An account freeze, or account block, occurs when a bank or financial institution temporarily suspends access to an individual's or entity's account. This is usually due to suspected fraudulent activity, unpaid taxes or debts, a court order, or other suspicious activities that raise red flags. When an account is frozen, the account holder cannot withdraw funds, write checks, make transfers, or perform any transactions involving the frozen account. The duration of the freeze varies, depending on the reason behind it. The bank is typically required to notify the account holder of the freeze. To lift the freeze, the account holder must resolve the issue that led to the suspension, which could involve paying outstanding debts, providing required documentation, or verifying suspicious transactions. An account holder is an individual or entity that holds a bank account. They have certain responsibilities, such as maintaining accurate records, safeguarding account information, and fulfilling obligations related to their account. If their account is frozen, the account holder typically cannot access their funds until the issue causing the freeze is resolved. Financial institutions, such as banks and credit unions, have the ability to freeze accounts. They do so for various reasons, typically in response to government orders, suspicious account activity, or outstanding debts. Financial institutions also have the responsibility to communicate with the account holder about the freeze and help resolve the issue. Government entities such as the IRS, law enforcement agencies, or courts may also be involved in account freezes. They can order a freeze due to unpaid taxes, suspected illegal activity, or court orders related to debt collection or divorce proceedings. Fraud is one of the most common causes of account freezes. If a bank detects unusual activity – such as large, frequent withdrawals or transactions in foreign countries – it may freeze the account to prevent further potential fraud. For instance, a sudden wire transfer to an unfamiliar overseas account can trigger an account freeze. If you owe money to government entities or creditors, your account may be frozen until the debt is paid. The IRS, for example, can issue a bank levy if you have unpaid taxes. Similarly, a creditor can obtain a court order to freeze your account and collect the debt you owe. Court orders can also lead to an account freeze. For instance, during divorce proceedings, a court may freeze a joint account to prevent either party from depleting the funds until the divorce is finalized. Or, in criminal cases, a court may order an account freeze if the funds are suspected to be proceeds from illegal activities. Suspicious activities such as frequent large transactions, transactions in high-risk locations, or repeated overdrafts can cause a bank to freeze an account. These actions can suggest money laundering, terrorist financing, or simply mismanagement of funds. When an account is frozen, the financial institution should notify the account holder, typically via mail or a message through online banking. The notification will explain why the account has been frozen and how to rectify the situation. The timeline for an account freeze can vary depending on the reason for the freeze. For instance, a freeze due to suspicious activity may last only until the suspicious transactions are investigated, while a freeze due to unpaid taxes or debts might last until the debts are paid. In cases of suspected fraud or suspicious activity, the bank will conduct an investigation. This could involve contacting the account holder, reviewing transaction history, and liaising with law enforcement agencies if necessary. The most immediate impact of an account freeze is the inability to access your funds. This can cause difficulties in paying bills, buying necessities, or fulfilling financial obligations. If an account is frozen due to illegal activities or a court order, the account holder could face legal consequences such as fines, penalties, or even imprisonment. A frozen account can indirectly affect your credit score. If you can't access your funds to pay bills or debts, this can lead to late or missed payments, which negatively impact your credit score. If your account is frozen, the first step is to contact your bank to understand why. Then, based on their advice, you can take necessary steps, such as paying outstanding debts, providing requested documents, or contacting legal counsel. Open communication with your financial institution is crucial. They can provide guidance on resolving the issue. Keep records of all communication and be proactive in resolving the issue. In some cases, you might need to consult a lawyer, especially if your account is frozen due to a legal issue such as a court order, divorce proceedings, or suspected illegal activities. To prevent your account from being frozen, maintain good financial habits. This includes paying your bills on time, avoiding overdrafts, and keeping accurate records. Regularly monitoring your account can help you detect and report any suspicious activity early, potentially avoiding a freeze. If you notice any unusual transactions or changes in your account, report them to your bank immediately. Your bank can then take necessary measures to secure your account. Unfreezing an account usually involves resolving the issue that led to the freeze, such as paying outstanding debts or providing requested documentation. Once the issue has been resolved, your bank can unfreeze your account. They will guide you through the process and ensure that you can access your funds again. The time it takes to unfreeze an account can vary. It can take anywhere from a few days to several weeks, depending on the complexity of the situation and how quickly the issue is resolved. An account freeze is a serious matter, typically resulting from fraudulent activity, unpaid taxes or debts, court orders, or suspicious activities. It involves several parties, including the account holder, financial institutions, and sometimes government entities. While frozen, an account becomes inaccessible, often leading to financial hardship and potential legal implications. An account holder must act promptly and effectively to resolve the issues causing the freeze, including communicating with the financial institution and possibly seeking legal advice. Prevention is equally important, emphasizing good financial habits, regular account monitoring, and immediate reporting of suspicious activities. Unfreezing an account requires resolution of the issue, with the timeframe varying on case specifics. The broader implications of account freezing can be significant, impacting an individual's financial stability and credit score, underlining the importance of quick resolution and preventive measures.How an Account Freeze Works

Parties Involved in an Account Freeze

Role of the Account Holder

Role of Financial Institutions

Role of Government Entities

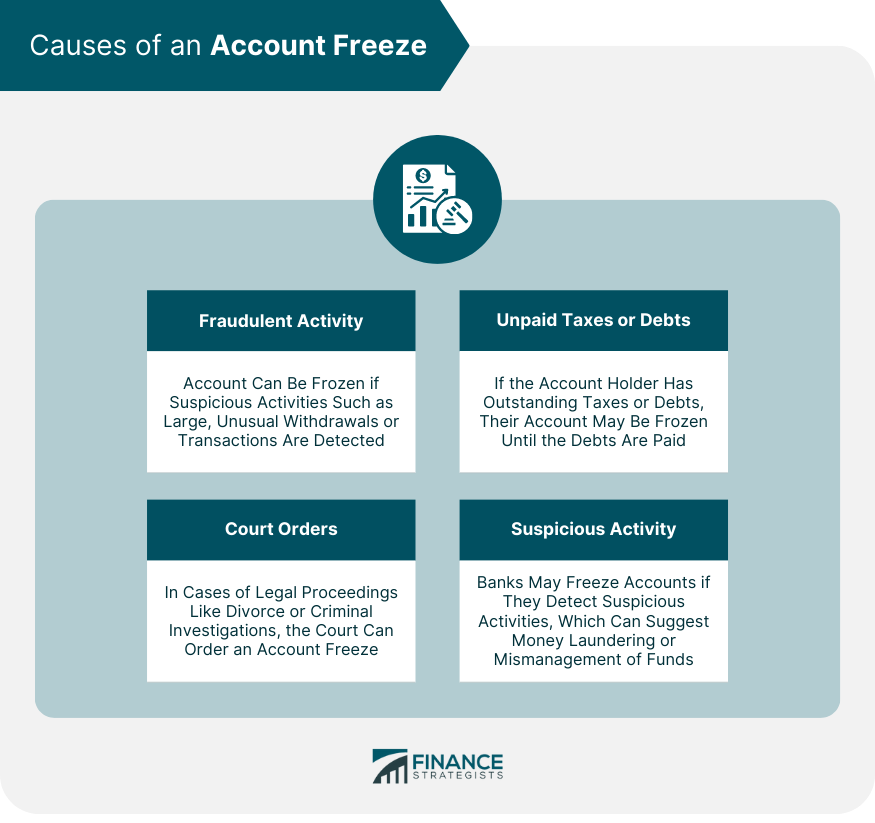

Causes of an Account Freeze

Fraudulent Activity

Unpaid Taxes or Debts

Court Orders

Suspicious Activity

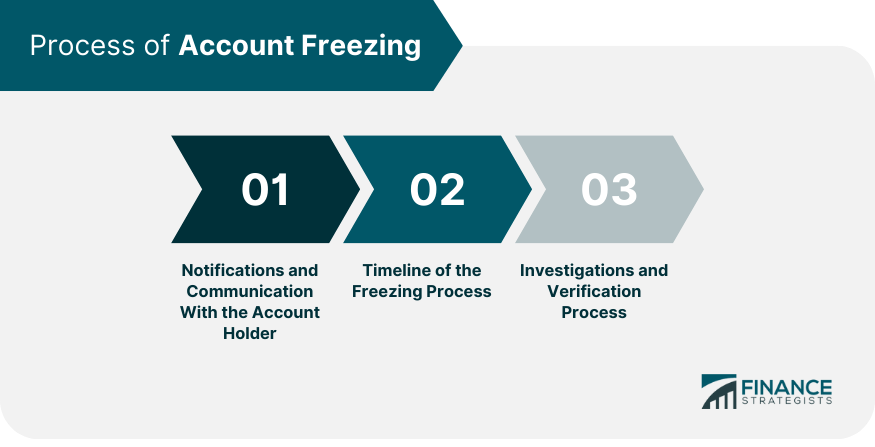

Process of an Account Freeze

Notifications and Communication With the Account Holder

Timeline of the Freezing Process

Investigations and Verification Process

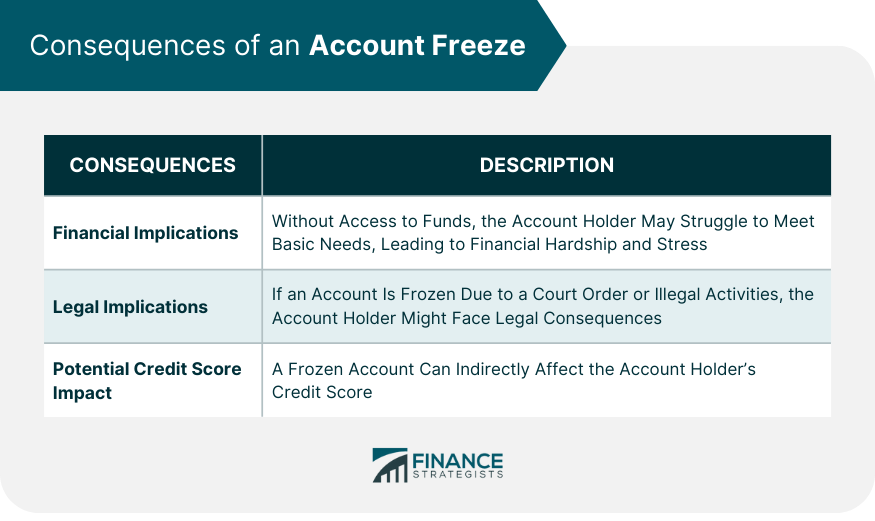

Consequences of an Account Freeze

Financial Implications for the Account Holder

Legal Implications for the Account Holder

Potential Credit Score Impact

How to Respond to an Account Freeze

Immediate Steps to Take Once an Account Is Frozen

Communicating With Financial Institutions

Seeking Legal Advice

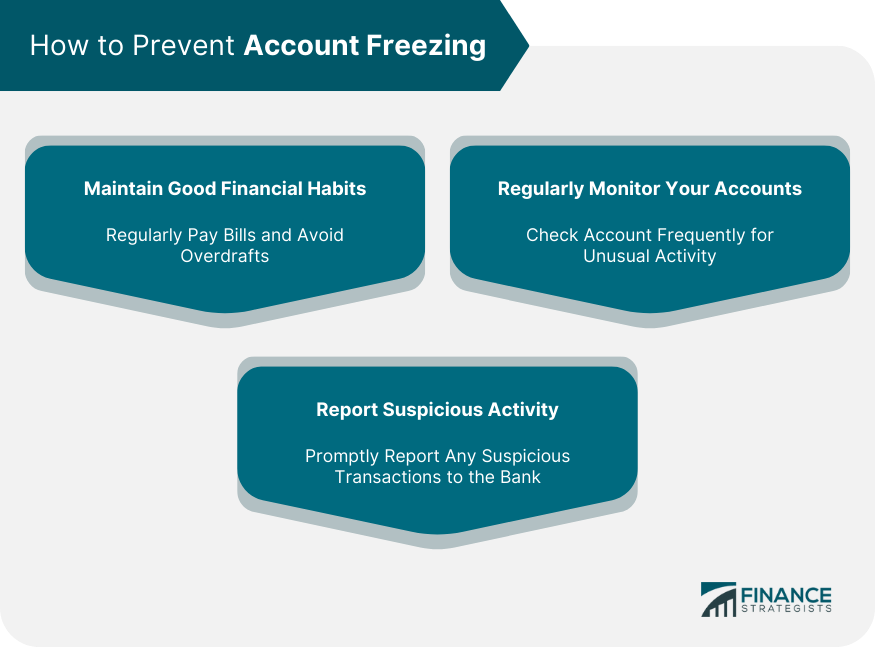

How to Prevent an Account Freeze

Maintain Good Financial Habits

Regularly Monitor Your Accounts

Report Suspicious Activity

Thawing a Frozen Account

Steps to Unfreeze an Account

Role of Financial Institutions in Unfreezing an Account

Timeline for Unfreezing an Account

Final Thoughts

How an Account Freeze Works FAQs

An account freeze is a temporary suspension placed on a financial account by a financial institution, preventing the account holder from accessing funds. This action is typically taken due to suspected fraudulent activity, unpaid taxes or debts, court orders, or other suspicious activities.

Yes, generally, you can still deposit money into your account during an account freeze. However, you might not be able to access those funds until the freeze is lifted.

The duration of an account freeze varies depending on the reason for the freeze. It could last anywhere from a few days to several weeks or more. The freeze remains until the issue causing the freeze is resolved.

The best ways to prevent an account freeze are by maintaining good financial habits such as paying bills and taxes on time, monitoring your account for suspicious activity, and ensuring your account information is secure.

If your account is frozen, you should immediately contact your bank to understand why and discuss next steps. Depending on the reason, you might also need to consult with a lawyer.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.