Yes, a bank can take money from your account under certain circumstances. This is known as the right of offset, which allows a bank to cover debts that are due by withdrawing from an account held by the debtor at the same institution. If you have an outstanding loan or credit card bill, the bank can take the owed amount from your account to offset the debt. Additionally, if your account is overdrawn, the bank may deduct an overdraft fee. Lastly, if there is a legal judgment against you, the bank may freeze and withdraw funds from your account to satisfy the judgment. Regularly checking your account balance and ensuring all payments are made promptly can prevent such instances. Understanding why and how a bank can access your funds is crucial in managing your finances effectively. Banks can take money from your account due to various reasons such as overdraft fees, unpaid loans, suspected fraudulent activity, and legal judgments. Banks charge overdraft fees when account holders spend more money than what is available in their accounts. An overdraft occurs when you make a purchase or withdrawal that exceeds the current balance in your checking account. Instead of declining the transaction, the bank covers the difference and charges an overdraft fee. Most banks charge a flat fee per overdraft. For instance, if you made three purchases resulting in an overdraft, you would be charged three separate overdraft fees. This can quickly accumulate and become a significant debt if not addressed promptly. Some of the best practices to avoid overdraft fees include monitoring your account balance regularly, setting up low balance alerts, and linking your checking account to a savings account or credit card to cover any potential overdrafts. Banks have the right to set-off any unpaid loans or debts against the funds in your account. The right of offset allows a bank to withdraw funds from your account to cover a loan in the same bank that's in default. This could be an unpaid credit card bill, mortgage payment, or any other outstanding loan. Banks can only exercise this right under specific conditions. Typically, both the loan and the account need to be with the same bank, and the bank should have given you reasonable notice. To protect yourself, you can distribute your funds across different banking institutions, ensure you meet all loan payments on time, and regularly check your accounts for any unexpected withdrawals. In the face of suspected fraudulent activity; banks can freeze and even withdraw funds from your account. Banks monitor accounts for suspicious activities. If such activities are detected, the bank may freeze your account, investigate, and sometimes withdraw funds if they confirm a fraudulent transaction. In the event of a fraud investigation, cooperate fully with your bank. Provide all necessary documents and information promptly to speed up the investigation process and get your account back to normal. Legal judgments can significantly impact your bank account, leading to frozen accounts or even direct withdrawals. If a court rules that you owe money to a creditor, the court can issue an order to freeze your bank account or allow the creditor to withdraw the funds directly from your account. When a judgment is issued against you, it's crucial to take immediate action. Contact an attorney to help you understand your options, which may include filing an appeal, setting up a payment plan, or declaring bankruptcy in extreme cases. Banks operate under strict regulations and are not allowed to take money from your account without a valid reason. Here's what you can do if you think a bank has unfairly taken money from your account. Knowing your rights is the first step in protecting yourself. Familiarize yourself with banking regulations and consumer protection laws in your country. If you believe your bank has wrongfully taken money from your account, you may need to take legal action. Consult with a legal professional to understand the best course of action. Proper management of your finances can help protect your bank account from unexpected withdrawals. Regularly monitor your account for any suspicious or unexpected transactions. Most banks offer free online and mobile banking services that can help with this. Ensure you keep up with all your loan payments. Late or missed payments could lead to penalties or direct withdrawals from your account. Understanding your bank's policies is essential in maintaining a healthy banking relationship. Familiarize yourself with your bank's policies on overdraft fees, loan repayments, and fraudulent activity. While it can be alarming, banks indeed have the right to take money from your account under specific circumstances. These include covering overdraft fees, offsetting unpaid debts or loans, addressing suspected fraudulent activities, or fulfilling legal judgments. Awareness of these circumstances can help you maintain effective control over your finances. Regular account monitoring, timely loan repayments, and a thorough understanding of your bank's policies can go a long way in safeguarding against unexpected withdrawals. Additionally, should you find yourself facing unfair deductions, knowing your rights and possibly seeking legal counsel can serve as powerful tools in rectifying the situation. Thus, effective financial management not only lies in growing your wealth but also in preventing unwarranted losses, particularly those occurring directly from your bank account.Can a Bank Take Money From Your Account?

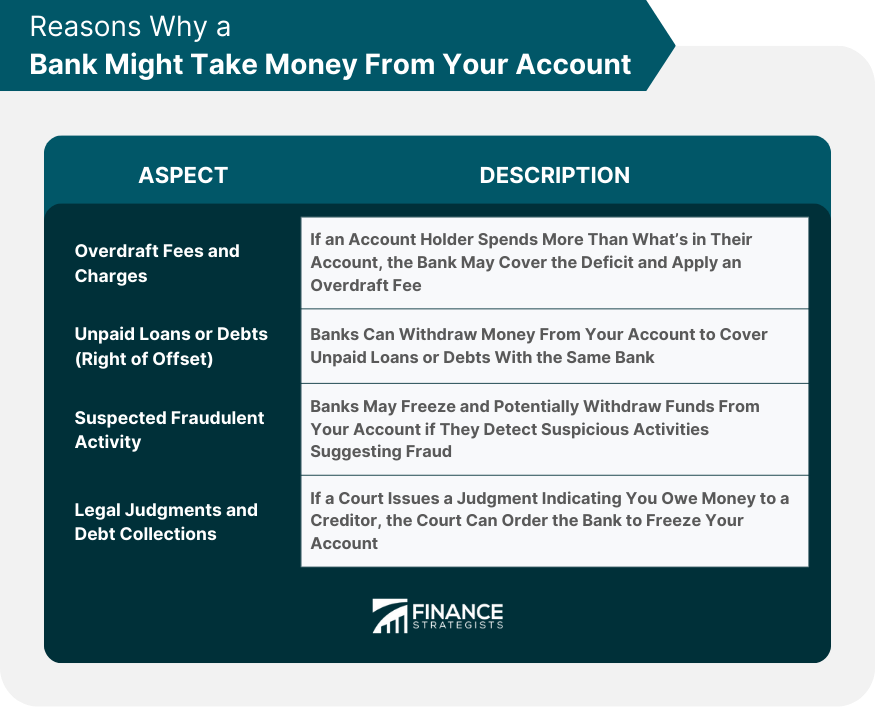

Reasons Why a Bank Might Take Money From Your Account

Overdraft Fees and Charges

What Is an Overdraft?

How Overdraft Fees Work

How to Avoid Overdraft Fees

Unpaid Loans or Debts: Bank's Right to Set-off

Right of Offset Explained

Conditions Under Which the Bank Can Exercise This Right

Protecting Yourself From Unjust Set-off

Deal With Suspected Fraudulent Activity

Bank’s Response to Suspected Fraud

How to Deal With a Fraud Investigation

Legal Judgments and Debt Collections

How Legal Judgments Can Impact Your Bank Account

What to Do When a Judgment is Issued Against You

What to Do if a Bank Takes Money From Account Unfairly

Knowing Your Rights

Taking Legal Action

Preventive Measures to Protect Bank Account

Regular Account Monitoring

Keep Up With Loan Payments

Understand Bank's Policies

Conclusion

Can a Bank Take Money From Your Account? FAQs

No, banks cannot legally take money from your account without permission. However, they can withdraw funds for specific reasons, like overdraft fees, unpaid loans or debts (under the right of offset), suspected fraudulent activity, or legal judgments.

Yes, a bank can use the right of offset to take money from your account to cover unpaid debts. This means that if you have an unpaid loan or credit card bill with the same bank where you have your account, the bank can withdraw money to cover those debts.

If a bank takes money from your account unfairly, it's essential to know your rights. Familiarize yourself with banking regulations and consumer protection laws. If necessary, consult with a legal professional to explore your options, which could include taking legal action against the bank.

Yes, if you make a purchase that exceeds the balance in your account, the bank can cover the transaction (resulting in an overdraft) and then charge you an overdraft fee.

Regularly monitor your account, keep up with all loan payments, and familiarize yourself with your bank's policies. If you spot suspicious activity, report it to your bank immediately. Understanding your bank's overdraft policies and setting up low-balance alerts can also help protect your bank account from unexpected withdrawals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.