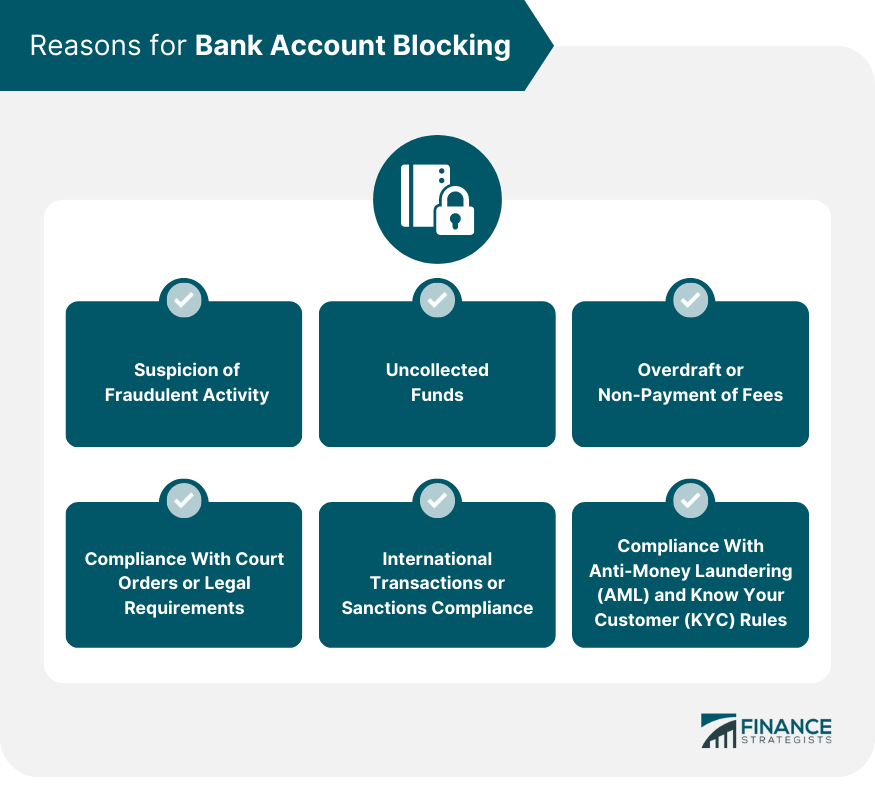

The immediate answer to this common query is, yes, a bank can block your account under certain circumstances. While it may come as a shock to account holders, it is essential to understand the rationale behind this action. Account blocking is not an arbitrary decision made by banks; it is based on specific circumstances that warrant such actions. Some of the key factors that can lead to account blocking include: Banks prioritize the safety and security of their customers' funds. If they detect unusual transactions or patterns that raise suspicions of fraud or unauthorized access, they may block the account to prevent further potential losses. A bank may block an account if a significant transaction, such as a large check or electronic transfer, is made when there are insufficient funds to cover it. This measure is taken to avoid the risk of unpaid transactions and overdrafts. Consistently overdrawing an account or failing to pay required fees can lead to account blocking. Banks have policies to ensure responsible account management and may take such action to protect their interests. Banks are obligated to comply with court orders or legal obligations. If an account is associated with ongoing legal proceedings or is suspected of involvement in criminal activities, it may be blocked as part of adherence to the law. In the context of international transactions, banks must adhere to various sanctions and regulations. Any involvement in transactions that violate these guidelines may result in account blocking to avoid potential legal repercussions. As part of efforts to combat money laundering and terrorist financing, banks are required to conduct due diligence on their customers. Failure to provide the necessary documentation or engaging in suspicious financial activities may lead to account blocking. Banks operate as highly regulated financial institutions, and as such, they possess legal rights to block or freeze accounts under specific circumstances. These rights are not arbitrary; instead, they are guided by well-defined laws and regulations designed to safeguard both the bank and its customers from financial risks, including fraud, money laundering, and other forms of financial crime. Regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, play a critical role in overseeing the operations of banks and ensuring consumer protection. These regulatory bodies stipulate the rules and guidelines that govern various aspects of banking, including account blocking. The legal rights of banks to block accounts are typically rooted in the terms and conditions agreed upon when an individual opens an account with the bank. These terms outline the responsibilities and obligations of both parties involved in the banking relationship. Account blocking is not an action taken lightly by banks; it is usually the result of thorough assessments and adherence to legal procedures. Banks deploy advanced fraud detection systems and compliance mechanisms to monitor account activities for any signs of suspicious behavior or potential risks. Experiencing a blocked bank account can be a concerning and inconvenient situation. Here are the steps to take if your account is blocked: The first and most crucial step when you discover that your account has been blocked is to contact your bank's customer service immediately. Getting in touch with the bank will allow you to understand the reasons behind the account block and the specific actions required to unblock it. Customer service representatives can provide valuable insights and guidance to help resolve the issue promptly. During the conversation with the bank's customer service, verify that the account details, such as your name, address, and contact information, are accurate and up-to-date. Incorrect or outdated information could potentially lead to account-related problems. Ensuring that your personal information is current will help avoid any unnecessary delays in resolving the block. Once you understand the reasons for the account block, take the necessary steps to resolve the underlying issue. If the block is due to insufficient funds, transfer the required amount to cover any outstanding transactions. If there are any suspicious transactions, report them to the bank immediately to initiate an investigation and rectify the situation. In some cases, the bank may require additional documentation or verification to lift the account block. Be prepared to provide any requested documents promptly to facilitate the resolution process. This might include proof of identification, address verification, or supporting documentation for specific transactions. Cooperating with the bank and following their instructions is essential to expedite the unblocking process. Be responsive to any requests for information or action from the bank. Timely cooperation can lead to a quicker resolution, allowing you to regain access to your funds and resume normal account activities. To maintain a healthy banking relationship and avoid potential account blocks, ensure that you make timely payments of all banking fees and charges. This includes avoiding overdrawing your account and promptly settling any outstanding fees or penalties. Regularly review and update your personal information with the bank to ensure accurate records. This is particularly important for contact details, as the bank relies on this information to communicate with you in case of any account-related issues or updates. Take advantage of online banking resources to monitor your account activity regularly. Online banking provides real-time access to account information, allowing you to keep track of transactions, balances, and any potential discrepancies. Being vigilant about your account activity can help identify and address issues early on. Adhere to security best practices to protect your account from potential unauthorized access or fraudulent activities. Use strong and unique passwords, avoid sharing sensitive account information, and be cautious when accessing your account from public or unsecured Wi-Fi networks. Account blocking can be a disruptive and concerning experience, but taking proactive measures can help individuals avoid such situations and maintain a healthy banking relationship. Here are some preventive measures to avoid account blocking: Engaging in regular transactions that align with your usual spending patterns is a prudent approach. However, conducting overly frequent or unusual transactions may raise suspicion and trigger alerts in the bank's monitoring systems. To avoid unnecessary scrutiny, use your bank account for everyday transactions and avoid excessive or erratic activity. Be vigilant about monitoring your account activity and promptly address any irregularities or discrepancies you notice. If you come across suspicious transactions or unfamiliar charges, contact your bank's customer service immediately to report the issue and seek clarification. Timely action can prevent potential account blocks resulting from unauthorized access or fraudulent activities. When engaging in international transactions, ensure that you comply with all relevant sanctions, laws, and regulations. Banks must adhere to strict guidelines regarding international transactions to prevent potential legal repercussions. Familiarize yourself with the sanctions laws applicable to your country and the countries you are transacting with to avoid inadvertent violations. Maintaining accurate and up-to-date personal information with your bank is essential. Outdated contact details, such as address or phone number, may hinder communication between you and the bank. It can also lead to difficulties in resolving account-related issues promptly. Regularly review and update your contact information to ensure smooth communication with the bank. Use your bank account as intended, based on its designated type (e.g., personal or business account). Mixing personal and business transactions in a personal account, for example, may raise suspicions and could lead to account blocking. Ensuring appropriate use of your account helps maintain transparency and reduces the likelihood of encountering issues. Account blocking can occur under specific circumstances, such as suspicion of fraudulent activity, uncollected funds, overdrafts, compliance with court orders, international transactions, and adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. Banks possess legal rights to block accounts, guided by well-defined laws and regulations, which aim to safeguard both the bank and its customers from financial risks. Regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB) and the Financial Conduct Authority (FCA), oversee and stipulate rules concerning account blocking, ensuring consumer protection. If an account is blocked, individuals should take immediate actions to resolve the issue, such as contacting the bank's customer service, verifying account details, addressing the underlying problem, and providing any required documentation. Long-term strategies involve timely payment of banking fees, keeping personal information updated, using online banking resources, and following security best practices. By understanding the reasons for and taking preventive measures against account blocking, individuals can maintain a healthier banking relationship and ensure uninterrupted access to their banking services. Can a Bank Block My Account?

Suspicion of Fraudulent Activity

Uncollected Funds

Overdraft or Non-Payment of Fees

Compliance With Court Orders or Legal Requirements

International Transactions or Sanctions Compliance

Compliance With Anti-Money Laundering (AML) and Know Your Customer (KYC) Rules

Legal Rights of Banks

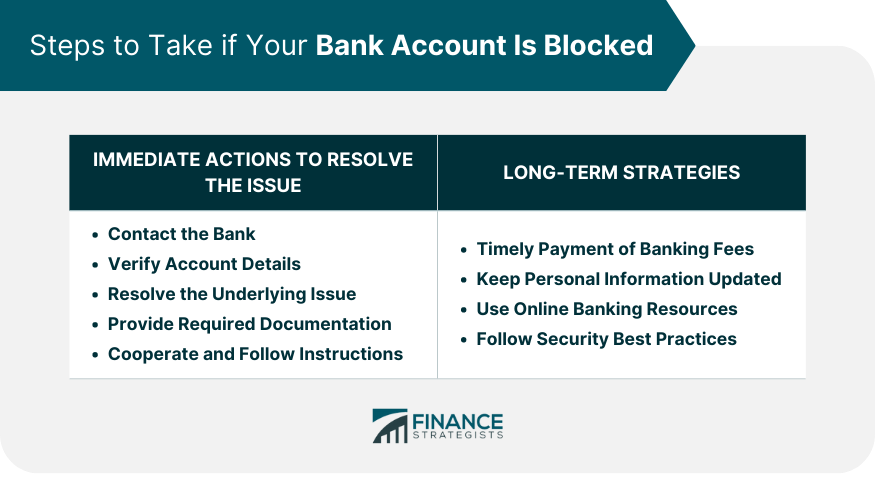

Steps to Take if Your Account is Blocked

Immediate Actions to Resolve the Issue

Contact the Bank

Verify Account Details

Resolve the Underlying Issue

Provide Required Documentation

Cooperate and Follow Instructions

Long-Term Strategies

Timely Payment of Banking Fees

Keep Personal Information Updated

Use Online Banking Resources

Follow Security Best Practices

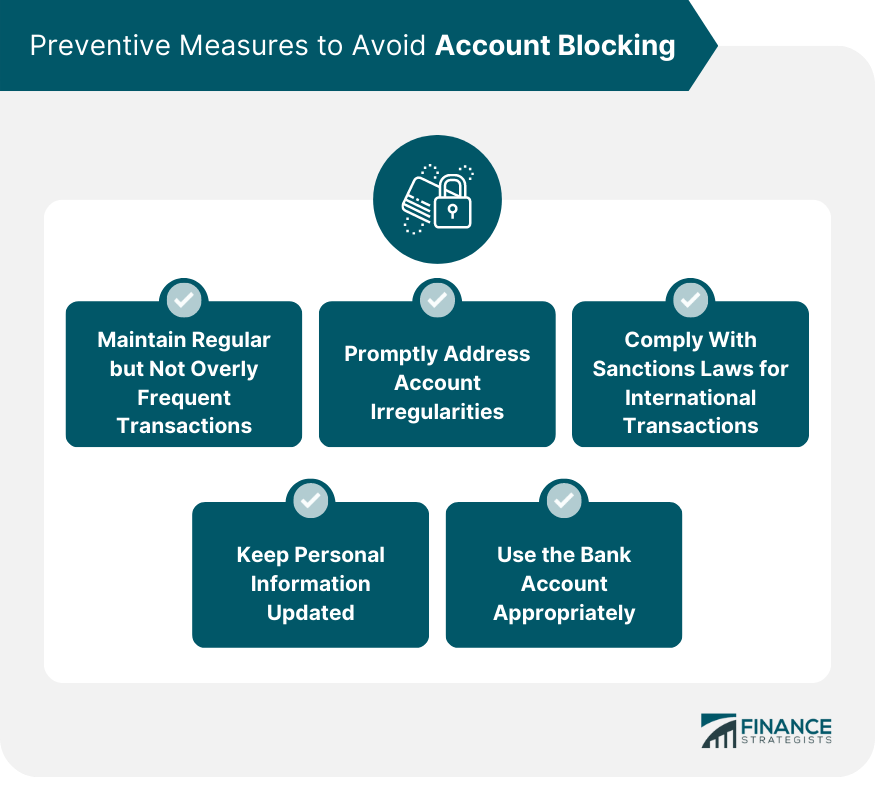

Preventive Measures to Avoid Account Blocking

Maintain Regular but Not Overly Frequent Transactions

Promptly Address Account Irregularities

Comply With Sanctions Laws for International Transactions

Keep Personal Information Updated

Use the Bank Account Appropriately

Conclusion

Can a Bank Block My Account? FAQs

Yes, a bank can block your account under certain circumstances, such as suspicion of fraudulent activity or non-payment of fees.

Account blocking can occur due to various reasons, including suspicion of fraud, uncollected funds, compliance with legal requirements, and violations of international sanctions or Anti-Money Laundering (AML) rules.

Signs of a blocked account may include notifications from the bank via email, text, or mail. Alternatively, you might experience declined transactions or difficulty accessing your funds through online banking.

If your account is blocked, contact your bank's customer service immediately to understand the reasons and steps to resolve the issue. Cooperate with the bank, provide required documentation, and address the underlying problem promptly.

To avoid account blocking, maintain regular transactions, address any account irregularities promptly, comply with sanctions laws for international transactions, keep personal information updated, and use your account appropriately as intended.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.