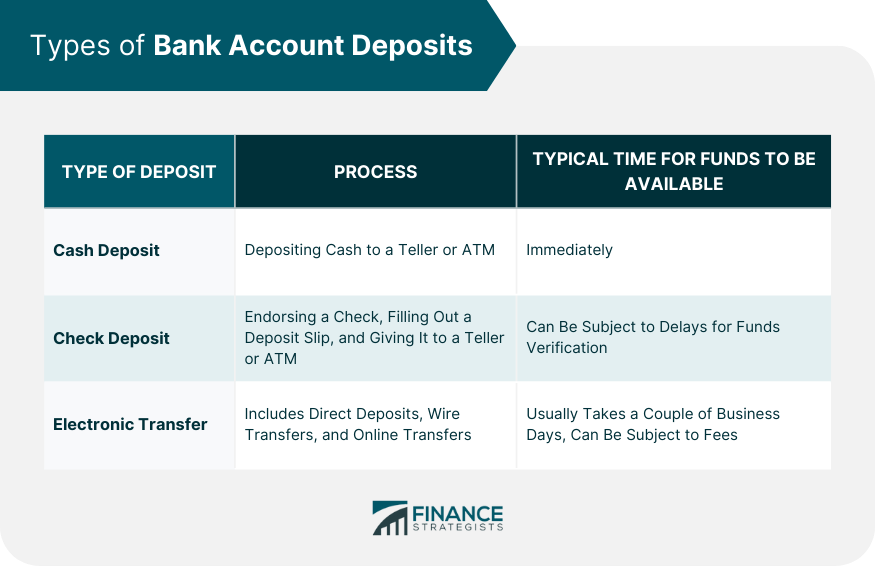

Cash Deposits

Check Deposits

Electronic Transfers

Issues and Resolutions With Bank Account Deposits

Common Issues

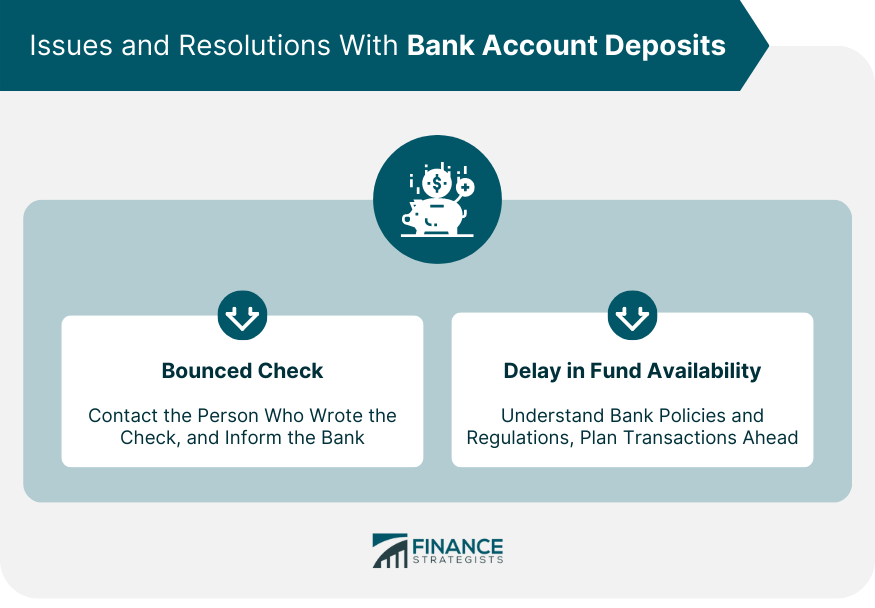

Check Bounce and Other Errors

Delay in Fund Availability

Resolution and Prevention Measures

Steps to Address Deposit Issues

Preventive Actions to Avoid Problems

Maximizing the Benefits of Bank Account Deposits

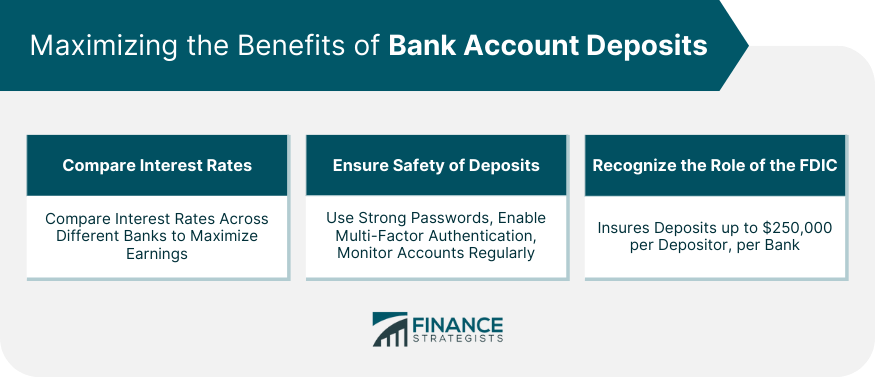

Compare Interest Rates Across Different Banks

Ensure the Safety of Deposits

Recognize the Role of the Federal Deposit Insurance Corporation (FDIC)

Final Thoughts

Bank Account Deposits FAQs

A bank account deposit is money that an individual or a business places into a bank account, typically kept in a checking or savings account.

Deposits can be made in different forms, including cash, checks, or electronic transfers, and can be made in-person at a branch, online, or through mobile banking.

Common issues include bounced checks, double deposits, and delays in fund availability due to bank policies, regulations, or non-business days.

The first step is to contact your bank for information about the issue and help with resolution. Keeping track of deposits and understanding your bank's policies can help prevent issues.

By comparing interest rates across banks, implementing robust security measures, and understanding how your bank calculates interest, you can maximize the benefits of your deposits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.