Overdrafts represent an essential aspect of modern banking often misunderstood by customers. At its core, a bank account overdraft occurs when a bank account holder's balance goes below zero, resulting in a negative balance. This situation can be a result of various factors, including uncontrolled spending, banking errors, and miscalculation of available funds. Overdraft essentially allows individuals to borrow a small amount of money on their current account for a short time to tide them over until payday. Banks automatically enroll customers in what is typically called "overdraft protection". This service allows transactions to go through even when there are not sufficient funds in the account. Essentially, the bank provides a short-term loan and charges an overdraft fee for the service. This automatic enrollment is designed to prevent the embarrassment and inconvenience of declined transactions due to insufficient funds. The most common cause of an overdraft is simply not having enough money in your account to cover your transactions. This can happen due to a discrepancy between the account balance and the customer's understanding of it, often because pending transactions have not yet cleared. Thus, it's critical to regularly monitor your bank account and be aware of any pending transactions that could potentially impact your balance. While less common, errors by the bank or other financial institutions can also lead to overdrafts. This could include double charges, incorrect transaction amounts, or other processing mistakes. If you suspect a banking error, it's important to promptly communicate with your bank, as most have processes in place to rectify such mistakes. Sometimes, the timing of transactions can result in an overdraft. For example, if a large automatic payment comes out of your account before your paycheck is deposited, it could cause an overdraft. Hence, synchronizing your major payments with your income cycle can help prevent such occurrences. When your account goes into overdraft, your bank will typically charge an overdraft fee. The median overdraft fee among American banks is $35 per transaction, but this varies widely between banks and countries. It's important to note that these fees can quickly add up, particularly if you frequently overdraw your account. Different banks have different policies regarding overdrafts. Some banks may offer a grace period, where you won't be charged an overdraft fee if you deposit enough money to bring your account back to a positive balance within a certain timeframe. Other banks may charge additional fees for each day your account remains overdrawn. So, understanding your bank's specific policy can help you avoid unnecessary charges. Overdrafts can impact your credit score indirectly. While the overdraft itself does not get reported to credit bureaus, if your account remains overdrawn for an extended period, the bank may close your account and turn the debt over to a collection agency. At that point, the unpaid debt can appear on your credit report and negatively impact your credit score. Thus, effectively managing your overdrafts is crucial to maintaining a good credit rating. Frequent overdrafts can lead to significant financial challenges. Overdraft fees can quickly accumulate, causing a financial burden that is much greater than the original overdraft amount. Additionally, if you're often relying on overdrafts to get by, it's a sign that you're living paycheck to paycheck, which can be a precarious financial situation. Therefore, focusing on improving your money management skills is key to avoiding financial troubles related to overdrafts. Overdraft protection services are meant to protect you from the consequences of an overdraft. When you sign up for overdraft protection, the bank will link your checking account to another account—such as a savings account, a credit card, or a line of credit. If you try to make a transaction that would result in an overdraft, the bank will automatically transfer funds from the linked account to cover it. However, it's important to note that the bank may still charge a fee for this service, albeit usually less than the typical overdraft fee. While overdraft protection can save you from costly overdraft fees, it's not a perfect solution. There are often fees associated with overdraft protection services, although they're generally lower than the fees for an overdraft. Additionally, these services can create a false sense of security, leading to poor financial habits. Hence, the best approach is to use overdraft protection as a safety net, not a solution to chronic financial mismanagement. Regularly reviewing your account balance and transactions can help you avoid overdrafts. Make sure you account for any pending transactions and checks that have not yet cleared. It can also be helpful to keep a cushion of extra funds in your account, just in case. Proactive account management can be a valuable habit to minimize the risk of overdrawing your account. Many banks offer budgeting tools that can help you stay on top of your finances. These might include spending alerts, low balance alerts, and budgeting apps. There are also many third-party apps available that can help you track your spending and save money. Utilizing these tools can greatly help in managing your finances and avoiding overdrafts. Various regulations exist to protect consumers from unfair overdraft practices. For example, in the U.S., a bank cannot charge overdraft fees on ATM withdrawals or one-time debit card transactions unless the account holder has opted into overdraft protection. Knowledge of these protections is critical to ensure that your rights as a consumer are not violated. Each bank has its own policies regarding overdrafts. Some banks offer overdraft forgiveness programs, where they waive the overdraft fee for the first incident each year. Others might offer lower-cost alternatives to traditional overdraft protection, such as linking your checking account to a savings account or line of credit. Understanding these policies can help you choose a bank that best fits your financial habits and needs. A credit card can be a useful tool for managing cash flow and can serve as an alternative to overdrafts. If managed properly, credit cards can provide short-term liquidity without the high fees associated with overdrafts. However, they must be used responsibly, as high interest rates and potential for increased debt are serious considerations. So, it's crucial to understand all the terms and conditions before using a credit card as an alternative to overdrafts. Short-term loans, such as payday loans, are another alternative. However, these often have high interest rates and fees, and can lead to a cycle of debt if not managed carefully. It's crucial to fully understand the terms of these loans and to explore all other options before resorting to short-term loans. A personal line of credit can be a more cost-effective alternative to overdraft protection. This revolving credit line allows you to borrow up to a predetermined limit, and interest is only charged on the amount borrowed. However, like any other financial tool, it should be used responsibly and not as a crutch to supplement inadequate budgeting or spending habits. If you find yourself in an overdraft situation, the first step is to deposit money into your account as soon as possible to return your balance to at least zero to avoid additional fees. Contact your bank to discuss the situation - some banks might be willing to waive the fee, especially if it's your first overdraft. Prompt action is vital in such cases to prevent further financial complications. If overdrafts are a regular occurrence, it might be a sign that you need to reevaluate your financial habits. Consider creating a budget, cutting back on unnecessary expenses, and building an emergency fund to prevent future overdrafts. Additionally, seeking the help of a financial advisor or a credit counseling service can provide you with the necessary tools and knowledge to regain control of your financial life. Bank account overdraft occurs when an account holder's balance goes below zero, resulting in a negative balance. It allows individuals to borrow a small amount of money on their account temporarily. However, this convenience comes with fees, which can accumulate if not managed properly. Overdrafts can negatively impact credit scores and lead to long-term financial challenges, indicating poor money management. To avoid overdrafts, regularly monitor account balances, use budgeting tools, and consider alternative financial solutions like credit cards or personal lines of credit. In case of an overdraft, act promptly by depositing funds and discussing fee waivers with the bank. Long-term financial planning, including budgeting and building an emergency fund, is essential for financial stability. Seek professional advice to improve financial habits and safeguard your financial future. Take control of your finances and explore the banking services available to you.What Is a Bank Account Overdraft?

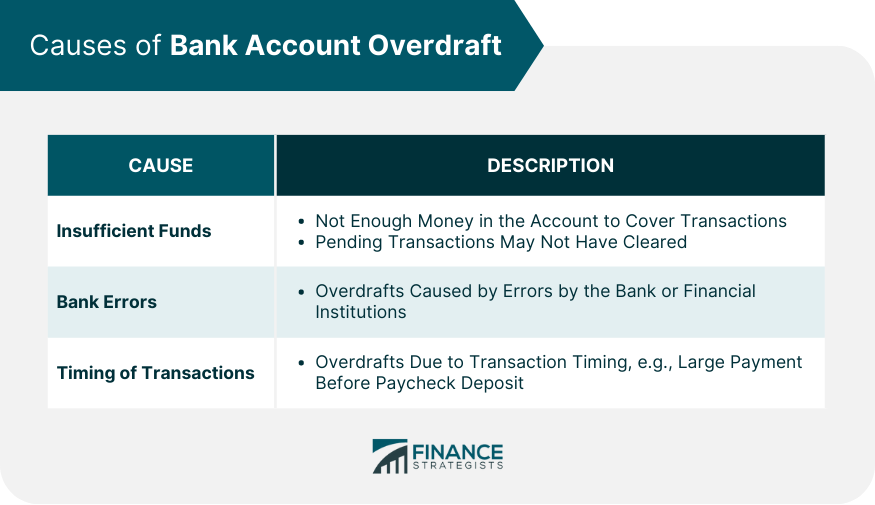

Causes of Bank Account Overdraft

Insufficient Funds

Bank Errors

Timing of Transactions

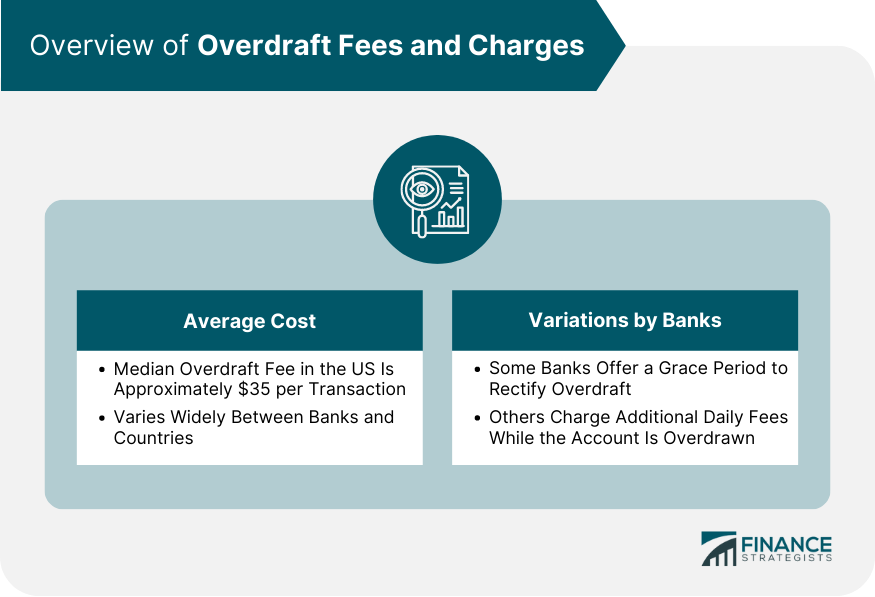

Overdraft Fees and Charges

Average Costs

Variations by Banks

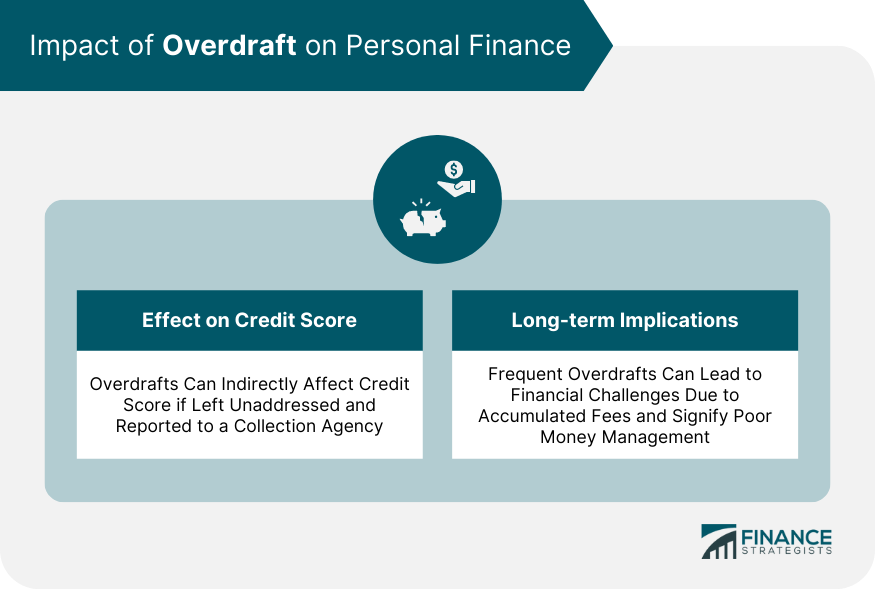

Impact of Overdraft on Personal Finance

Effect on Credit Score

Long-Term Financial Implications

Overdraft Protection Services

How They Work

Associated Costs and Limitations

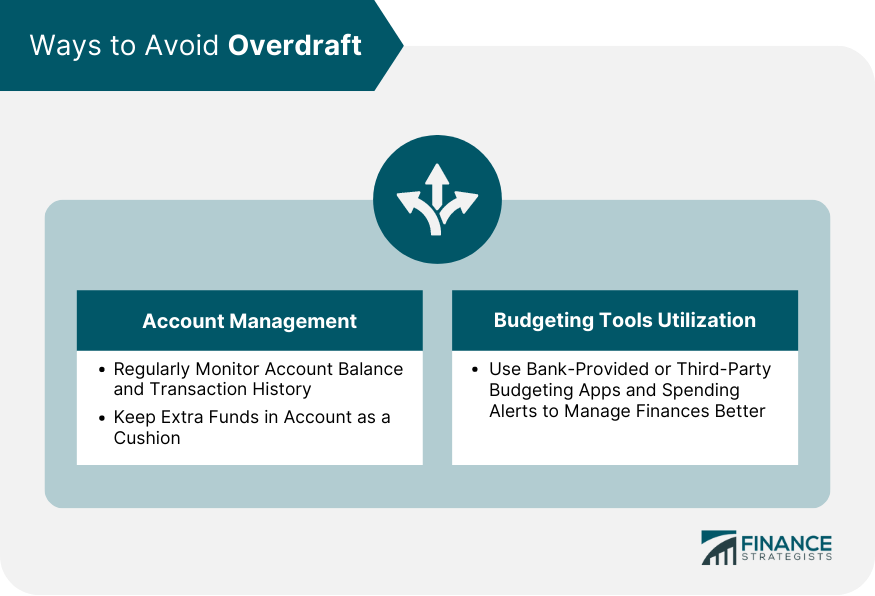

Ways to Avoid Overdraft

Account Management Techniques

Budgeting Tools Utilization

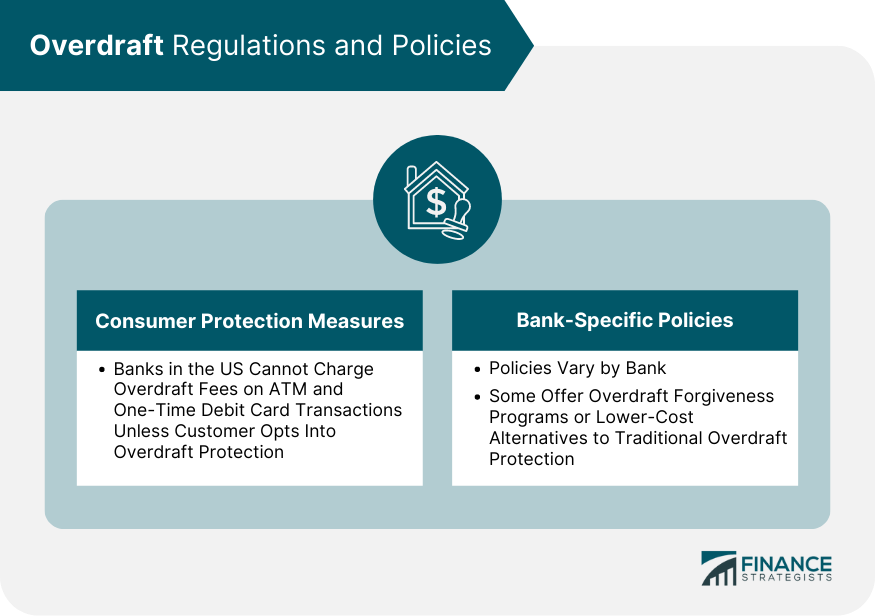

Overdraft Regulations and Policies

Consumer Protection Measures

Bank-Specific Policies

Overdraft vs Alternative Financial Solutions

Credit Cards

Short-term Loans

Line of Credit

How to Recover From an Overdraft

Immediate Steps

Long-Term Financial Planning

Final Thoughts

Bank Account Overdraft FAQs

A bank account overdraft occurs when an account balance goes below zero, allowing transactions to occur despite insufficient funds.

Common causes include insufficient funds, bank errors, and timing of transactions.

Overdraft fees can accumulate quickly and negatively impact your finances. Prolonged overdrafts can also harm your credit score.

These are services offered by banks to cover transactions that would otherwise result in an overdraft, typically for a smaller fee.

Promptly deposit money to balance your account and consider long-term financial planning, including budgeting and building an emergency fund.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.