Financial literacy for kids is critical to impart at a young age to instill money-management skills and habits early on. Understanding money and financial concepts helps kids make informed decisions about spending, saving, investing, and donating, and teaches them about financial independence and security. Key concepts should include earning money through chores or jobs, the idea of saving for future needs or wants, understanding the value of money and differentiating between needs and wants. Children should also learn about simple budgeting, basics of banking like checking and savings accounts, and how interest works. Moreover, lessons on credit, debt, and the dangers of impulsive buying can help prevent future financial missteps. Digital platforms, games, and storybooks can be effective tools in this learning journey. Overall, financial literacy is not just about understanding money, but it's also about fostering responsible and informed citizens. In the modern era, financial literacy has become a crucial life skill. Opening a bank account for a child can be the first step towards teaching them the fundamentals of money management. This practical experience gives them a hands-on understanding of how money is earned, saved, invested, and spent. It can also serve as a practical tool to introduce them to the concepts of budgeting and planning their expenses. It's important to teach children that money is a finite resource, and having a bank account helps children see how their savings can grow or dwindle over time, giving a tangible lesson in cause and effect. One of the most tangible benefits of opening a bank account for a child is the opportunity for them to learn about saving and interest. Banks often offer special accounts for children that encourage savings by offering interest. These accounts provide a safe place for children to store their money and watch it grow over time. By seeing their money accrue interest, children learn the value of saving over spending and the basics of how interest works, an invaluable lesson for their financial future. Financial transactions and the routine maintenance of a bank account require basic math skills. Regular interaction with these numbers can significantly improve a child's numeracy skills. Counting money, calculating interest, and understanding the differences between different denominations can provide an ongoing opportunity for practical math lessons. Opening a bank account for a child provides them with their first taste of financial independence. With their own bank account, they have the power to save, withdraw and manage their own funds, which can be incredibly empowering. This early sense of financial independence can give a child confidence and motivation to further improve their financial skills. Starting a bank account early can help a child begin building their financial history. This can be advantageous when the child grows up and needs to apply for financial products like loans or credit cards, as they will have a longer financial history. Moreover, it will give them a head start in understanding the importance of maintaining a positive financial history. Childhood is the ideal time to ingrain positive financial habits. By starting a bank account early and promoting regular saving, children can develop a savings habit that lasts into adulthood. Encouraging your child to regularly deposit a portion of their allowance or any money they receive can help establish this habit. A childhood bank account is more than just a place for children to keep their money; it's a tool for educating them about real-world financial responsibilities. The earlier children begin learning these lessons, the more time they will have to make, learn from, and correct their mistakes before they're in the real world managing much larger sums of money. Opening a bank account for a child can be the first step in a journey towards understanding and making sound investment decisions in the future. Over time, parents can introduce more complex financial concepts like stocks, bonds, and retirement savings. The child's bank account serves as a launching pad for these more advanced discussions, setting them up for a successful financial future. When deciding to open a bank account for your child, it's important to compare different banks and the features they offer. Look for banks with accounts specifically designed for children, as these often come with educational materials and features. Additionally, consider factors like minimum balance requirements, interest rates, and fees. Once you've chosen a bank, it's time to open the account. It's likely you'll need to accompany your child to do this, as banks often require a parent or guardian's signature. Use this as an opportunity to talk your child through the process and explain the documents they're signing. After the account is open, the real work begins. Teach your child how to deposit and withdraw money, check their account balance, and understand their bank statements. Many banks offer online platforms and apps that can make this easier and more accessible for children. As a parent, it's important to supervise your child's banking activities. While it's crucial for them to learn from their mistakes, it's also essential to prevent any major missteps that could result in substantial losses. Regularly review their account statements with them and discuss any concerns or questions they may have. It's essential to guide your child on how to make deposits and withdrawals, as well as how to keep track of their account balance. This is a good time to introduce the concept of budgeting and explain how to plan for future expenses. Lastly, but perhaps most importantly, parents should encourage regular savings. This could be a portion of their allowance, or any holiday or birthday money they receive. This will help to instill the value of saving, and show them how money can grow over time when saved and invested wisely. Opening a bank account for children offers an array of immediate and long-term benefits. It serves as a practical tool for teaching basic money management, encouraging saving habits, enhancing numeracy skills, and fostering financial independence from an early age. This early financial education aids in building a solid financial history, preparing children for real-world responsibilities, and setting the foundation for making sound investment decisions in the future. As a parent, your role in guiding this process is vital. Monitoring account activities, guiding deposits, withdrawals, and balances, and encouraging regular savings are key responsibilities. The steps to open a bank account for a child are straightforward, and banks offer a range of features specifically tailored for children. Embrace this opportunity today and seek banking services for your child to set them on a path to financial success.Financial Literacy for Kids: Overview

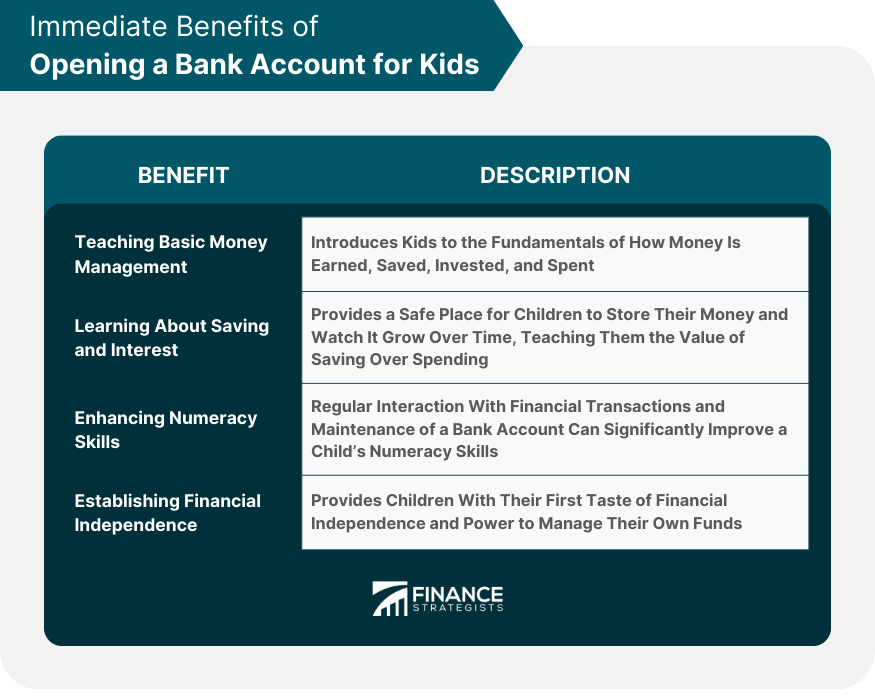

Immediate Benefits of Opening a Bank Account for Kids

Teaching Basic Money Management

Learning About Saving and Interest

Enhancing Numeracy Skills

Establishing Financial Independence Early

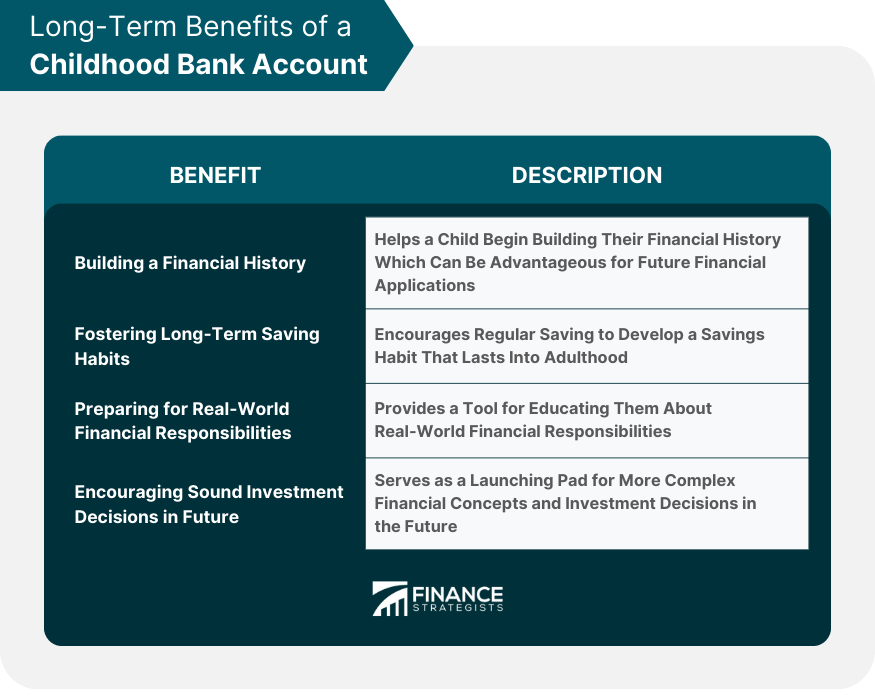

Long-Term Benefits of a Childhood Bank Account

Building a Financial History

Fostering Long-Term Saving Habits

Preparing for Real-World Financial Responsibilities

Encouraging Sound Investment Decisions in Future

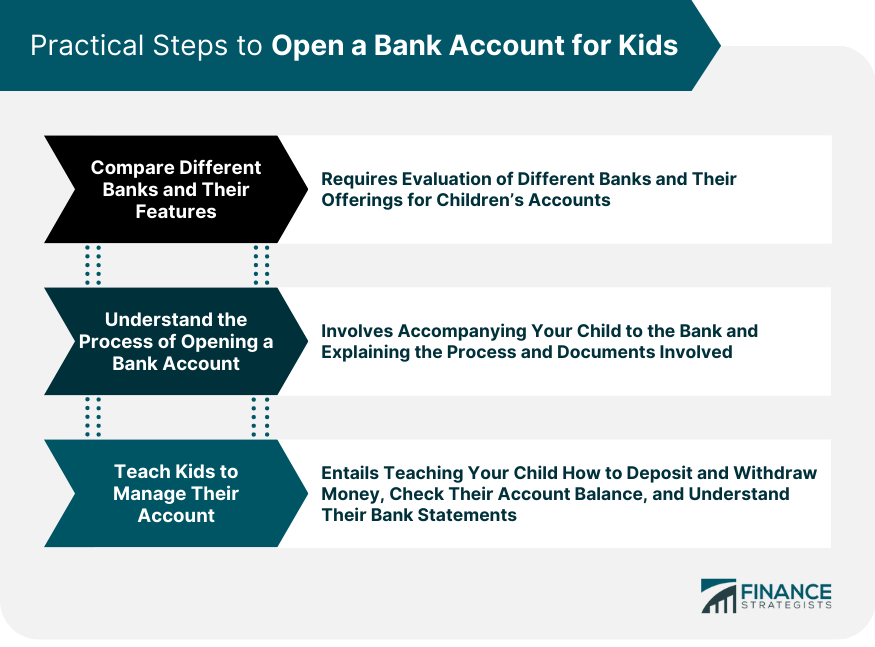

Practical Steps to Open a Bank Account for Kids

Compare Different Banks and Their Features

Understand the Process of Opening a Bank Account

Teach Kids to Manage Their Account

Parental Roles and Responsibilities in Kids' Banking

Monitors Account Activities

Guides Kids on Deposits, Withdrawals, and Balances

Encourages Regular Savings

Bottom Line

Benefits of Opening a Bank Account for Kids FAQs

Opening a bank account for kids provides them hands-on experience in money management, teaches the value of saving, and fosters long-term financial habits.

Bank accounts often offer interest on savings, helping kids understand how money can grow over time, thereby teaching them the benefits of saving over spending.

A childhood bank account helps build financial history, fosters long-term savings habits, prepares kids for real-world financial responsibilities, and encourages sound future investment decisions.

Parents play a key role in supervising account activities, guiding kids on deposits, withdrawals, balances, and encouraging regular savings to instill financial discipline.

The process involves comparing different banks and their offerings, understanding the process of opening a bank account, and teaching kids how to manage their account effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.