A bank account number is a unique identifier that each bank assigns to every account held in their institution. The structure of a bank account number can vary by country and by the bank itself, but it often includes details like the branch location and an individual account identifier. Security measures such as check digits, which help to verify the accuracy of a number and reduce the chance of input errors, are also commonly incorporated into account numbers. A bank account number's primary purpose is to identify a specific account for both the bank and the account holder. This identification is crucial for various banking processes, such as the crediting and debiting of transactions. Moreover, the bank account number plays a critical role in facilitating financial transactions. Whether you're sending or receiving money, domestically or internationally, the account number ensures the funds reach the correct account. The process of issuing a bank account number begins when a customer decides to open a new account with a bank. During the account creation process, the bank assigns a unique account number to the newly created account. This number serves as a fundamental identifier for all transactions and activities linked to that specific account. At the moment of opening a new bank account, the customer is provided with a designated account number. This number acts as the account's distinct identity within the bank's system. It enables the bank to differentiate and track transactions, balances, and other essential account-related details associated with the customer. The structure of a bank account number may differ across various financial institutions, and banks often have their own unique systems. However, in general, a bank account number is designed to contain meaningful information about the account. In the realm of domestic transactions, the bank account number assumes a pivotal role in facilitating seamless financial exchanges within the same country. This unique identifier serves as a key element that enables various payment processes and ensures accurate crediting of funds to the intended recipient's account. Bank account numbers are fundamental to electronic transfers, which have become increasingly prevalent in modern financial systems. When individuals or businesses initiate electronic transfers, the account number acts as the destination address for the funds. It allows the sender's bank to precisely identify the recipient's account and direct the funds accordingly. As a result, funds are securely and swiftly transferred from one account to another, providing a convenient and efficient method for financial transactions. For employers or organizations that disburse funds to individuals, the bank account number is indispensable for direct deposits. Whether it's a salary payment, pension, or government benefits, the account number serves as a reference point to accurately credit the funds to the recipient's account. This streamlines payment processes and eliminates the need for physical checks, offering a more convenient and reliable payment method. In everyday transactions, such as bill payments or online purchases, the bank account number plays a crucial role. When you make a payment, whether through online banking or mobile apps, you often need to provide your bank account number to complete the transaction. This information ensures that the payment is directed to the correct account, minimizing the chances of errors or misallocations. One of the essential aspects of the bank account number is its role in ensuring precise crediting of funds. Each bank account number is unique, serving as a distinct identifier for a specific account holder. When funds are transferred or payments are made, using the correct account number is vital to ensuring that the funds reach the intended recipient's account accurately. This precision is essential for maintaining the integrity of financial transactions and avoiding any potential discrepancies. In the context of international transactions, the International Bank Account Number (IBAN) plays a vital role in enabling smooth and secure cross-border financial exchanges. As the name suggests, the IBAN is an internationally recognized and standardized format used to uniquely identify bank accounts across different countries. This standardized system ensures the accuracy and efficiency of international payments, making it an essential component of global banking. The IBAN serves as a unified identification system for bank accounts, regardless of the country or financial institution. It is a unique alphanumeric code that contains essential information about the account, including the country code, bank code, branch code, and the individual account number. This comprehensive structure allows financial institutions worldwide to recognize and process transactions accurately, mitigating potential errors and ensuring a seamless transfer of funds. International transactions involve various currencies and financial systems, making it crucial to use a standardized method of identifying bank accounts. The IBAN's uniform format ensures that all relevant details are included in a consistent manner, enhancing the precision and reliability of cross-border transactions. This is particularly important in scenarios such as international wire transfers, where the funds need to be directed to the correct recipient's account with minimal delays. The adoption of the IBAN system is not only beneficial for financial institutions but also aids in compliance with international regulations. Many countries and regulatory bodies require the use of IBANs for cross-border transactions to enhance transparency and traceability. By adhering to the IBAN format, banks can ensure compliance with international standards and mitigate the risk of non-compliance penalties. The IBAN's standardized format contributes to the security of international payments. It provides an additional layer of verification, as the recipient's account information is presented in a consistent manner, making it easier to detect and prevent fraudulent activities. The consistent structure also reduces the chances of human error in processing international transactions, reducing the risk of misdirected funds. In an increasingly interconnected global economy, the IBAN plays a critical role in promoting seamless cross-border trade and finance. Businesses and individuals can conduct international transactions with confidence, knowing that their funds will reach the intended recipient's account accurately and promptly. The standardized use of IBANs fosters trust and reliability in international financial transactions, facilitating international trade and investment. Bank account numbers play a significant role in facilitating efficient financial management for both individuals and businesses. With these unique identifiers, tracking and monitoring financial activities become effortless. By regularly checking account statements, account holders gain better insights into their income, expenses, and overall financial health. This information enables them to make informed financial decisions, plan for future expenses, and create effective budgets. This easy transaction tracking ensures that no financial activity goes unnoticed, promoting responsible financial behavior. For individuals or businesses with multiple bank accounts, the uniqueness of each account number becomes invaluable. These distinct identifiers help differentiate between different accounts, such as personal savings, business checking, or joint accounts. By having separate account numbers, managing multiple financial streams becomes simpler and more organized. Account holders can easily track funds flowing into and out of each account, ensuring that transactions are correctly allocated. This ability to distinguish accounts prevents confusion and potential mix-ups, leading to better financial management. The security aspect of bank account numbers cannot be overstated. These unique identifiers are crucial in safeguarding against fraud and unauthorized access to accounts. When conducting transactions, whether online or in-person, banks use the account number to verify the account holder's identity. This verification process helps prevent fraudulent activities, such as unauthorized fund transfers or identity theft. With the proper use of bank account numbers, banks can ensure that only authorized individuals have access to the account, enhancing the security of financial transactions. In the age of increasing digital transactions, banks have implemented additional security measures like two-factor authentication (2FA). The bank account number plays a crucial role in this process, acting as one of the factors for authentication. When logging into an account or conducting sensitive transactions, the account number is often combined with a password or a personal identification number (PIN). This two-factor authentication adds an extra layer of security, making it more challenging for unauthorized parties to gain access to the account. By incorporating the account number in 2FA, banks further fortify the security of their customers' financial information. Account information theft poses a significant threat to bank account holders. Cybercriminals use various techniques, such as phishing emails, malware, or data breaches, to obtain sensitive account details. Once they gain access to a bank account number, they can potentially conduct unauthorized transactions or steal funds. It is essential for account holders to remain vigilant and adopt security measures to protect their account information. Careless handling of bank account numbers can lead to severe consequences. Leaving sensitive information exposed, such as writing down account numbers on easily accessible surfaces, increases the risk of unauthorized access. If account details fall into the wrong hands, individuals may face financial losses, fraudulent activities, or even identity theft. Practicing responsible account information management is crucial to prevent such adverse outcomes. Changing bank account numbers can be a cumbersome process. While it is possible under certain circumstances, it typically involves a series of steps and verification procedures. Individuals may need to provide valid reasons for changing the account number, and the bank will assess the request before approval. The difficulty in changing numbers emphasizes the importance of safeguarding account details from potential threats. The ability to change bank account numbers and the security measures in place often depend on the policies of the banking institution. Each bank may have its own set of rules and guidelines regarding account number changes, fraud prevention, and security protocols. Account holders should familiarize themselves with their bank's policies and adhere to them to ensure the safety and security of their bank accounts. Understanding the bank's procedures and working within their framework is essential for smooth account management. Protecting your personal information is crucial to prevent unauthorized access to your bank account. Avoid sharing your account details online or through insecure channels, such as social media or unencrypted messages. Be cautious when providing your account number, and only do so when necessary and to trusted entities, such as your employer for direct deposits or authorized payment services. Frequent monitoring of your account activity is essential to quickly detect any suspicious transactions or unauthorized access. Regularly review your account statements and transaction history to ensure all activities are legitimate. If you notice any unfamiliar or fraudulent transactions, contact your bank immediately to report the issue and take appropriate actions. If you suspect a security breach or unauthorized access to your bank account, it is crucial to act swiftly. Contact your bank's customer support or their dedicated fraud hotline as soon as possible. Inform them about the suspected breach and request them to freeze your account to prevent further unauthorized transactions. Your bank will initiate an investigation to resolve the issue and protect your account from any potential harm. Learning from past security breaches, it's essential to proactively implement additional security measures to safeguard your bank account. Consider enabling two-factor authentication (2FA) for your online banking and payment services. 2FA adds an extra layer of security by requiring a second verification method, such as a one-time code sent to your mobile device, in addition to your password. This helps prevent unauthorized access, even if your password is compromised. Bank account numbers are unique identifiers assigned to customers when they open new accounts with banks. They play a crucial role in efficient financial management, enabling easy tracking of transactions and differentiation of multiple accounts. By regularly checking account statements, individuals and businesses can make informed financial decisions, plan for future expenses, and create effective budgets. Having distinct account numbers for multiple accounts simplifies financial management and enhances organization. Additionally, bank account numbers are essential for secure financial transactions, offering protection against fraud and serving as a vital component of two-factor authentication. However, there are drawbacks to consider, such as the risk of fraud through account information theft and the difficulty in changing account numbers. To safeguard account numbers, individuals should avoid sharing personal information, regularly monitor account activities, and contact their bank in case of security breaches. Implementing preventive measures like two-factor authentication and strong passwords enhances account security. For international transactions, the International Bank Account Number (IBAN) serves as a standardized format, ensuring precise credit and promoting seamless cross-border trade and finance.What is a Bank Account Number?

How Bank Account Numbers Work

Issuance and Structure

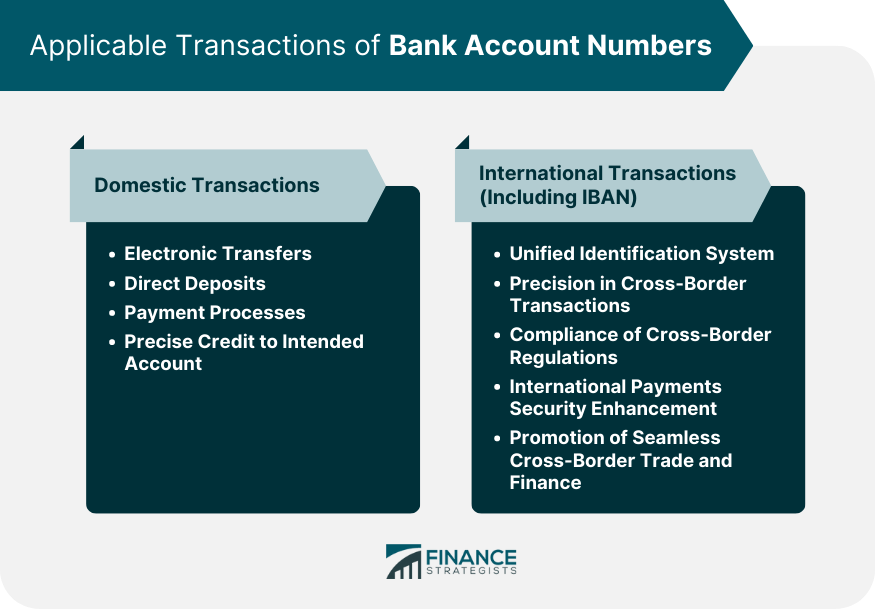

Applicable Transactions

Domestic Transactions

Electronic Transfers

Direct Deposits

Payment Processes

Precise Credit to Intended Account

International Transactions (Including IBAN)

Unified Identification System

Precision in Cross-Border Transactions

Compliance of Cross-Border Regulations

International Payments Security Enhancement

Promotion of Seamless Cross-Border Trade and Finance

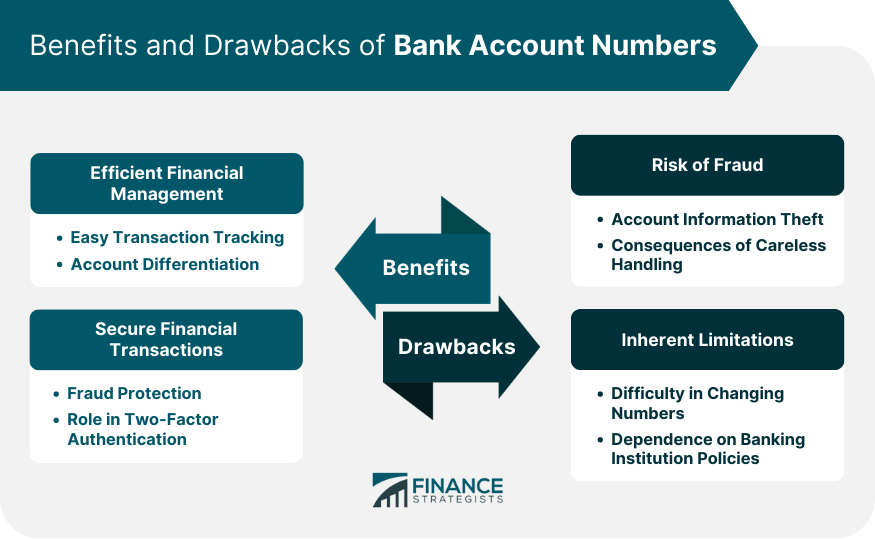

Benefits of Bank Account Numbers

Efficient Financial Management

Easy Transaction Tracking

Account Differentiation

Secure Financial Transactions

Fraud Protection

Two-Factor Authentication Role

Drawbacks of Bank Account Numbers

Risk of Fraud

Account Information Theft

Consequences of Careless Handling

Inherent Limitations

Difficulty in Changing Numbers

Dependence on Banking Institution Policies

Safeguarding Your Bank Account Number

Protect Personal Information

Regular Monitoring of Account Activity

Contact Bank in Case of Security Breach

Preventive Measures for Future Security

Conclusion

Bank Account Number FAQs

A bank account number is a unique identifier assigned to a customer's account by a bank, enabling transactions and account management.

In transactions, the bank account number serves as the destination address for funds, ensuring precise credit to the recipient's account.

Yes, you can have multiple bank account numbers. Many individuals and businesses often maintain various accounts to segregate funds for different purposes, such as personal expenses, savings, investments, or business operations. Each account will have its unique account number for identification purposes.

Yes, bank account numbers are considered confidential information and should be kept secure. Sharing your account number with unauthorized individuals or entities can potentially lead to fraudulent activities, such as unauthorized withdrawals or unauthorized transactions. Be cautious while providing your account number and only share it with trusted parties, like your bank or legitimate service providers.

Safeguarding your bank account number is crucial to prevent unauthorized access and potential fraud.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.