Banking is an integral part of modern financial systems, offering a secure way to store funds, access credit, transfer money, and perform other transactions. Institutions provide various products like checking accounts, savings accounts, mortgages, and loans. Closing a bank account, however, is a necessary step when switching financial institutions or for other reasons. It involves contacting your bank, either in person, online, or over the phone, to request account closure. Be mindful to settle any outstanding fees or charges, ensure all checks and scheduled payments have cleared, and move your money to a new account before closure. Failure to follow the correct procedures might lead to additional fees or complications. When it comes to closing a regular bank account, the direct impact on your credit score is typically nonexistent. Credit scores, such as those calculated by FICO or VantageScore, mainly consider factors like payment history on loans and credit cards, the amount of debt you have, the age of your credit accounts, the mix of credit types, and recent applications for credit. Regular bank accounts, such as checking or savings accounts, don't usually factor into these credit scoring models directly because they are not lines of credit. Thus, closing such an account won't directly affect your credit score. However, there may be indirect ways that closing a bank account could affect your credit. These effects are generally due to how you manage your bank account rather than the closure of the account itself. For example, if you close a checking account that has an overdraft line of credit associated with it, this might impact your credit utilization ratio, a key factor in credit score calculations. To understand why bank accounts and credit accounts have different effects on your credit score, it's helpful to understand what they are and how they work. Bank accounts are essentially places to store your money. The most common types are checking and savings accounts. Checking accounts are used for daily transactions, like paying bills, and typically don't earn interest. Savings accounts, on the other hand, are meant for longer-term storage of money and usually do earn interest. Neither of these account types provides a line of credit. They are meant for depositing, storing, and withdrawing your own money, not for borrowing. Credit accounts, such as credit cards, personal loans, auto loans, and mortgages, are lines of credit. When you open a credit account, a lender provides you with a certain amount of money or credit that you promise to repay, typically with interest. It's your payment history on these accounts, among other things, that affects your credit score. Credit scores are designed to provide potential lenders with an assessment of the risk they take on when they lend you money or provide you with a line of credit. They are not concerned with how well you manage your own money in a bank account, but rather how well you manage borrowed money. Some checking accounts come with an overdraft line of credit. If your account goes below zero, the overdraft line of credit kicks in, effectively lending you money to cover the difference. If you close an account that has an overdraft line of credit, you are reducing the amount of credit available to you, which can increase your credit utilization ratio and possibly lower your credit score. However, this would typically be a small effect, especially if you have other, larger lines of credit open. When you close a bank account, it's crucial to ensure that all fees and charges are paid first. Unpaid fees can be sent to a collection agency, which can then report the debt to the credit bureaus. Having a collection on your credit report can significantly harm your credit score. While closing bank accounts frequently won't directly affect your credit score, it may affect your relationship with the bank or other banks. Banks may see this activity as a red flag, possibly impacting your ability to open new accounts in the future. Before closing your account, ensure that all fees, including any overdraft fees, are paid. As mentioned earlier, unpaid fees can go to collections and affect your credit. If you have automatic payments set up from your account, such as utility bills or loan payments, be sure to redirect these to a new account. Missing a loan payment because it didn't get redirected can lead to late fees and credit damage. The same goes for direct deposits — make sure these are redirected so you don't miss any income. Once you've closed your account, ask the bank for a written confirmation. This document can serve as proof of the closure in case of any disputes later on. After closing an account, keep an eye on your credit reports to ensure that no unexpected issues arise. You can get a free credit report from each of the three major credit bureaus once per year at AnnualCreditReport.com. Closing a regular bank account typically has no direct impact on your credit score, as credit scoring models focus on factors related to credit accounts, such as loans and credit cards. Checking and savings accounts are not lines of credit, thus don't directly impact credit scores. However, indirect impacts may arise from how the account is managed. Closing an account with an overdraft line of credit may affect credit utilization and impact your score. Unsettled fees could result in negative credit consequences if sent to collections. To smoothly close your account and protect your credit, follow these best practices: settle all fees, redirect payments and deposits, get written confirmation from the bank, and monitor credit reports for issues. For all your banking needs, be sure to explore a wide range of banking services offered by reputable institutions to find the best fit for your financial goals and requirements.Overview of Banking

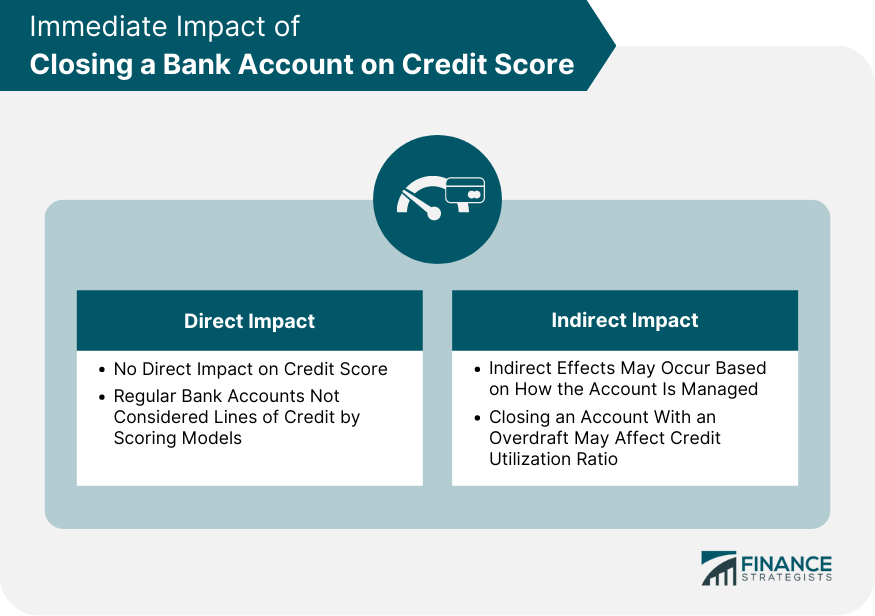

Immediate Impact of Closing a Bank Account on Credit Score

Direct Impact

Indirect Impact

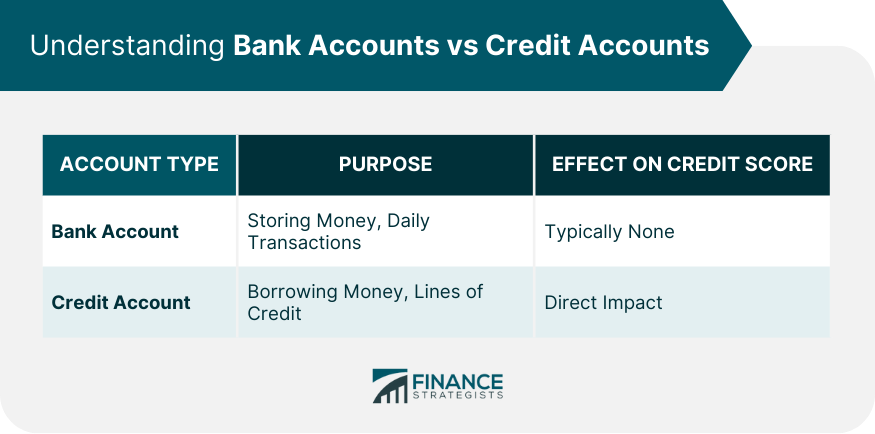

Understanding Bank Accounts vs Credit Accounts

Types of Bank Accounts

Types of Credit Accounts

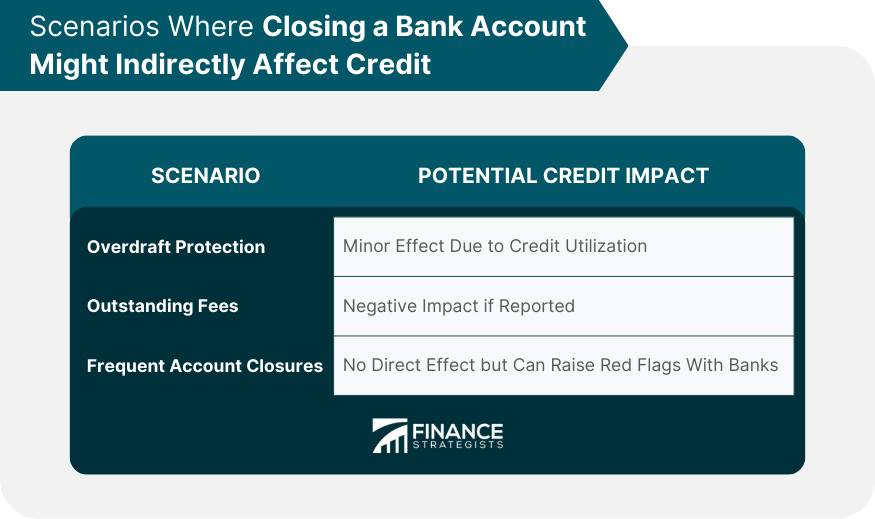

Scenarios Where Closing a Bank Account Might Indirectly Affect Credit

Overdraft Protection

Outstanding Fees

Closing Accounts Frequently

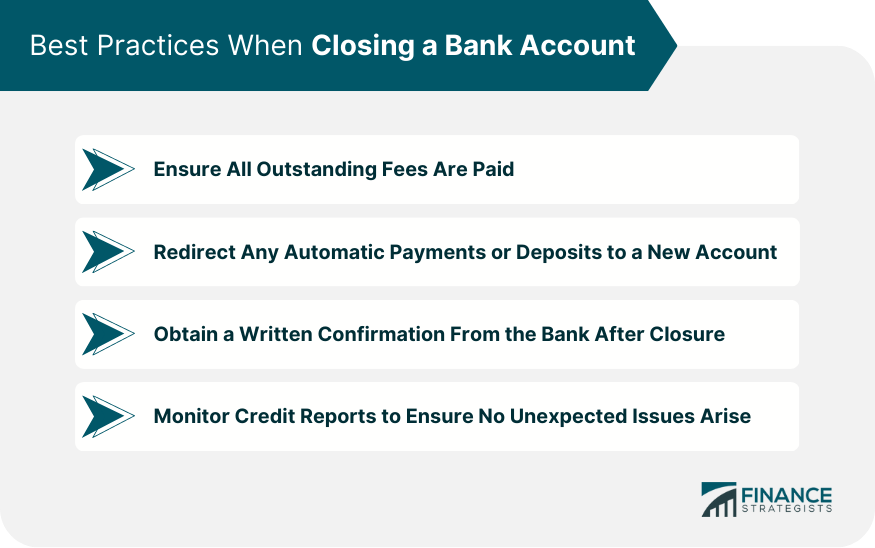

Best Practices When Closing a Bank Account

Ensure All Outstanding Fees Are Paid

Redirect Any Automatic Payments or Deposits to a New Account

Obtain a Written Confirmation From the Bank After Closure

Monitor Credit Reports to Ensure No Unexpected Issues Arise

Bottom Line

Does Closing a Bank Account Affect Your Credit? FAQs

No, closing a regular bank account doesn't directly impact your credit score.

Yes, factors like linked overdrafts or unpaid fees can indirectly influence your credit score.

Credit accounts, such as loans or credit cards, directly affect credit scores, while regular bank accounts typically do not.

Unpaid overdrafts can be sent to collections, which may harm your credit score if reported.

Pay all outstanding fees, redirect any automatic payments or deposits, and obtain closure confirmation from the bank.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.